Learn what CFD trading is – including how to open a CFD account in Singapore – with our simple guide.

- What is a CFD?

- What is a CFD trade?

- What CFD markets exist?

- CFD prices explained

- CFD leverage explained

- Managing CFD risk

- How to become a CFD trader in Singapore

- FAQs

What is a CFD?

A CFD is a contract for difference, which is an agreement between two parties to exchange the difference in a market’s price from when the contract is opened to when it is closed.

When you trade CFDs, you can find opportunities regardless of whether prices are rising or falling. This is because you’re speculating on price movement rather than ever taking ownership of the underlying instrument.

You buy and sell these contracts in the same way that you'd buy and sell the underlying market. But instead of choosing how much of a particular asset you would like to invest in – such as 100 DBS shares – you pick how many contracts to buy or sell.

The size of a single CFD will change depending on your asset class. With equities, for example, buying one contract is the same as buying one share. With forex, it is the equivalent of a single lot – the standardised batch of a currency, usually equal to 100,000 units.

You can learn more about lots here.

If the market moves in your favour, your position will earn a profit. If it moves against you, it will incur a loss. When you close the position, you realise your profit or loss by selling the contracts you bought at the outset.

What is a CFD trade?

A CFD trade is a speculative position taken on an asset using a contract for difference. There are two types of CFD trades you can open: a long position or a short position.

In traditional share dealing, you are buying an asset, so will only profit if the price goes up. This is known as a long position.

But a key benefit of CFD trading is that you can sell an asset if you think it will fall in value. This is known as going short and enables you to make a profit from falling prices. Shorting with CFDs works in the same fundamental way as going long. But instead of buying contracts to open your position, you sell them. In doing so, you’ll open a trade that earns a profit if the underlying market drops in price – but a loss if it rises.

Calculating a CFD trade’s profit and loss

Like traditional investing, your return from a CFD trade is determined by the size of your position and the number of points the market has moved.

If you buy 100 DBS CFDs at $31 and then sell them at $32, you will make $100 (100 x $1). But if the price dropped and you sold them at $30, you would lose $100.

CFDs are also leveraged instruments, which means that you only need to put down a small initial deposit to open a full-sized position. But your total will always be based on the full exposure. This means that CFDs can magnify your profits, as well as your losses – making it important to manage your CFD trading risk.

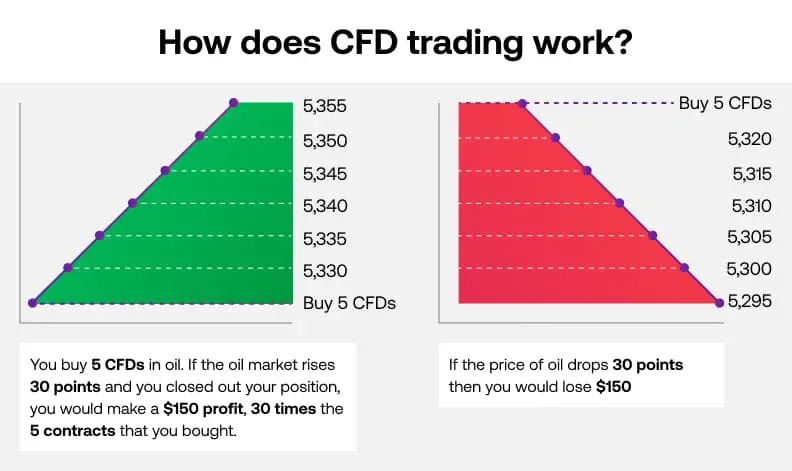

CFD example – going long

You think the price of oil is going to go up, so you place a buy trade of five oil CFDs for $53.25.

The market rises 30 points to $53.55, so you close out your position by selling your five contracts. When you close a CFD position, your profit (or loss) is the difference in the asset's price from when you opened it to when you closed it.

In this example you opened at $53.25 and closed at $53.55, so you would make $30 for each contract you bought: a $150 profit (5 x $30).

However, if the market moved against you by 30 points and the price of oil dropped to $52.95, you would lose $150.

Please note: prices in image are displayed as points. In this example, $1 is 100 points.

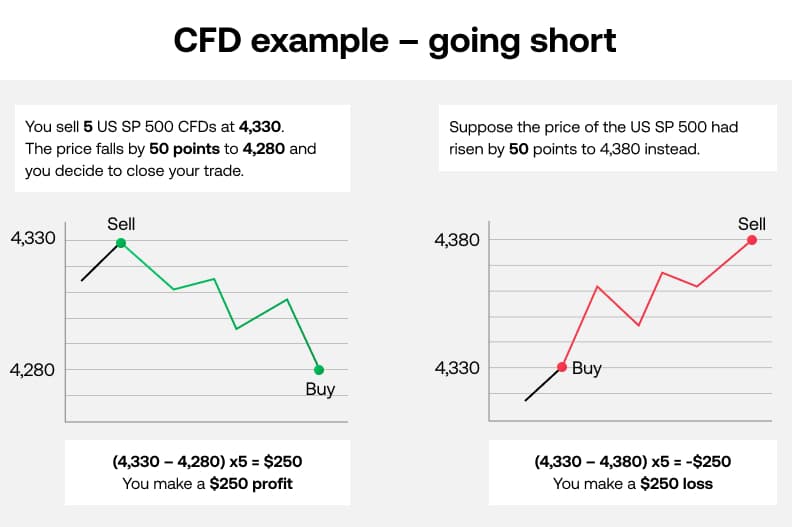

CFD example – going short

The US SP 500 is at 4,330, but you believe it is about to fall as you expect the forthcoming US earnings season to disappoint.

So, you sell five US SP 500 CFDs at 4,330.

Your prediction is correct, and the US SP 500 falls to 4,280. When you sell CFDs, you’re still agreeing to exchange the difference in an asset’s price, but you earn a profit if the market falls and a loss if it rises.

The US SP 500 has fallen 50 points, so you earn $50 for each of your five contracts – a profit of $250.

But what would have happened if the index had risen 50 points instead? You would lose $50 for each of your five CFDs, a total loss of $250.

If you want to see more CFD trade setups, head over to our CFD examples page.

What CFD markets exist?

You can trade more than 6,000 global CFD markets with City Index Singapore without taking ownership of any physical asset, including FX, indices, shares and commodities.

What are CFDs in the stock market?

CFDs in the stock market are contracts to exchange the value of the shares of publicly listed companies. They are an agreement to trade the difference in price of the company’s shares between the time they open and close the contract.

Stock CFDs differ from traditional investment as you’re never buying the underlying company shares, which means you won’t be entitled to any shareholder benefits – such as dividends or voting rights. However, your position will be adjusted for dividends, and as you never take ownership, you can go short on the share price.

What are CFDs in forex?

CFDs in forex are contracts used to trade currency pairs. This a popular way of speculating on the forex market as being able to go long or short enables CFD traders to capture the volatility of the market.

As currencies are traded in lots, which are often very large to account for the fact that forex price movements are usually small, trading via a leveraged instrument is often necessary for most retail traders to access the market. For example, a standard lot is 100,000 units of the base currency, meaning without leverage, you’d need to pay $100,000 for a trade as opposed to £3300 with 3.33% leverage.

CFD prices explained

Buy and sell prices

You’ll see two prices listed for every CFD market: the buy (or ask) price and the sell (or bid) price. To open a long position, you trade at the buy price. To go short, you trade at the sell price.

When you want to close, you do the opposite of when you opened. So, if you’d bought, you would sell. If you’d sold, you would buy.

The buy price will always be slightly higher than the market’s current level, while the sell price will be a bit below. The difference is called the spread.

What are CFD spreads?

The spread is one of the key costs involved in trading CFDs. It’s the difference between the 'buy' and 'sell' price of a financial instrument, collected by a broker.

For example, if a buy price is $1.50 and a sell price is $1.40, the spread is $0.10.

It’s important to understand what spread you’re being quoted, as it directly relates to your trading costs.

What are CFD fees in Singapore?

As a Singaporean trader, there are a few other CFD fees you’ll pay besides the spread. Some of the main fees you’ll pay are:

- Commission – for standard accounts, commission is only charged on share CFDs and is based on the overall trade value

- Overnight financing – is a charge to cover the cost of holding a leveraged position open overnight

- Rolling CFD futures – is a way of holding a futures position open beyond expiry by carrying it into the following contract, but incurs a charge

- Guaranteed stop loss orders – is a type of stop loss order that is free to attach but incurs a fee if triggered

See our full list of trading costs

What is leverage in CFD trading?

CFDs are leveraged products, which means you can open a trade by paying just a small fraction of its total value.

In other words, you can invest a smaller amount of money to trade a position higher in value. This will magnify your return on investment, but it will also magnify your losses. So, you should make sure to manage your trading risk accordingly.

Let’s return to our oil example above to see how this works in practice. Buying five oil CFDs at $53.25 would give you a total position size of $266.25 (5 x $53.25). Because CFD trading is leveraged, you would only have to put up a fraction of that, known as your margin.

If oil requires a 10% margin, then you’d only need to pay 10% of $266.25 to open your trade: $26.63.

Managing risk in CFD trading

As they are leveraged, it’s a good idea to manage your CFD trading risks carefully. Two key trading tools to help control risk are take profit orders and stop losses.

Take profits – also known as limit orders – will automatically close your position if it hits a certain profit level. In doing so, they help you stick to your trading plan when you may be tempted to hold onto a winning position, despite the risk that the market may reverse.

Stop losses also automatically close your position, but they do it once it hits a specified level of loss, limiting your total risk from any given trade. However, standard stop losses aren’t 100% effective as they can be subject to slippage if your market ‘gaps’ over your stop.

To ensure that your position will always close if your stop level is reached, you’ll need to upgrade to a guaranteed stop loss order (GSLO).

How do you become a CFD trader in Singapore?

To start CFD trading as a beginner in Singapore you need to:

- Make sure you know how to trade CFDs properly and look at some CFD example trades

- Have a detailed trading plan and strategy in place

- Research the markets you want to trade

- Understand the risk management tools at your disposal

- Practice trading in a demo account first

You should only start trading using a live account if you’re confident putting real capital at risk.

The advantages of CFD trading

Flexibility

You can trade on falling markets as well as rising ones, without borrowing any stock.

Leverage

By using a small amount of money to control a much larger value position, you don’t have to tie up lots of capital.

Hedging

As CFDs allow you to short sell, they are often used by investors as ‘insurance’ to offset losses made in their physical portfolios. This is known as hedging.

For example, if you hold $5,000 of DBS Bank shares and you are concerned that they are due for an imminent sell-off, you can help protect your share portfolio by short selling $5,000 of DBS Group Holdings CFDs.

Should DBS Bank share prices fall by 5% in the underlying market, the loss in your share portfolio would be offset by a gain in your short trade. In this way, you can protect yourself without going through the expense and inconvenience of liquidating your stock holdings.

It is important to ensure you understand the risks associated with CFD trading before making your first trade.

You can try trading risk-free with the City Index demo trading account.