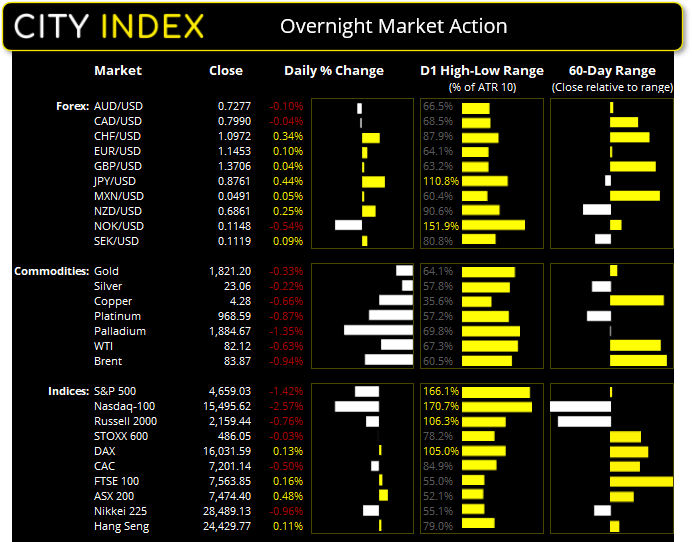

Tuesday US cash market close:

- The Dow Jones Industrial fell -534.34 points (-1.51%) to close at 35,368.47

- The S&P 500 index fell -85.74 points (-1.84%) to close at 4,577.11

- The Nasdaq 100 index fell -400.836 points (-2.57%) to close at 15,210.76

Asian futures:

- Australia's ASX 200 futures are down -59 points (-0.8%), the cash market is currently estimated to open at 7,349.80

- Japan's Nikkei 225 futures are down -250 points (-0.88%), the cash market is currently estimated to open at 28,007.25

- Hong Kong's Hang Seng futures are up 59 points (0.25%), the cash market is currently estimated to open at 24,171.78

- China's A50 Index futures are up 50 points (0.33%), the cash market is currently estimated to open at 15,347.27

US traders returned to their desk and simply continued the trends that were seen in Asia; sell bonds and equities, buy the US dollar. The US 10-year rose +5 bps to 1.87% which is its highest level in two-years. And both impressive and underwhelming at the same time is to see the European 10-year yield rise to a 2.5 year high of -0.03%.

The rate-sensitive technology sector led declines which saw the Nasdaq 100 fall -2.6% and closed at a 3-month low. The Dow Jones closed firmly beneath its 50-day eMA to a 3-week low and the S&P 500 closed below 4600 and trend support on the daily chart. The VIX (volatility index) rose to a 1-month high of 22.87.

USD/JPY gave back the day’s gains after failing to hold above the 115 handle and trend resistance, leaving a bearish pinbar in its wake. However, both the US dollar and Japanese yen were the strongest major currencies yesterday, so it is a stalemate with both showing relative strength against their peers.

The euro was the weakest major currency, seemingly on the basis of yield differentials as rising US yields outpaced their European counterparts. EUR/USD bears made ‘short’ work of key support at 1.1386 by cutting through it like a hot knife in butter. Falling around -0.7%, it was its most bearish session in over four-weeks and trades just 20 pips above our initial 1.13 target. As mentioned in our video, we suspect the corrective high was seen last week, just below 1.15.

WTI hits a 7-year high

In yesterday’s video we noted WTI’s potential for it to test $85 and, at the time of writing, it is on the cusp of closing above that level to 7-year high. On one hand, that it closed a few ticks from the daily high can be a sign of confidence. Yet on the other, it has closed just a few ticks above the October high. So a bit more clearance of that key level would have been nicer. Therefore, our conclusion from yesterday still stands; how prices reaction around these highs is key for its near-term direction.

How to start oil trading

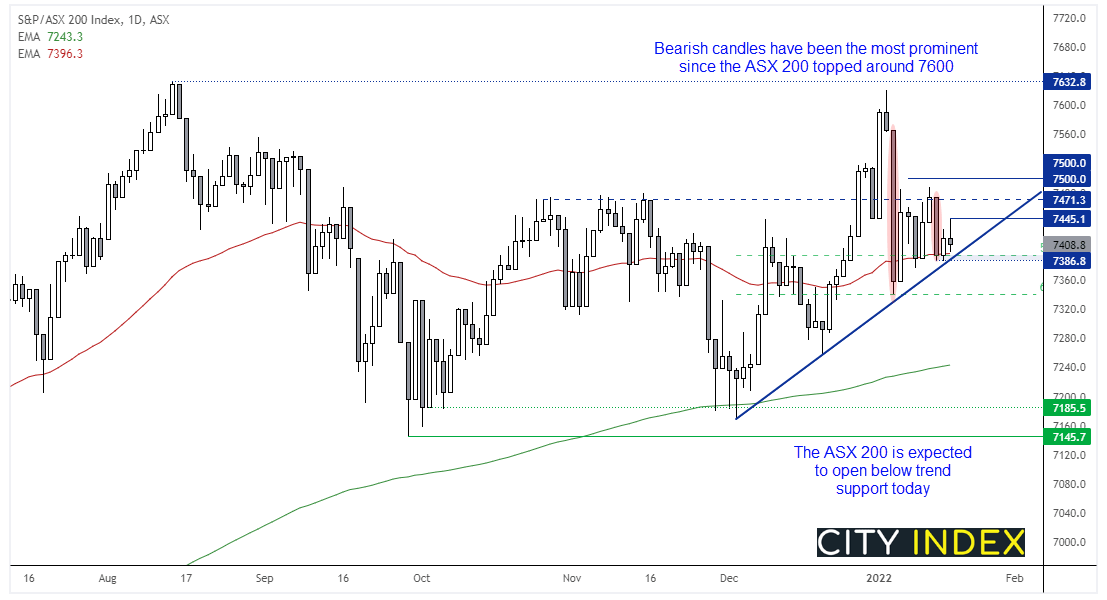

The ASX 200 is expected to open below 7400

Read our guide on the ASX 200 trading guide

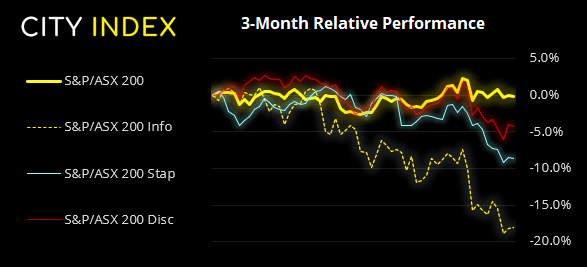

With US cash markets and Asian indices in the red, the ASX 200 is also expected to get dragged down with equity market sentiment. Futures currently suggest an open around 7350 (use that with a large pinch of salt), but it is likely to be beneath trend support. If so, it provides a clear level for bears to fade into if they want to retain a bearish view over the near-term. Due to the prominent bearish candles since it topped around 7600, the bias was for a downside break so now we need momentum to drive it lower in line with that bias.

ASX 200: 7408.8 (-0.11%), 18 January 2022

- Utilities (-0.57%) was the strongest sector and Information Technology (0.23%) was the weakest

- 5 out of the 11 sectors closed higher

- 6 out of the 11 sectors closed lower

- 5 out of the 11 sectors outperformed the index

- 101 (50.50%) stocks advanced, 89 (44.50%) stocks declined

Outperformers:

- +7.04% - Imugene Ltd (IMU.AX)

- +6.86% - JB Hi-Fi Ltd (JBH.AX)

- +6.33% - Liontown Resources Ltd (LTR.AX)

Underperformers:

- ·-7.51% - AVZ Minerals Ltd (AVZ.AX)

- ·-3.53% - Virgin Money UK PLC (VUK.AX)

- ·-3.43% - Zip Co Ltd (Z1P.AX)

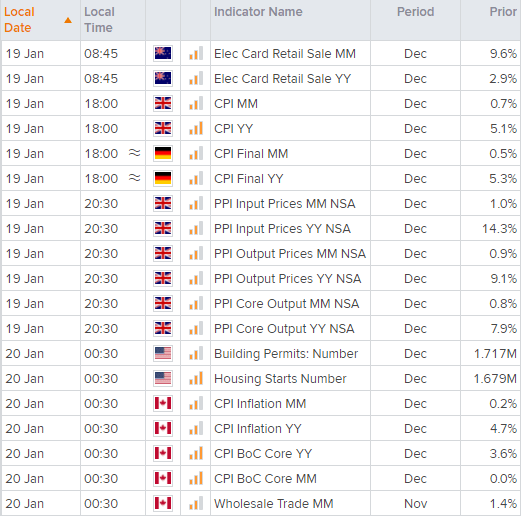

Up Next (Times in AEDT)

How to trade with City Index

You can easily trade with City Index by using these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade