- USD/JPY analysis: JPY faces big test as BoJ decides whether to end NIRP

- Gold analysis: Metal could head to new record if FOMC dot plots still point to 3 cuts

- GBP/USD analysis: Pound faces testing week, with BoE, CPI and retail sales all to come

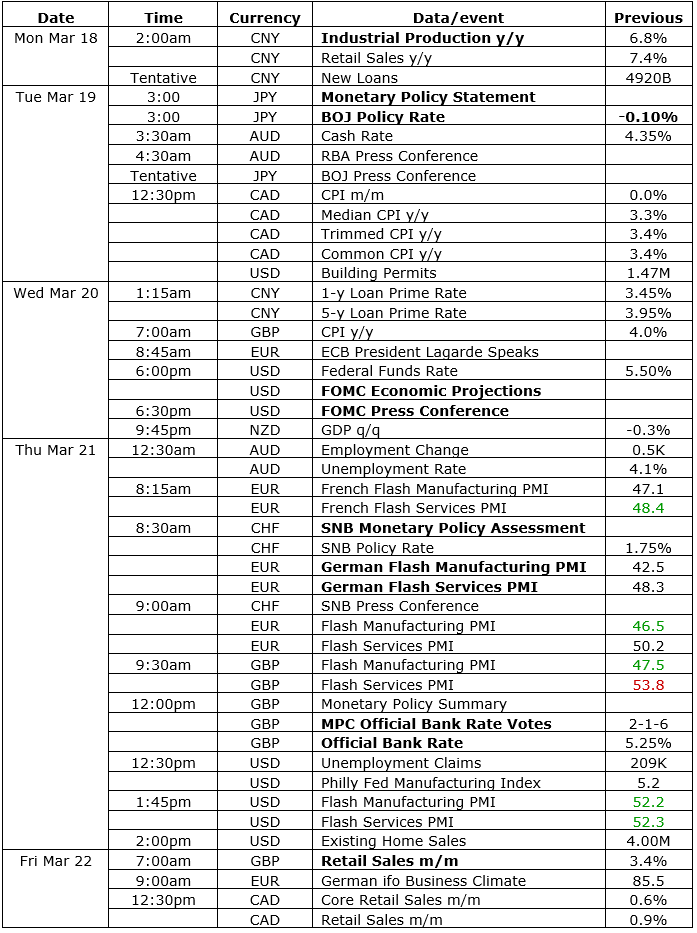

In the week ahead, the economic calendar is full of major central bank meetings and some top-tier economic data from Australia, China, UK, Eurozone and US & Canada. Expect heightened volatility across asset crosses. Among the major central banks, we will hear from the Bank of Japan and Reserve Bank of Australia on Tuesday, followed by the US Federal Reserve on Wednesday and finally the Swiss National Bank and Bank of England on Thursday. Global manufacturing PMI data will be the highlight in terms of economic data. In the UK we will also have CPI and retail sales figures to consider, while China’s industrial production and retail sales figures should garner some attention in light of recent optimism surrounding Chinese demand, which has helped to fuel a rally in commodity prices.

Let’s discuss some of the central bank meetings and how this will impact their respective currencies.

USD/JPY analysis: JPY faces big test as BoJ decides whether to end NIRP

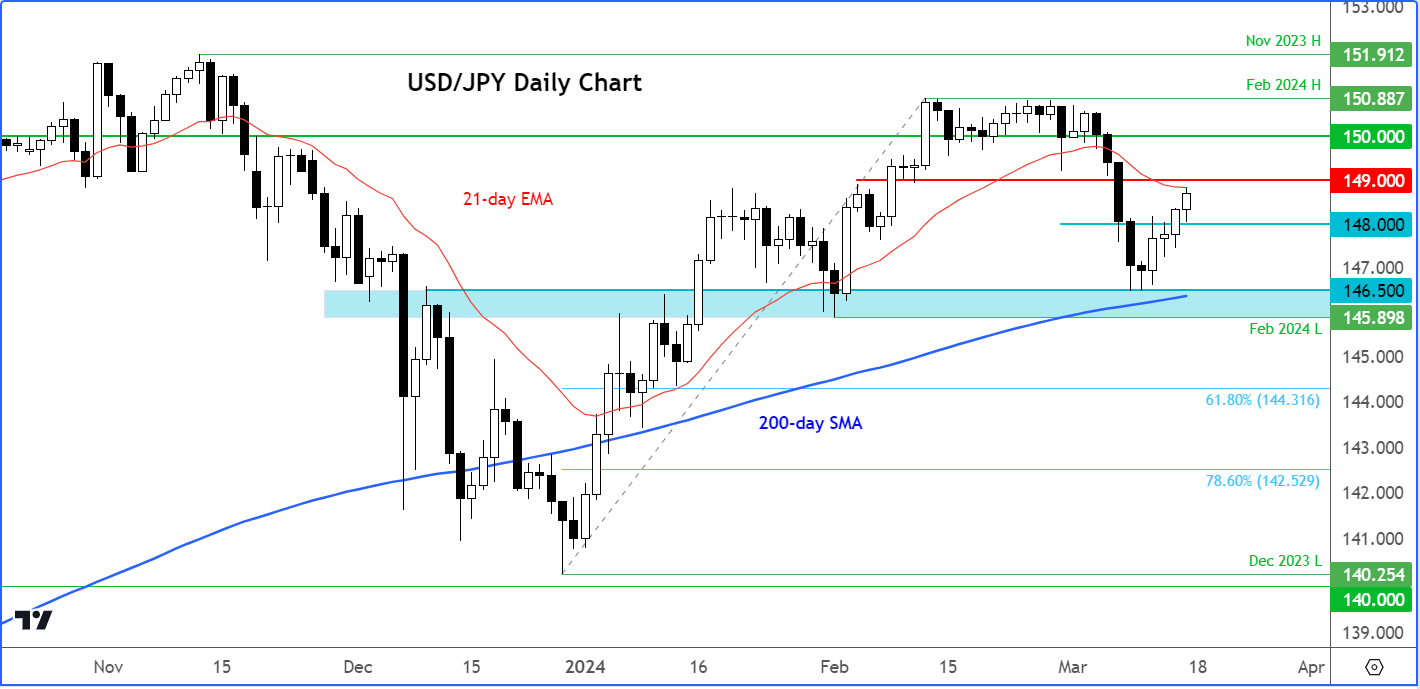

The Bank of Japan meets on Tuesday, March 19 with the decision expected around 03:00 GMT. The USD/JPY has risen from around 146.50 to above 148.50 in recent days thanks to strong US inflation data raising some concerns that the Fed will keep rates higher for longer. More on that later, but first it will be the BoJ meeting that will keep the USD/JPY traders busy next week.

Japan's spring wage negotiations concluded, aligning with the Bank of Japan's goals to ease ultra-accommodative monetary policy. Companies agreed to significant pay raises, averaging over 4%, the highest in 30 years, surpassing last year's 3.6%. This is notable as smaller firms, major employers, typically offer lower raises. These increases might prompt a re-evaluation of the Bank of Japan's negative interest rate policy, at next week’s meeting. The BoJ is aiming for sustained inflation near the 2% target, so keeping rates in the negative could adversely impact inflation. The BoJ will also want to have some ammunition in case the economy needs it at a later point in time. Reports suggest the BOJ is planning to end its negative interest rate policy at this meeting, but will there be another disappointment?

Well, judging by how the USD/JPY and other JPY crosses have traded in recent days, doubts are starting to creep into investors minds. BoJ Governor Kazuo Ueda recently warned that ‘weakness has been seen in some data’ and we’ve heard more of the same from the central bank’s other officials, which means the central bank remains reluctant to switch gears.

Ahead of the BoJ meeting, the key levels to watch on the USD/JPY are 149.00 on the upside, which was a former support levels, while 148.00 and then 146.50 are the next two potential support levels, with the latter also marking the 200-day average.

Gold analysis: Metal could head new record if FOMC dot plots still point to 3 cuts

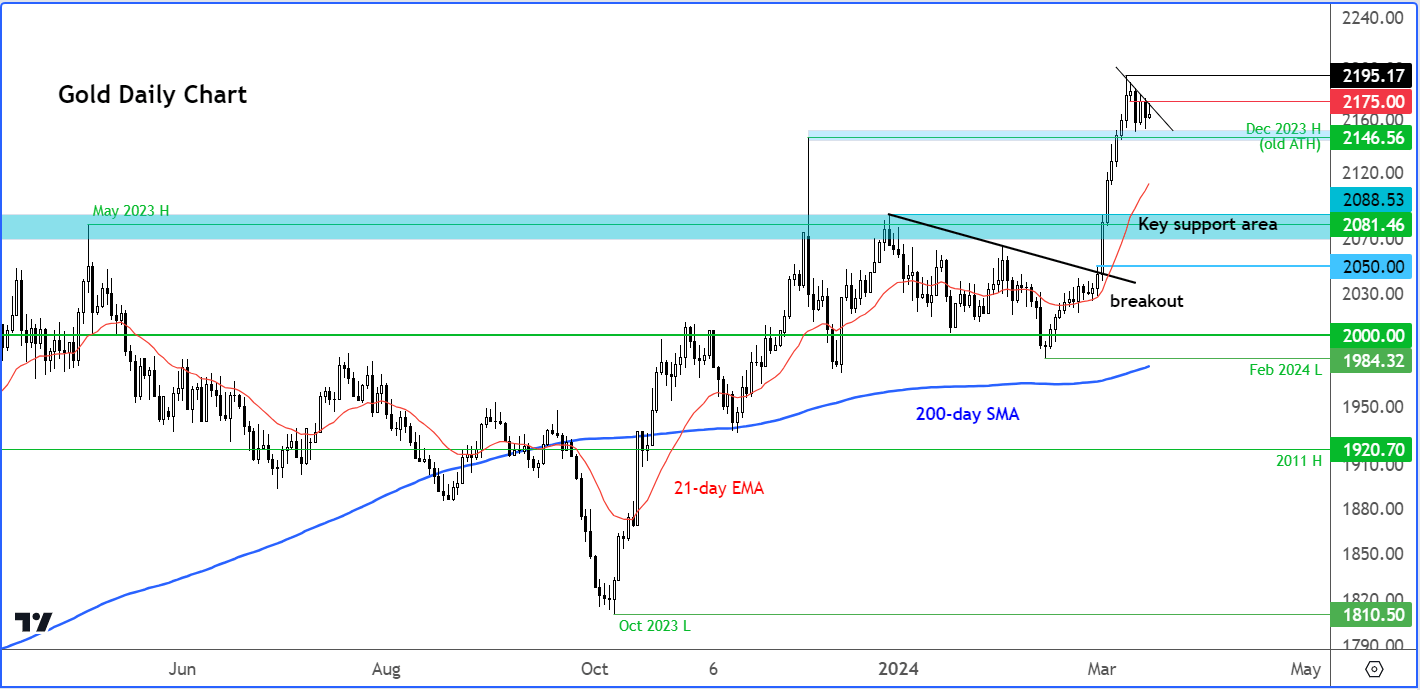

The Fed will update its economic forecasts (“Dot plots”) at its meeting on Wednesday, March 20. The December dot plot had a median estimate of 3 cuts this year. But in light of the strength in inflation, there is a chance that the median could drop to 2 cuts, and that could light a match under the US dollar’s bull fire. Following last week's unexpectedly high CPI report, Thursday's significant rise in producer prices appears to have solidified the stance on Fed policy for those who were undecided. However, despite these developments, Fed fund futures continue to indicate a 59% probability of a rate cut in June. While no rate cut is expected at next week’s meeting, the fact that the dot plots will get updated means it is very important for the dollar, gold and financial markets in general. If the dot plot still has a median estimate of 3 cuts pr more this year, then that could send the dollar tumbling, sending gold to a new record high.

Ahead of the FOMC meeting, gold is in consolidation mode, holding above short-term support seen around the $2145/$2150 area (where it had peaked in December), ahead of stronger support around the $2080/90 area.

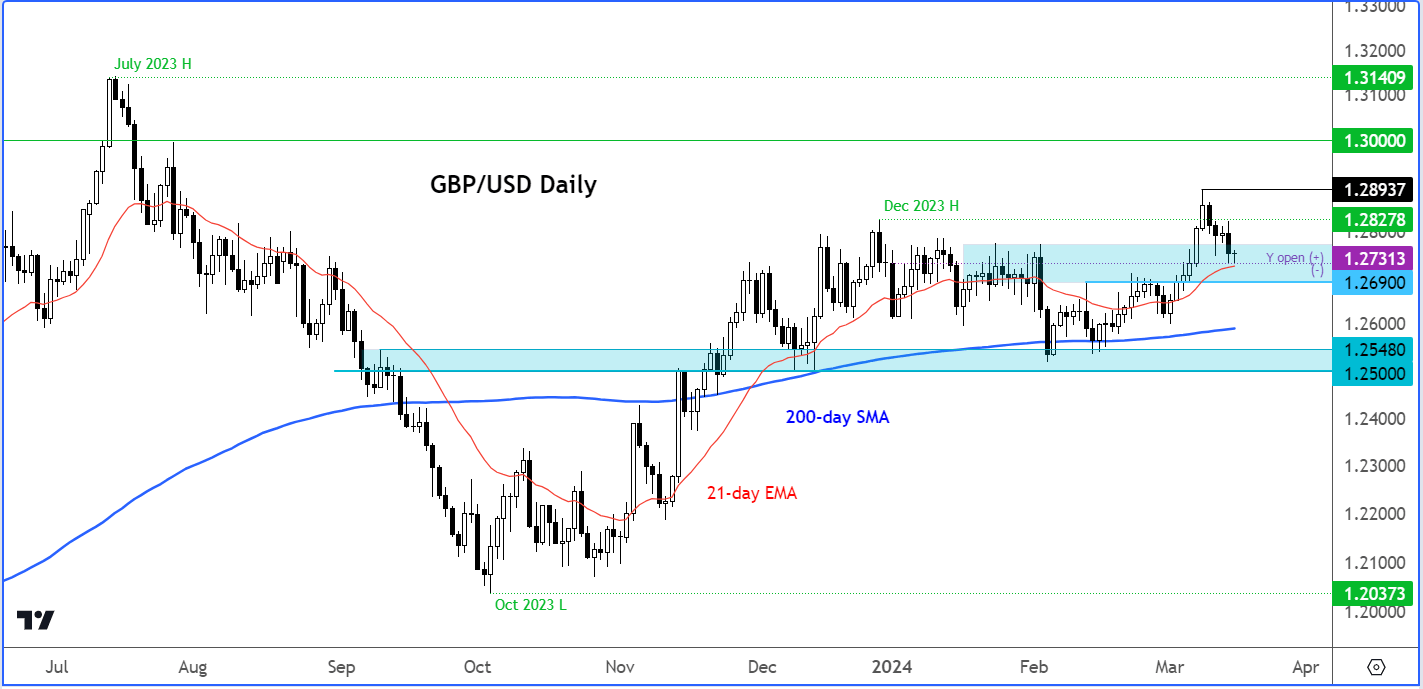

GBP/USD analysis: Pound faces testing week, with BoE, CPI and retail sales all to come

The Bank of England meeting is on Thursday, March 21. Ahead of it, we will have heard from the Federal Reserve the day before. The Fed meeting may well set the tone for the GBP/USD, reducing the impact of the BoE meeting. Still, we can’t take anything for granted. We will also have important PMI data from both sides of the pond, as well as UK CPI and retail sales to take into account.

Insofar as the BoE is concerned, the market is not expecting any rate cuts at this meeting. At it its first meeting of 2024 in February, the UK central bank maintained the Bank Rate at 5.25%, as expected. However, dissent emerged with two policymakers advocating for a 25bps hike, while one member preferred a decrease. While stressing the need for sustained restrictive policy to achieve 2% inflation, the bank dropped hints of further tightening and recognised a more balanced inflation risk. Despite this, inflation indicators remain elevated, though services inflation and wage growth fell more than anticipated. The Bank anticipates gradual GDP growth recovery, attributed to reduced impact from previous rate hikes. CPI inflation is forecasted to briefly hit the 2% target in Q2 before rising in Q3 and Q4. No change in policy is expected but it is all about hints of cuts in the future.

What else to watch in the week ahead?

Here’s the full economic calendar for the week ahead, with lots of market moving events to

Source for all charts used in this article: TradingView.com

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade