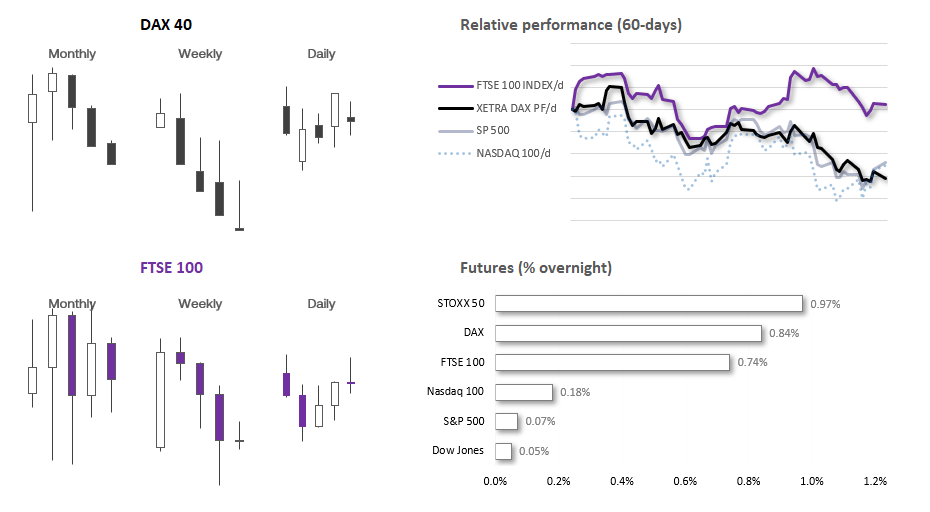

Asian Indices:

- Australia's ASX 200 index rose by 77.5 points (1.11%) and currently trades at 7,047.70

- Japan's Nikkei 225 index has risen by 736.25 points (2.46%) and currently trades at 31,757.92

- Hong Kong's Hang Seng index has risen by 226.59 points (1.29%) and currently trades at 17,743.99

- China's A50 Index has fallen by -27.94 points (-0.23%) and currently trades at 12,284.93

UK and Europe:

- UK's FTSE 100 futures are currently up 57 points (0.76%), the cash market is currently estimated to open at 7,549.21

- Euro STOXX 50 futures are currently up 40 points (0.97%), the cash market is currently estimated to open at 4,152.57

- Germany's DAX futures are currently up 131 points (0.86%), the cash market is currently estimated to open at 15,259.11

US Futures:

- DJI futures are currently up 16 points (0.05%)

- S&P 500 futures are currently up 3.25 points (0.07%)

- Nasdaq 100 futures are currently up 28.25 points (0.19%)

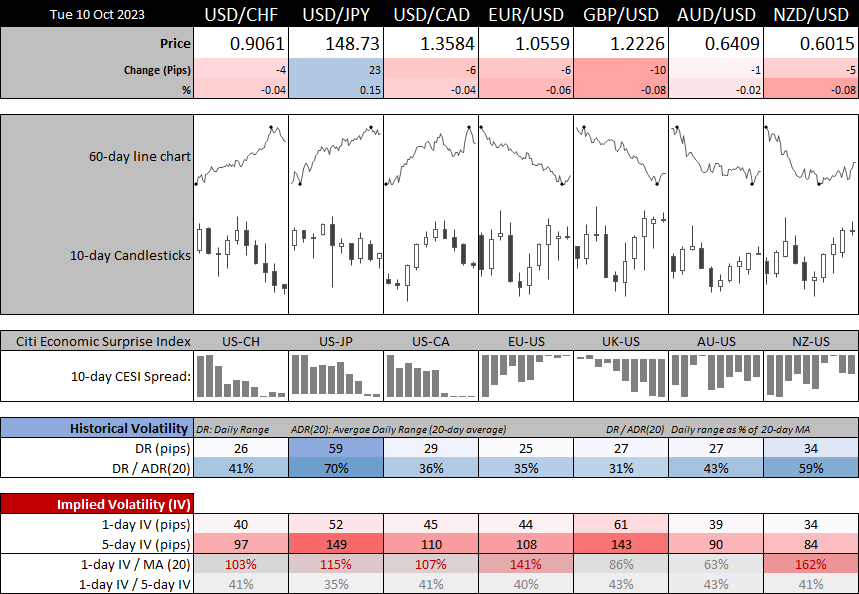

APAC shares excluding China were higher on Tuesday as they took Wall Streets lead. Comments from Fed member Jefferson seems to have convinced markets that the Fed are done with hiking, which saw odds of a 25bp November hike fall from 27.1% to 11.4% on Monday.

US cash bond markets will reopen today after being closed on Monday due to Columbus Day. Yet futures markets suggest the yields curve from the 2-year and above could open 10-15bp lower. Bond investors seem to have stepped back into the market due to the Middle East conflict, and whilst lower yields allowed risk to rise on Monday, it is not a true risk-on rally by my books. And it is for that reason that I feel inclined to fade many of the moves seen on Monday, such as gold and indices.

Events in focus (GMT+1):

- 14:30 - FOMC Member Bostic Speaks

- 16:00 – US 1-year consumer inflation expectations

- 18:30 – Fed Waller Speaks

- 20:00 – Fed Kashkari speaks

- 23:00 – FOMC Member Daly Speaks

With Fed Jefferson noting high bond yields and the need for the Fed to approach policy with caution, I’m interested to hear if other Fed members follow suit. So it is worth keeping a note of that Bostic, Waller, Kashkari and Daly say over the next 24 hours as it could make a material impact on sentiment. Given stocks rose yesterday, then we could see a follow-through if Jefferson’s comments are echoed by most if not all. But if Fed members continue to dangler that hawkish carrot, it could see sentiment swayed for equities and gold to the downside.

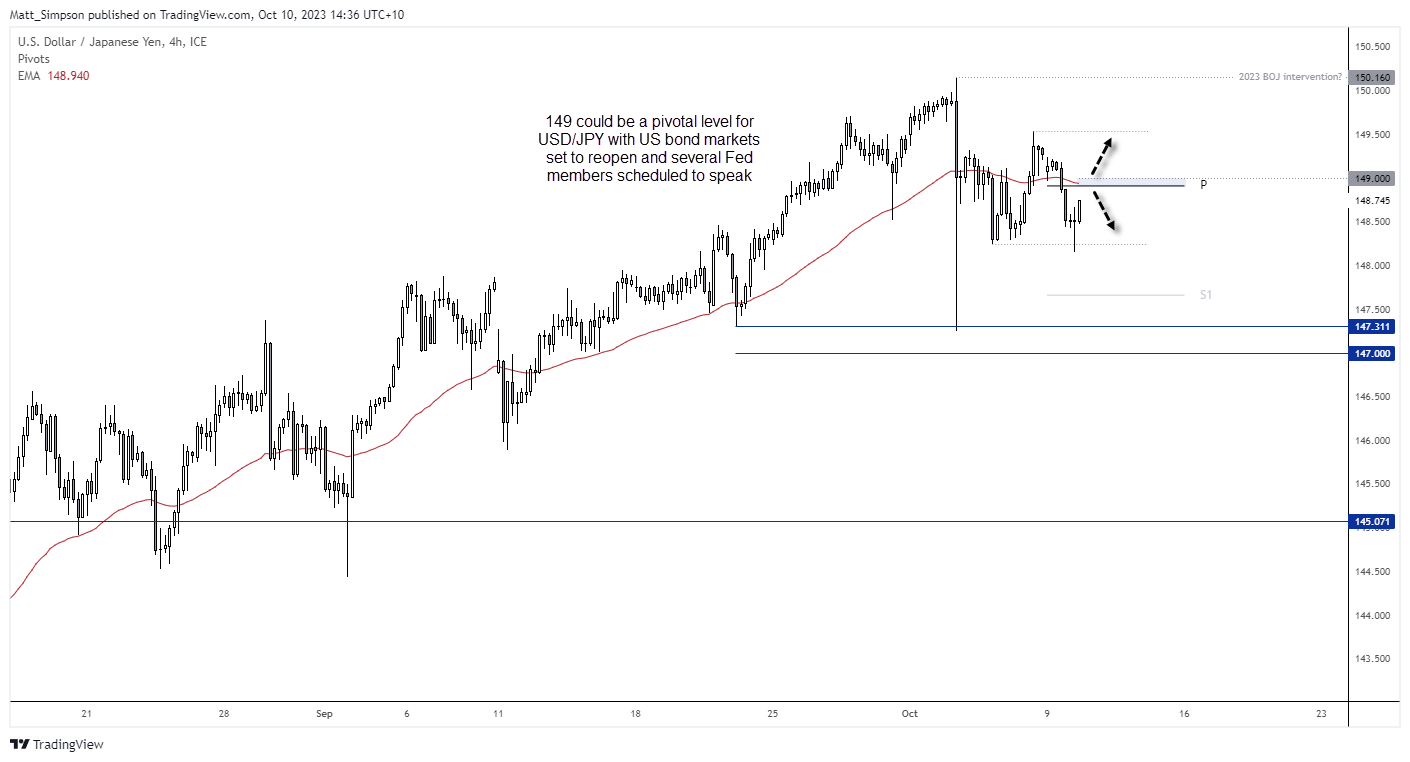

USD/JPY technical analysis (4-hour chart):

Unfortunately as expected, USD/JPY price action has remained confined within the candle range that sparked accusations of a BOJ intervention. With prices prattling around without much of a care in the world, a new range has formed between 148.25 – 149.55. And momentum is trying to turn higher following its Doji on the 4-hour, and prices have just confirmed it as a reversal candle with a break of its high.

149 is a pivotal level to keep an eye on as it houses the 50-dar EMA and weekly pivot point. Should prices drift towards that level, I’d keep an eye on evidence of a reversal, whereas a clear break above 149 brings the cycle highs around 149.55 into view.

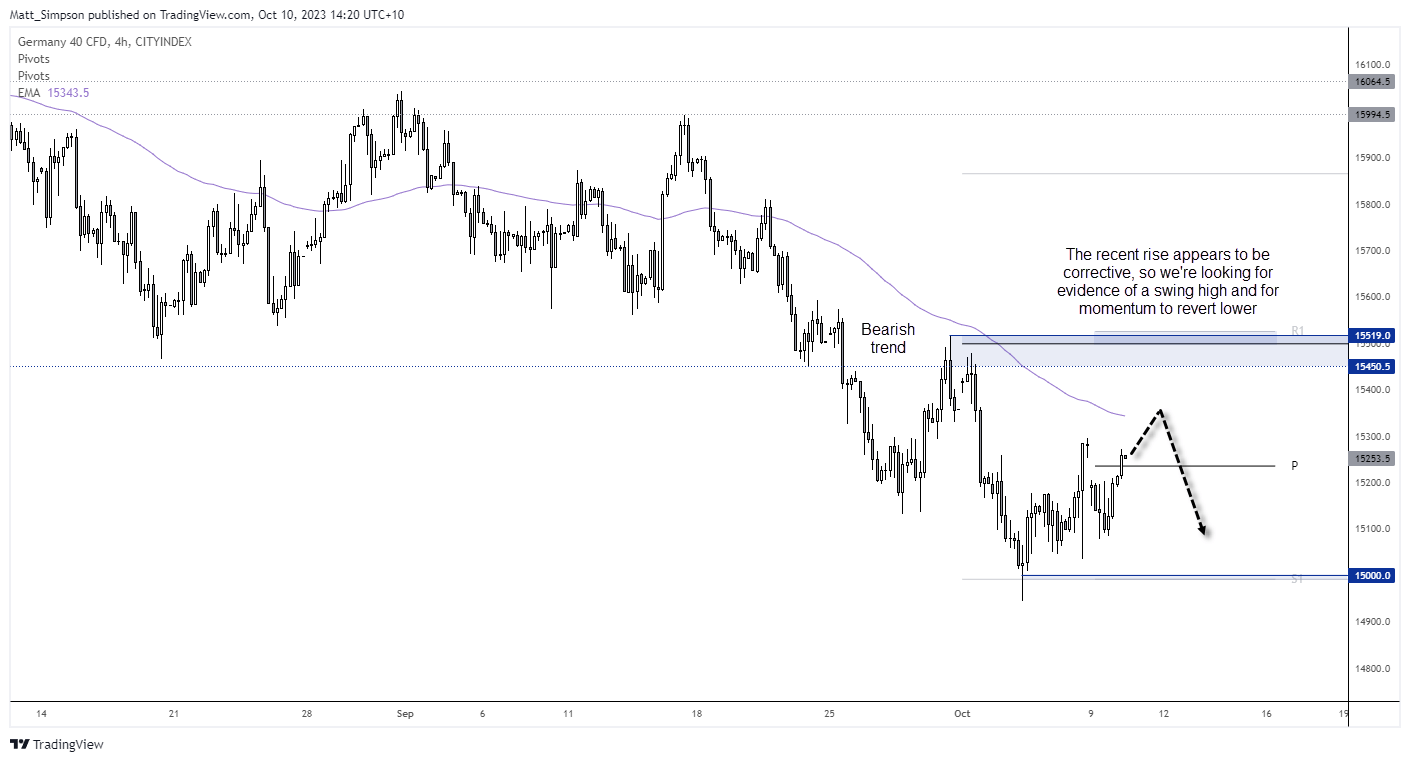

DAX technical analysis (4-hour chart):

The DAX managed to build support around the 15k level before forming a countertrend rally. However, the recent leg higher lacks conviction if we compare it to what we saw last Friday. The DAX has closed its weekend gap and looks like it wants to breach the high around 15,300. From here, I’m looking for evidence of a swing high whilst prices remain beneath the 15,500 resistance zone. Perhaps it can top out near the 100-bar EMA around 15,350 and head for 15,100 and 15,000.

View the full economic calendar

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade