The big news today was from the US jobs market, as ADP reported private payrolls rose by 235,000 in December which was significantly more than 152,000 expected. In addition, initial jobless claims came in weaker, at 204K vs. 230K eyed, with continuing claims also declining. The data comes as Amazon has announced a huge 18,000 job cuts, with several other companies in the tech sector also recently announcing job cuts. Today’s stronger employment data has therefore reduced fears about a downturn in employment and has raised worries that wage inflation could accelerate further and thus provide a major source of risk in the inflation outlook. Accordingly, traders have pushed up their expectations for the terminal interest rates in the US. The June Fed funds futures contract implies a peak interest rate of above 5.00% now, much higher than at the start of the week.

Following the publication of the ADP payrolls data, there was a swift recovery for the dollar which saw the cable slice through $1.20 handle to drop near 1.19 handle before bouncing back slightly. Similarly, the EUR/USD plunged below 1.0600, while the USD/JPY climbed above 133.50. We also saw bond yields bounced back, which caused low and zero-yielding assets tumble. Gold fell further below the $1850 level which it had broken overnight. Nasdaq futures went the other direction, losing their earlier gains made on optimism about Amazon’s cost savings (i.e., job cuts).

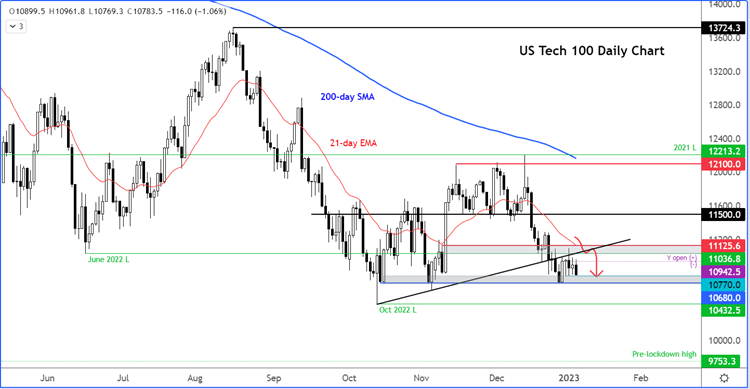

At the time of writing, the Nasdaq was again testing this week’s low around 10770, a level which has provided decent support in the last few days. The bears will be eyeing a clean break below this level to target last year’s low at 10432 next.

Conservative bulls need to wait for a confirmed reversal signal before looking for potential long setups. This could come in the form of a break above the key resistance area highlighted between 11035 to 11125 area.

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade