Hot inflation

Inflation, the increase of prices for products and services, is rampant. Inflation, as measured by the consumer price index (CPI), rose to a record high of 9.1% YoY in Europe, has hit double digits in the UK, and is cooling at a much slower than expected pace in the US, where it currently sits at 8.3% YoY.

Central banks across the globe are hiking interest rates at the fastest pace in decades in a bid to tame soaring prices, yet inflation is showing few signs of cooling rapidly.

Higher interest rates slow growth, yet central banks have made it clear that high inflation is the bigger risk. Policymakers are willing to hike rates aggressively, even if this means tipping the economy into recession.

The prospect of aggressive rate hikes and rising recession fears have created a solid risk-off play in the stock markets. US indices recorded the worst weekly performance last week since early June.

What to trade in today’s high inflationary environment ?

Broadly speaking, certain assets tend to outperform during times of high inflation, such as Gold, commonly referred to as a hedge against inflation, commodities, real estate, and blue-chip stocks.

However, the fact that Gold is trading at a 2.5-year low, and that oil has fallen 30% since its June highs suggests that these may not be good inflation plays this time around.

Instead, the USD is standing out as a strong inflation play and goes some way to explain the weakness seen in Gold. Not only is the USD benefitting from the hawkish Federal Reserve, it is also gaining ground on safe-haven inflows. And let’s be honest, while Europe and the UK are in a much worse economic position than the US, investors are likely to keep buying the dollar quite simply because there are a few other sensible alternatives.

The USD could continue to perform well against the Japanese yen, as central bank divergence remains strong and potentially against other currencies where central banks are looking to slow their pace of tightening, such as the AUD and CAD.

The USD could start to lose its shine when US inflation shows clearer signs that it is cooling and when the Fed starts to show signs that it is ready to start taking its foot off the hiking gas.

This week sees both the Fed and the BoJ meeting to discuss monetary policy. The outcomes could further highlight central bank divergence, meaning USD/JPY could have further to rise.

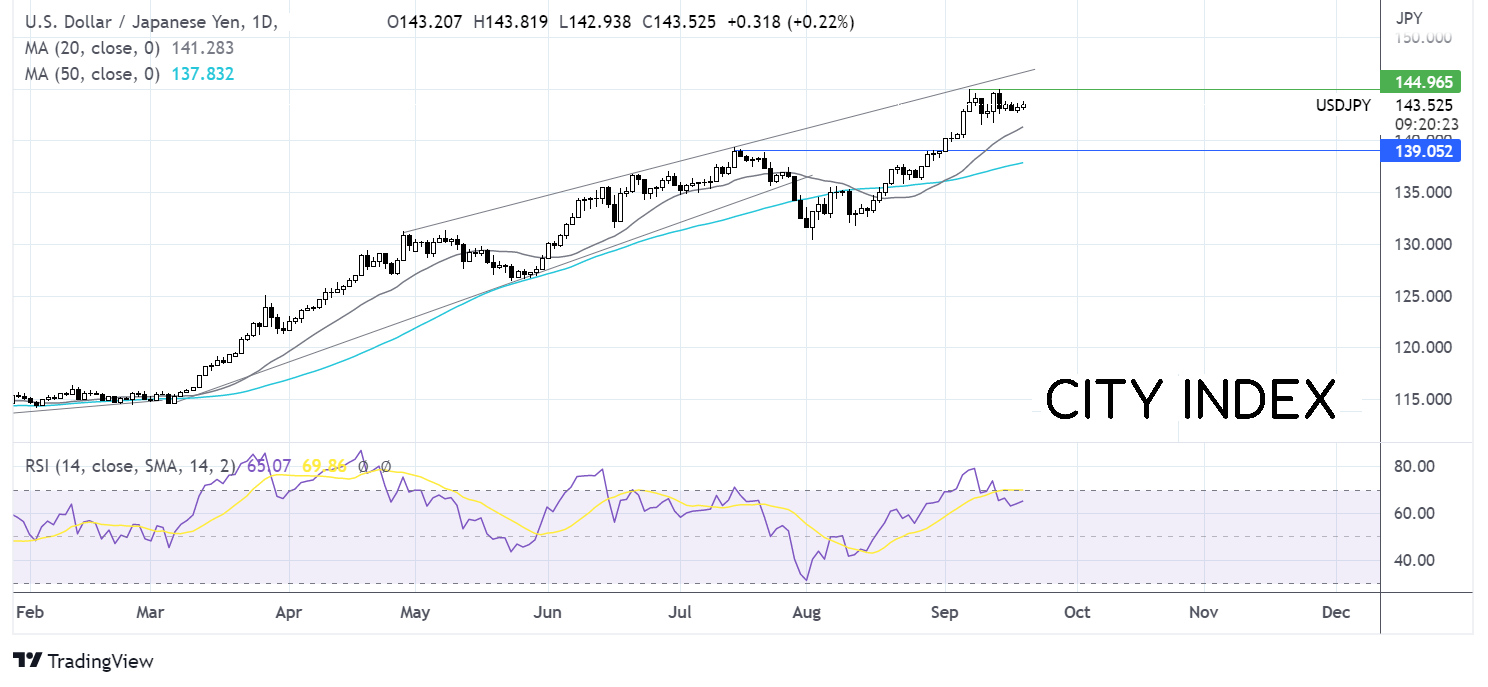

Where next for USD/JPY?

USD/JPY has been trending firmly higher since the start of Q2, forming a series of higher highs and higher lows. The pair trades above its 20 & 50 sma and is guided higher by a rising trendline resistance. The recent consolidation of around 143.50 has seen the RSI ease back from overbought territory. Buyers will look for a move over 145.00 the 22-year high reached last week, the extend the bullish trend towards 146.55 the rising trend line resistance. On the flip side, support can be seen at 141.20 the 20 sma and last week’s low. A break below here opens the door to 140.00 round number and 139.40 the July high.

Other inflation plays

Highly leveraged companies also perform badly in a high inflation environment. This is reflected in the underperformance of the tech-heavy Nasdaq. The Nasdaq has fared worse than its Wall Street peers as inflation remains persistently high. Shorting the Nasdaq could be another inflation play, if the Fed ramps up its hawkish rhetoric. Meanwhile, when inflation eases going long, the Nasdaq could be a strong recovery trade.

With regards to sigle stocks, look for those firms that are able to pass on higher costs to the consumer. Consumer staples are often a good starting spot.

Falling into recession?

One of the key risks seen in the market is that high inflation and rising interest rates could trigger a recession. High-interest rates make credit harder to secure and make services existing dent even more expansive, choking economic growth.

In a recession, safe havens, such as the USD, could remain firm, in addition to defensive stocks with strong balance sheets such as utilities, energy, and consumer staples.