Attention is firmly fixated on the upcoming release of US inflation report, which has the potential to move the markets sharply. Ahead of it, the US dollar index has extended its losses for the fifth consecutive day, with US 10-year bond yields declining for the third day in a row. Consequently, gold is finding itself higher, along with the European markets and US index futures. While it is down now, the US dollar outlook is subject to change depending on the outlook of the data.

Before discussing the soon-to-be-released inflation data in greater detail, let’s take a look at some dollar pairs.

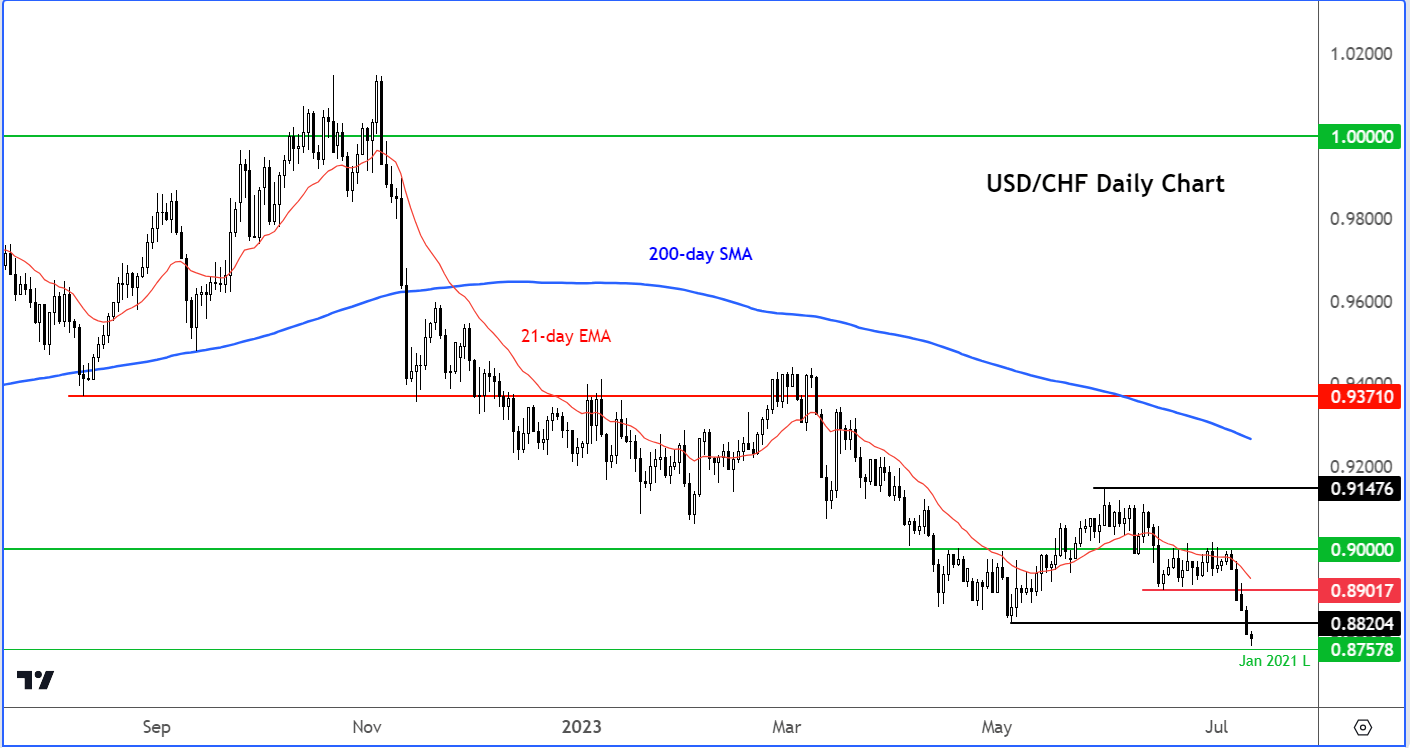

USD/CHF analysis: Swissy at lowest point since Jan 2021

The greenback has fallen to a 2-month low on bets that the Fed is close to reaching peak rates this cycle. We have seen the greenback weaken especially against currencies where the central bank is the least hawkish, thanks to the sharp fall in US bond yields. The likes of the USD/JPY and USD/CHF have fallen sharply over the past couple of days, with the latter hitting its lowest level since January 2021…

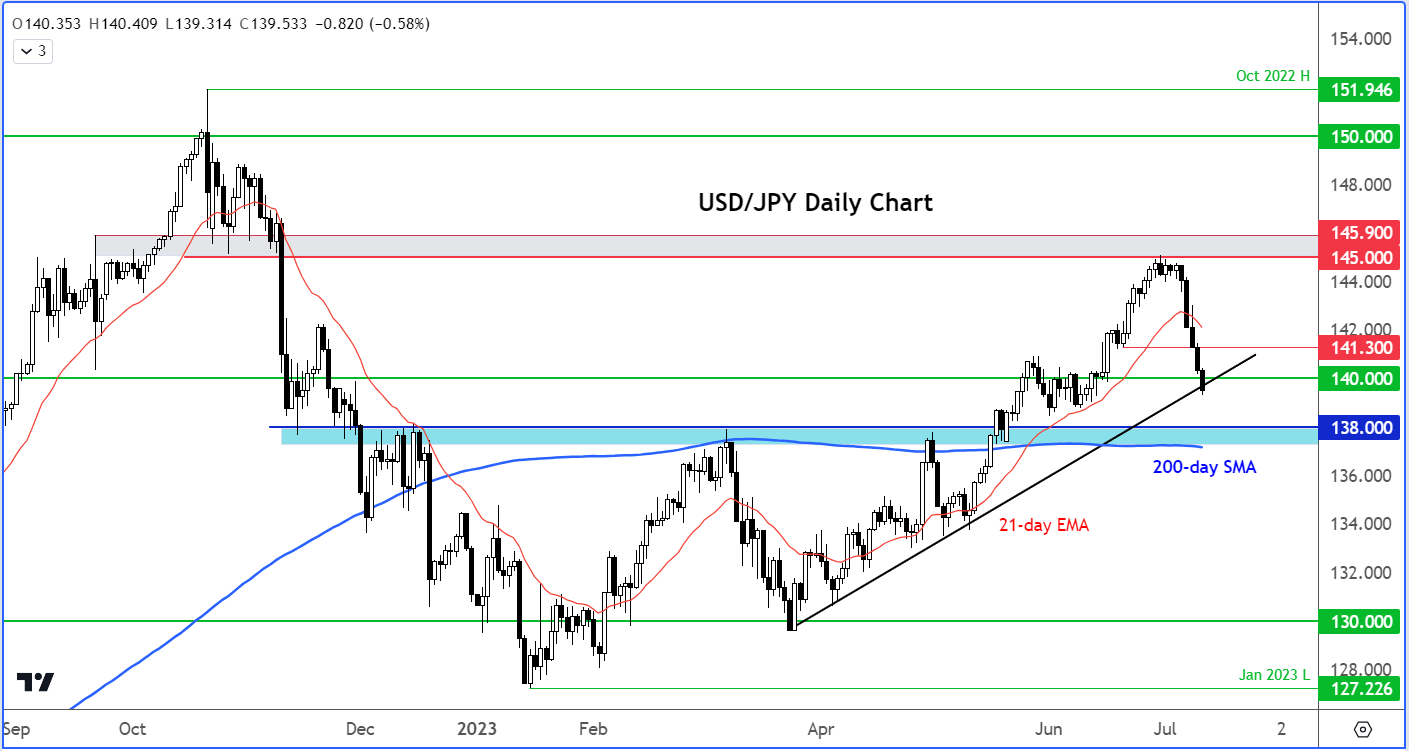

USD/JPY analysis

Meanwhile, the USD/JPY is below the key 140 handle – it will need to close back above this key psychological level to re-establish its bullish bias.

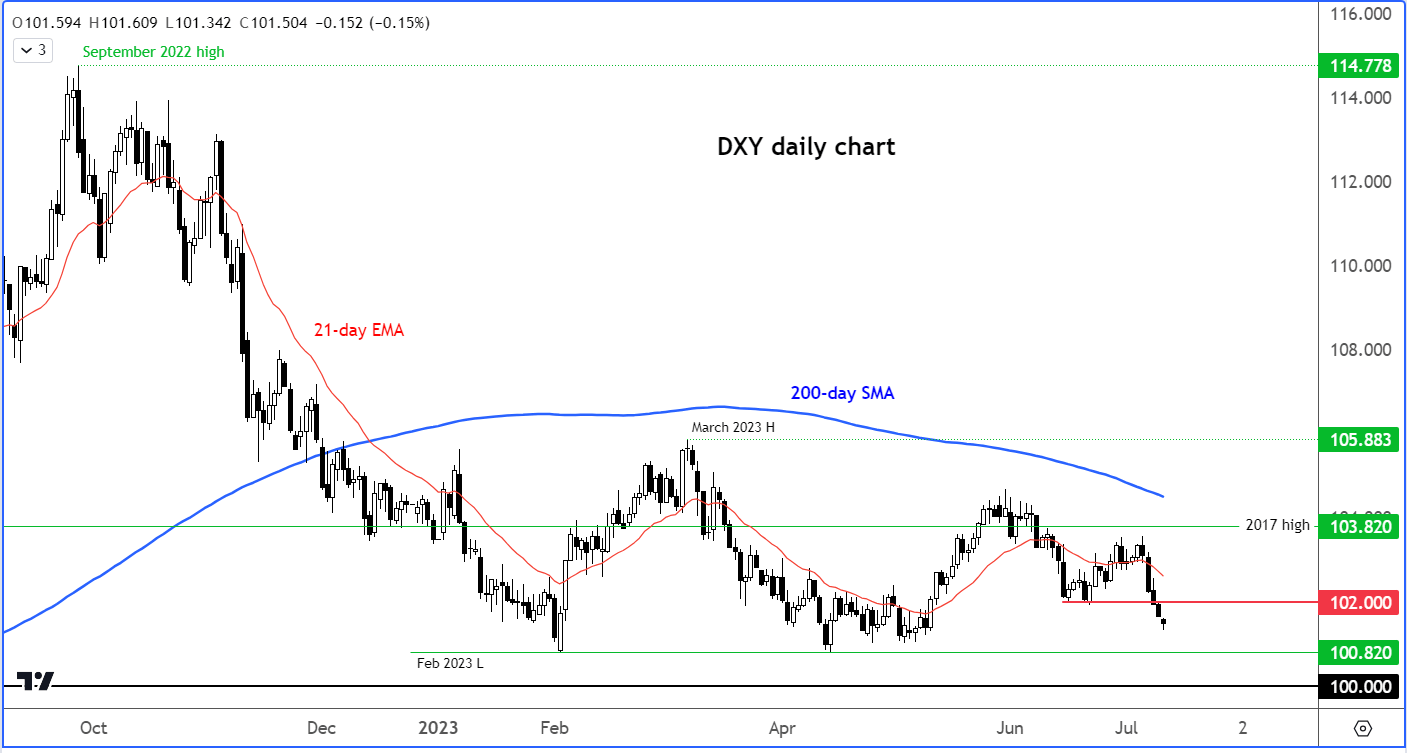

Dollar outlook: DXY technical analysis

The dollar outlook appears bearish judging by the breakdown in the Dollar Index, which has fallen below key support in the 102.00 area after failing to make a higher high in June. As a minimum, it will need to go back above this level in order to make its short-term outlook bullish again.

We will get bullish on the dollar outlook from a technical point of view in the event it makes a higher high now or a false break reversal around its February low of 100.82. The declining moving averages are objectively telling us to remain cautions on any long trades or bullish views.

The weaker US dollar suggests investors are possibly expecting to see a weaker-than-expected CPI report and, in any case, a 25-basis-point rate hike is now fully priced in.

What to expect from the CPI report?

The inflation report is expected to show that consumer prices cooled to 3.1% annual pace in June. The actual reading will need to be substantially below 3% for the odds of a 25-bps hike to fall meaningfully from the current level of around 95%.

However, inflation is only expected to fall sharply mainly due to base effects. Indeed, on a month-over-month basis, CPI is expected to rise 0.3% - not something that would appease the Federal Reserve.

Meanwhile core inflation is expected to cool for a third straight month to a still very high 5.0% from 5.3% previously. The Fed will want to see core prices decline towards their 2% target before thinking about cutting rates again. It could still be a long time.

For now, investors are fully expecting a potentially last rate increase in July, but the inflation report is still going to be important because the data may shed more light on whether to expect another hike this year.

So, the dollar could still make a comeback after what has been a bruising few days.

Source for all charts used in this article: TradingView.com

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade