Did you know US bond yields have or are threatening to punch through the highs seen last year? Or how about real yields on benchmark US inflation-protected securities about to top 200 basis points? How about China Evergrande filing for Chapter 15 bankruptcy protection in the United States, amplifying concerns about the health of China’s property sector and economy?

If you’ve spent any time on social media in market circles recently, you’ll won’t have been able to miss it. Pessimism is everywhere towards just about everything, explained by the price witnessed in riskier asset classes as well as supposed safe havens.

Everyone seems bearish risk right now

But how long can that continue when everyone already knows? I’m not convinced the prevailing trend is over just yet, but in the short-term, ahead of a weekend where traders have no ability to hedge against potential shifts in sentiment, you have to wonder whether we may see a reversal of recent market moves on Friday, especially with headlines about further stimulus measures from China already doing the rounds.

Price action suggest risk of near-term market reversals

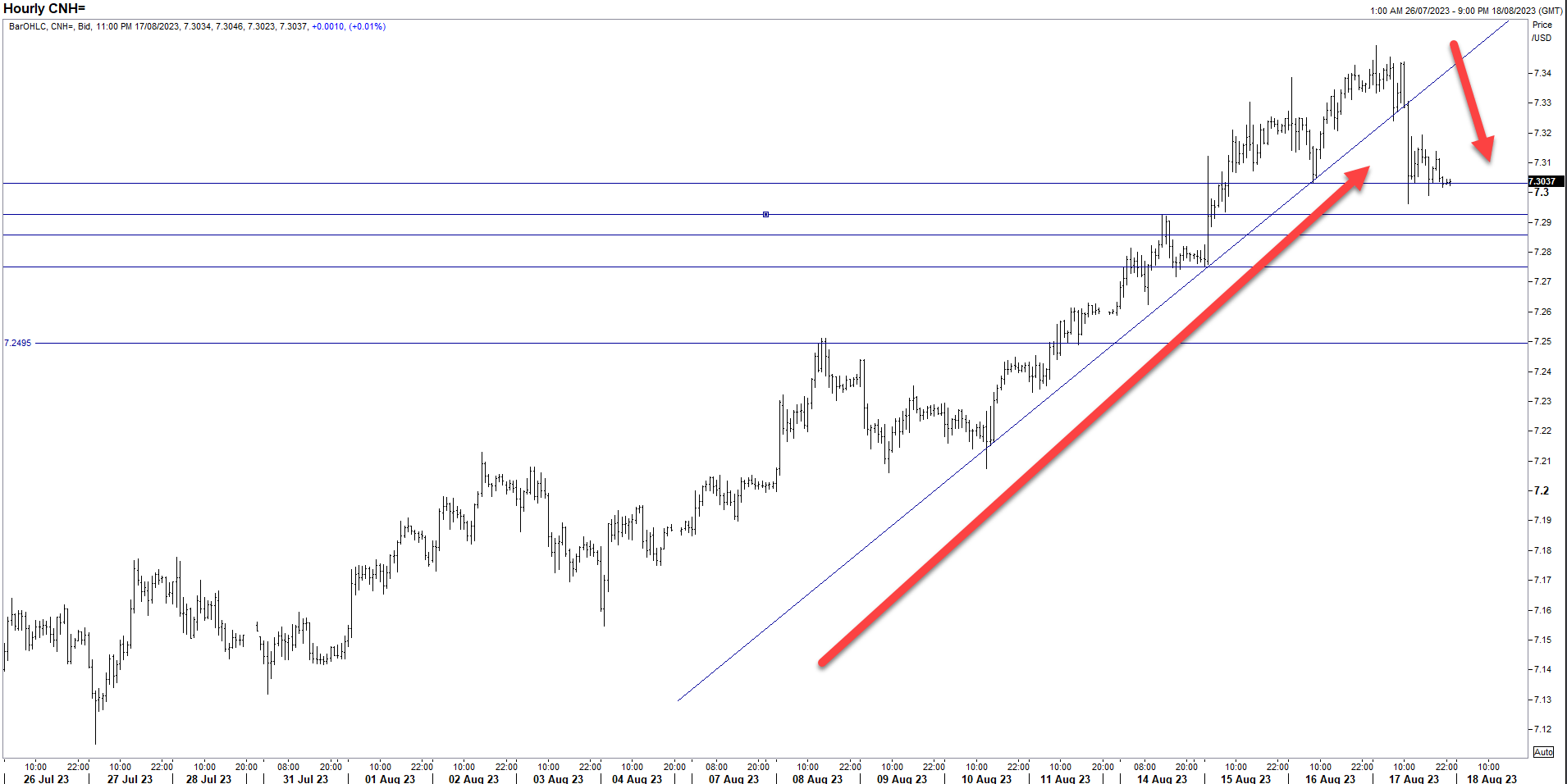

The price action in highly liquid markets such as AUD/USD, USD/CNH and USD/JPY, along with US Treasuries, was instructive on Thursday, reversing swiftly midway through the Asian session against the prevailing trend. While influenced by the People’s Bank of China continuing to intervene in FX markets by instructing state-run banks to sell dollars to support the yuan, the fact these moves stuck – despite the risk-off tone in US stocks – suggests short-term sentiment and positioning in less-liquid markets may be vulnerable to a squeeze today.

Keep an eye on US Treasuries and USD/CNH – they’ve proven to be influential on broader risk appetite during August. US stock and index options later today is a wildcard event that could prompt outsized and influential moves on markets outside of equities.

-- Written by David Scutt

Follow David on Twitter @scutty

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade