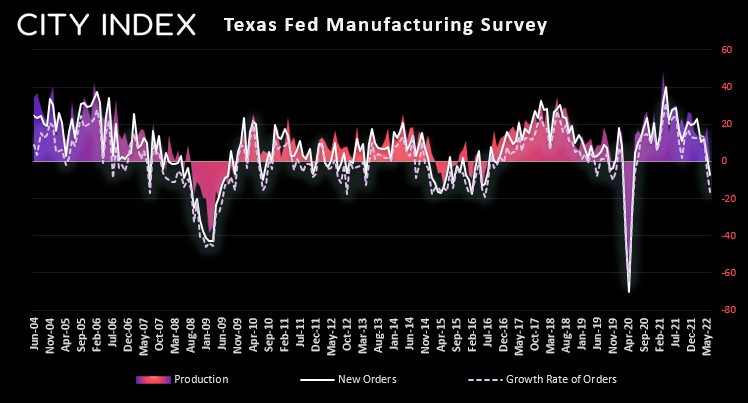

Summary of the June Texas Fed Business Outlook Survey

- Production lowest since May 2020

- New orders contracted (1st time in 2 years)

- The growth rate of orders index pushed further negative, from -5.3 to -16.2.

- The capacity utilization and shipments remained positive but fell markedly to 3.3 and 1.2, respectively.

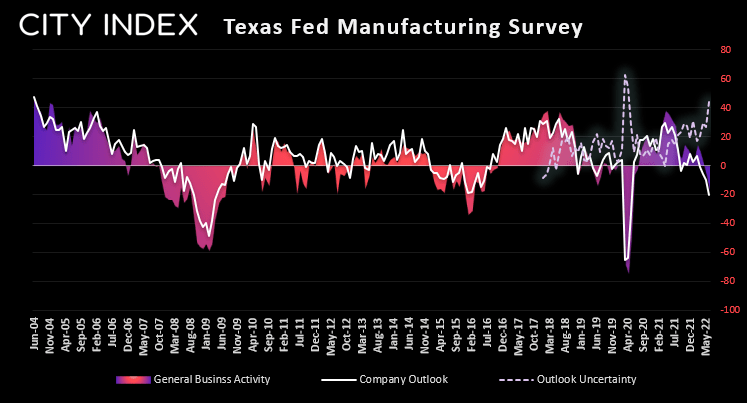

- The company outlook index also fell 10 points, from -10.0 to -20.2.

- The outlook uncertainty index shot up to 43.7, a 17-point jump from May.

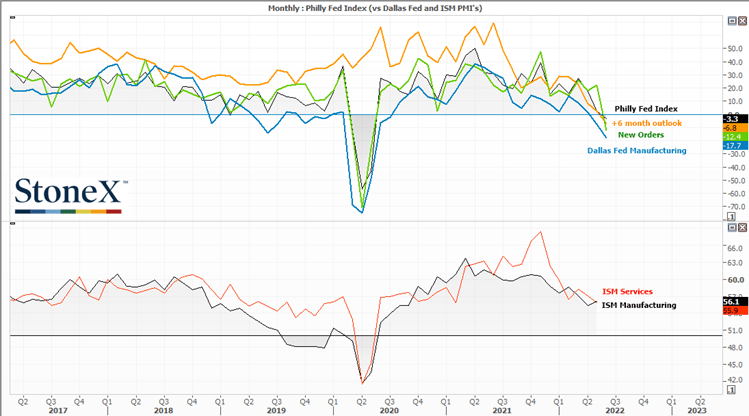

I’ve been taking a closer look at regional US business sentiment reports as they may be able to provide a sneak-peak of what to expect of the wider economy. Fears of a potential recession have resurfaced after Jerome Powell openly acknowledged a hard landing is possible, and a risk they accept as they aggressively hike rates (even if he still sees a recession as unlikely). Yet looking through many of the reports it appears possible that the risk of the recession may be higher than the Fed are letting on.

The Texas Fed Business Outlook Survey makes for a grim read, with new orders and growth rate for orders contracting and production at its lowest since October 2019 (and barely expansive). Shipments are also at a 2-year low and delivery time rose 15.6 points (its most aggressive spike in 14-months) which suggests supply chain issues are resurfacing. Not that they ever really went away.

What are economic indicators?

Business outlook is the worst since the pandemic

Optimism for the futures remains grim, with the business outlook index falling to a 2-year low of -20.2. General business activity contracted for a second month (and faster pace) of -17.7, and outlook uncertainty rose to a 25-month high of 43.7.

The report echoes that of the Philadelphia Fed Index studied last week; sentiment is not only weak in some regions, but deteriorating at a fast pace – and it could spill over to the national PMI reports in due course. On Friday the ISM (Institute of Supply Management) release their manufacturing PMI report for the US. It has been the longest running business sentiment survey of its kind and is closely followed as it helps analysts decipher where we are in the business cycle and help project future growth estimates. As the ISM manufacturing and services indices topped in Q1 2021 and have trended lower since, these reginal reports suggests the ISM reports could be headed towards a contraction over the coming months.

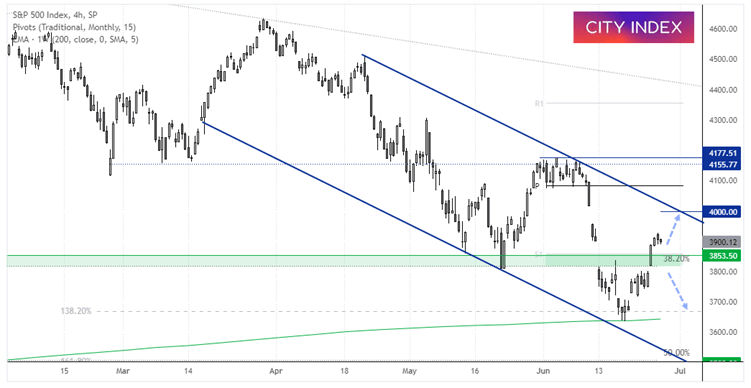

Until then we see the potential for further upside o the S&P 500. It trades within a bearish channel, although prices are rising as part of a retracement against its (arguably oversold) bearish trend. Support was found at the 200-week eMA ahead of a break above the 3850 resistance zone, which could now provide support whilst it moves towards 4000 or the upper trendline. A break below 3800 assumes momentum has realigned with its bearish trend.

How to trade with City Index

You can easily trade with City Index by using these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade