Its products are sold primarily in Australia, New Zealand, Greater China, and North America. A2M reports its half-year numbers on Monday, the 21st of February.

By its own admission, A2M has had an extraordinary journey, disrupted in FY 2021 by the arrival of COVID 19. Initially, A2M sales surged on a wave of panic buying, prompting A2M to upgrade its full-year earnings guidance in April 2020 by 32%.

Soon afterward, A2M experienced a drastic reversal of fortune, and the share price fell by over 75%. The closure of international borders bought the daigou/reseller channel to a halt that accounted for 60-70% of A2M’s revenue from Great China. And lower birth rates in China negatively impacted the size and growth of the China infant nutrition market.

The company has since acted to address the disruption, writing down excessive stock and bolstering its leadership team. Key to the companies turnaround will be building on its relatively small market share in China.

The company has long been touted as a takeover target. In August 2021, Nestle was reportedly taking a close look at A2M and, more recently, a rumour that Canadian dairy giant Saputo was a potential suitor. No bid has as yet has come from either rumours.

Analysts expect net profits after tax (NPAT) of NZ$60 million for 1HY22, a 50% reduction on the NZ$120 million of NPAT reported in 1HY21.

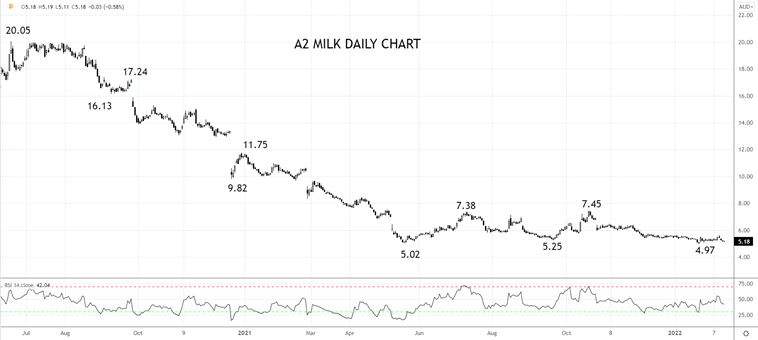

A2M Share Price Chart

After falling from a high of $20.05 in June 2021, the share price of A2M has settled into a range the past nine months, with support viewed near $5.00 and resistance viewed at $7.40ish.

Providing support at $5.00 holds another test of the $7.40 area is likely in the coming months, and as such, the bias is to be long A2M at current levels.

Source Tradingview. The figures stated areas of the 15th of February 2021. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade