As of Tuesday 1st March 2022:

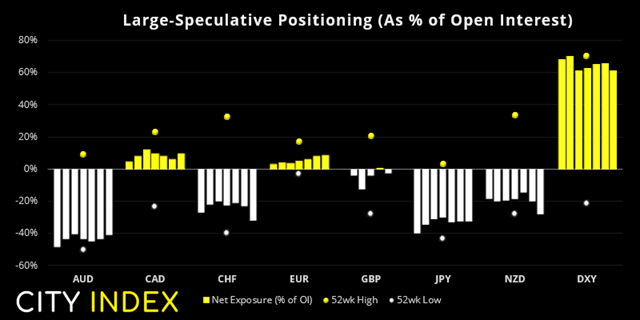

- Traders were net-long the US dollar by $3.854 billion, its lest bullish level for 29 weeks.

- Large speculators were net-long the dollar against G10 currencies by $6.1 billion, and net-short against emerging FX by -$2.3 billion.

- Traders were their most bullish on euro futures in 34-weeks, yet the strong decline heading into the weekend suggests bears were returning to the table.

- Net-short exposure to NZD futures were at their most bearish level since May 2020.

- Traders were their most bearish on CHF futures in 18-weeks.

Read our guide on how to interpret the weekly COT report

Read our guide on how to interpret the weekly COT report

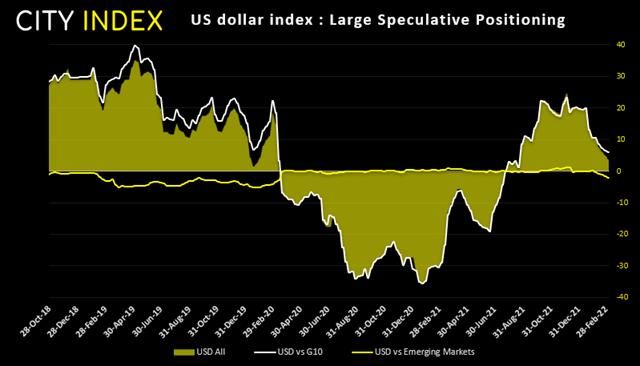

USD demand continues to dwindle:

Despite multiple hikes from the Fed on the horizon, traders continued to reduce net-long exposure to the US dollar. Against G10 currencies traders are not just $6 net-long, although also net-short the dollar against emerging FX by -$2.3 billion – taking the aggregate to A 29 week low of $3.9 billion.

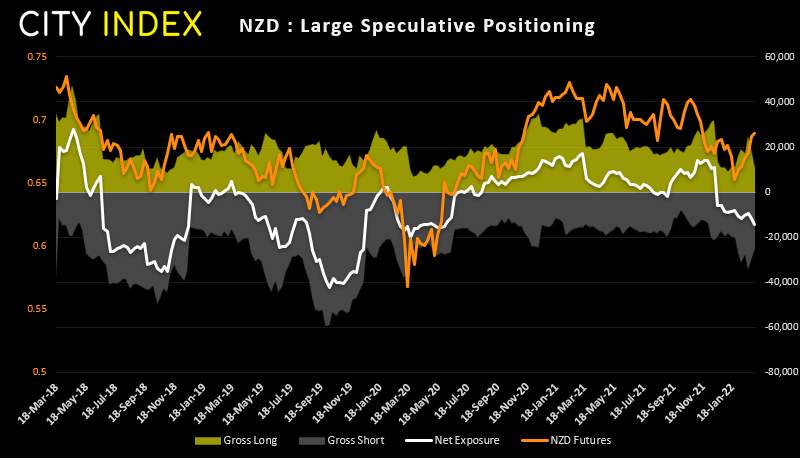

NZD futures:

There’s quite a divergence between prices and market positioning on the Kiwi dollar. Traders were net short by their most bearish level since May 2020, yet prices have risen to a 15-week high. However, if we look at the data, both gross longs and shorts have been trimmed over the past two weeks, meaning prices are rising on lower trading activity and undermines the rally somewhat.

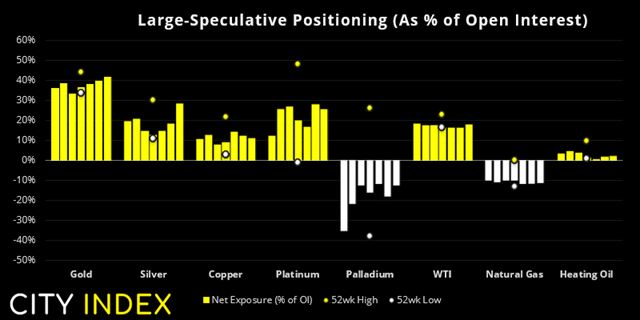

As of Tuesday 1st March 2022:

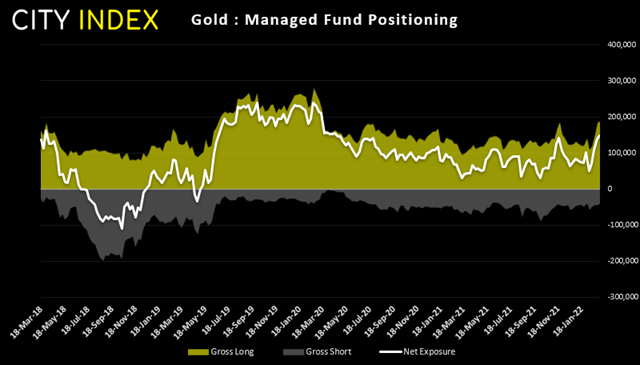

- Net-long exposure to gold rose to a 15-week high, although managed funds are ‘all in’ on the yellow metal as they’re the most bullish on the metal since March 2020.

- Silver moved in lockstep with net-long exposure also rising to a 15-week high.

- Traders increased net-long exposure to oil by 29.6k contracts, which is its largest weekly addition since November 2020.

Gold futures:

Managed funds were their most bullish on gold futures since the pandemic in March 2020. Bulls added 3.9k long contracts, taking its 4-week total to 69.6k contracts and gross shorts were trimmed by -5.8k contracts, and fell to their least bearish level since June 2021. Futures markets have just opened and now trade at 1988.90 – its highest level since August 2020 and now appears within easy reach of its record high of 2063.

How to trade with City Index

You can easily trade with City Index by using these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade