- USD/CAD hovering above 1.35

- Canada CPI cooled below 3% in January & further easing could fuel BoC rate cut bets

- Oil prices offered support to CAD, watch oil inventory data

- FOMC rate decision, a hawkish Fed could lift USD/CAD

USD/CAD is hovering above the 1.35 psychological level at the end of last week as attention turns towards the Federal Reserve interest rate decision and Canadian inflation data in the coming days.

Last week's recap

USD/CAD rose modestly across the week on USD strength after stickier-than-expected inflation fueled expectations that the Federal Reserve may not be able to cut rates three times this year as they had signaled in the December meeting.

While the US dollar index rose 0.7% versus its major peers, the loonie put up some resistance as oil prices rallied to a four-month high above $80.00 a barrel. The latest leg higher for Canada's largest export came after the IEA lifted its oil demand forecasts by 110,000 barrels per day in 2024.

Week ahead:

- Canada CPI

The Bank of Canada is one of the few major central banks that will not announce an interest rate decision next week. However, Canadian inflation data will be under the spotlight, which is possibly the next best thing to drive price action.

Canadian inflation cooled by more than expected in January, falling below 3% for the first time since June 2023, according to the January reading. Investors will be watching closely to see whether this trend continues. Cooling inflation encouraged the Bank of Canada to leave rates unchanged at 5% at the meeting in early March.

The Bank of Canada reiterated in its policy statement that it needs to see further progress in core consumer prices to cut interest rates. It maintains that it's premature to consider loosening monetary policy.

Cooling inflation could further support the view that the Bank of Canada will look to cut rates sooner rather than later, although the timing of the first cut remains unclear. Inflation is already within the Bank of Canada's 1%-3% target, and the economy is showing signs of weakness, which could encourage the BoC to move earlier than the Fed, which could lift USD/CAD higher.

- Oil prices

In addition to Canadian inflation data, oil prices will also be under the spotlight. This week, oil rose 3% as US crude oil stockpiles and gasoline inventories fell by more than expected, supporting the view that the market remains tight. Another large draw could lift oil prices, which would support the loonie.

- Federal Reserve interest rate decision

Next week, many major central banks will announce their interest rate decisions; however, the Federal Reserve is likely to be one of the most closely watched.

The Fed is widely expected to leave interest rates on hold, but owing to this week’s sticky inflation data, it could adopt a more hawkish stance.

The focus will be on new projections, particularly on the dot plot. In December, the Fed signaled three rate cuts this year. This could well be revised lower to two, and the Fed is not likely to provide further clarity on the timing of the first cut, given that the struggle with inflation is clearly ongoing.

USD/CAD forecast – technical analysis

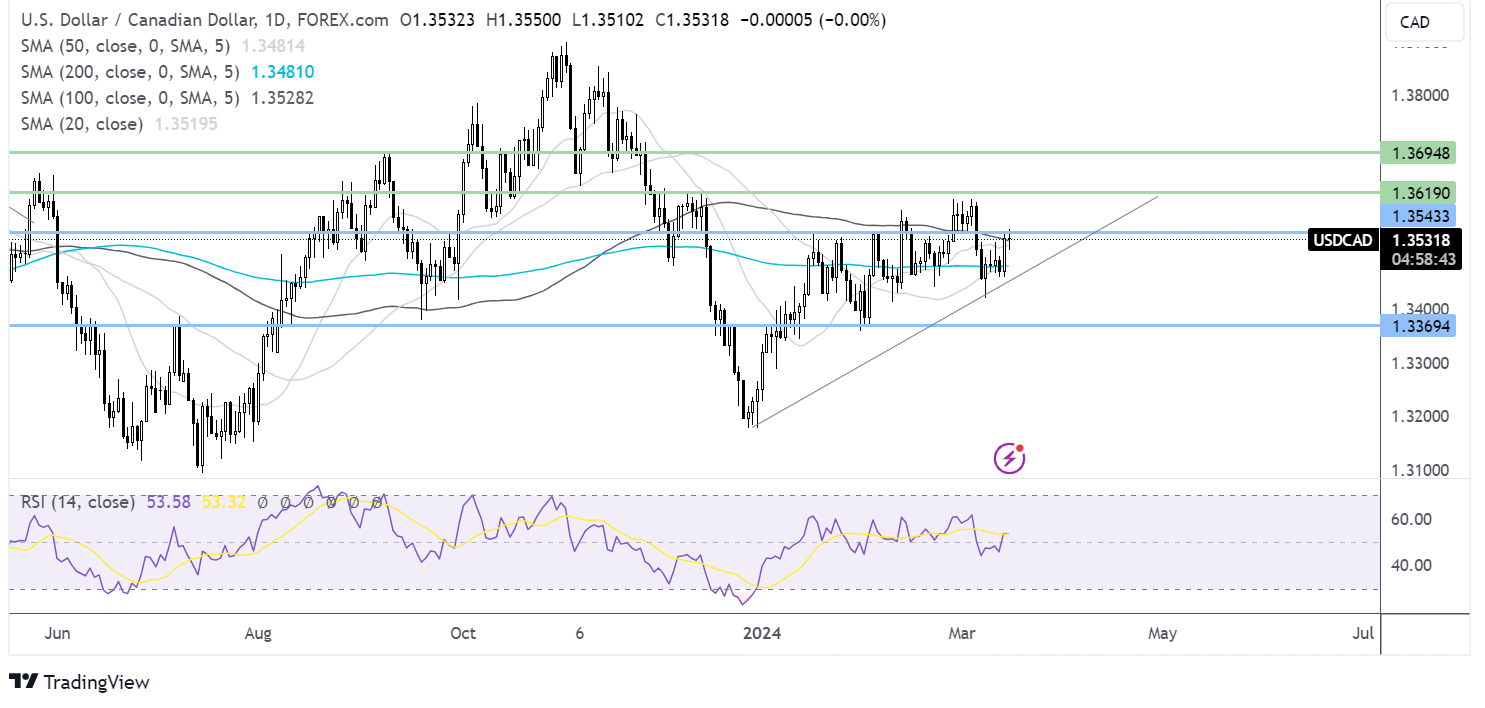

USD/CAD trades in a rising triangle. After rebounding from the March low of 1.3420 and the rising trendline, USD/CAD has risen above the 200 SMA, and it is testing a minor resistance around 1.3550 a level that has limited gains on several occasions since the start of the year.

A rise above here brings 1.3620, the December high, into focus and opens the door to 1.37, the September high.

On the downside, a move below the 200 SMA at 1.3480 opens the door to 1.3420, the March low. A break below here creates a lower low towards 1.3370