Friday’s US non-farm payrolls report bolstered the view the Fed may have increased interest rates for the last time this cycle. Given the implications for inflation, bond yields and US dollar, it suggests risks for the gold price remain skewed to the upside in the short-to-medium term.

Gold holding up well in a tough environment

Whenever evaluating how the gold may perform moving forward, you should pay close attention to what’s happening in the US dollar and bond yields. For one, gold’s most conventional value is priced against the US dollar. Secondly, as a non-interest-bearing commodity, changes in the interest rate outlook can influence its appeal relative to other asset classes.

With the US dollar and bond yields soaring until just over a week ago, it’s remarkable the gold price didn’t fall further during August. Real, inflation-adjusted 10-year US bond yields jumped to the highest level in over a decade, hitting low or non-yielding assets. The US dollar index also hit levels not seen June, lifting by over 4% within the space of weeks.

In terms of market conditions, it doesn’t get much worse for gold. But the price held tough all things considered. In that context, I completely agree with recent remarks from Macquarie Research that a “forceful new catalyst would be required for gold to break lower”.

Market risks for gold appear skewed to the downside

But what plausible catalyst could knock gold from its perch, tarnishing the resilience seen since the middle of August? Given the linkages between the USD and bond yields, the obvious answer is for the Fed to become more hawkish towards the interest rate outlook. But what are the odds of that occurring given recent data on labour market conditions and inflation suggests the Fed is moving closer to achieving its dual mandate of full employment and price stability, rather than away? I’d say remote.

When you look at the USD and short-term policy-sensitive US Treasury yields, it’s arguable the risk-reward for both is to the downside given where they sit, especially the latter after soaring 500 basis points in little over a year. As a function of market valuation, it also points to the potential for further upside for gold should the soft economic landing narrative start to waver.

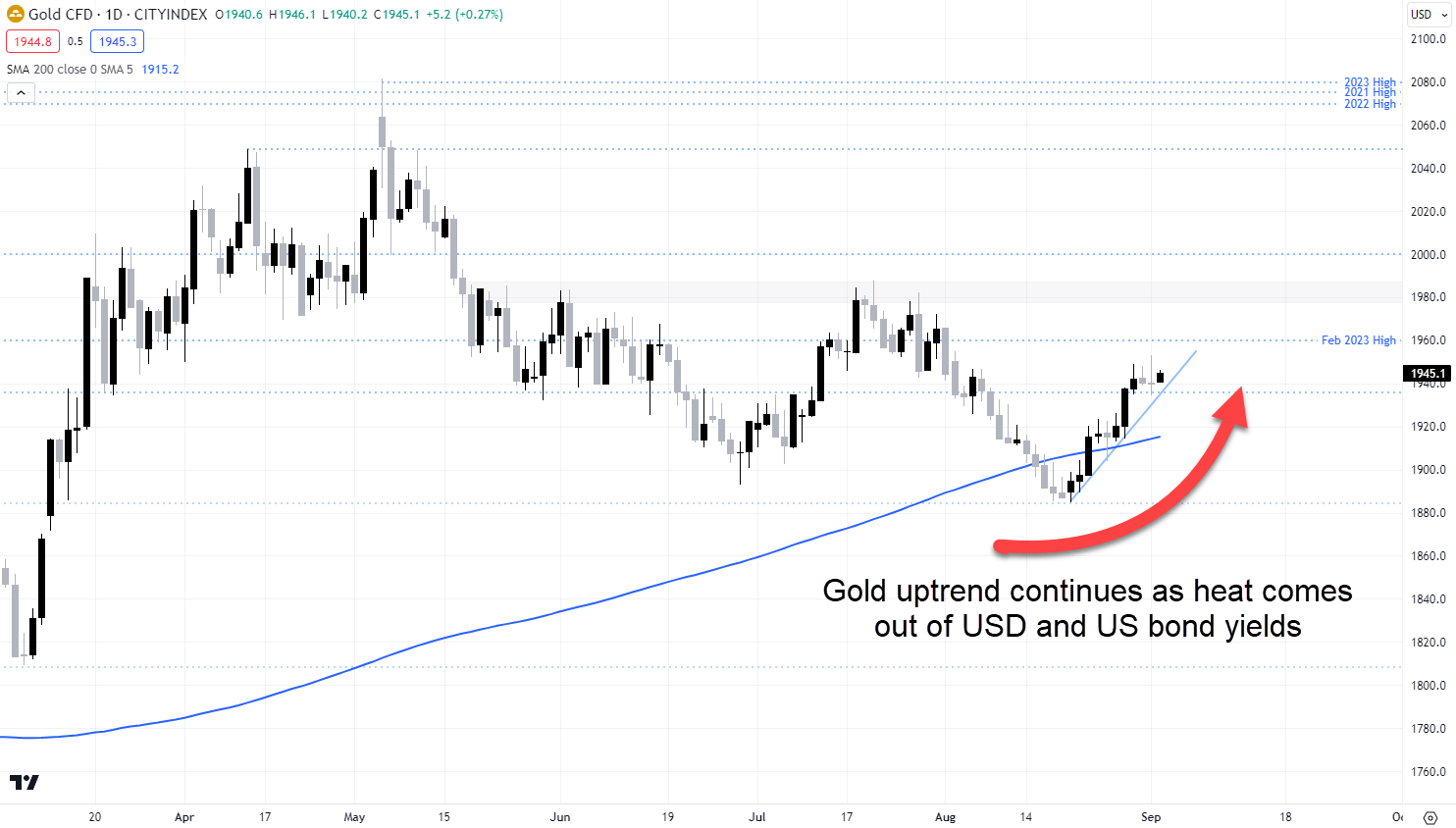

Gold uptrend remains intact

Gold remains in a clear uptrend on the daily, even with the outside candle seen on Friday following the non-farm payrolls report. Near-term support is likely to kick in at $1935/oz, coinciding with the uptrend and session low recorded on Friday. A stop underneath will limit losses if the bullish price action were to falter. On the upside, a move back towards a resistance zone beginning from $1977/oz appears likely should the current trend prevail.

-- Written by David Scutt

Follow David on Twitter @scutty

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade