EUR/USD is rising post-Fed on USD weakness

- Federal Reserve left rates unchanged

- Powell gave a mixed message, which was interpreted as marginally more dovish.

- EUR/USD holds above 1.07

EUR/USD is heading higher for a second straight day on U.S. dollar weakness as investors continued to digest yesterday's Federal Reserve interest rate decision. The Fed, as expected, left interest rates unchanged at 5.25% to 5.5%, and Powell offered a mixed message.

While Federal Reserve chair Powell quashed expectations of a rate hike this year, he also indicated that the central bank was in no rush to start cutting interest rates. The market is now pricing in 35 basis points of cuts this year, up from 29 basis points worth of cuts prior to the meeting. This suggests that the market interpreted the lack of change in forward guidance as a lean towards a dovish stance.

Attention will now turn to US jobless claims and challenger job cuts ahead of tomorrow's non-farm payroll report. Weaker data could pull the US dollar lower.

Meanwhile, the euro has managed to recover from last month’s low on an improving economic outlook for the region. Recent data has broadly surprised to the upside. However, the ECB is still expected to cut rates for the first time in June.

The eurozone economic calendar is relatively light today, with just Eurozone manufacturing PMI data with a modest upward revision to 45.7. ECB chief economist Philip Laden Students will speak later today, and his comments will be watched closely for clues about the future path of rates.

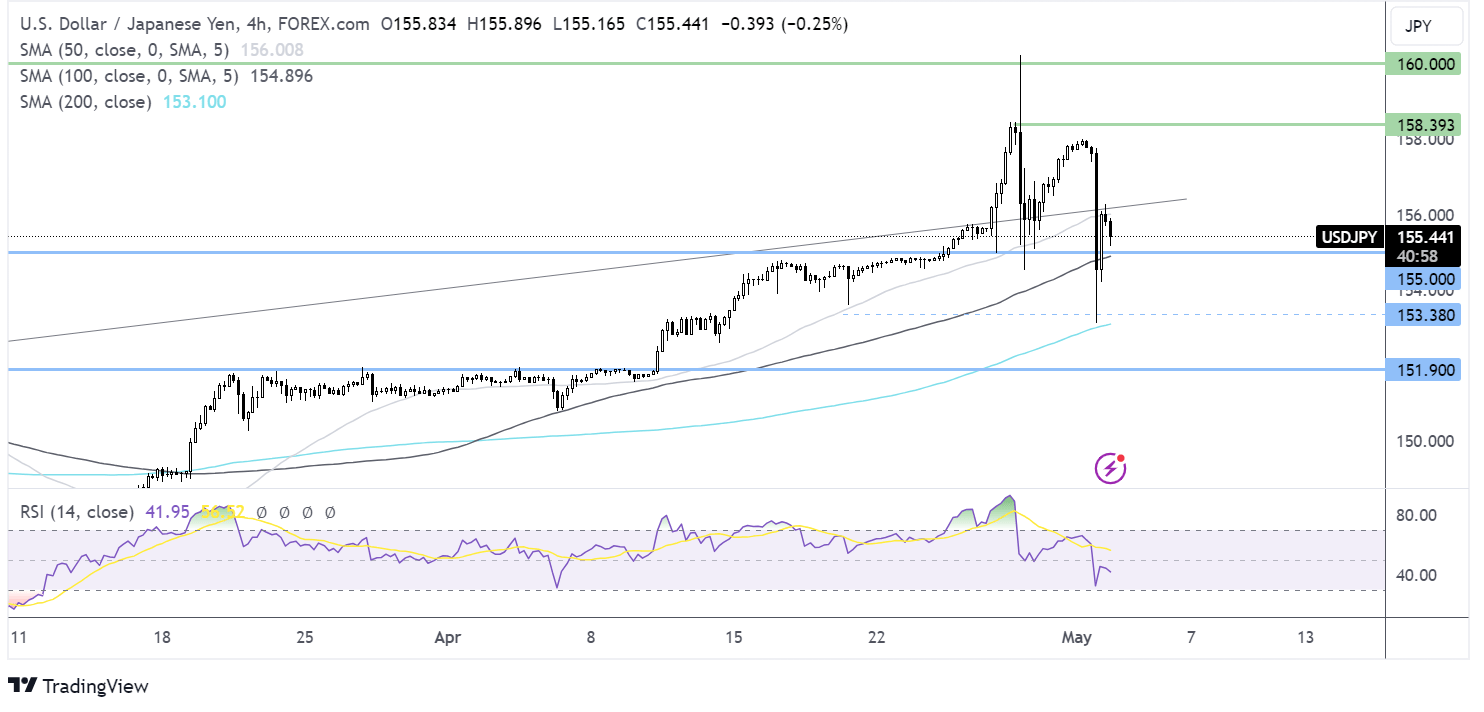

EUR/USD forecast – technical analysis

EUR/USD continues to trade in a falling channel. The price has rebounded from 1.06, the April low. However, the recovery has stalled around 1.07. Buyers will need to rise above 1.0750, last week’s high, to extend gains towards 1.08, the 200 SMA, and static resistance.

Should sellers manage to break below 1.07, the next level of support is 1.0650, the weekly low. Below here, 1.06 comes back into focus.

USD/JPY steadies after another suspected intervention

- USD/JPY fell 450 points in a suspected intervention

- US jobless claims & Job cuts are in focus

- USD/JPY recovers from 153.15

The Japanese yen is under pressure once again as volatility in the pair continues following another suspected intervention by Japanese authorities.

Traders seem convinced that the wide gap in interest rates between Japan and the US will remain for some time, which is helping the pair recover.

Federal Reserve chair Jerome Powell gave mixed messages yesterday. He downplayed speculation of any further interest rate hikes despite sticky inflation but also added that the central bankers are in no rush to start cutting right.

The Fed's lack of change in forward guidance, which continues to signal it's leaning towards a reduction in borrowing costs at some point this year, was perceived as dovish, pulling the US dollar lower versus its major pairs.

Meanwhile, the minutes from the Bank of Japan's March policy meeting revealed that the central bank will continue to support the economy in order to achieve a domestic demand-driven recovery. However, it's worth noting that there's been much water under the bridge since that meeting in March when the Bank of Japan raised interest rates for the first time in 17 years.

Looking ahead, attention will be on US jobless claims and challenger job cuts ahead of tomorrow's all-important US nonfarm payroll report. Weaker jobs data could pull USD/JPY lower.

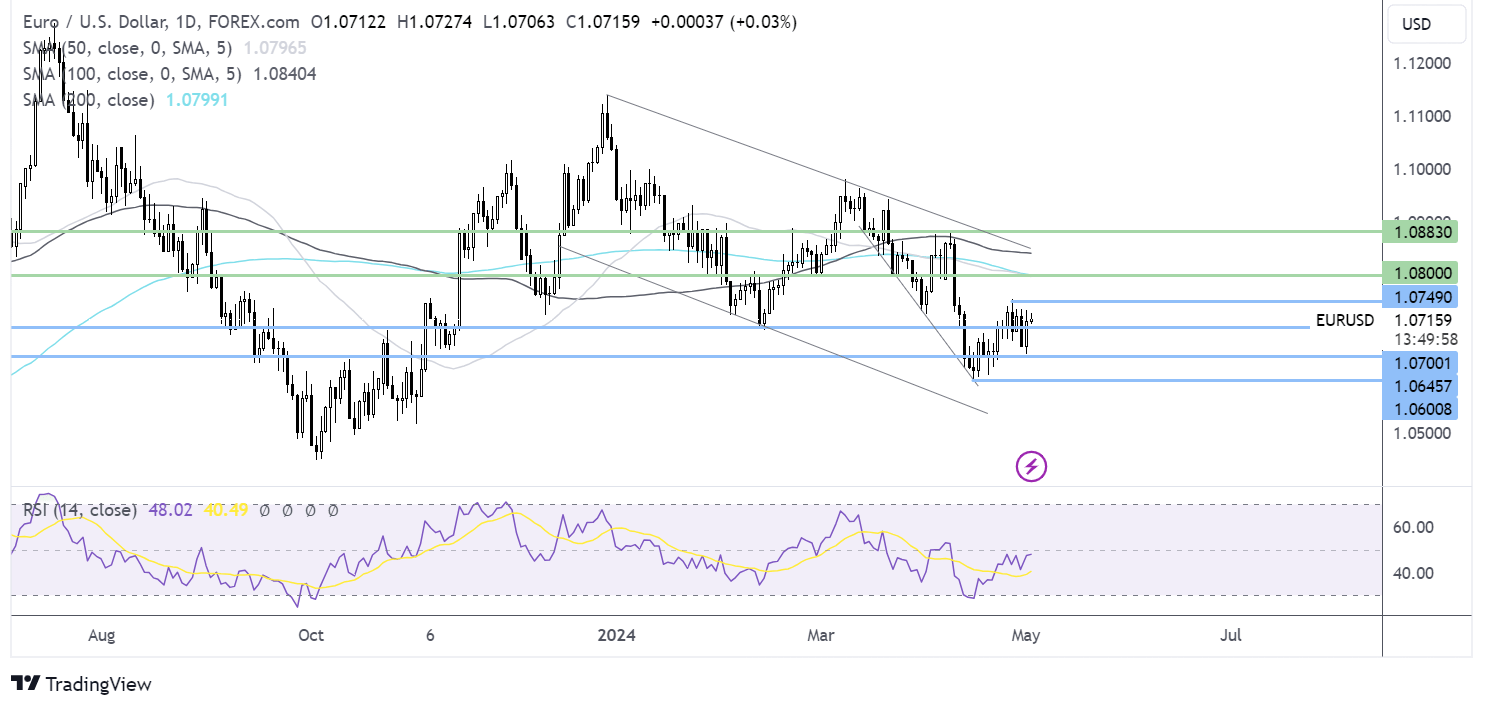

USD/JPY forecast – technical analysis

USD/JPY dropped sharply to a low of 153.15, the 200 SMA on the 4-hour chart, before recovering higher. However, it failed to retake the rising trendline resistance dating back to April last year.

The price has steadied above 155.00 the 100 SMA, which has guided the price higher over the past two weeks and the static support level.

Sellers supported by the RSI below 50 could look to test 155.00. A break below here would open the door to the 200 SMA and weekly low of 153.15.

Any recovery would need to rise above 156.25 the trendline support and today’s high, to extend gains towards 158.40.