EU indices up this morning | TA focus on Reckitt Benckiser Group

INDICES

Yesterday, European stocks kept trading on the upside, with the Stoxx Europe 600 Index adding 1.8%. Germany's DAX 30 jumped 2.9%, the U.K.'s FTSE 100 rose 2.6%, and France's CAC 40 was up 2.2%.

EUROPE ADVANCE/DECLINE

83% of STOXX 600 constituents traded higher yesterday.

95% of the shares trade above their 20D MA vs 86% Tuesday (above the 20D moving average).

26% of the shares trade above their 200D MA vs 24% Tuesday (above the 20D moving average).

The Euro Stoxx 50 Volatility index eased 2.29pts to 30.72, a new 52w high.

SECTORS vs STOXX 600

3mths relative high: none

3mths relative low: none

Europe Best 3 sectors

banks, travel & leisure, automobiles & parts

Europe worst 3 sectors

health care, food & beverage, personal & household goods

INTEREST RATE

The 10yr Bund yield fell 2bps to -0.47% (below its 20D MA). The 2yr-10yr yield spread rose 1bp to -21bps (above its 20D MA).

ECONOMIC DATA

FR 06:30: Q1 GDP Growth Rate QoQ Prel, exp.: -0.1%

GE 07:00: Mar Unemployment Rate Harmonised, exp.: 3.2%

GE 07:00: Mar Retail Sales MoM, exp.: 1.2%

GE 07:00: Mar Retail Sales YoY, exp.: 6.4%

UK 07:00: Apr Nationwide Housing Prices YoY, exp.: 3%

UK 07:00: Apr Nationwide Housing Prices MoM, exp.: 0.8%

FR 07:45: Apr Harmonised Inflation Rate MoM Prel, exp.: 0.1%

FR 07:45: Apr Harmonised Inflation Rate YoY Prel, exp.: 0.8%

FR 07:45: Apr Inflation Rate MoM Prel, exp.: 0.1%

FR 07:45: Mar Household Consumption MoM, exp.: -0.1%

FR 07:45: Mar PPI MoM, exp.: -0.6%

FR 07:45: Apr Inflation Rate YoY Prel, exp.: 0.7%

GE 08:55: Apr Unemployment Rate, exp.: 5%

GE 08:55: Apr Unemployment chg, exp.: 1K

UK 09:00: Mar Car Production YoY, exp.: -0.8%

EC 10:00: Mar Unemployment Rate, exp.: 7.3%

EC 10:00: Q1 GDP Growth Rate YoY Flash, exp.: 1%

EC 10:00: Q1 GDP Growth Rate QoQ Flash, exp.: 0.1%

EC 10:00: Apr Core Inflation Rate YoY Flash, exp.: 1%

EC 10:00: Apr Inflation Rate YoY Flash, exp.: 0.7%

EC 10:00: Apr Inflation Rate MoM Flash, exp.: 0.5%

EC 12:45: ECB Interest Rate Decision, exp.: 0%

EC 12:45: Marginal Lending Rate, exp.: 0.25%

EC 12:45: Deposit Facility Rate, exp.: -0.5%

EC 13:30: ECB Press Conference

MORNING TRADING

In Asian trading hours, EUR/USD held gains at 1.0877 while GBP/USD eased to 1.2453. USD/JPY was little changed at 106.72. AUD/USD was firm at 0.6555. Earlier today, official data showed that China's Manufacturing PMI fell to 50.8 in April (51.0 expected) from 52.0 in March, while non-manufacturing PMI climbed to 53.2 (52.5 expected) from 52.3. Also, the Caixin China Manufacturing PMI dropped to 49.4 in April (50.5 expected) from 50.1 in March.

Spot gold slipped to $1,710 an ounce.

#UK - IRELAND#

British American Tobacco Plc, an international cigarette maker, pointed out: "The impact from COVID-19 is difficult to predict. (...) we now expect the building blocks of high single figure adjusted constant currency EPS growth in FY 2020 to include: Constant currency adjusted revenue growth around the low end of the 3-5% range (...) Continued progress towards our 2023/24 ambition of £5bn in revenue in New Categories (...) A dividend pay-out ratio of 65% of adjusted diluted EPS and growth in sterling terms."

GlaxoSmithKline, a global healthcare company, announced the U.S. Food and Drug Administration (FDA) has approved the Company's supplemental New Drug Application (sNDA) for Zejula (niraparib), an oral, once-daily poly (ADP-ribose) polymerase (PARP) inhibitor, as a monotherapy maintenance treatment for women with platinum-responsive advanced ovarian cancer.

St. James's Place, a financial services firm, issued a 1Q update: "With retention remaining very strong, net inflows for the period were up 9% at 2.37 billion pounds, representing annualized growth of 8.1% on opening funds under management. (...) With the escalation of the COVID-19 crisis during March there was a sharp decline in global markets and this negatively impacted our funds under management, which closed the period at 101.7 billion pounds. (...) the Board has decided to withhold 11.22 pence per share, or around one-third of the proposed 2019 final dividend, until such a time as the financial and economic impacts of COVID-19 become clearer."

Royal Dutch Shell, a giant oil producer, reported that 1Q adjusted net income (CCS earnings) dropped 46% on year to 2.86 billion dollars while cash flow from operating activities increased 72% to 14.85 billion dollars. The company said it has decided to reduce its quarterly dividend to 0.16 dollar per share from 0.47 dollar per share in the prior quarter, stating: "Given the continued deterioration in the macroeconomic outlook and the significant mid and long-term uncertainty, we are taking further prudent steps to bolster our resilience, underpin the strength of our balance sheet and support the long-term value creation of Shell."

Glencore, a commodity trading and mining company, posted a 1Q production report: "Own sourced copper production of 293,300 tonnes was 27,400 tonnes (9%) lower than Q1 2019. (...) Own sourced zinc production of 295,600 tonnes was 33,300 tonnes (13%) higher than Q1 2019. (...) Own sourced nickel production of 28,200 tonnes was 1,100 tonnes (4%) higher than Q1 2019. (...) Attributable ferrochrome production of 388,000 tonnes was 14,000 tonnes (3%) lower than Q1 2019. (...) Coal production of 31.9 million tonnes was 1.3 million tonnes (4%) lower than Q1 2019. (...) Entitlement interest oil production of 1.8 million barrels was 0.7 million barrels (58%) higher than in Q1 2019. (...) We also expect a c$1.0 to $1.5 billion reduction in 2020 capex compared to our original 2020 guidance of $5.5 billion."

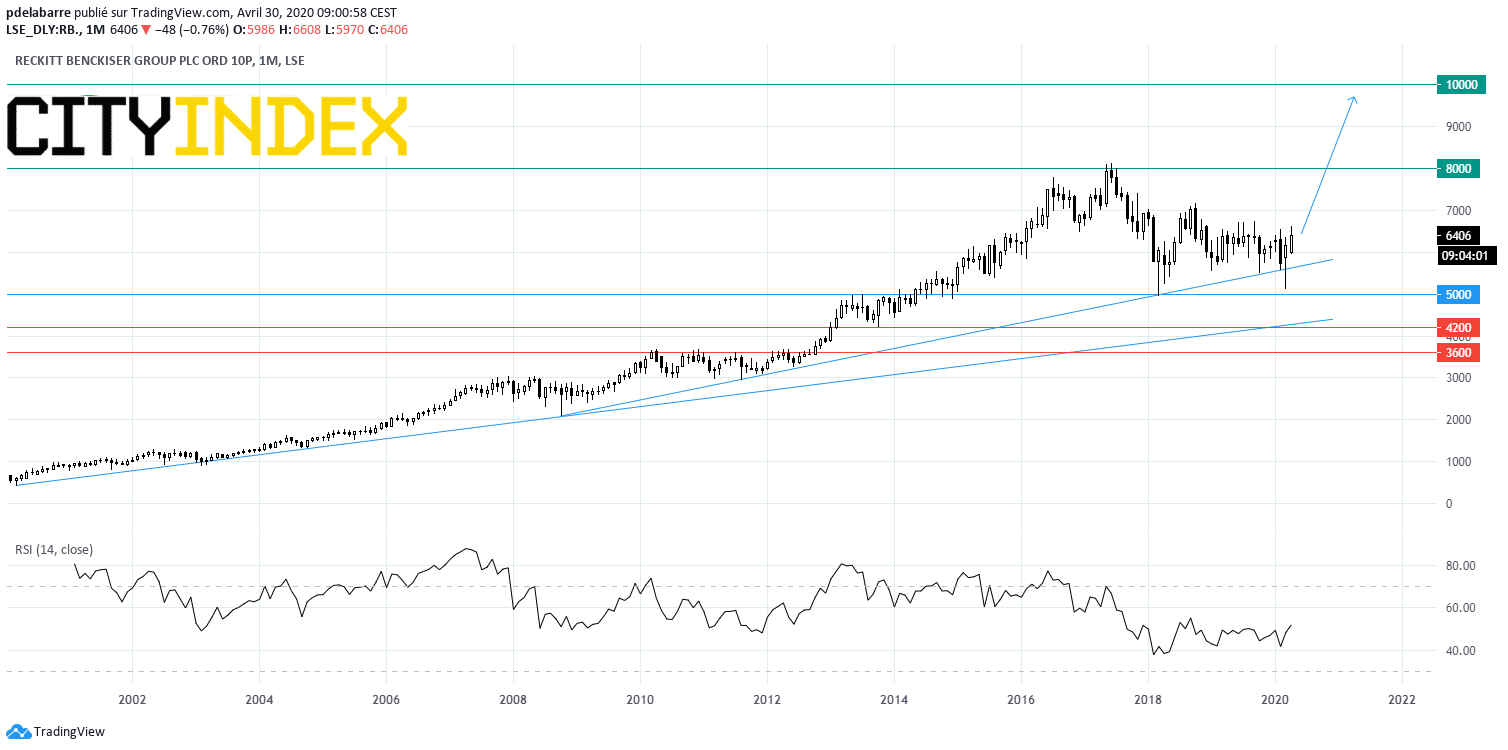

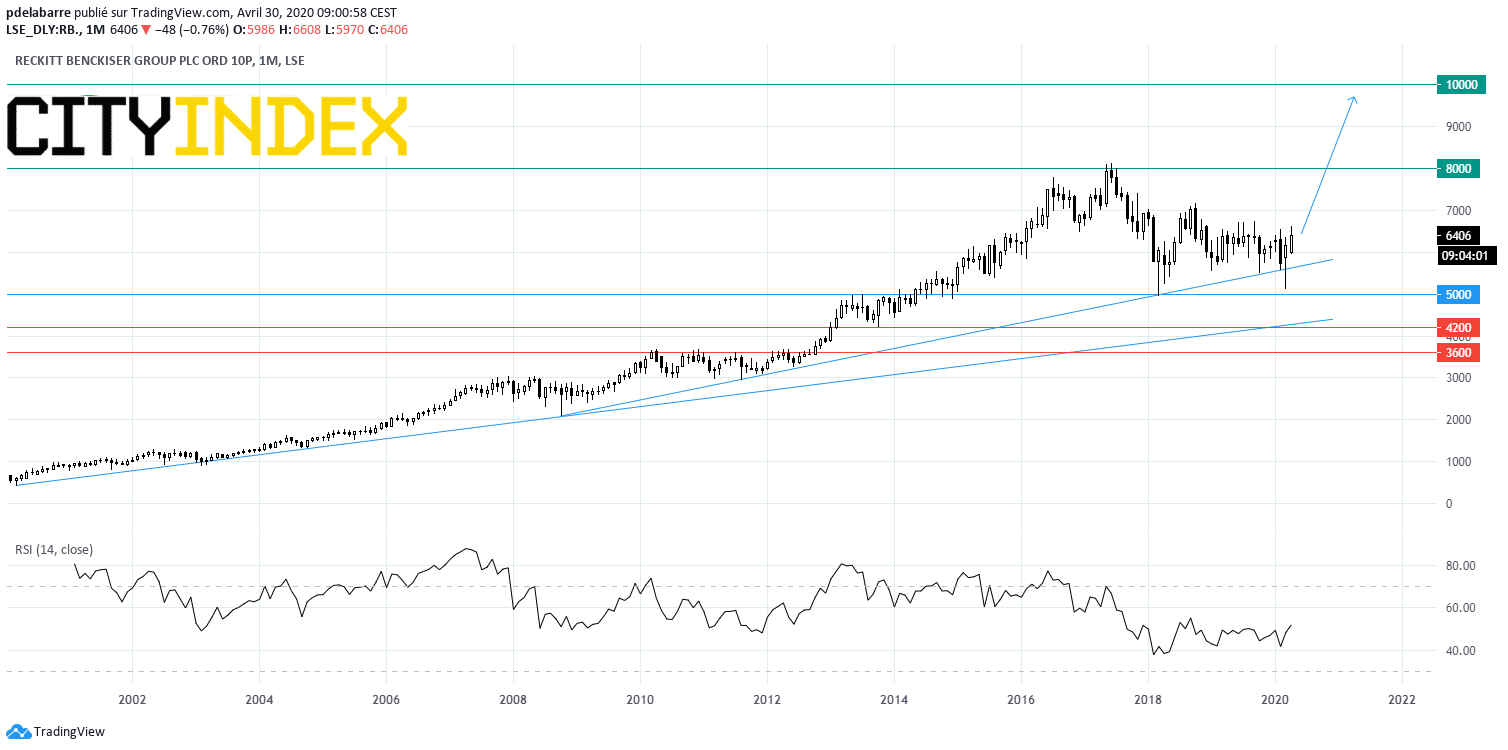

Reckitt Benckiser Group, a consumer goods company, announced that 1Q revenue rose 12.3% on year to 3.54 billion pounds, up 13.3% on a like-for-like basis. The company stated: "2020 performance now expected to be better than original expectations, although the outlook for the balance of 2020 remains uncertain, with significant COVID-19 challenges across our markets; fuller update on plans and guidance at the Half Year."

Source: GAIN Capital, TradingView

Hikma Pharmaceuticals, a drug maker, published a trading statement: "Based on performance in the year to date, we are reiterating our guidance for global Injectables revenue growth in the low to mid-single digits for 2020. (...) For the full year, we continue to expect Generics revenue in the range of $700 million to $750 million. (...) We remain confident in the outlook for the Branded business and continue to expect revenue growth in constant currency to be in the mid-single digits for the full year in 2020. (...) Subject to approval at today's Annual General Meeting, we will be paying a final dividend of 30 cents per share (approximately 23 pence per share) bringing the total dividend for the full year to 44 cents per share (approximately 34 pence per share), an increase of 16% on 2018."

J Sainsbury, a supermarket chain, released full-year results: "Underlying profit before tax down two per cent to £586 million; profit before tax up 26 per cent to £255 million. (...) Given a wide range of potential profit and cash flow outcomes, the Board believes it is prudent to defer any dividend payment decisions until later in the financial year. (...) Sales in recent weeks have reflected: Strong grocery demand since the start of March (+12%), with particularly high demand over week 52 of our 2019/20 financial year and weeks 1 to 2 of our current financial year and some normalization over recent weeks."

#GERMANY#

BASF, a chemical group, announced that 1Q adjusted EBIT dropped 6% on year to 1.6 billion euros on revenue of 16.8 billion euros, up 7%. The company said: " Owing to the very challenging macroeconomic environment, there is great uncertainty in the markets, making reliable planning nearly impossible at the moment. For this reason, concrete statements on the development of sales and earnings in 2020 cannot be made at present."

#FRANCE#

France's 1Q GDP contracted 5.4% on year (-3.6% expected), according to government data.

Societe Generale, a banking group, announced that it swung to a 1Q net loss of 326 million euros from a net profit of 686 million euros in the prior-year period, amid a surge in net cost of risk to 820 million euros from 264 millions. Operating loss totaled 328 million euros, compared with an operating profit of 1.14 billion previously, and net banking income dropped 16.5% on year to 5.17 billion euros. Regarding 2020 outlook, the bank said: "The Group confirms its target to decrease operating expenses for the full year 2020 compared to 2019, (...) Furthermore the Group will introduce additional cost reduction measures through 2020 for a total amount comprised between EUR 600 million and EUR 700 million net of additional costs related to the management of Covid-19 crisis (operational costs, contributions to solidarity funds, etc)."

Orange, a telecommunications group, announced that 1Q net income EBITDA after lease increased 0.7% on year to 2.60 billion euros on revenue of 10.39 billion euros, up 2.1% (+1.0% on a comparable basis). Regarding the outlook, the company said: "Based on currently available information, Orange does not expect a significant deviation from its financial objectives for the fiscal year 2020 but will closely monitor developments."

#SPAIN#

BBVA, a Spanish bank, announced that it swung to a 1Q net loss of 1.79 billion euros from a net profit of 1.18 billion euros in the prior-year period, citing an increased impairment on financial assets of 1.43 billion euros due to the COVID-19 and a goodwill impairment in the U.S. of 2.08 billion euros. Meanwhile, operating income rose 14.1% to 3.57 billion euros on net interest income of 4.56 billion euros, up 3.6%.

#BENELUX#

KPN, a telecommunications group, announced that 1Q net income rose 35% on year to 120 mullion euros and EBITDA after leases grew 2.1% to 575 million euros on adjusted revenue of 1.33 billion euros, down 2.4%.

#ITALY#

STMicroelectronics, a semiconductor manufacturer, was downgraded to "sell" from "neutral" at Goldman Sachs.

#SWITZERLAND#

Swisscom, a telecommunications group, announced that 1Q net income grew 2.9% on year to 394 million Swiss franc while EBITDA fell 0.7% to 1.11 billion Swiss franc on net revenue of 2.74 billion Swiss franc, down 4.3%. The company confirmed its full-year net revenue guidance of 11.1 billion Swiss franc and EBITDA forecast of 4.30 billion Swiss franc.

Swiss Re, an insurance group, reported that it swung to a 1Q net loss of 225 million dollars from a net profit of 429 million dollars in the prior-year period, citing a pre-tax charge of 476 million dollars for the property and casualty businesses due to the COVID-19 impact. Also, net premiums earned and fee income rose 7.3% on year to 9.59 billion dollars.

#SCANDINAVIA - DENMARK#

Nokia, a telecommunications group, posted 1Q net loss narrowed to 100 million euros from 442 million euros in the prior-year period (adjusted EPS of 0.01 euro compared with an adjusted LPS of 0.02 previously) on net sales of 4.91 billion euros, down 2% on year (-3% an constant currency). The company lowered its full-year adjusted EPS guidance to 0.18 - 0.28 euro from 0.20 - 0.30 euro previously.

Danske Bank, a Danish bank, said it swung to a 1Q net loss of 1.3 billion Danish krone from a net profit of 3.0 billion Danish krone in the prior-year period, citing 4.3 billion Danish krone loan impairment charges, compared with 0.4 billion previously. Also, net interest income was down 1% to 5.5 billion Danish krone. The bank said it now aims for a net profit of at least 3 billion Danish krone for the full-year.

DNB, a Norwegian financial services group, reported that 1Q net income declined 47.2% on year to 4.00 billion Norwegian krone, where impairment of financial instruments jumped to 5.77 billion Norwegian krone from 316 million Norwegian krone in the prior-year period. Also, net interest income was up 11.9% to 10.40 billion Norwegian krone.

DSV, a Danish transport and logistics company, reported that 1Q net income decreased 65.6% on year to 331 million Danish krone while adjusted EBIT rose 7.7% to 1.57 billion Danish krone on revenue of 6.68 billion Danish krone, up 30.7%.

EX-DIVIDEND

Assa Abloy: SEK2, Beiersdorf: E0.7, ING Groep: E0.45, London Stock Exchange:49.9p, Lonza Group: SF1.375, MunichRe: E9.8, Renault: E1.1, Santander: E0.0243, Swiss Life: SF15

Yesterday, European stocks kept trading on the upside, with the Stoxx Europe 600 Index adding 1.8%. Germany's DAX 30 jumped 2.9%, the U.K.'s FTSE 100 rose 2.6%, and France's CAC 40 was up 2.2%.

EUROPE ADVANCE/DECLINE

83% of STOXX 600 constituents traded higher yesterday.

95% of the shares trade above their 20D MA vs 86% Tuesday (above the 20D moving average).

26% of the shares trade above their 200D MA vs 24% Tuesday (above the 20D moving average).

The Euro Stoxx 50 Volatility index eased 2.29pts to 30.72, a new 52w high.

SECTORS vs STOXX 600

3mths relative high: none

3mths relative low: none

Europe Best 3 sectors

banks, travel & leisure, automobiles & parts

Europe worst 3 sectors

health care, food & beverage, personal & household goods

INTEREST RATE

The 10yr Bund yield fell 2bps to -0.47% (below its 20D MA). The 2yr-10yr yield spread rose 1bp to -21bps (above its 20D MA).

ECONOMIC DATA

FR 06:30: Q1 GDP Growth Rate QoQ Prel, exp.: -0.1%

GE 07:00: Mar Unemployment Rate Harmonised, exp.: 3.2%

GE 07:00: Mar Retail Sales MoM, exp.: 1.2%

GE 07:00: Mar Retail Sales YoY, exp.: 6.4%

UK 07:00: Apr Nationwide Housing Prices YoY, exp.: 3%

UK 07:00: Apr Nationwide Housing Prices MoM, exp.: 0.8%

FR 07:45: Apr Harmonised Inflation Rate MoM Prel, exp.: 0.1%

FR 07:45: Apr Harmonised Inflation Rate YoY Prel, exp.: 0.8%

FR 07:45: Apr Inflation Rate MoM Prel, exp.: 0.1%

FR 07:45: Mar Household Consumption MoM, exp.: -0.1%

FR 07:45: Mar PPI MoM, exp.: -0.6%

FR 07:45: Apr Inflation Rate YoY Prel, exp.: 0.7%

GE 08:55: Apr Unemployment Rate, exp.: 5%

GE 08:55: Apr Unemployment chg, exp.: 1K

UK 09:00: Mar Car Production YoY, exp.: -0.8%

EC 10:00: Mar Unemployment Rate, exp.: 7.3%

EC 10:00: Q1 GDP Growth Rate YoY Flash, exp.: 1%

EC 10:00: Q1 GDP Growth Rate QoQ Flash, exp.: 0.1%

EC 10:00: Apr Core Inflation Rate YoY Flash, exp.: 1%

EC 10:00: Apr Inflation Rate YoY Flash, exp.: 0.7%

EC 10:00: Apr Inflation Rate MoM Flash, exp.: 0.5%

EC 12:45: ECB Interest Rate Decision, exp.: 0%

EC 12:45: Marginal Lending Rate, exp.: 0.25%

EC 12:45: Deposit Facility Rate, exp.: -0.5%

EC 13:30: ECB Press Conference

MORNING TRADING

In Asian trading hours, EUR/USD held gains at 1.0877 while GBP/USD eased to 1.2453. USD/JPY was little changed at 106.72. AUD/USD was firm at 0.6555. Earlier today, official data showed that China's Manufacturing PMI fell to 50.8 in April (51.0 expected) from 52.0 in March, while non-manufacturing PMI climbed to 53.2 (52.5 expected) from 52.3. Also, the Caixin China Manufacturing PMI dropped to 49.4 in April (50.5 expected) from 50.1 in March.

Spot gold slipped to $1,710 an ounce.

#UK - IRELAND#

British American Tobacco Plc, an international cigarette maker, pointed out: "The impact from COVID-19 is difficult to predict. (...) we now expect the building blocks of high single figure adjusted constant currency EPS growth in FY 2020 to include: Constant currency adjusted revenue growth around the low end of the 3-5% range (...) Continued progress towards our 2023/24 ambition of £5bn in revenue in New Categories (...) A dividend pay-out ratio of 65% of adjusted diluted EPS and growth in sterling terms."

GlaxoSmithKline, a global healthcare company, announced the U.S. Food and Drug Administration (FDA) has approved the Company's supplemental New Drug Application (sNDA) for Zejula (niraparib), an oral, once-daily poly (ADP-ribose) polymerase (PARP) inhibitor, as a monotherapy maintenance treatment for women with platinum-responsive advanced ovarian cancer.

St. James's Place, a financial services firm, issued a 1Q update: "With retention remaining very strong, net inflows for the period were up 9% at 2.37 billion pounds, representing annualized growth of 8.1% on opening funds under management. (...) With the escalation of the COVID-19 crisis during March there was a sharp decline in global markets and this negatively impacted our funds under management, which closed the period at 101.7 billion pounds. (...) the Board has decided to withhold 11.22 pence per share, or around one-third of the proposed 2019 final dividend, until such a time as the financial and economic impacts of COVID-19 become clearer."

Royal Dutch Shell, a giant oil producer, reported that 1Q adjusted net income (CCS earnings) dropped 46% on year to 2.86 billion dollars while cash flow from operating activities increased 72% to 14.85 billion dollars. The company said it has decided to reduce its quarterly dividend to 0.16 dollar per share from 0.47 dollar per share in the prior quarter, stating: "Given the continued deterioration in the macroeconomic outlook and the significant mid and long-term uncertainty, we are taking further prudent steps to bolster our resilience, underpin the strength of our balance sheet and support the long-term value creation of Shell."

Glencore, a commodity trading and mining company, posted a 1Q production report: "Own sourced copper production of 293,300 tonnes was 27,400 tonnes (9%) lower than Q1 2019. (...) Own sourced zinc production of 295,600 tonnes was 33,300 tonnes (13%) higher than Q1 2019. (...) Own sourced nickel production of 28,200 tonnes was 1,100 tonnes (4%) higher than Q1 2019. (...) Attributable ferrochrome production of 388,000 tonnes was 14,000 tonnes (3%) lower than Q1 2019. (...) Coal production of 31.9 million tonnes was 1.3 million tonnes (4%) lower than Q1 2019. (...) Entitlement interest oil production of 1.8 million barrels was 0.7 million barrels (58%) higher than in Q1 2019. (...) We also expect a c$1.0 to $1.5 billion reduction in 2020 capex compared to our original 2020 guidance of $5.5 billion."

Reckitt Benckiser Group, a consumer goods company, announced that 1Q revenue rose 12.3% on year to 3.54 billion pounds, up 13.3% on a like-for-like basis. The company stated: "2020 performance now expected to be better than original expectations, although the outlook for the balance of 2020 remains uncertain, with significant COVID-19 challenges across our markets; fuller update on plans and guidance at the Half Year."

Source: GAIN Capital, TradingView

Hikma Pharmaceuticals, a drug maker, published a trading statement: "Based on performance in the year to date, we are reiterating our guidance for global Injectables revenue growth in the low to mid-single digits for 2020. (...) For the full year, we continue to expect Generics revenue in the range of $700 million to $750 million. (...) We remain confident in the outlook for the Branded business and continue to expect revenue growth in constant currency to be in the mid-single digits for the full year in 2020. (...) Subject to approval at today's Annual General Meeting, we will be paying a final dividend of 30 cents per share (approximately 23 pence per share) bringing the total dividend for the full year to 44 cents per share (approximately 34 pence per share), an increase of 16% on 2018."

J Sainsbury, a supermarket chain, released full-year results: "Underlying profit before tax down two per cent to £586 million; profit before tax up 26 per cent to £255 million. (...) Given a wide range of potential profit and cash flow outcomes, the Board believes it is prudent to defer any dividend payment decisions until later in the financial year. (...) Sales in recent weeks have reflected: Strong grocery demand since the start of March (+12%), with particularly high demand over week 52 of our 2019/20 financial year and weeks 1 to 2 of our current financial year and some normalization over recent weeks."

#GERMANY#

BASF, a chemical group, announced that 1Q adjusted EBIT dropped 6% on year to 1.6 billion euros on revenue of 16.8 billion euros, up 7%. The company said: " Owing to the very challenging macroeconomic environment, there is great uncertainty in the markets, making reliable planning nearly impossible at the moment. For this reason, concrete statements on the development of sales and earnings in 2020 cannot be made at present."

#FRANCE#

France's 1Q GDP contracted 5.4% on year (-3.6% expected), according to government data.

Societe Generale, a banking group, announced that it swung to a 1Q net loss of 326 million euros from a net profit of 686 million euros in the prior-year period, amid a surge in net cost of risk to 820 million euros from 264 millions. Operating loss totaled 328 million euros, compared with an operating profit of 1.14 billion previously, and net banking income dropped 16.5% on year to 5.17 billion euros. Regarding 2020 outlook, the bank said: "The Group confirms its target to decrease operating expenses for the full year 2020 compared to 2019, (...) Furthermore the Group will introduce additional cost reduction measures through 2020 for a total amount comprised between EUR 600 million and EUR 700 million net of additional costs related to the management of Covid-19 crisis (operational costs, contributions to solidarity funds, etc)."

Orange, a telecommunications group, announced that 1Q net income EBITDA after lease increased 0.7% on year to 2.60 billion euros on revenue of 10.39 billion euros, up 2.1% (+1.0% on a comparable basis). Regarding the outlook, the company said: "Based on currently available information, Orange does not expect a significant deviation from its financial objectives for the fiscal year 2020 but will closely monitor developments."

#SPAIN#

BBVA, a Spanish bank, announced that it swung to a 1Q net loss of 1.79 billion euros from a net profit of 1.18 billion euros in the prior-year period, citing an increased impairment on financial assets of 1.43 billion euros due to the COVID-19 and a goodwill impairment in the U.S. of 2.08 billion euros. Meanwhile, operating income rose 14.1% to 3.57 billion euros on net interest income of 4.56 billion euros, up 3.6%.

#BENELUX#

KPN, a telecommunications group, announced that 1Q net income rose 35% on year to 120 mullion euros and EBITDA after leases grew 2.1% to 575 million euros on adjusted revenue of 1.33 billion euros, down 2.4%.

#ITALY#

STMicroelectronics, a semiconductor manufacturer, was downgraded to "sell" from "neutral" at Goldman Sachs.

#SWITZERLAND#

Swisscom, a telecommunications group, announced that 1Q net income grew 2.9% on year to 394 million Swiss franc while EBITDA fell 0.7% to 1.11 billion Swiss franc on net revenue of 2.74 billion Swiss franc, down 4.3%. The company confirmed its full-year net revenue guidance of 11.1 billion Swiss franc and EBITDA forecast of 4.30 billion Swiss franc.

Swiss Re, an insurance group, reported that it swung to a 1Q net loss of 225 million dollars from a net profit of 429 million dollars in the prior-year period, citing a pre-tax charge of 476 million dollars for the property and casualty businesses due to the COVID-19 impact. Also, net premiums earned and fee income rose 7.3% on year to 9.59 billion dollars.

#SCANDINAVIA - DENMARK#

Nokia, a telecommunications group, posted 1Q net loss narrowed to 100 million euros from 442 million euros in the prior-year period (adjusted EPS of 0.01 euro compared with an adjusted LPS of 0.02 previously) on net sales of 4.91 billion euros, down 2% on year (-3% an constant currency). The company lowered its full-year adjusted EPS guidance to 0.18 - 0.28 euro from 0.20 - 0.30 euro previously.

Danske Bank, a Danish bank, said it swung to a 1Q net loss of 1.3 billion Danish krone from a net profit of 3.0 billion Danish krone in the prior-year period, citing 4.3 billion Danish krone loan impairment charges, compared with 0.4 billion previously. Also, net interest income was down 1% to 5.5 billion Danish krone. The bank said it now aims for a net profit of at least 3 billion Danish krone for the full-year.

DNB, a Norwegian financial services group, reported that 1Q net income declined 47.2% on year to 4.00 billion Norwegian krone, where impairment of financial instruments jumped to 5.77 billion Norwegian krone from 316 million Norwegian krone in the prior-year period. Also, net interest income was up 11.9% to 10.40 billion Norwegian krone.

DSV, a Danish transport and logistics company, reported that 1Q net income decreased 65.6% on year to 331 million Danish krone while adjusted EBIT rose 7.7% to 1.57 billion Danish krone on revenue of 6.68 billion Danish krone, up 30.7%.

EX-DIVIDEND

Assa Abloy: SEK2, Beiersdorf: E0.7, ING Groep: E0.45, London Stock Exchange:49.9p, Lonza Group: SF1.375, MunichRe: E9.8, Renault: E1.1, Santander: E0.0243, Swiss Life: SF15

Latest market news

Yesterday 10:44 PM

Yesterday 05:00 PM

Yesterday 03:13 PM

Yesterday 01:39 PM

Yesterday 11:05 AM