US futures

Dow futures 0.34% at 38375

S&P futures 0.52% at 5121

Nasdaq futures +0.58% at 17819

In Europe

FTSE 0.17% at 8159

Dax -0.24% at 18125

- Tesla soars 14% on reports it will launch its driver-assisted technology in China.

- Apple rises on reports of renewed talks with OpenAI

- FOMC rate decision & NFP are due this week

- Oil edges lower as Middle East tensions ease

Apple and Tesla do the heavy lifting

US stocks point to a higher open, adding to last week's rise and boosted by mega-cap gains.

The move higher came following gains on Friday, as robust quarterly results from Alphabet and Microsoft helped lift the indices, overshadowing hotter-than-expected core PCE inflation data.

Today, there is no high impacting U.S. economic data. The focus will be firmly on Wednesday's Federal Reserve interest rate decision and Friday's nonfarm payroll report, which could set the tone for the market in the near term.

Markets are a bit fragile after last week's data raised some concerns about stagflation, as GDP figures were weaker than expected.

Markets are pricing in around 36 basis points of interest cuts this year, down considerably from the 150 basis points expected at the start of the year.

Earnings season is in full swing, with earnings in Q1 expected to grow 8.7% year on year. Of the 229 companies that have reported earnings, 77.7% had surpassed analyst expectations; this was ahead of the long-term average of 66.7%

Corporate news

Tesla is among the main gainers and is set to open almost 14% higher after the EV maker cleared some regulatory red tape and received permission to launch its self-driving software in China, its second-largest market.

Apple is set to gain over 2.5% on reports that the iPhone maker has restarted discussions with Open AI about using generative AI technology. So far, the tech giant has been slow to join the AI race, but there is hope that Apple will produce a superior product.

Domino's Pizza is on track to open higher after earnings came in ahead of expectations at $3.58 on revenue of $1.08 billion.

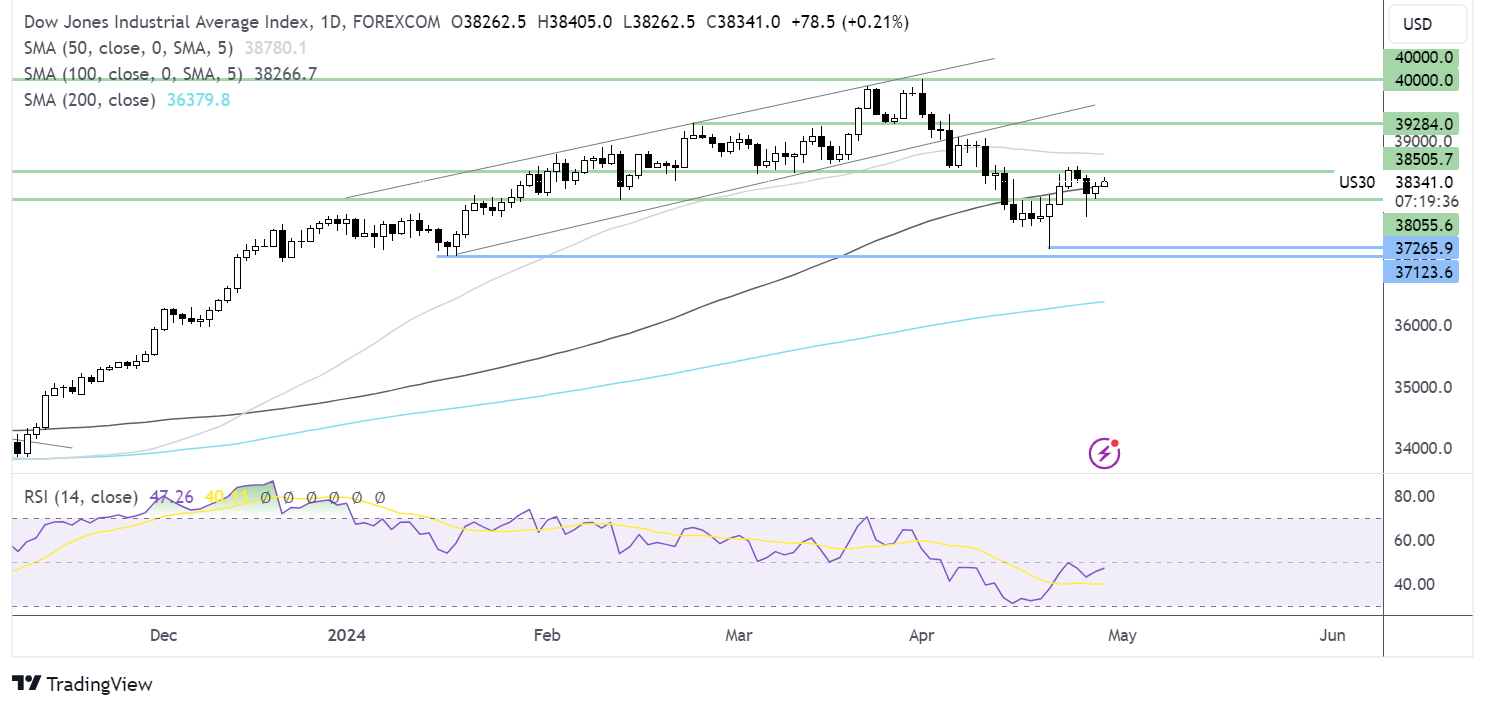

Dow Jones – technical analysis.

The Dow Jones has extended its rebound from 37230, the April low, rising above the 38000 level. It is attempting to rise above the 100 SMA at 38250 as it looks to 38550, last week’s high. A rise above here creates a high high and brings 39284, the February high, into focus. On the downside, failure to rise above the 100 SMA could cause sellers to retest 38000 and 37230.

FX markets – USD falls, USD./JPY plunges

The USD is falling, pressurized by the stronger yen's unsuspected intervention. Still, the U.S. dollar maintained most of its gains through April on the belief that the Fed may struggle to cut rates anytime soon.

EUR/USD is rising against a weaker U.S. dollar despite cooler-than-expected German inflation figures. German inflation remained unchanged at 2.2% in March, defying expectations of a tick higher than 2.3%. They may have supported the view that the ECB will cut interest rates in June.

USD /PY has fallen over 400 points after briefly spiking above 160 on a suspected intervention by Japanese authorities. Japan's top currency diplomat has declined to comment. However, the sharp fall does have the hallmarks of an intervention. The move comes as it's a public holiday in Japan, and therefore, when liquidity is low.

Oil weighs up cease-fire talks and Fed expectations.

Oil prices are Edging lower after modest gains last week amid fresh talks of a ceasefire in Gaza and concerns over the timing of rate cuts in the US.

US Secretary of State Antony Blinken has traveled to the Middle East to press for a truce and hostage deal between Israel and Hamas. Meanwhile, a Hamas delegation is set to meet Egyptian and Qatari officials in Cairo to discuss cease-fire proposals.

The latest developments offer some hope of a de-escalation in the region, which is helping to reduce the risk premium on oil.

Meanwhile, concerns that the Fed may keep interest rates high for longer are limiting any upside in oil ahead of Wednesday's meeting. High interest rates for longer could slow economic growth, which is bad news for the oil demand outlook.