After a solid day to start the week, the Dow Jones Industrial Average (Wall Street CFD) is gaining more ground today.

The proximate cause for this morning’s rally comes from the US consumer. Between a solid 11.6% y/y rise in Redbook’s weekly retail sales figure and strong results from both Walmart (WMT +5%) and Home Depot (HD +4%), traders are more confident that economic growth remains on sound footing, despite ongoing inflationary pressures.

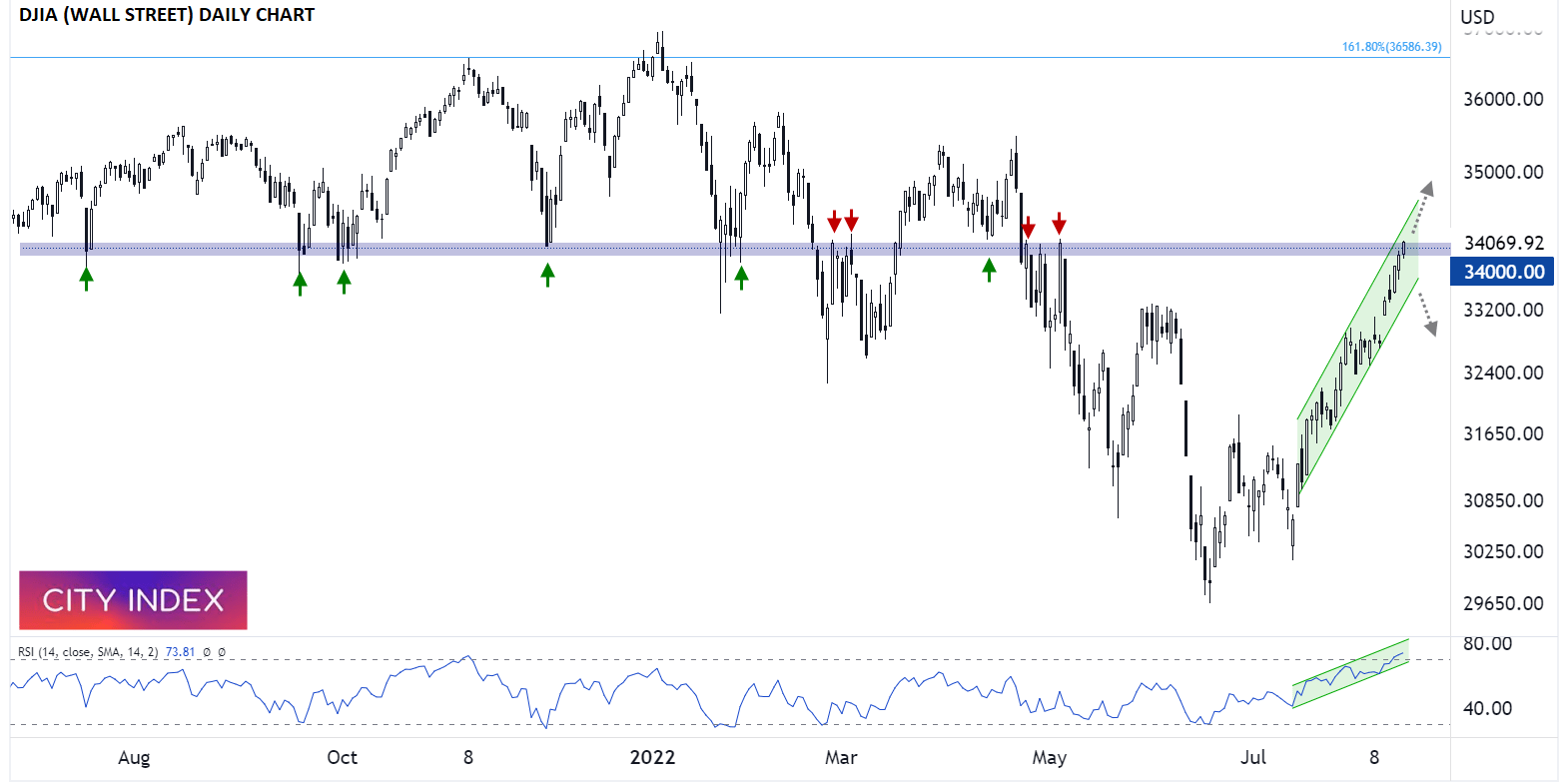

As we go to press, the Dow is testing arguably its most important price level of the past year at 34,000. Looking at the chart below, the index consistently found support near 34K in July, September, October, November and January, and, once breaking below it, found resistance at that same level in March and May. This price action underscores the technical principle of polarity, which states that a previous support level, once broken, becomes future resistance and vice versa.

All told, the price action suggests that the 34K level is a critical bull/bear delineation point, so a confirmed break above 34K would strengthen the near-term bullish bias and potentially pave the way for a move back toward record highs around 37K later this year. Meanwhile, a strong reversal off the 34K zone that breaks the near-term bullish channel would suggest that the most-followed US index has yet to shake off this year’s bearish momentum and would point a deeper retracement back below 32K.

Source: StoneX, TradingView

Despite the lack of top-tier economic data and generally lower liquidity due to “Dog Days of Summer” trade, this week’s price action could nonetheless set the trading bias for US indices heading into September and beyond.

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade