- Australia’s September labour force survey is released today

- Unemployment is expected to hold steady at 3.7%

- The RBA believes the jobs market has reached a turning point. That will have to be confirmed to diminish the risk of a further interest rate outlook.

Australia’s September obs report is arguably the most important G10 FX data release in the world today when it comes to the interest rate outlook from the Reserve Bank of Australia (RBA), ensuring there’ll be significant interest among AUD/USD and ASX 200 traders when it is released at 11.30am in Sydney.

The details on what to expect

When it comes to the volatile seasonally adjusted figures, markets are looking for employment to lift by 20,000 in September, a sharp deceleration from the 64,900 figure in August that was largely driven by part-time workers. While the rapid growth in Australia’s working age population means the economy needs to generate around 35,000 jobs per month just to keep unemployment steady, economists expect the national participation rate will decline by 0.1 percentage points, keeping the unemployment rate steady at 3.7%.

And what really matters for the ASX 200 and AUD/USD

While the seasonal adjusted series can and does generate significant volatility in the AUD/USD and ASX 200, providing scope for ultra-short-term traders to scalp a few ticks and points here and there, for longer-term traders and investors, what really matters is the unemployment rate, along with the underemployment and underutilisation rates which provide a more accurate guide on the degree of slack in the labour market. They have been trending higher since the middle of the year, allowing the RBA to pause its rate hike cycle and watch the lagged impact on incoming economic data.

Many analysts, including myself, deemed as likely to be permanent, with the next move in the cash rate likely to be a reduction at some point around the middle of next year. However, given hawkish remarks contained in the minutes of the RBA’s October monetary policy meeting released earlier this week, it has meant markets are likely to be hyper-sensitive to lead indicators that suggest inflationary pressures won’t moderate as fast as the RBA currently expects. This includes labour market slack given the flow-through effects to wage pressures, as the RBA discussed.

“Members observed that the labour market had reached a turning point as labour supply had picked up and labour demand had moderated,” it said. “The unemployment rate remained at 3.7% in August, slightly above the 50-year low of 3.5%. Underemployment had risen a little more noticeably, as had the youth and medium-term unemployment rates.”

Put simply, to diminish the risk of another hike or even hikes from the RBA this cycle, these indicators need to keep trending higher, especially today ahead of Australia’s Q3 CPI report next week.

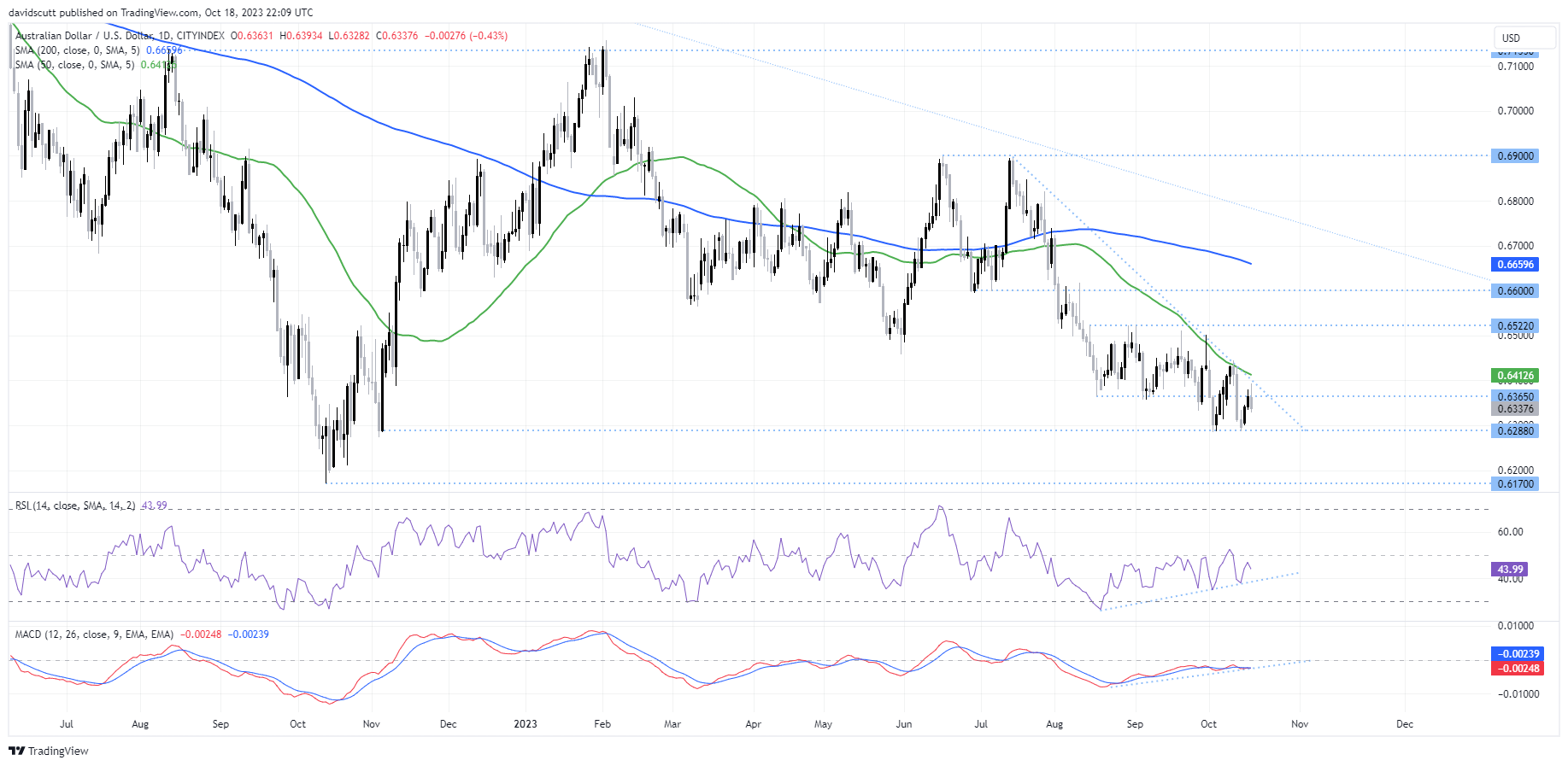

AUD/USD setup

Looking at AUD/USD before today’s release, the price action and momentum indicators are giving off divergent signals right now, with the former setting lower-high after lower-high while RSI and MACD suggest the downside momentum is ebbing. Given the proximity to horizontal support at .6288 and downtrend resistance currently located just below .6400, you get the sense today’s report (or the conflict in Israel and Gaza), could easily see the AUD/USD breakout in either direction. If it’s support at .6288, .6170 would be the next downside target for traders to watch. Conversely, should downtrend resistance give way, a move back towards sellers parked above .6500 may be on the cards.

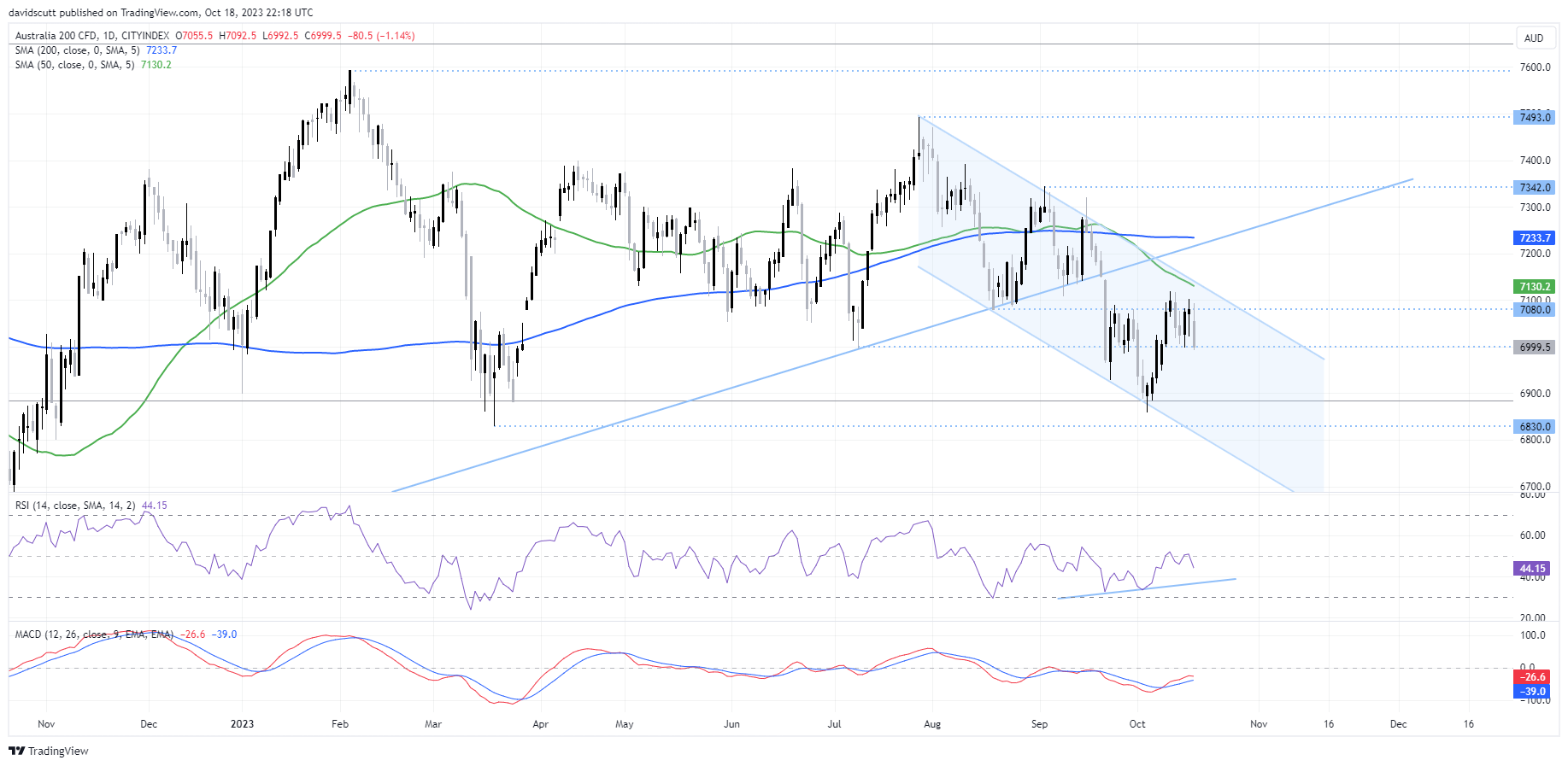

ASX 200 sits on major support

For the ASX 200, the index is sitting on support at 7000, suggesting today’s report could act as a potential catalyst for a swift move lower towards support at 69000 or bounce back towards resistance located above 7080. Given how negatively the index reacted to the RBA minutes earlier this week, a soft jobs report will likely assist the latter while a surprise decline in unemployment could easily spark further downside.

-- Written by David Scutt

Follow David on Twitter @scutty

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade