- WTI analysis: Crude oil creates bullish hammer at support

- What does rising oil prices mean for risk assets, inflation and interest rates?

Welcome to another edition of Technical Tuesday, a weekly report where we highlight some of the most interesting markets that will hopefully appease technical analysts and traders alike.

In this shortened edition of Technical Tuesday, we will analyse WTI crude oil.

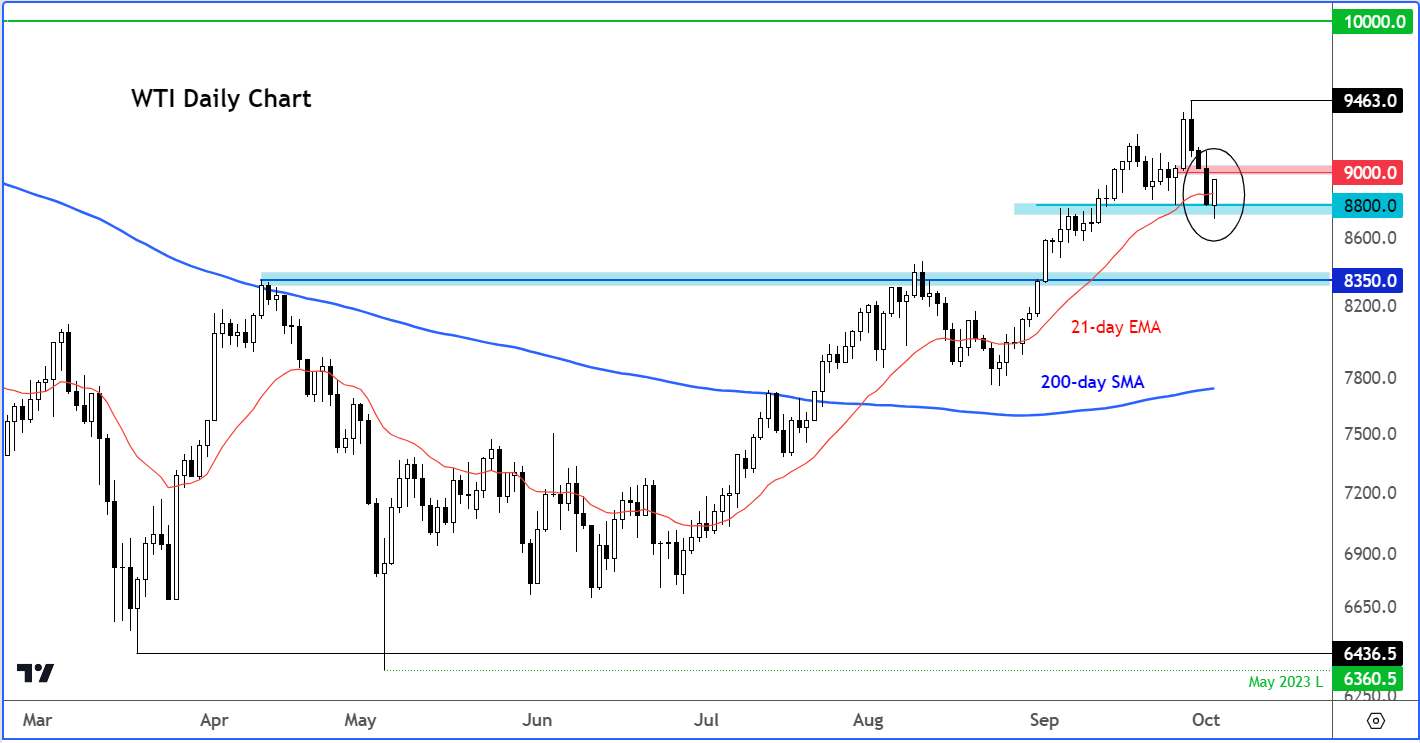

Before discussing what rising oil prices mean for inflation and interest rates, and therefore stocks and other risk assets, let’s have a quick look at the chart of WTI, for it has potentially created a bullish reversal pattern today.

WTI analysis: Crude oil creates bullish hammer at support

Source: TradingView.com

WTI was down early for the fourth consecutive session. But then as the selling pressure abated, it found fresh bullish momentum, in a sign that it has potentially resumed its bullish trend again. It found strong support just below the key $88.00 level where it had previously bounced from.

The sharp recovery means WTI may have formed a low for now, instead of falling to a more significant support around the $83.50 area. If it closes near today’s highs, WTI will have formed a hammer-like candle. This type of a candlestick pattern usually precedes follow-up buying momentum in the next day.

Key short-term resistance is around $90.00, which means the bull still have some work to do to completely reverse the short-term bearish momentum. A decisive move above the $90 level at some point this week, if seen, would be a major bullish development.

What does rising oil prices mean for risk assets, inflation and interest rates?

Investors’ focus will remain on oil prices after their recent sharp gains amid the ongoing supply cuts by the OPEC and allies, and in light of today’s bullish reversal. Owing to concerns over a crude supply deficit, there is a good chance we could see oil prices climb above $100 and thus stoke inflationary worries further.

Ministers from the OPEC+ will meet on October 4 but are unlikely to call for a full OPEC+ meeting. This is because the group is unlikely to change the current policy, which is working wonderfully for them right now with oil prices surging until recently despite a sluggish global economy.

Rising oil prices could make stagflation even worse for oil-importing countries in the Eurozone, Japan and China, among others. This comes as borrowing costs have skyrocketed across the developed economies. If crude oil were to rise even further, then this could further hurt the global economy, which is not something that would appease the stock market bulls.

What’s more, if oil prices now resume higher then this will likely push up inflationary pressures once more, encouraging major central banks like the Fed to hold their contractionary monetary policies in place for longer. Perhaps this may be why we are seeing continued pick up in long-term bond yields. Again, this won’t be good news for growth stocks.

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade