Market Summary:

- US inflation came in broadly as expected, with PCE and core PCE rising 0.2% m/m in July. The annual rates also met estimates, with PCE rising 3.3% y/y and core PCE rose 4.2%.

- Yet personal spending rose to an 8-month high of 0.8% m/m, and its trend is clearly higher despite higher interest rates.

- There was no blood in the ADP employment numbers, with initial and continuous job claims coming in roughly on target, although layoffs rose 75k (3x more than prior) or 267% y/y.

- Whilst some cracks slowly emerge in the US employment market, it seems the excitement from lower job openings has reversed ahead of NFP and personal spending played into the 'higher for longer' narrative, without necessarily meaning another hike from the Fed.

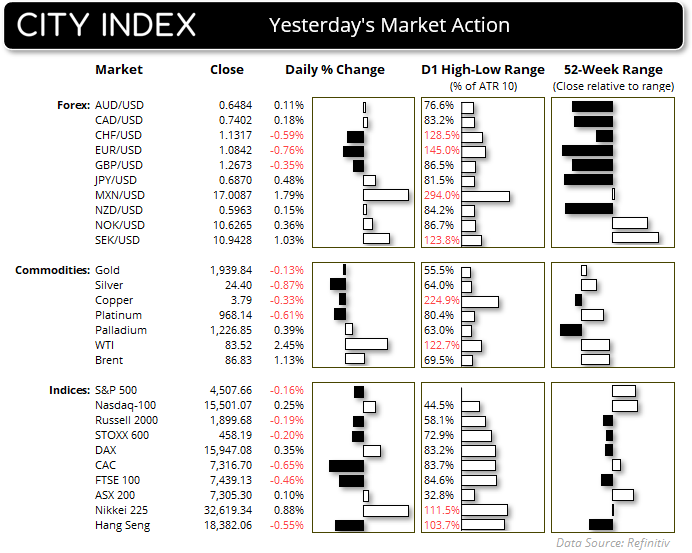

- This saw the US dollar snap its 3-day losing streak and the dollar index form a bullish engulfing day.

- However, the Japanese yes was the strongest forex major on Friday, likely helped by comments from BOJ member that the central bank are watching the yen as “currency moves have a big impact on inflation”.

- The euro was lower in the European and US sessions after renowned ECB hawk, Isabel Schnabel, noted that eurozone growth was weaker than anticipated. Money markets lowered their expectations of a 25bp hike in September from ~50% to ~30%, weighing on the euro in the European through to the US session.

- The S&P 500 and Nasdaq 100 broke their 5-month winning streaks and printed a hanging man reversal pattern in the month of August. It’s worth noting that September has generated negative average returns in September over the past 30 years.

- WTI crude oil enjoyed its most bullish day in 20, closing above 83.50 thanks to weaker dollar and expectations what OPEC+ will extend oil production cuts. It is the third month higher for oil.

- USD was the strongest forex major pair in August, commodities FX pairs NZD, AUD and CAD were the weakest

- China’s PBOC (People’s Bank of China) provided more stimulatory measures to support the property market and broader economy, by lowering the deposit rate for first and second-time home buyers and encouraged lenders to lower rates o existing mortgages

Events in focus (AEDT):

- 09:00 – Australian manufacturing PMI (final)

- 11:30 – Australian home, investor loans

- 11:45 – China manufacturing PMI (Caixin)

- 17:55 – German manufacturing PMI (final)

- 22:30 – US Nonfarm payroll, unemployment, average earnings

- 22:30 – Canadian quarterly GDP

- 23:45 – US manufacturing PMI (final)

- 00:00 – ISM services PMI

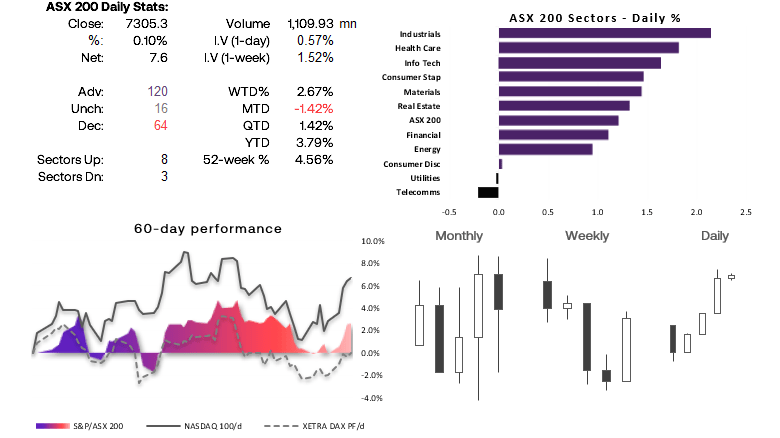

ASX 200 at a glance:

- The ASX 200 printed its smallest daily high to low range in over four months, of just 18.8 points on the last day of the month

- It did however close higher for a fourth day, although there is a clear hesitancy for it to trade materially above 7300

- With the soft lead from Wall Street and SPI futures falling -0.5% overnight, the cash market is expected to open below 7300 today

- 7292 – 7300 is a likely intraday resistance level, 7250 could mark nearby support

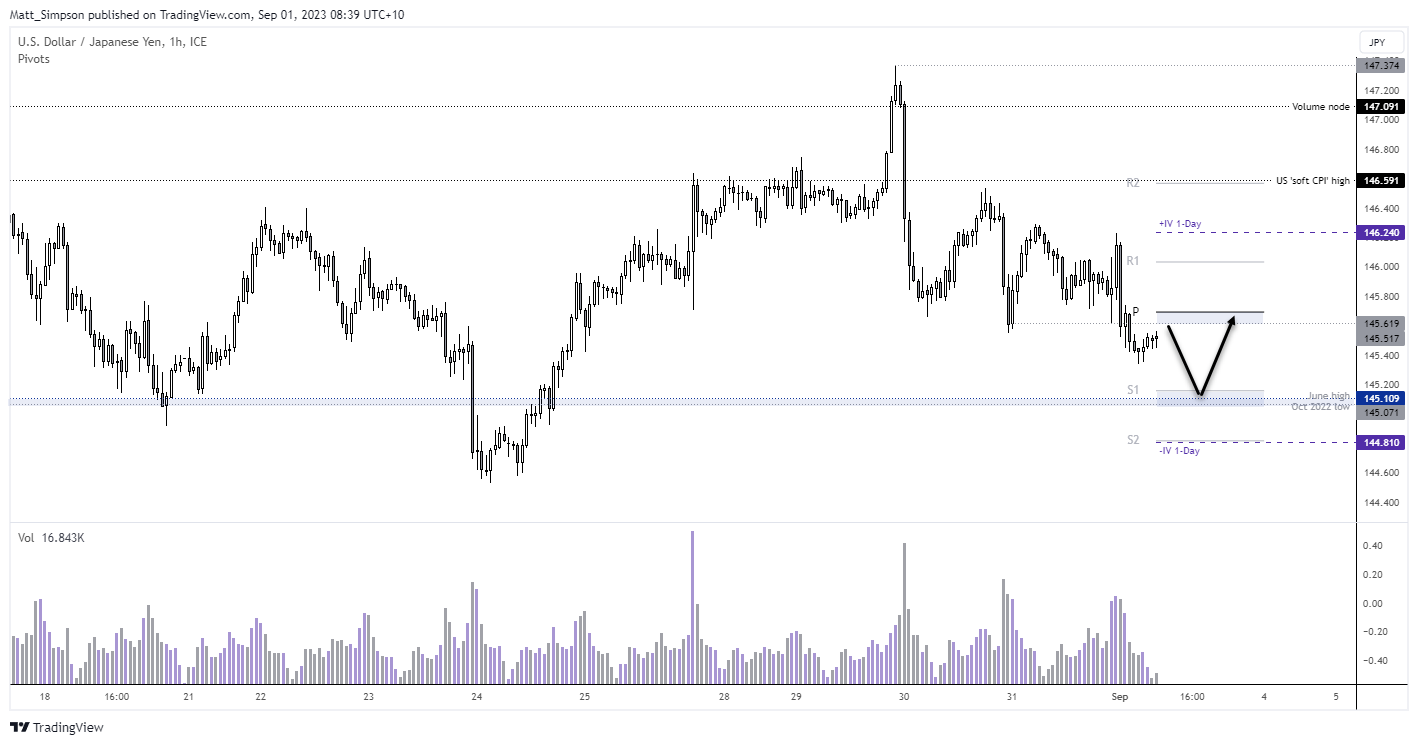

USD/JPY technical analysis (1-hour chart):

A bearish engulfing day formed on USD/JPY on Thursday, as the yen stood up to USD strength with a reminder from the BOJ that they’re watching currency markets. Volumes rose alongside prices at the start of the US session, but bears quickly dominated to push USD/JPY to a new cycle low with high volumes. Prices are drifting higher and show the potential to retest the 1.4517 lows / daily pivot point. For now I’d prefer to seek evidence of a swing high and seek shorts, with the October 2022 low / June high making a likely support level. At which point it could then be down to NFP – and if I had to take a guess, it could support the USD with ok or better numbers.

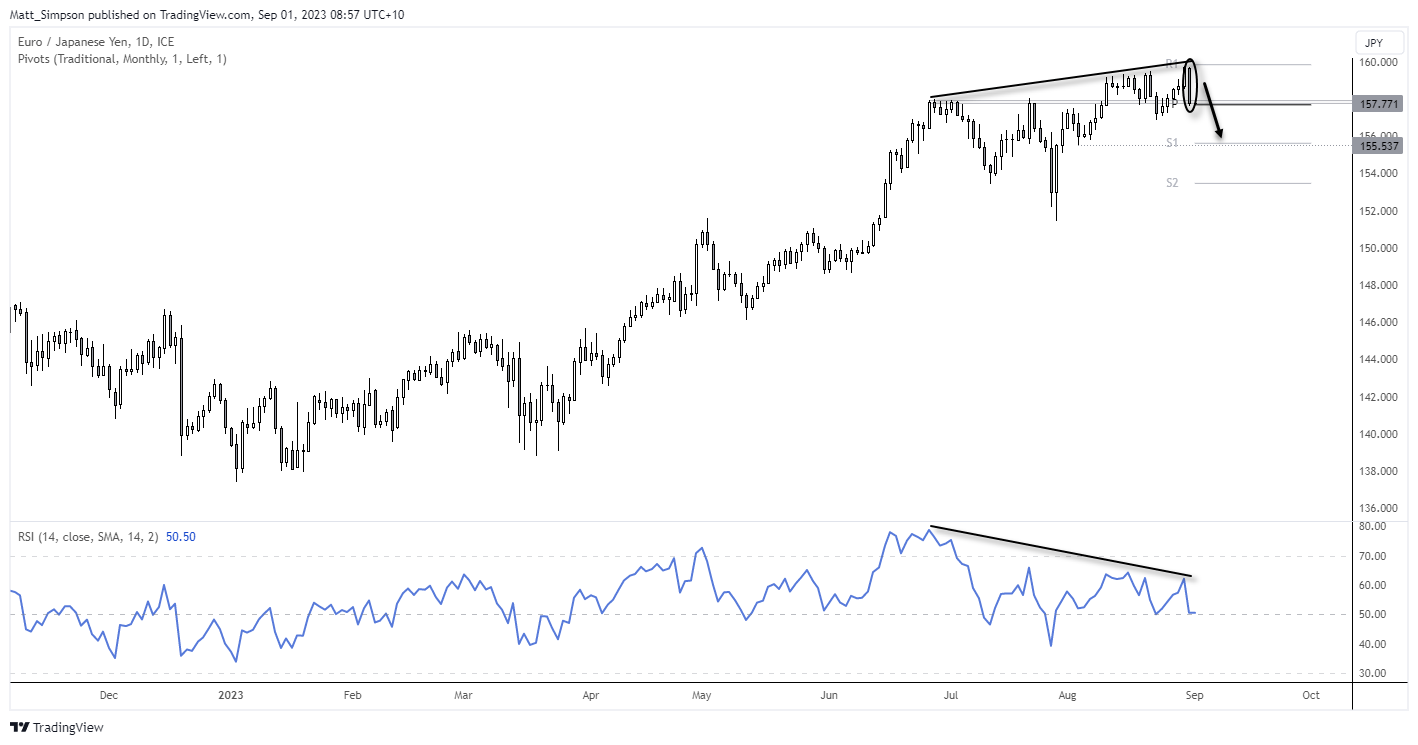

EUR/JPY technical analysis (daily chart):

The combination of a verbal BOJ warning shot and relatively dovish comments from an ECB official saw EUR/JPY suffer its worst session in five weeks on Thursday. A near bearish engulfing candle formed on the daily (the open was just beneath the prior days close – but the sentiment in there…). A multi-month bearish divergence has also formed on the RSI (14), and the bullish trend on 2023 has clearly lost steam since June.

Given the increased odds that yen weakness is very near (or at) a turning point, I am going to stick my neck on the line and speculate that EUR/JPY has topped for now. And as we have NFP looming, then perhaps we’ll see the obligatory retracement higher on EUR/JPY within yesterday’ range. But bears could consider seeking evidence of a swing high on lower timeframes to anticipate a break lower, or simply wait for a break of yesterday’s low. The initial target is near the monthly S1 pivot / 155.34 low.

View the full economic calendar

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade