US futures

Dow futures +0.12% at 32930

S&P futures +0.13% at 3855

Nasdaq futures +0.22% at 11260

In Europe

FTSE +0.46% at 7360

Dax +0.5% at 13930

Learn more about trading indices

A quiet start to the week

US stocks are set to start the week on the front foot, rebounding after sharp losses across the previous week. However, the market mood remains cautious amid fears that aggressive policy tightening by the US Federal Reserve could hamper economic growth next year and tip the US economy into a recession.

All three major indices lost ground across last week, posting a second straight week of declines after the Federal Reserve hiked interest rates and signaled that there were more hikes to come.

While last week was an extremely busy week for economic data and central bank meetings, this week, things are set to be much quieter, although there are still some data releases to watch closely.

While the economic calendar is quiet today, Wednesday sees the release of the Conference Board consumer confidence index, and Friday sees the release of the core PCE index, which is the Federal Reserves’ preferred measure of inflation.

Corporate news

Tesla is rising pre-market after Elon Musk launched a poll on Twitter asking users whether he should step down as the head of the social media platform. 57.5% of the respondents voted in favor. Musk has yet to respond, but TESLA has rallied over 4% on optimism that he may leave his position as CEO.

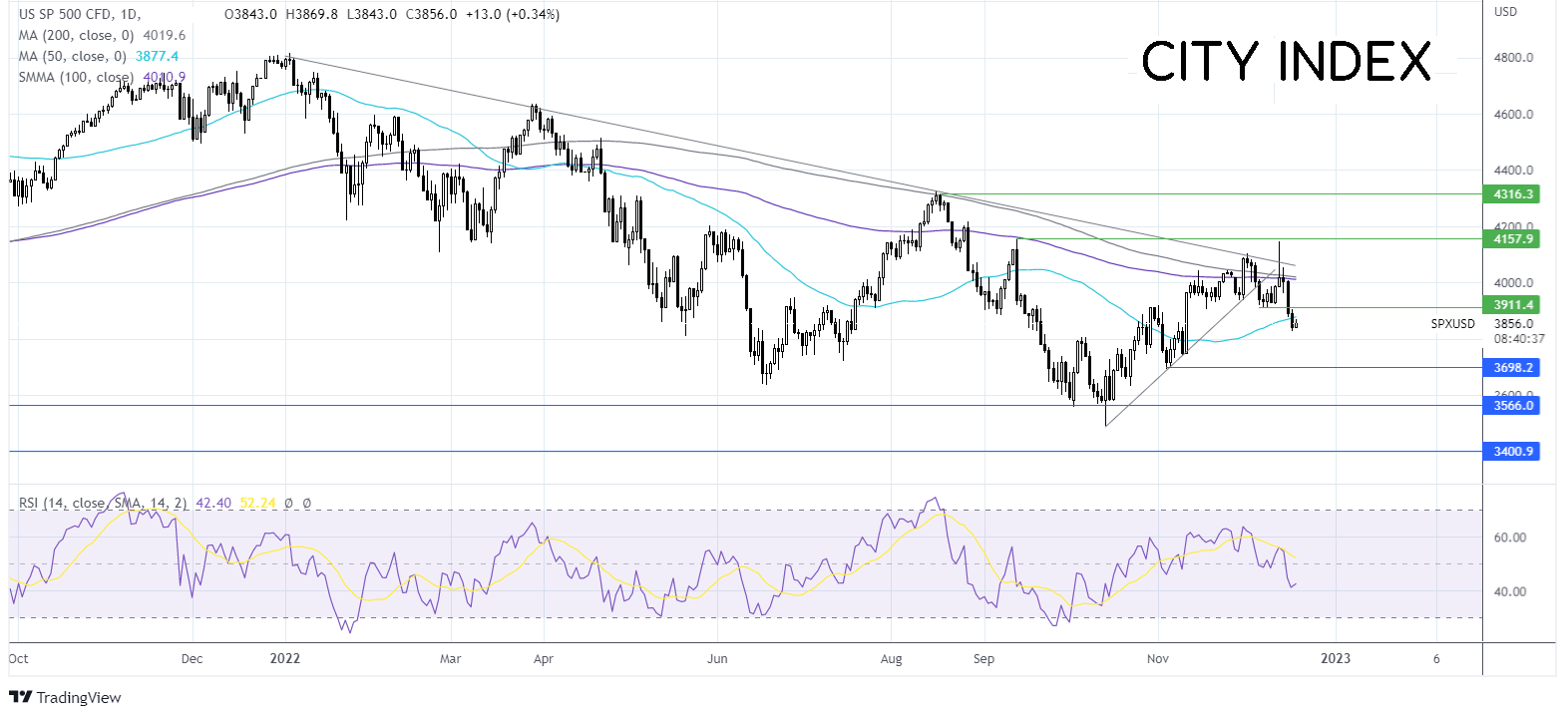

Where next for the S&P500?

After failing to rise meaning fully above the multi-week falling trendline, the S&P500 ran into resistance at 4145 before falling lower. The price fell below support at 3910, the early December low, before dropping below the 50 sma to 3830. This, combined with the RSI below 50 supports the idea of further losses. Sellers could look to break below 3840 to extend the bearish trend towards 3700, the November low. Meanwhile, buyers could look for a rise above 39 10 to expose the 100 sma just over 4000 the psychological level.

FX markets – USD falls, GBP rises

The USD is falling extending losses from last week. The US dollar ended last week modestly lower despite the Federal Reserve warning of further rate hikes in 2023 and lifting the terminal rate. The mood towards the dollar remains cautious ahead of core PCE inflation data on Friday.

EUR/USD is rising, adding to last week’s gains boosted by stronger-than-expected business morale in Germany. The German Ifo business climate was better than expected in December, rising to 88.6, up from 86.4 in November and ahead of forecasts of 87.3. The rise comes as concerns over gas rationing in the eurozone’s largest economy fall and as inflation shows signs of cooling.

GBP/USD is rising, paring some of last week's losses. The pound fell sharply last week after the Bank of England interest rate decision was more dovish than expected. Still, gains could be limited as the economic outlook for the UK remains gloomy, which investors were reminded of after British factory output and export orders fell this month, highlighting the troubles faced by the manufacturing sector. The CBI gauge of manufacturing output dropped to its lowest level since September 2020.

GBP/USD +0.4% at 1.2180

EUR/USD +0.23% at 1.0610

Oil rises after losses last week

Oil is rising, paring some of last week’s losses as optimism over the reopening of the Chinese economy overshadowed concerns of a global recession. News that Beijing is also planning to step up support for the Chinese economy in 2023 is helping the demand outlook.

Oil prices are also being supported by the US Energy Department announcing that it will begin to repurchase oil for its strategic petroleum reserves (SPR) this would mark the first purchases since releasing 180 million barrels from the reserves earlier this year.

WTI crude trades +1% at $74.85

Brent trades at +1.05% at $79.30

Learn more about trading oil here.

Looking ahead

15:00 NAHN Housing market index