US futures

Dow futures -1% at 32950

S&P futures -1% at 4237

Nasdaq futures -1.2% at 13570

In Europe

FTSE -0.4% at 7102

Dax -2% at 13470

Euro Stoxx -2.6% at 3661

Learn more about trading indices

Ukraine crisis & inflation fears hit sentiment

US stocks are set for a weaker start. The optimism that lifted stocks yesterday has evaporated after Russia continued to attack civilians. Peace talks were held in Turkey today, the first meeting with the two foreign ministers. However, expectations were much lower than what they were yesterday which is being seen as risk-off trading resumes. Little to no progress was made in the meeting which lasted 90 minutes with no ceasefire or humanitarian corridors agreed upon.

Interconnected to the Ukraine crisis, inflation, as measured by the consumer price index jumped to 7.9% YoY in February, ahead of the 7.5% recorded for January in line with forecasts. Meanwhile, core inflation which removes more volatile items such as food and fuel, rose 6.4% up from 6%, and again in line with forecasts. The reading doesn’t take into account the 20% jump in oil prices which has been seen so far in March and could continue to rise. In short, inflation still has higher to run.

With no end in sight for the Russian war and no alternative supplier for Russian oil, the out outlook is pretty grim. Stagflation is set to be a very real problem

Fed Chair Powell has already signaled to a 0.25% rate hike is coming next week. He has also said that the Fed will move faster to hike rates if needed. This data is unlikely to have changed that stance.

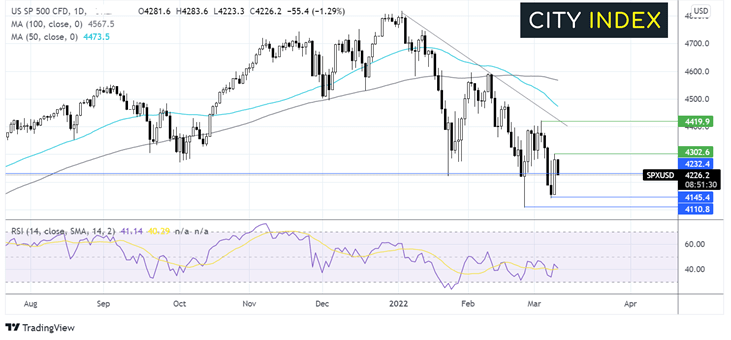

Where next for the S&P500?

The S&P500 is heading lower once again, as it continues to trade below its 50 & 100 sma and falling trendline. The RSI points to further losses whilst it remains out of oversold territory and the 50 sma crossed below the 100 sma. All in all, this is a negative picture. The index is testing support at 4220 the January 24 low. A break below here could bring 4145 the weekly low into target, ahead of 4110 the year-to-date low. Buyers could look for a move over 4300 in order to bring 4420 into focus.

FX markets USD falls, EUR rebounds

USD is falling for a second straight session. Whilst yesterday the USD fell in response to the improved mood in the market, today the USD is falling after the ECB announcement. However the prices has picked up off the lows following the inflation print.

EURUSD rises after the ECB voted to keep interest rates on hold but announced a faster than expected wind-down of the APP bond-buying programme. The more hawkish than forecast move highlights the ECB’s concerns over rising inflation.

GBP/USD +0.04% at 1.3178

EUR/USD +0.22% at 1.1100

Oil rises after 12% selloff

After tumbling 12% in the previous session, oil prices are once again climbing higher on fears of tight supply. Yesterday the UAE said that it would be in favour of OPEC raising output, sending the price tanking lower, despite the day before Biden banning the import of Russian oil.

The huge swings that are being seen in the oil market reflect the level of uncertainty of what all this means for supply. Traders are struggling to piece together how supply will ultimately be affected by the fallout from the Ukraine crisis.

Yesterday’s slump is likely to be more of a technical correction from a market that was massively overbought. At the end of the day, there is still a high level of uncertainty over where supply will come from to replace Russian oil and that uncertainty will keep pushing prices higher.

WTI crude trades +3.7% at $110.5

Brent trades +4.3% at $114.68

Learn more about trading oil here.

Looking ahead

N/A

How to trade with City Index

Follow these easy steps to start trading with City Index today:

- Open a City Index account, or log-in if you’re already a customer.

- Search for the market you want to trade in our award-winning platform.

- Choose your position and size, and your stop and limit levels

- Place the trade.