US futures

Dow futures -0.13% at 33834

S&P futures +0.1% at 4113

Nasdaq futures +0.26% at 12505

In Europe

FTSE +0.51% at 7876

Dax -0.25% at 15313

Learn more about trading indices

Biden’s State of the Union address is also in focus

US stocks are lacking direction on Tuesday as investors look keenly ahead to a speech by Federal Reserve chair Jerome Powell and digest the latest round of corporate earnings.

Fed Chair Powell will speak at the Economic Club of Washington later in the session, and investors will be looking for clues over the future path of interest rates, particularly in light of the strong data on Friday.

The US labour market saw job creation skyrocket in January, and ISM services were also upbeat. Could the strong data prompt Powell to adopt a slightly more hawkish stance? This reassessment of the Fed’s outlook has already pulled US stocks over 1.5% lower across the past two sessions.

Today is also the annual state of the Union address, with Joe Biden expected to highlight the strong labour market as employment sits at a 53-year low and progress with reining in inflation. This isn’t usually a market-moving event.

More corporate earnings will roll in with the likes of DuPont, Royal Caribbean and Chipotle due to report. Of the 254 S&P 500 companies that have reported so far 69.3% have beat forecasts.

Corporate news

BP rises after reporting a record full-year profit of $27.7 billion for 2022 compared to $12.8 billion in the previous year. The oil major announced $2.75 billion share buyback and boosted its dividend by 10% to 6.61 cents. These earnings follow impressive earnings from Exxon Mobile and Chevron.

Bed Bath & Beyond trades 30% lower pre-market after announcing that it was planning to raise some $1 billion in a last attempt to avoid bankruptcy.

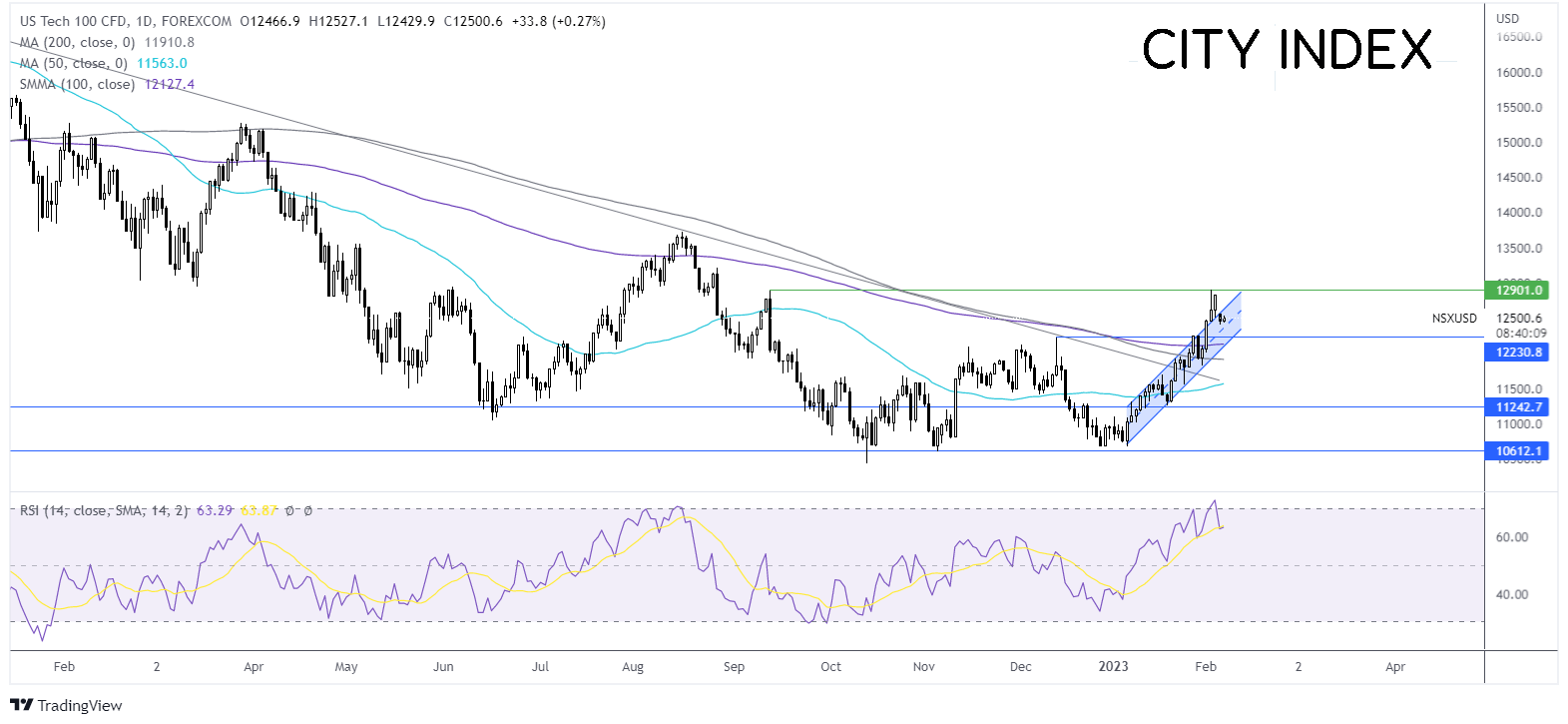

Where next for the Nasdaq?

After hitting resistance at just below 12900, the price has eased lower and is consolidating above 12500. The price has returned into the rising channel dating back to the start of the year and remains above the 50, 100 & 200 sma. The RSI is also above 50 but below the 70 level, which indicates overbought territory. Buyers could look for a move above 12900 to extend the bullish run and create a higher high. Sellers could look for a fall below 12200, the December high, exposing the 100 sma at 12120 and the 200 sma 11915.

FX markets – USD rises, EUR falls

The USD is rising, adding to gains from the previous session as investors look ahead to Fed Chair Powell's speech. The rise in the USD suggests that the market is expecting a more hawkish-sounding Powell post-Friday’s strong data.

AUD/USD has jumped higher, outperforming its major peers after the RBA raised interest rates by 25 basis points as expected but also suggested that there could be more rate hikes to come. This was in contrast to the December meeting, where the RBA suggested that rate hikes could soon be paused.

EUR/USD is edging lower for a fourth straight fashion after German industrial production tumbled by more than expected in December and as investors digest speeches from ECB governing council members. German industrial production fell 3.1% MoM, after rising 0.4% in Nov. This was below the 0.7% forecast.

GBP/USD +0.1% at 1.2070

EUR/USD -0.15% at 1.0770

Oil rises on demand optimism & supply concerns

Oil prices are rising for a second straight day on Tuesday, boosted by optimism surrounding the China reopening and also by concerns over supply shortages amid the shutdown of a major export terminal following the earthquake in Turkey.

Saudi Arabia, the world's top oil exporter, increased prices for Asian buyers for the first time in six months amid expectations of a demand recovery, particularly from China. Optimism surrounding the reopening of the Chinese economy has helped support oil prices over the past few months. Yesterday IEA said that it expects half of this year’s global oil demand growth to stem from China.

Meanwhile, Turkey's export terminal in Ceyan, has seen operations halted following a major earthquake in the region.

However, the rebound in oil prices is capped ahead of Jerome Powell’s speech later, where he could shed more light on the future path of rate hikes and, therefore, the likelihood of a soft landing in the US, the world’s largest consumer of oil.

WTI crude trades +1.3% at $75.50

Brent trades at +0.7% at $80.45

Learn more about trading oil here.

Looking ahead

17:30 BoC’s Macklem speech

17:40 Fed Powell speech

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade