US CPI, ECB and a slew of China data: The Week Ahead

The combination of a key US inflation report and finely-balanced ECB interest decision should keep EUR/USD on trader’s radars. The ZEW economic report will also shed further light on the slowdown in Europe, although will sway the ECB’s decision? We also have plenty of data out from China which could sway sentiment for risk assets, including CPI/PPI, loan growth, investment, retail sales and employment. US retail sales and the preliminary University of Michigan Consumer Sentiment report (with inflation expectations) also warrant a look.

The week that was:

- Rising bond yields continued to dominate sentiment in the first half of the week and further support the US dollar

- Stronger-than-expected economic data from the US also supported the ‘higher for longer’ narrative for Fed rates

- ISM services PMI data rose to a 6-month high, with 15/18 companies reporting growth towards an estimated GDP rate of 1.6% y/y (new orders, business activity and employment indices were also higher)

- The British pound continued to hand back some of its 2023 gains after BOE governor Andrew Bailey suggested that inflation could continue to soften, following earlier him from BOE chief economist that interest rates could plateau

- A BOE survey also revealed corporate prices are expected to fall further

- The recession bells for Germany continued to ring with industrial production falling nearly -12% m/m in July

- The Bank of Canada (BOC) held rates at 5% but warned that further hikes may be required if the rate of inflation does not fall quickly enough, which governor Macklem backed up in later comments

- The RBA also held interest rates at Dr Lowe’s final meeting as governor, and kept the door open for “further tightening” (although money markets continue to price in a terminal cash rate at the current 4.1%)

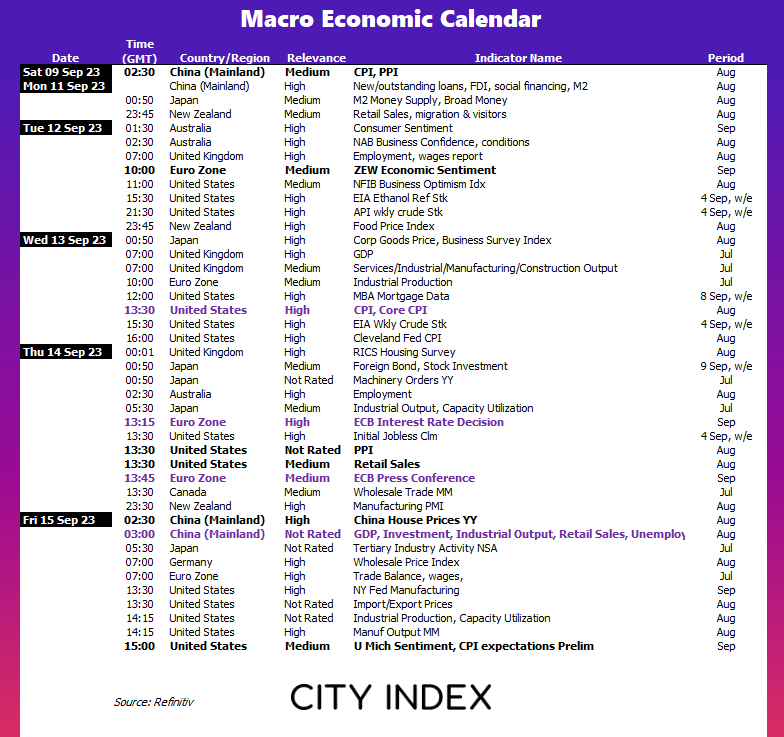

The week ahead (calendar):

This content will only appear on City Index websites!

Earnings This Week

Look at the corporate calendar and find out what stocks will be reporting results in Earnings This Week.

The week ahead (key events and themes):

- US consumer price indices (CPI)

- ECB interest rate decision and press conference

- China’s loan growth

- China consumer and producer prices indices (CPI, PPI)

- China’s data dump (fixed asset investment, retail sales, real estate development, industrial production)

- Australian employment

US consumer price index (CPI)

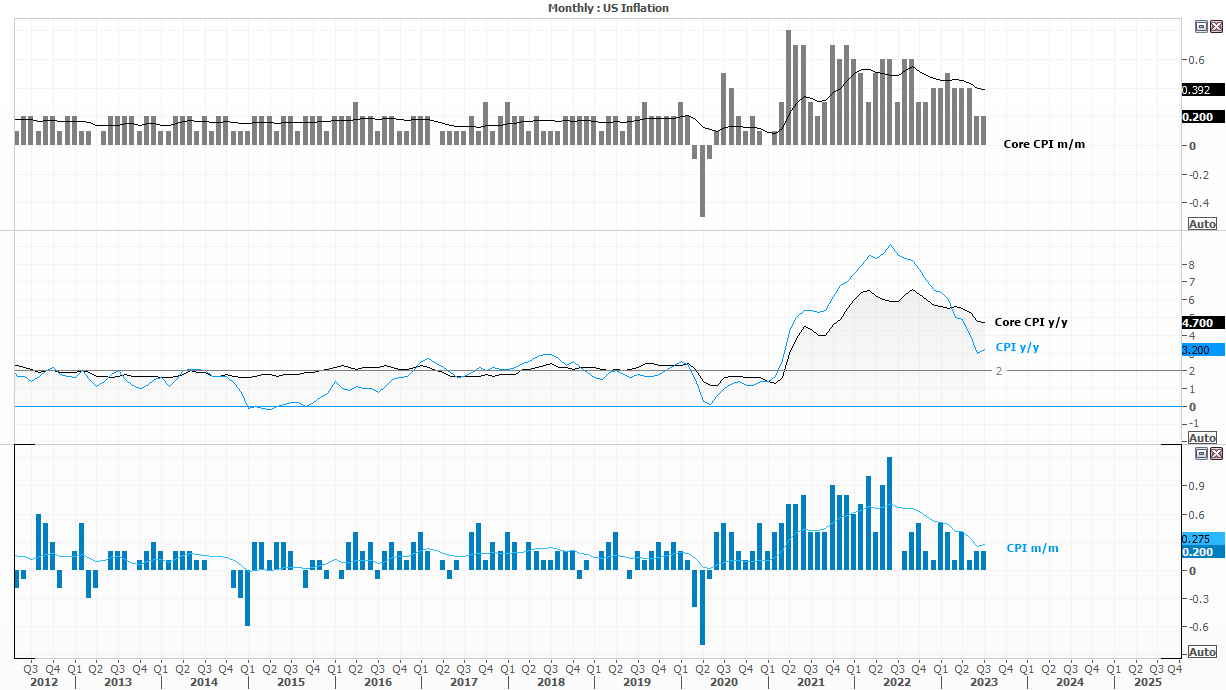

Recent US economic data points towards a soft landing for the US economy, yet at the same time supports ‘higher for longer’ Fed rates. Therefore, it is the trajectory of inflation that matters in next week’s US CPI report.

Whilst core CPI slowed to a 21-month low of 4.7% in July, it remains move than twice the Fed’s 2% target. But if we look at the trajectory of the monthly prints, there is reason to believe it could continue to soften. And if it does, it could weaken the mighty US dollar as markets presumably bring forward their bets of the Fed’s first cut.

And with a relatively strong employment markets, imagine what a soft inflation report could do for risk sentiment. But of course, the reverse is true. Should inflation tick above expectations (or even rise) then it could further support US bond yields and the dollar, to the detriment of risk appetite on markets such as the S&P 500 and Nasdaq 100.

Market to watch: EURUSD, USD/JPY, WTI Crude Oil, Gold, S&P 500, Nasdaq 100, Dow Jones

ECB interest rate decision

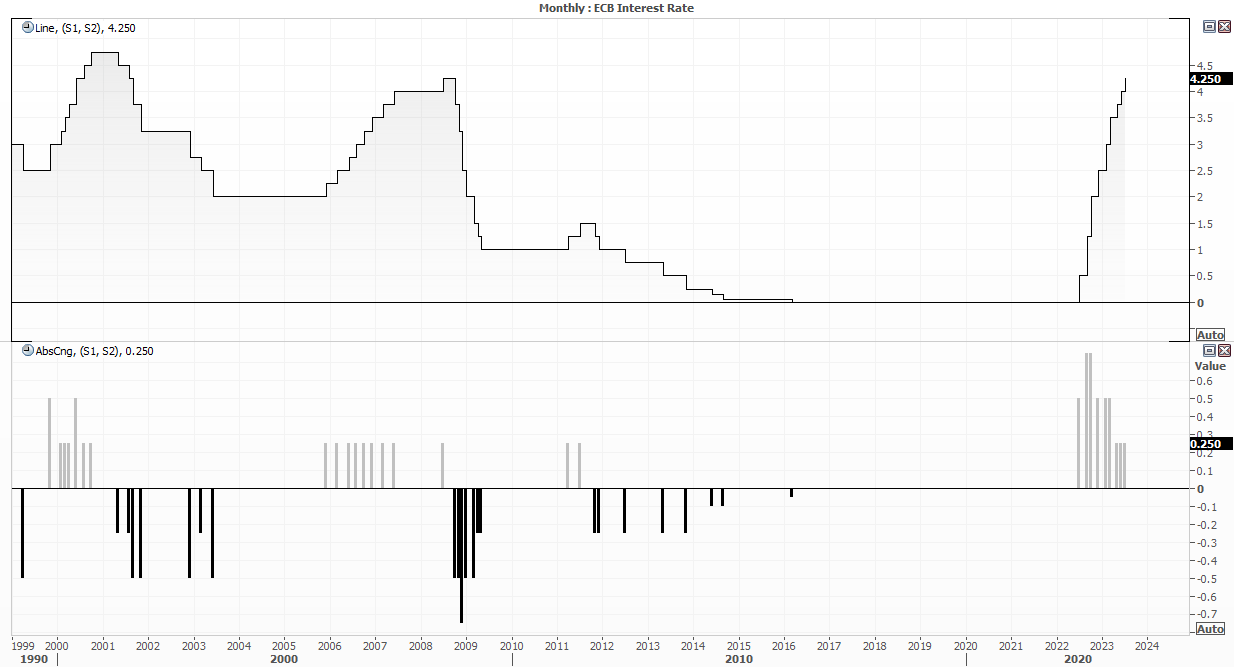

Next week’s interest rate decision for the ECB remains very much in the air, with strong cases for both a final 25bp hike or to hold rates steady. A Reuters poll slightly favours the ECB to hold, which is likely due to a slew of weak economic data from Germany and weaker business and consumer confidence across Europe. Yet just under half have tipped a final 25bp hike.

This week we saw three influential ECB members hint that those betting that the ECB are done have underestimated the potential for a hike. Perhaps another way of looking at this is that it’s the message that is conveyed over their action. And as they are fighting weak growth alongside high inflation, their decision is indeed finally balanced but we can at least rule out a dovish hold or a hawkish hike.

If the ECB opt to hold, it’s possible that Lagarde will keep another hike on the table to curb inflation expectations if nothing else. SO perhaps the bigger reaction could be if we see a hike followed with a relatively dovish press conference (hinting that the ECB may be done for now), which could weigh further on the euro and support European bourses such as the DAX, STOXX and CAC.

Market to watch: EUR/USD, EUR/GBP, DAX 40, CAC 40, STOXX 50

China’s loan growth, inflation, investment data and more

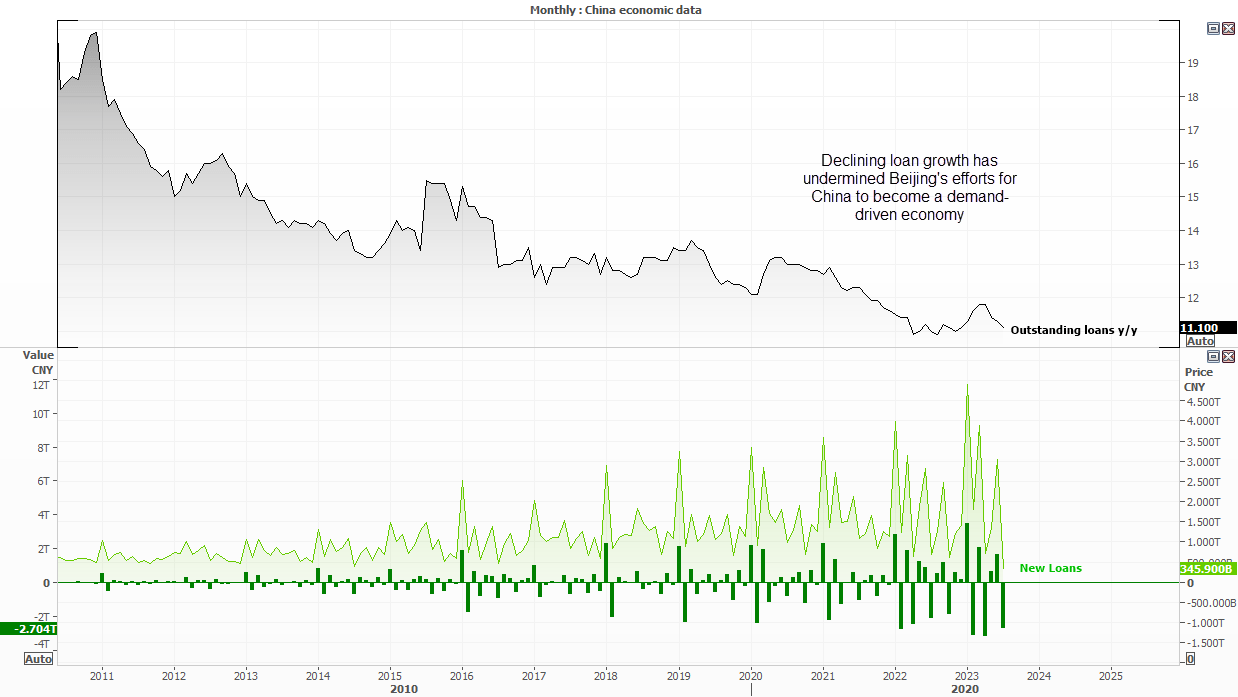

Monday’s loan growth figures will be closely watched to see if there is a pickup in domestic demand. Failure to do so will make it yet another data set which has underwhelmed this year, and points to weaker global growth. Last month we saw new loan growth crawl to its lowest level since 2009 and the annual rate of outstanding loans fall to an 8-month low of 11.1% y/y. It may not knock sentiment as these trends are well established so, like much of China’s data at the moment, it could take a noteworthy upside surprise to stir a real market response and support appetite for risk.

We also have inflation data released on Saturday ahead of the open. It may not be such a market mover, but as mentioned in last week's report I’m wary that we’ll be seeing too many negative prints from China’s CPI report which leaves the potential for inflationary pressures to build in Q4 or 2024.

We also have a data dump later in the week which includes industrial production, retail sales, fixed asset investment and employment. All of their trends of which have tended to underwhelm in recent months.

Market to watch: USD/CNH, Hang Seng, China A50, AUD/JPY, AUD/USD

Australian employment

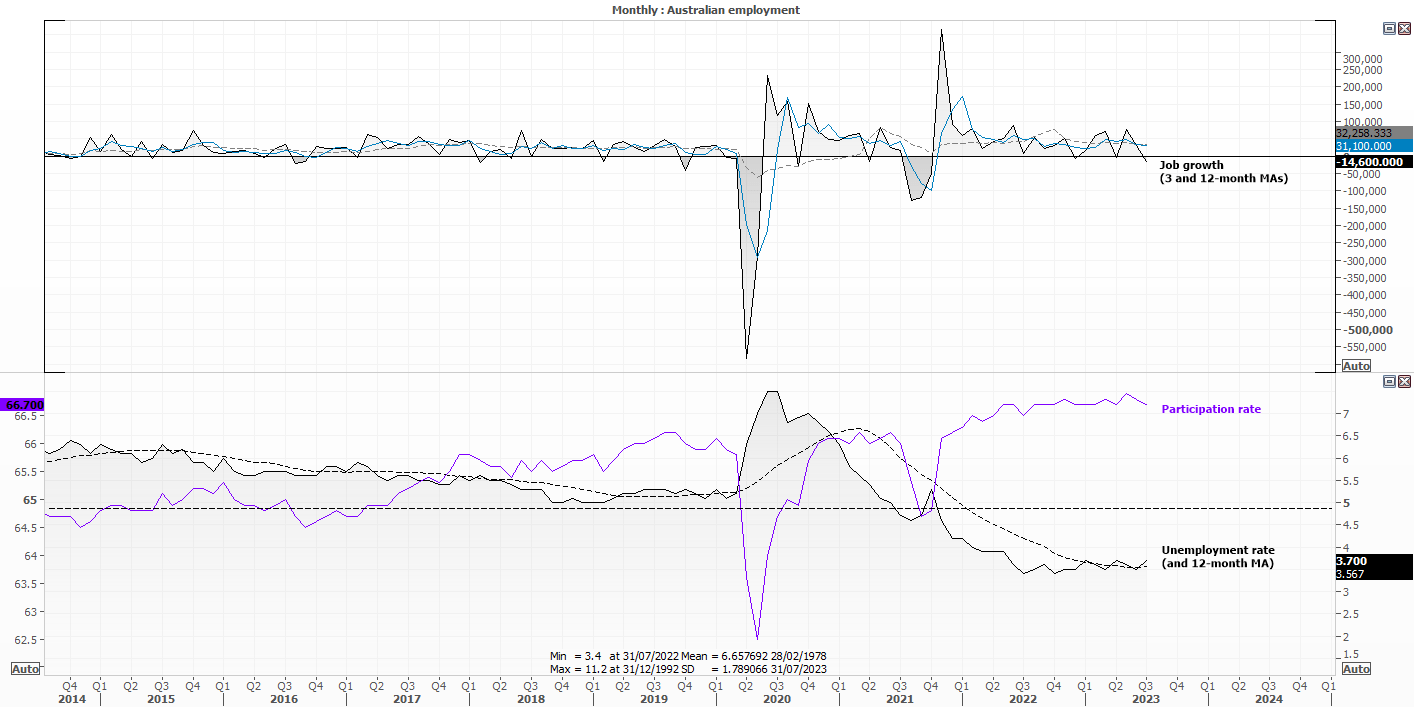

With the majority now in agreement that the RBA have completed their tightening cycle, it may take quite a strong set of employment figures to reverse those opinions. And with cracks appearing in August’s labour force report, this is really about whether those cracks get wider to confirm suspicions that all is not well, or will we find out it was a blip in the data and employment remains strong as ever. Keeping in mind that job growth was negative, the participation rate was lower and unemployment rose 0.2 percentage points to 3.7%, so we may need to see a reversal of all three to deem it a ‘blip’.

Market to watch: AUD/USD, NZD/USD, AUD/NZD, NZD/JPY, AUD/JPY, ASX 200

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade