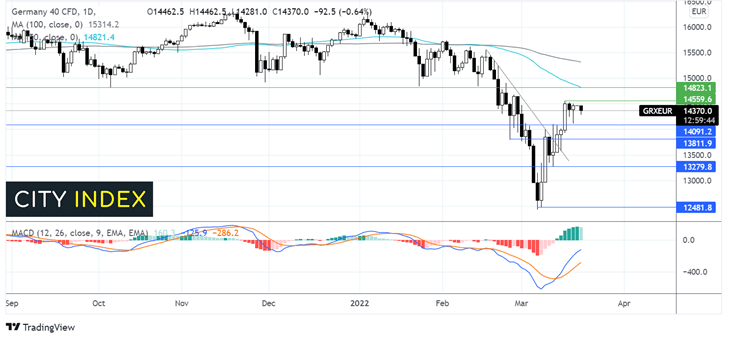

DAX eases back from 3 week high

DAX is heading lower after strong gains last week. The German index jumped 5% last week, in its best weekly performance since November, on hopes of a diplomatic solution to the Ukraine crisis.

Today, risk sentiment is under pressure as Ukraine refused Russian demands to surrender in Mariupol. This combined with heavy bombing of Ukraine is prompting risk aversion.

German producer prices rose to 25.9% YoY in February, up from 25% in January, although slightly short of the 26.1% forecast, showing hat inflationary pressures continued to build even before the Russian war.

Today EU leaders are set to talk with US President Biden over the prospect of tougher sanctions on Moscow.

Learn more about trading the DAXWhere next for the DAX?

The DAX has extended its rebound from 12460 the March 4 low but ran into resistance at 14550 last week’s high. The price is just easing away from this recent high as it consolidates after the run northwards.

Whilst the prices trade well below its 50 & 100 sma this conflicts with the bullish crossover on the MACD.

It would take a move below 14100 to negate the near-term uptrend, which could open the door to support at 13800 the February 24 low, ahead of 13300 the March 11 low.

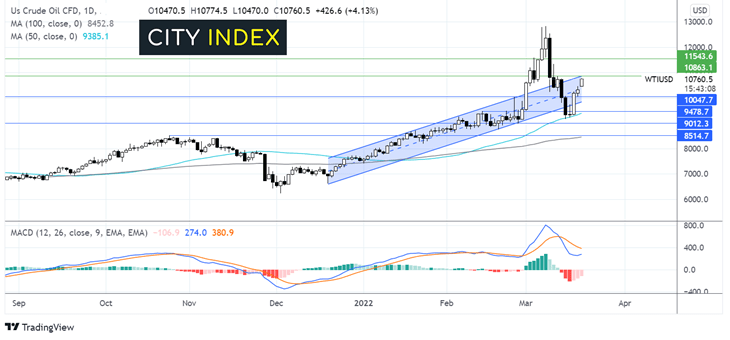

Oil price rise as EU considers banning Russian oil

Oil fell 4% last week, after falling 5% the previous week amid optimism of a diplomatic solution to the Ukraine crisis.

Today, oil is on the rise as the EU considers joining the US by banning Russian oil. The EU and the US are due to hold a series of summits to discuss imposing tougher sanctions on Moscow.

With few signs of the conflict in Ukraine easing, oil bulls are pushing prices higher.

In addition to the Ukraine crisis, an attack on a Saudi Arabian energy terminal and warnings over OPEC’s failure to reach production levels are also lifting oil prices.

Learn more about trading oilWhere next for WI oil?

WTI crude oil found support on the 50 sna last week and has rebounded high, supported by the receding bearish bias on the MACD.

The price is trading at the upper band of the rising channel dating back to mid-December.

Resistance can be seen at 108.50 the confluence of the upper bad of the rising trendline and the March 11 high. Beyond here, resistance at 115.00 the March 3 high could come into play.

On the downside, 100.00 the key psychological level offers near-term support, with a break below here opening the door to 98.00 the lower band of the rising channel which could then expose the 50 sma at 93.65.

How to trade with City Index

Follow these easy steps to start trading with City Index today:

- Open a City Index account, or log-in if you’re already a customer.

- Search for the market you want to trade in our award-winning platform.

- Choose your position and size, and your stop and limit levels

- Place the trade.