US futures

Dow futures -1.43% at 30098

S&P futures -1.58% at 3702

Nasdaq futures -1.7% at 11342

In Europe

FTSE -1.3 at 7057

Dax -2% at 13020

Euro Stoxx -1.62% at 3427

Learn more about trading indices

Stocks tumble

US stocks are set to fall sharply on the open after yesterday’s rally proved to be short-lived and as all eyes are on Fed Chair Powell as his two-day testimony before Congress begins.

Legislators will focus on inflation, where Powell sees inflation rising, and when will peak inflation pass? He will also likely be pressed on the chances of a recession in addition to the Fed’s plans going forward.

The market will be watching closely for signs that the Fed could hike looking to raise rates by 75 basis points again in July. Currently, this is 86% priced in, with another 50-basis point rate hike for September.

Such aggressive tightening will make a soft landing very difficult to engineer and those fears of recession or at least significantly slower growth are hitting demand for equities. The likelihood of the US entering into recession has risen substantially with Citigroup now putting the chances at 50%

There is no high-impacting data from the US today, all eyes are on Powell.

In corporate news:

Twitter is falling pre-market despite the social media’s board voting unanimously recommending shareholders vote in favour of Elon Musk’s takeover.

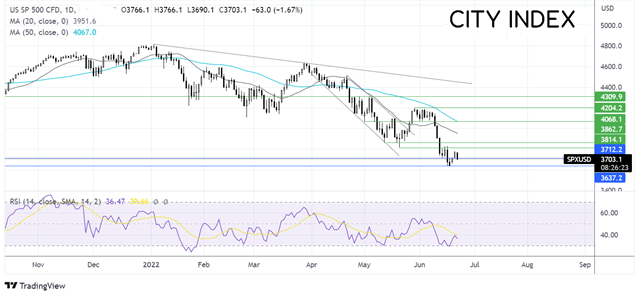

Where next for the S&P500?

The S&P 500 rose of the 2022 low of 3636 before stalling at 3780. The price has resumed its decline, trading below its 20 & 50 sma, whilst the RSI is also indicating further losses could be on the cards. Sellers will look for a move below 3636 for to extend the bearish trend. Buyers will look for a move over 3815/30 zone Friday’s high to bring 3860 into focus.

FX markets – USD rises, GBP falls

USD is rising, although has pared earlier gains as attention turns to Fed Chair Powell ahead of his testimony before congress. Any sense of a 75 basis point hike could send the USD higher.

USDJPY is easing after reaching a 24-year high overnight after the minutes of the BoJ monetary policy meeting highlighted the dovish stance of the central bank, particularly next to the Fed which is turning increasingly hawkish. Today the yen is strengthening on safe-haven flows, as recession fears grow.

GBP/USD The pound is falling against the USD and the EUR despite UK inflation data showing that consumer prices rose to 9.1% YoY in May, up from 9% in April, the fastest price in prices in 40 years. The data clearly puts pressure on the BoE to continue hiking rates in order to tame inflation, at a time when the UK economy is running out of steam. What makes today’s data particularly grim is the knowledge that inflation is likely to continue rising. Producer prices (PPI) which measures inflation at the wholesale level rose a higher than expected 22.1%. Given that PPI is often considered a lead indicator for consumer prices, it is possible to conclude that the cost-of-living crisis is only going to deepen further and a recession seems almost impossible to avoid.

GBP/USD +0.18% at 1.2267

EUR/USD +0.47% at 1.0557

GBP/USD +0.18% at 1.2267

EUR/USD +0.47% at 1.0557

Oil tanks as recession fears rise

Oil prices are tumbling lower as recession fears build in the market. The commodities market appears to be calling a recession with expected demand destruction pulling the price sharply lower.

President Biden is expected to announce a temporary halt on federal gasoline tax at 18.4 cents a gallon.

Seven major oil companies will meet with Biden on Thursday as surging oil prices have become very political as the mid-term elections start drawing into view.

API inventory data is due later in the session, a day later than usual owing to the Monday public holiday.

WTI crude trades +0.8% at $109.56

Brent trades +0.8% at $113.22

Learn more about trading oil here.

Looking ahead

15:00 US existing home sales