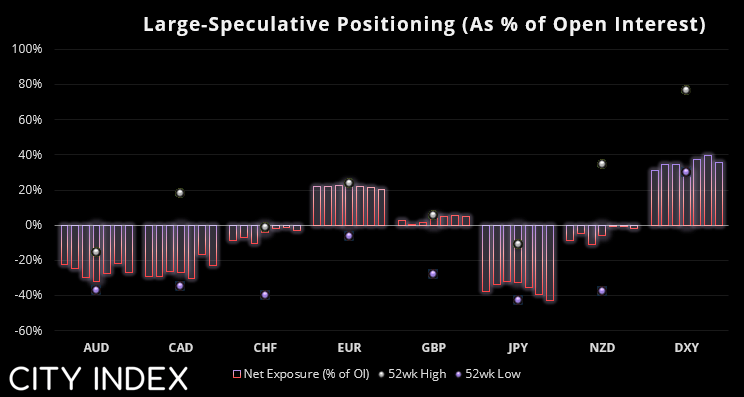

Commitment of traders (forex) as of Tuesday 6th June 2023:

- Large speculators trimmed their net-long exposure for a third week

- Net-short exposure to JPY futures rose to a 2-year high

- AUD futures traders trimmed -14.7k long contracts (-21%)

- Gross long exposure to CHF futures rose to a 40-week high (but large speculators remain slightly net-short at -1.3k contracts)

This content will only appear on City Index websites! Read our guide on how to interpret the weekly COT report

Commitment of traders (indices, bonds) as of Tuesday 6th June 2023:

- Net-short exposure to the 30-day Fed Fund Futures contract increased by 37% as traders bet on a more hawkish Fed

- Open interest to VIX futures rose to its highest level since March 2020

- Net-short exposure for the 2 and 10-year bond futures contracts pulled back from their record highs last week

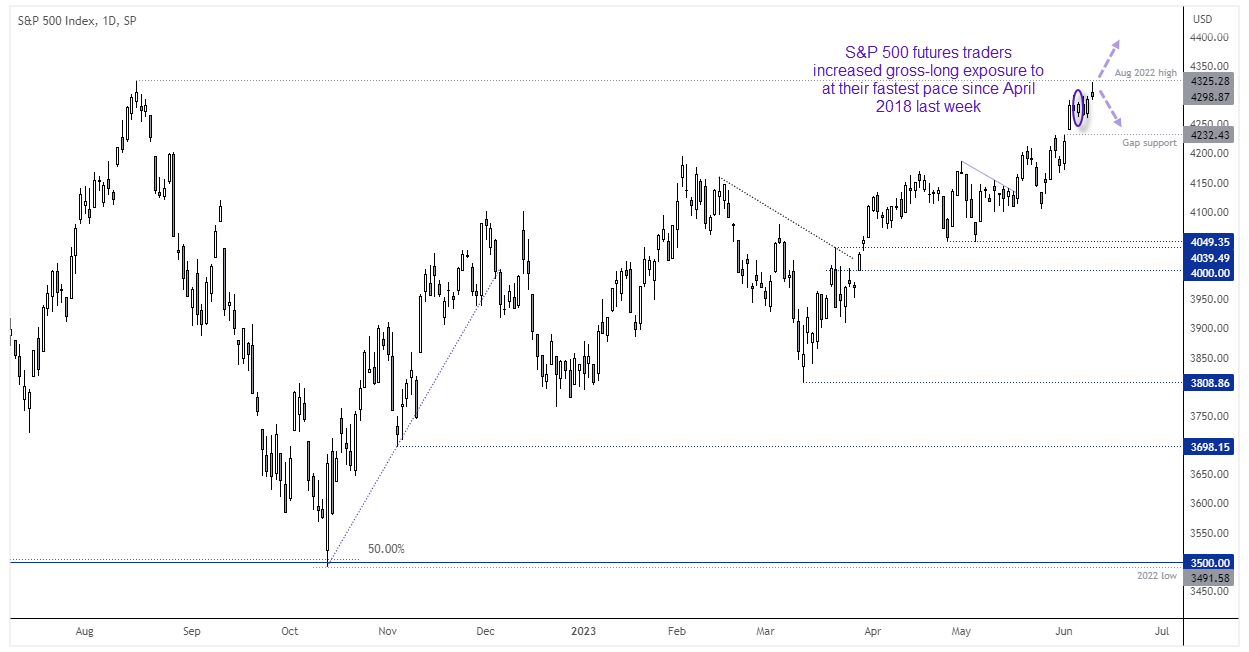

S&P 500 Commitment of traders:

We had noted the potential for a sentiment extreme on the S&P 500, given traders were fast approaching (an then eventually arrived at) their most net-short exposure on record. A sharp rise of gross longs saw net-short exposure fall at its fastest pace in 24 weeks and second fastest in 14 months. Interestingly, it has yet to trigger the short-covering rally we had anticipated, with only -18.8 gross shorts being trimmed relative to the 71.1k long contracts initiated, but the higher the S&P 500 traders the more pressure bearish speculators will be to cover, which in theory could send the futures prices higher.

S&P 500 daily chart:

So all eyes are on the S&P 500 cash index August high of 4325.28, to see if a bullish breakout triggers its next round of bullish initiation and short covering. A small bearish hammer formed on Friday just beneath resistance, so there does appear to be some hesitancy to break immediately higher, and that leaves the potential for a pullback towards 4323.43 on the cards, in an attempt to close the gap. But, as things stand, an eventual upside break is under consideration given that prices are trending higher yet the vast majority of large speculators are caught short.

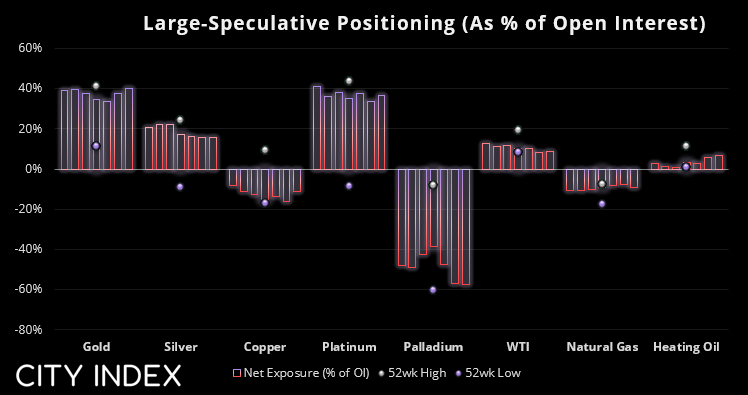

Commitment of traders (commodities) as of Tuesday 6th June 2023:

- Net-short exposure to copper futures fell by 9.8k contracts (-27.3%)

- Gross-short exposure to gold futures fell to a 2-year, 2-month low

- Large speculators reduced their gross-short exposure to platinum futures by -25.1%

- Large speculators were their most bearish on palladium futures in 8 weeks

Gold weekly chart:

Net-long exposure among large speculators rose by a mild 6.3k contracts last week, and that was mostly a function of short covering as only 161 gross longs were added compared to -6,164 shorts closed. And as we saw gold prices print a small bullish candle last week, perhaps there’s a case for an interim low (although this could be down to how hawkish or not the Fed’s meeting is this week). If the Fed surprise with a dovish hold, we suspect could break comfortably above $2000. Although a more likely outcome is for the Fed to hold and deliver a hawkish ‘warning’ to keep inflation expectations in check, but that could still be supportive of gold over the near term. A surprise hike could send gold to a new cycle low.

How to trade with City Index

You can easily trade with City Index by using these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade