EUR/USD extends gains ahead of ECB Lagarde’s speech

- EUR/USD adds to gains from last week

- Eurozone & US inflation data this week are a key focus

- EUR/USD tests resistance at the 200 SMA

After rising last week and snapping a 5-week losing streak, EUR/USD is heading higher again on Monday, capitalising on a weaker USD ahead of a busy week with a focus on inflation.

Eurozone inflation data will be released on Friday and is expected to show that CPI cooled to 2.5%, down from 2.8% in January. Yet despite inflation cooling further towards the ECB's 2% target and despite data showing an ongoing downturn in the eurozone economy, the ECB has been reluctant to talk about cutting interest rates, which has offered some support to the euro.

ECB president Christine Lagarde is due to speak today, and investors will be watching carefully for clues about when the central bank could start to cut rates.

Meanwhile, the US dollar is inching lower ahead of a busy week on the economic calendar, with US inflation data taking center stage.

The core PCE index, the Fed's preferred measure of inflation, is due on Thursday and is expected to show a 0.4% monthly increase but continue cooling annually. The data comes as Fed policymakers continue to push back on expectations of an early rate Fed cut and as both the market and the Federal Reserve point to the first rate cut in June.

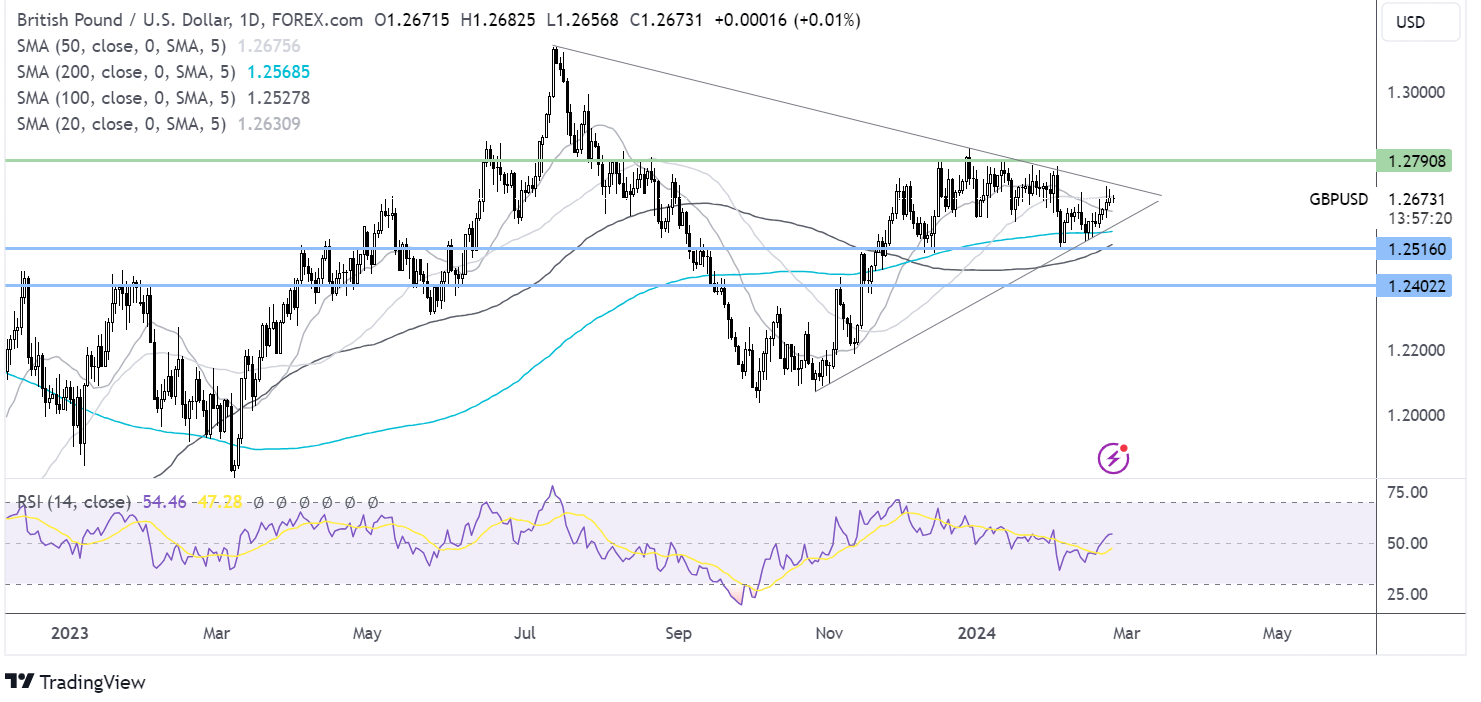

EUR/USD forecast – technical analysis

EUR/USD attempts to break out of the falling channel dating back to the start of the week but continues to struggle at the 200 SMA at 1.0825.

Buyers will need a close above this level to extend gains towards 1.09, last week’s high, before bringing 1.10 to the psychological level into focus.

Should the pair face rejection at the 200 SMA, support can be seen at 1.0786, the falling trendline, ahead of 1.0725, the February 6 low, and 1.07, the 2024 low.

GBP/USD holds steady, awaiting the next catalyst

- BoE chief economist Huw Pill is due to speak

- US New Home sales data is due

- GBP/USD trades in a symmetrical triangle

GBP/USD rose last week on USD softness, and after UK services, PMI came in stronger than expected, fuelling expectations that the recession in the UK will be short-lived.

While the UK economic calendar is quiet today, attention will be on Bank of England chief economist Huw Pill, who is due to speak and could provide some clues about when the central bank's future path for interest rates.

With inflation still sticky, at twice the Bank of England's target level, and with the service sector showing strength, the central bank is unlikely to rush to cut rates, keeping GBP supported against the USD.

Meanwhile, despite solid data and hawkish Fed chatter, the USD fell last week amid an upbeat market mood and safe haven outflows. This week, US inflation will be the main focus. Hotter-than-expected inflation could help the USD higher.

Today, new home sales data is due to be released. It comes after new home sales jumped in the previous month as mortgage rates slipped below 7%.

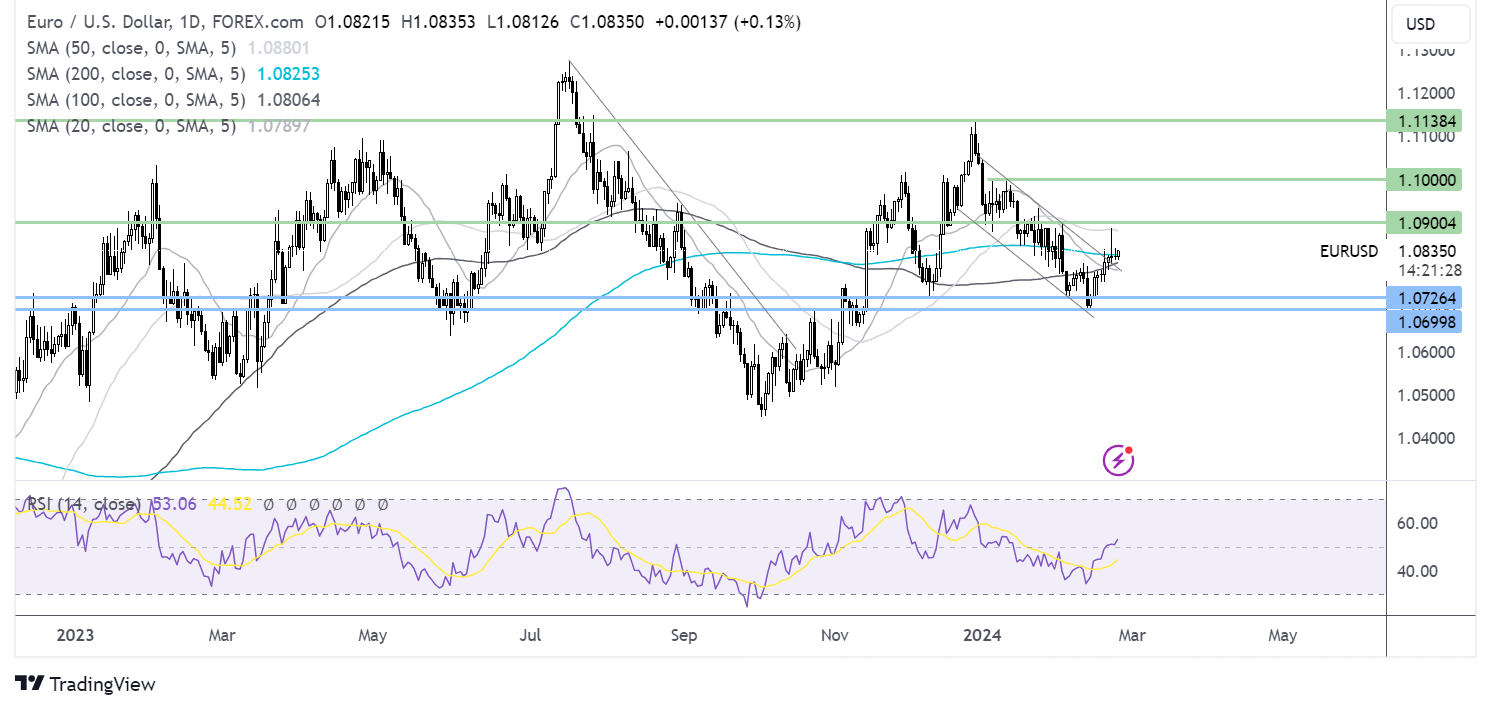

GBP/USD forecast – technical analysis

GBP/USD trades within a symmetrical triangle. The price rebounded off the 200 SMA and headed toward the falling trendline resistance.

Supported by the RSI over 50, buyers could look to break above 1.2720, the falling trendline resistance, bringing 1.2770, the February high, into play ahead of the 1.28 round number, and 1.2830, the December 2024 high.

On the flip side, strong support can be seen at 1.2570. the confluence of the 200 SMA and the rising trendline support. A break below here opens the door to 1.2520, the February low.