Asian Indices:

- Australia's ASX 200 index fell by -72.2 points (-1.02%) and currently trades at 7,038.60

- Japan's Nikkei 225 index has risen by -791.44 points (3.05%) and currently trades at 25,194.03

- Hong Kong's Hang Seng index has fallen by -750.94 points (-3.43%) and currently trades at 21,154.35

- China's A50 Index has fallen by -398.16 points (-2.76%) and currently trades at 14,019.08

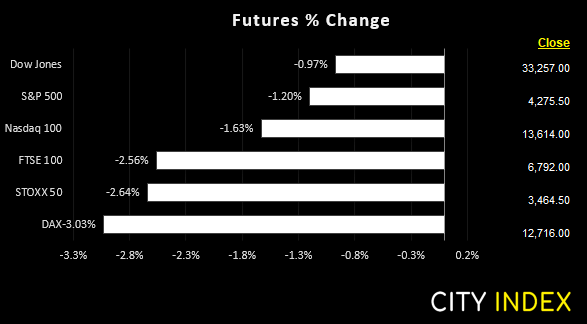

UK and Europe:

- UK's FTSE 100 futures are currently down -178.5 points (-2.56%), the cash market is currently estimated to open at 6,808.64

- Euro STOXX 50 futures are currently down -92.5 points (-2.6%), the cash market is currently estimated to open at 3,463.51

- Germany's DAX futures are currently down -390 points (-2.97%), the cash market is currently estimated to open at 12,704.54

US Futures:

- DJI futures are currently down -329 points (-0.98%)

- S&P 500 futures are currently down -224.75 points (-1.62%)

- Nasdaq 100 futures are currently down -51.5 points (-1.19%)

It’s been another volatile start to the week with the Ukraine crisis continuing to grip sentiment. But news that the US and Europe are seriously considering a ban of Russian oil imports is a development many had called for yet did not expect. The main concern is that it is another (big) step towards stagflation, just as central banks as expected to continue raising rates. It was another sea of red for Asian equity markets with the Hang Seng and Nikkei leading the way lower, declining -3.4% and -3.2% respectively. US future markets gap lower and are down around -1% to -1.5%, whilst European futures are currently down around -3%.

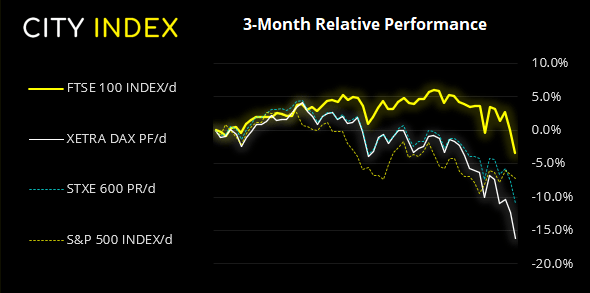

DAX gaps below 13,000

The DAX is the weakest performer looking at futures markets and fell to a 16-month low. It was down nearly -4% by the session low before recovering back above the monthly pivot. As market rarely trade in straight line we are open to the potential for a bounce from current levels, but would prefer to fade into rallies below 13,000. A break beneath 12,586 opens up a run down to 12,000, near the weekly S pivot. Whilst a break back above 13,000 would likely lead to a stronger rebound.

FTSE 350: Market Internals

FTSE 350: 3911.57 (-3.48%) 04 March 2022

- 29 (8.26%) stocks advanced and 319 (90.88%) declined

- 1 stocks rose to a new 52-week high, 104 fell to new lows

- 15.67% of stocks closed above their 200-day average

- 9.4% of stocks closed above their 50-day average

- 11.97% of stocks closed above their 20-day average

Outperformers:

- + 12.99% - EVRAZ plc (EVRE.L)

- + 12.30% - Morgan Advanced Materials PLC (MGAMM.L)

- + 8.61% - Fresnillo PLC (FRES.L)

Underperformers:

- ·-17.19% - Ferrexpo PLC (FXPO.L)

- ·-16.17% - Auction Technology Group PLC (ATG.L)

- ·-13.98% - TBC Bank Group PLC (TBCG.L)

WTI and gold close in on record highs

That’s not a headline you see too often. News that the West are considering a ban of Russian oil imports saw WTI rally over 10% overnight, and gold tapped $2000. Yet gold didn’t have around there for long and has pulled back to 1988, but with momentum on its side and trading just -4% from its record high, all of a sudden a break to a new record high seems feasible without a positive headline coming out of Ukraine. One potential scenario that would likely revere moves seen overnight is for the West to not embargo Russian oil. WTI rose to its highest level since July 2008 and is also quite close to its record high.

Currencies avoid risk-off flows

The usually flight to safety did not see any noteworthy moves into the yen. In fact, AUD and NZD are the strongest major as they track key commodity prices higher, a move that is not typical alongside weak sentiment. AUD/JPY printed another YTD high and is around two thirds the way to our 86.20 target near the 2021 high. AUD/USD also rose above 74c for the first time in three months.

The ruble fell to a new record low on reports the US is seriously considering an embargo on Russia’s oil and natural gas. US Secretary of State Antony Blinken has had “very active” discussions with Europe over the weekend on the matter, and is a scenario many thought would not be on the table. It’s a move that could land a crippling blow to Russia’s economy as rising oil prices simply soften the blow of sanctions already in place. Ultimately, this will hit Russia where it really hurts as higher oil prices have softened the blow of sanctions already in place.

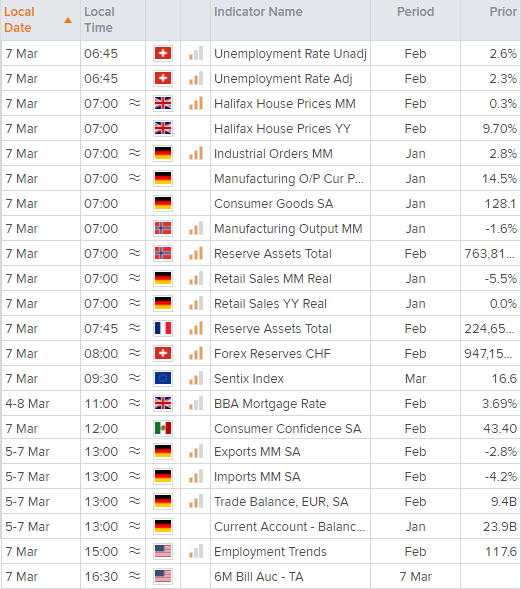

Up Next (Times in GMT)

How to trade with City Index

You can easily trade with City Index by using these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade