The US dollar was coming under a bit of pressure in the first half of Friday’s session, but after Thursday’s sharp rally it remained to be seen if the selling had any real momentum behind it. The Fed’s favorite inflation measure – core PCE – came in a touch softer but this was offset by a stronger-than-expected personal spending data. Investors were looking forward to another very busy week for macro data and central banks.

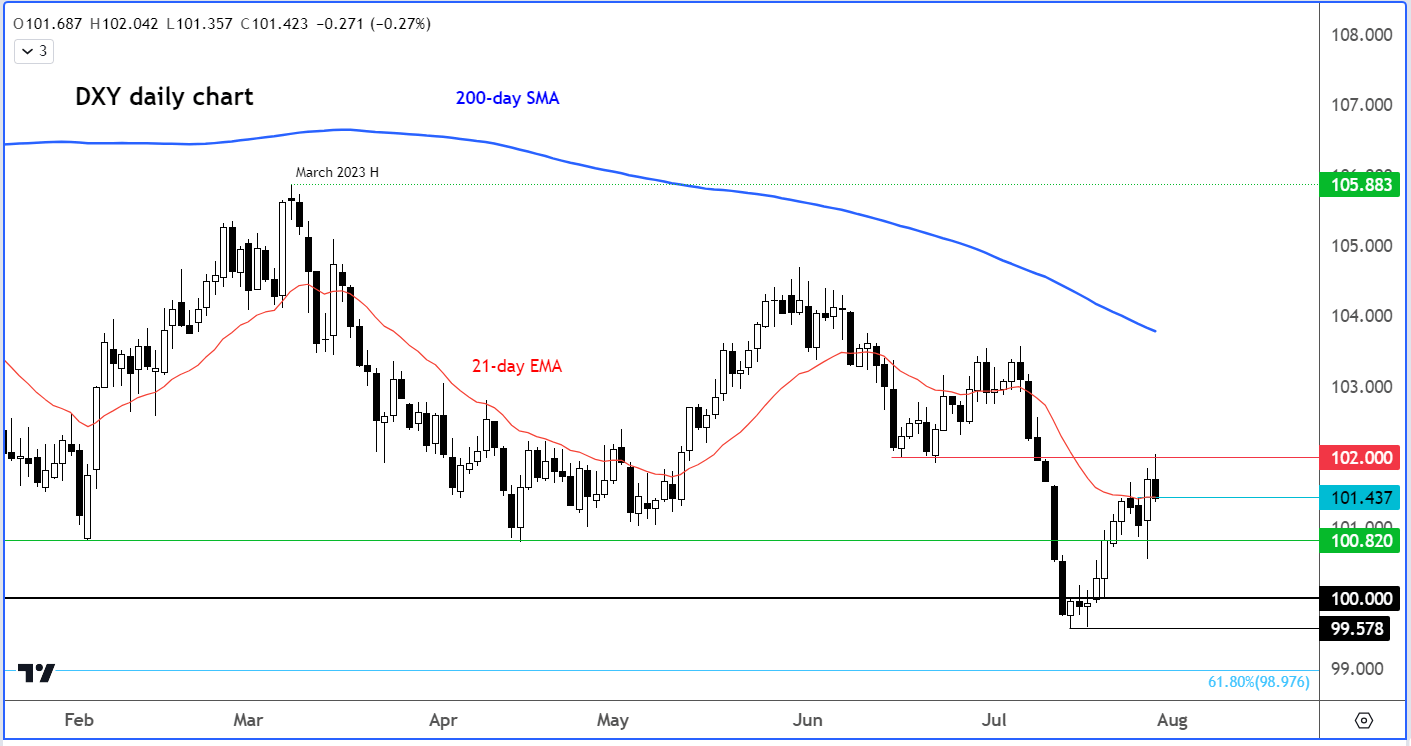

Dollar analysis: Dollar Index hits resistance

There’s about 2 months until the Fed meets again, which means a lot can change in the interim in terms of data. Inflation is obviously in focus. But the Fed will also keep an eye on other macro indicators in determining whether to hike further. Later in the day, we will have the UoM consumer surveys and next week the focus will be on the ISM manufacturing data (given the weakness we have seen in the sector) ahead of the official jobs report on Friday.

Earlier today personal income printed +0.3% vs. +0.5% expected, while personal spending was up 0.5%, more than 0.4% expected. Meanwhile the PCE Core Deflator came in at 4.1% y/y/ vs. 4.2% expected.

The latest data comes after the US dollar strengthened on Thursday, following a dovish ECB meeting and upbeat macroeconomic data from the world’s largest economy, with GDP expanding 2.4% in the second quarter, more than 1.8% expected. We also had better-than-expected Jobless claims data.

The University of Michigan’s Consumer Confidence will also be in focus and is expected to improve to 72.6 from 64.4.

In the first half of Friday’s session, the Dollar Index had started to retreat again thanks to the rebound in the EUR/USD and the earlier weakness in USD/JPY as a result of the Bank of Japan’s policy tweak overnight – the central bank has effectively widened the yield curve control band by saying its 0.5% ceiling was now a reference point, not a rigid limit as it wanted to make its ultra-loose policy more flexible.

The dollar index found resistance at 102.00, a level that was previously support. The bulls will want to reclaim this level to further erode the dollar’s overall bearish bias. Support around 101.40ish was being tested at the time of writing.

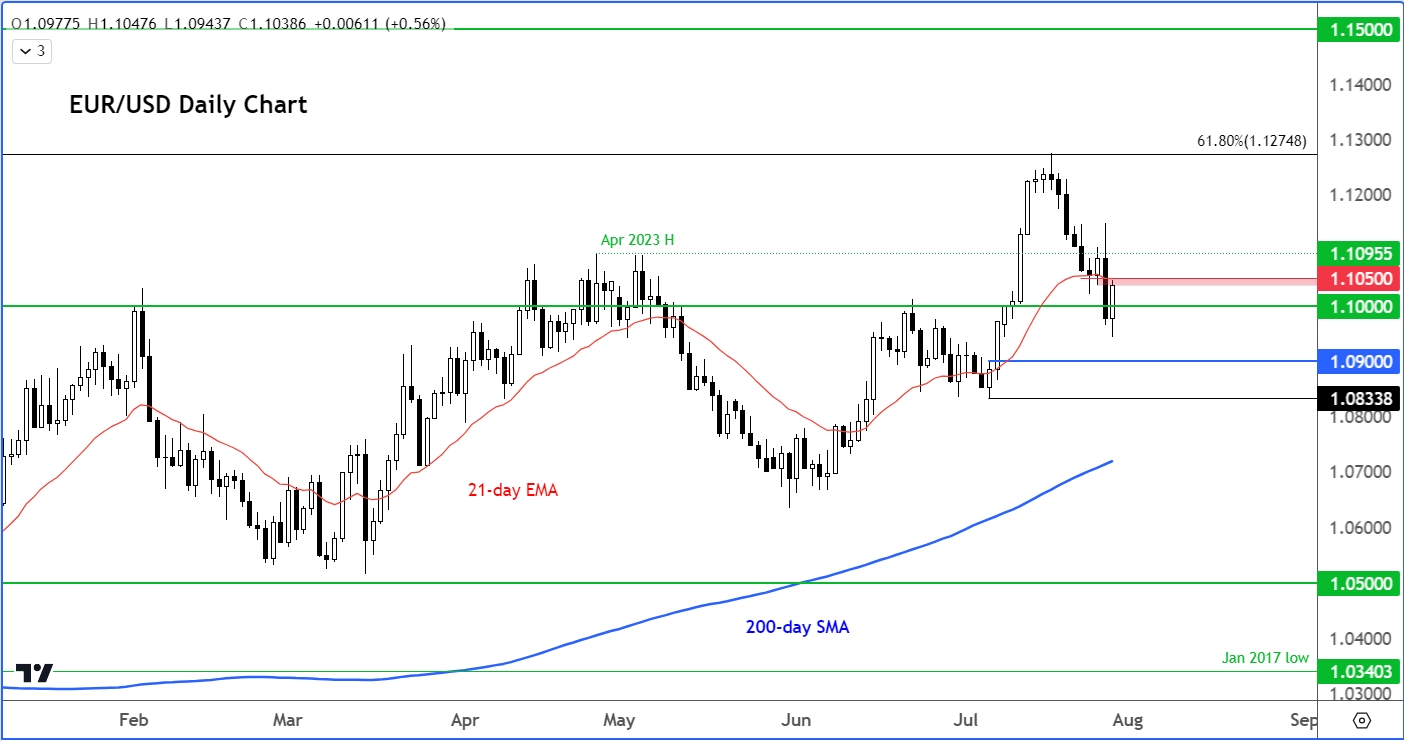

EUR/USD rebounds to test key level after a busy week

Along with the other dollar pairs, the EUR/USD had bounced back in the first half of Friday’s session. But this popular trading pair was testing a key resistance area, around 1.1020 to 1.1050 area (old support):

After Thursday’s sell-off, the onus was now on the bulls to show up as they have failed to defend some key levels earlier this week. Unless we go back above Thursday’s high now, to suggest the selling was a big trap for the bears, the path of least resistance remains to the downside.

The single currency fell sharply on Thursday after the ECB signalled that a pause in interest rate hikes could come as soon as September, which took the markets by a bit of surprise. The drop in the EUR/USD was aided further by strength in US data suggesting that the world’s largest economy was still holding its own relatively well, requiring monetary policy there to remain restrictive for longer.

German CPI for July was expected to cool to 6.2% YoY, down from 6.4%. And it came in bang in line with the expectations. With price pressures cooling, this could fuel bets that the ECB won’t hike in September.

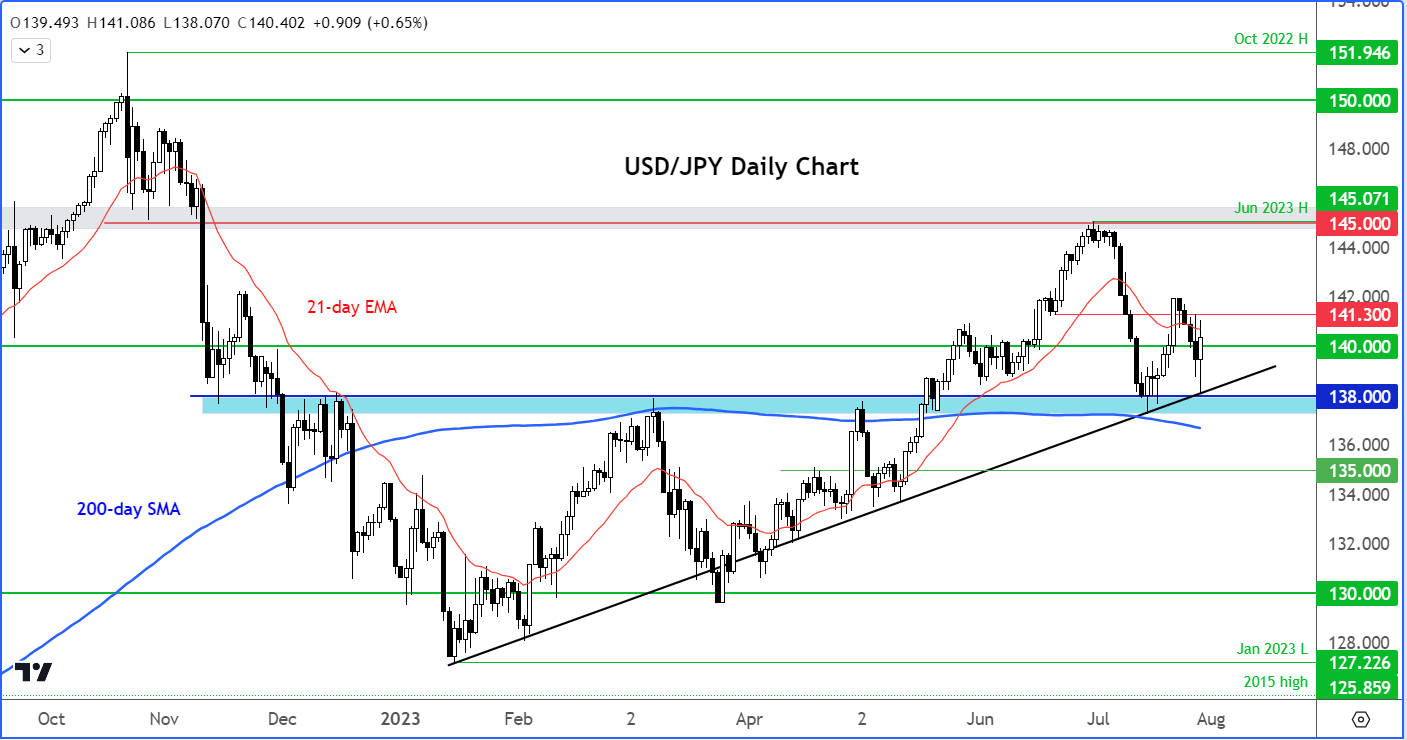

USD/JPY analysis: bulls defend 138 again despite BoJ policy tweak

Overnight saw the Bank of Japan make its yield curve control policy more flexible, in a move that may precede a shift away from its ultra-loose monetary policy. The BoJ has effectively widened the yield curve control band by saying its 0.5% ceiling was now a reference point, not a rigid limit as it wanted to make its ultra-loose policy more flexible.

This has caused the USD/JPY to drop sharply in the last couple of days, although we didn’t see any further significant follow through as the news was leaked on Thursday.

The key level that needs to be watched on the downside is still at 138.00, a major support zone, where we also have the bullish trend line coming into play. Given the importance of the 138.00 level, if it now breaks then this could lead to follow-up technical selling for days to come.

Meanwhile the bulls will want to reclaim 140.00 to keep the long-term bullish trend intact.

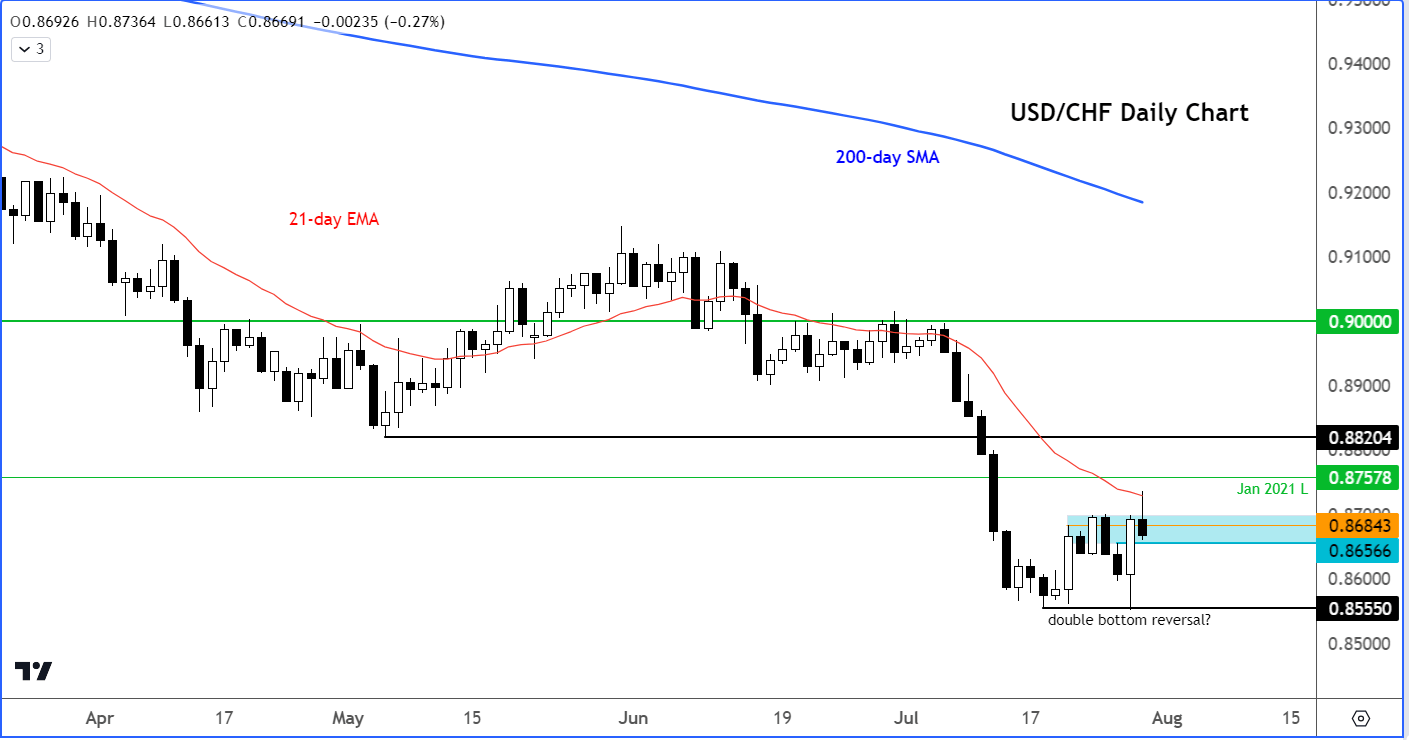

USD/CHF technical analysis: double bottom?

The USD/CHF was off its earlier highs, but it may have nonetheless created at least a short-term bottom after turning positive on the week on the back of Thursday’s USD rally. The USD/CHF has potentially formed a double bottom at 0.8555. Keep an eye on the support zone around 0.8655-0.8685 area that was being tested at the time of writing. We will need to see whether it can hold the bullish momentum, so what happens here is quite important from a technical point of view.

Looking ahead to next week

Looking ahead to next week, it is another busy one for the economic calendar. Among the key events, we will have policy decisions from the Reserve Bank of Australia and Bank of England, as well as key US data including the ISM manufacturing PMI and NFP jobs report.

RBA policy decision

Tuesday, August 1

05:30 BST

Softer inflation data from Australia last week saw the odds of another rate increase drop to less than 15%, meaning that if the RBA were to surprise the markets (again), this could send the AUD sharply higher. However, the impact of the past rate hikes is starting to take effect – with the latest Aussie retail sales data showing a surprise 0.8% monthly fall.

BOE policy decision

Thursday, August 3

12:00 BST

UK inflation came in weaker-than-expected last week, with CPI easing to 7.9% from 8.7% previous, core CPI falling to 6.9% and other measures of inflation also declining across the board. Therefore, market chatter of a possible 50 basis point rate hike has been scaled back. Nonetheless, a 25-bps hike to 5.25% is fully priced in, with markets expecting a further 2 rate hikes before year-end. But policy is now very restrictive, so will the BoE now signal a pause?

US non-farm payrolls report

Friday, August 4

13:30 BST

Fed Chair Powell made it quite clear that US monetary policy was now restrict enough and that the next policy decision in September would be entirely data dependent. Until then, we will have two more inflation and a couple of jobs reports to consider. While the focus is clearly on inflation as employment is still very strong, any potential weakness in jobs data could cement expectations of a policy hold. But another surprising strong employment report would keep the threat of further Fed hikes alive.

Source for all charts used in this article: TradingView.com

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade