- US dollar analysis: Focus turns to sticky inflation and elevated interest rates narrative

- Markets regain poise – for now – as Iran downplays impact of Israel strikes

- EUR/USD and USD/JPY analysis: Global PMIs and BoJ policy among other risk events next week

Markets regain poise – for now – as Iran downplays impact of Israel strikes

The sudden drop in risk assets overnight to reports Israel had struck targets in western Iran, and the corresponding rally in gold and crude oil, goes to show how sensitive the market remains to the situation in the Middle East. The indices managed to regain their poise, with gold and crude also trading back to Thursday’s closing levels by mid-morning London session, as investors seemed to downplay the impact of what apparently was a small-scale Israeli strike, after the initial panic overnight. The US dollar, which fell against haven currencies likes the Japanese yen and Swiss franc, was bouncing back. Against the more risk-sensitive commodity dollars, it was weakening a little.

While I am no expert in this matter, judging by market’s reaction suggests investors think that due to the small scale of the attacks and the fact there has been very limited and ambiguous information about the events, and not to mention the absence of official statements, it is likely that both parties may now feel there is a restoration of deterrence. So, hopefully, an open conflict can be averted. That being said, nothing can be taken for granted. The markets may remain on the edge, especially considering the looming weekend risk. It was only last Saturday that Iran attacked Israel.

US dollar analysis: Focus turns to sticky inflation and elevated interest rates narrative

Investors’ focus will now turn back to the other, potentially bigger, worry: Sticky inflation and elevated interest rates for longer in the US. The dollar is likely to remain supported on the dips, which should apply downward pressure on the likes of the EUR/USD and even gold, after the precious metal’s big rally despite the upsurge in bond yields.

Federal Reserve Chairman Jerome Powell has cautioned that a robust US economy might justify keeping rates at their current levels for an extended period as necessary, emphasising that inflation had exhibited a "lack of progress" towards their objectives. This puts next week’s Core PCE inflation data into a sharp focus.

US dollar analysis: PCE inflation could determine short-term direction for USD

Inflation data continues to be a focal point for traders due to its potential influence on the Fed’s monetary policy. Next Friday will see the release of the Fed's preferred inflation gauge – the Core PCE Price Index, which is potentially the week’s most important macro highlight. After a strong US CPI print, the dollar has been pushing higher, especially considering that both US interest rates and those of other major economies, such as the ECB and the Bank of Canada, have recently taken a more favourable turn for the greenback. Additionally, the escalation of geopolitical risks in the Middle East has only added to the US dollar’s overall bullish tone. If Core PCE also turns out to be stronger, then this could keep the dollar supported and potentially undermine risk assets.

However, with markets gradually scaling back expectations of multiple Fed rate cuts to a couple or even possibly none for the remainder of the year, one has to wonder about the true impact of next Friday’s PCE inflation data on the markets

A significant market reaction to any data release hinges on an element of surprise, whether positive or negative. Yet, considering that PCE inflation data tends to be less volatile than headline CPI figures, coupled with market expectations aligning towards minimal rate cuts, a bullish surprise may not have as much an impact as a downside surprise. A potentially weaker reading will give the dollar longs the perfect excuse to exit their trades.

But until the release of the PCE data, the bullish dollar narrative is unlikely to change significantly, which means the dollar should remain supported for a few more days yet.

EUR/USD and USD/JPY analysis: global PMIs and BoJ policy among other risk events next week

The global PMI data will be released on Tuesday, with a particular focus on the European ones. The prospect of higher interest rates for longer from the likes of the US and UK have raised concerns that the global economy could be heading for a downturn. These concerns could intensify should we see continued weakness in global PMI data on Tuesday. The manufacturing PMIs across Europe have remained weak for months, albeit the pace of the contraction has slowed. Unless we see further improvement, then this could further hurt market sentiment, which has taken a hit already by factors such as elevated geopolitical risks and a hawkish Fed.

Meanwhile, the US dollar index could find further support if the Japanese yen continues selling off. The focus is turning to the Bank of Japan’s policy decision next Friday. The Japanese government has been quite vocal about the ongoing depreciation of the yen, after traders continued to favour the higher-yielding foreign currencies over JPY despite the BoJ’s first rate hike in March in 17 years. While the Policy Rate went back above zero for the first time in 8 years, this failed to slow the yen’s decline. Traders wanted a stronger commitment from the BoJ towards further policy tightening. But no further tightening is expected at this meeting, with investors pricing in less than a 50% chance of a 10bp hike by July, according to Bloomberg. This is something the BoJ will need to address, otherwise the only other solution to support the yen is through FX intervention, which is becoming increasingly likely.

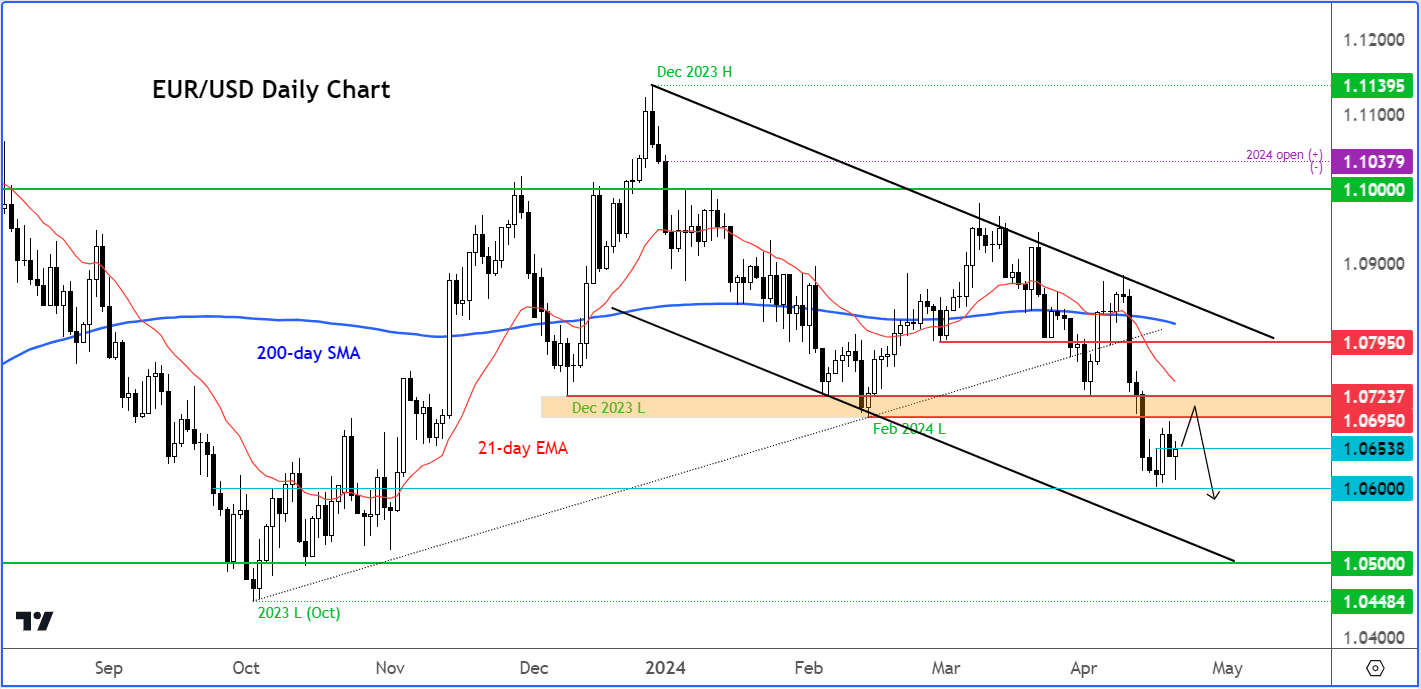

US dollar analysis: EUR/USD technical levels to watch

The EUR/USD remains inside a bearish channel and below all the key moving averages as you can see on the chart. The path of least resistance is therefore to the downside. Key resistance is now seen between 1.0695 to 1.0725 area (shaded in orange on the chart). Potential support comes in at 1.0600 followed by the bottom of the channel around 1.0500 area.

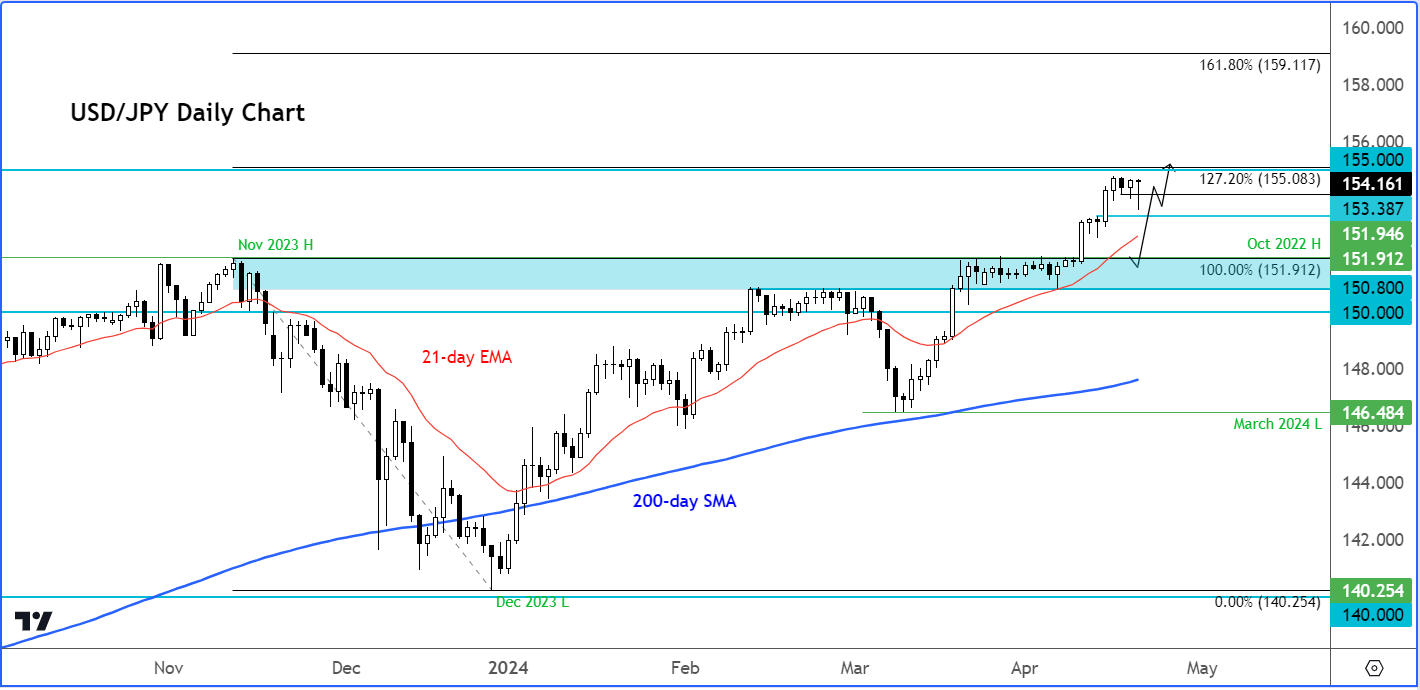

US dollar analysis: USD/JPY technical analysis point higher

The USD/JPY's rebound from its lows overnight suggests that a potential hammer candle is forming on the daily chart. If the price manages to close near current levels, approximately around 154.50, it could indicate a possible continuation towards, and potentially beyond, the 155.00 mark, where intervention by the Japanese government might occur. Support levels are seen around 154.00, followed by approximately 153.35. Long-term support resides in the range of 151.90 to 152.00, a zone that previously served as significant resistance in October 2022 and November 2023, with lesser resistance observed in late March and early April of this year.

US dollar analysis video

Source for all charts used in this article: TradingView.com

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade