Our crude oil outlook is bullish heading into a new quarter.

After last month’s 10% decline, both crude oil contracts are set to end June with modest gains. By Friday afternoon, they were up around 4% on the month, after recovering along with other risk assets in the second half of the week. It looks like investor concerns about demand have been reduced, despite the prospects of even higher interest rates in the US, UK and Eurozone.

Supporting crude oil at these levels is no doubt due largely to the OPEC+ deal and voluntary cuts made by several members to support the market, including Saudi. The cuts mean supply could tighten significantly if members comply.

Meanwhile, we have also seen sharp falls in US crude oil stocks while in China, the refinery throughput jumped more than 15% in May YoY, its second-highest level on record. With China also cutting interest rates again, this has alleviated concerns about demand from the top oil importer in the world.

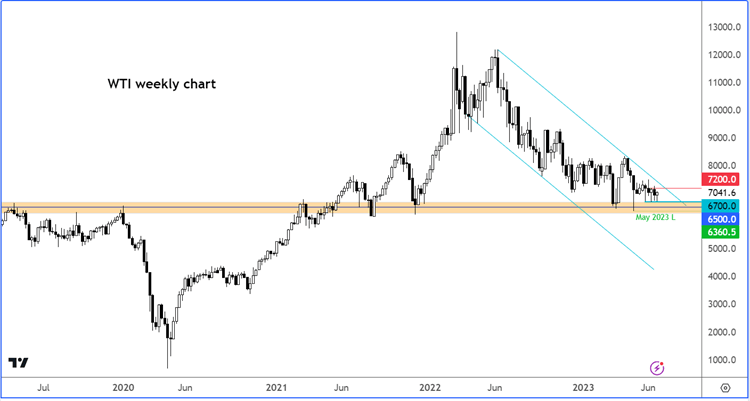

Crude oil outlook: Technical analysis

WTI crude oil is trying to form a base and move north of the $70 level, having successfully defended the $65 long-term support zone. As the weekly chart shows, WTI has been finding support on the dips to $67.00 in the last several weeks, as oil prices traded inside a narrow range. But the inability of the bears to push oil lower means we may have already seen the low on oil prices. A potential rally above the resistance trend of the long-term bear channel would confirm the reversal. Short-term resistance is seen around $72.00. Break that and $75.00 and then $80.00 will be the next logical targets for the bulls to aim for.

In short, the crude oil outlook remains positive after much of the selling pressure was absorbed successfully in June.

Source: TradingView.com

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade