Corn at 7-year highs. Will it continue?

The July Corn contract made new highs (again) today, above 7.20. Soybeans are a stone-throw away from the April 27th highs of 15.74 per bushel. The same can be said for Wheat, which is nearing its April highs at 7.69 per bushel. Commodity prices have been rising across the board, from all-time highs in lumber to all-time highs in copper and iron ore.

What are Commodity market hours?

However, the rise in corn is notable for quite a few reasons, which suggest the grain may have more room to go on the upside:

- With the reopening of economies after the coronavirus, demand in general is high.

- Due to lack of rainfall in Brazil, coupled with lows corn stock, supply is lower and can’t keep up with demand

- China (1): Because of the deterioration of the hog herd last season due to the swine flu, China is trying to rebuild the herd. This is resulting in extra demand.

- China (2): Though China cancelled 5.5 million bushels of corn from the US, Joe Biden stated that he wants to get China back to the table to review how they are doing regarding “Phase One” of the trade deal agreed to under the Trump Administration.

- Although the Federal Reserve claims that the current inflation is “transitory”, inflation is here at this moment (and may be here to stay)

- With the US Dollar continuing to move lower, it makes commodities cheaper to buy for other countries.

What do the technical say?

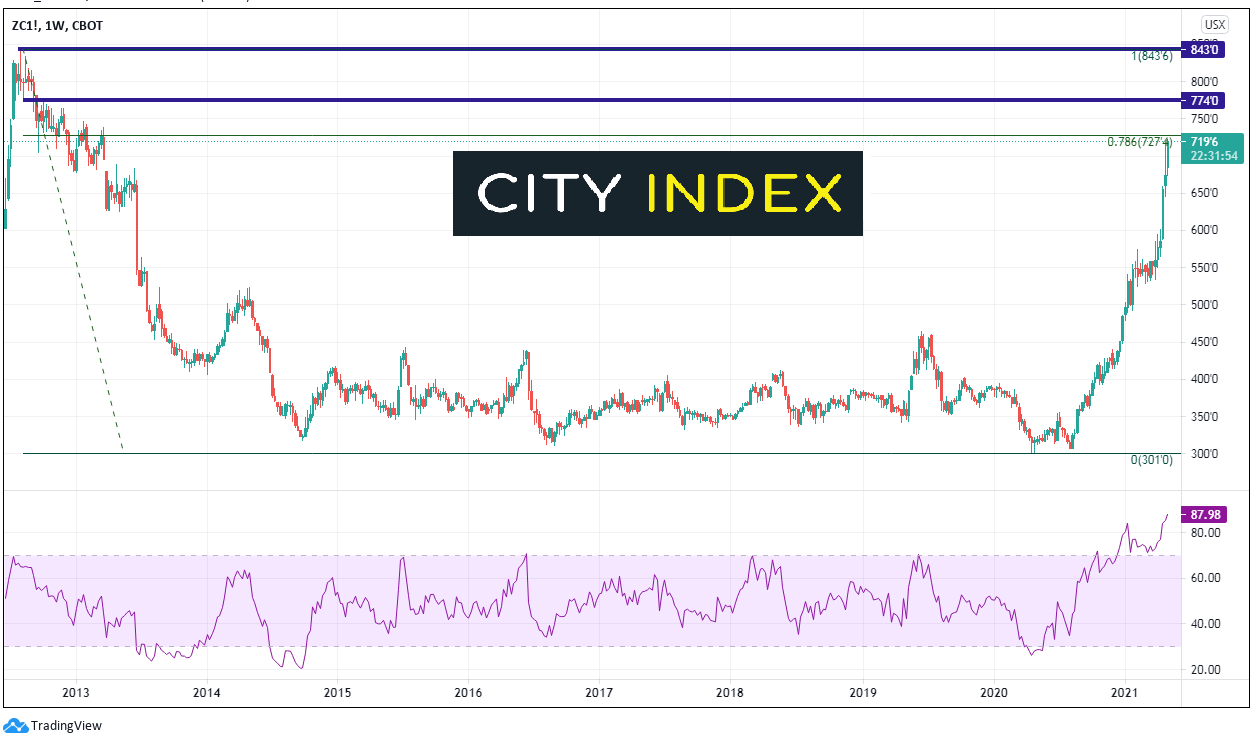

On a weekly timeframe, it’s easy to see that Corn has been on fire since last summer 2020, rising from 3.01 to near 7.20. However, there is resistance just above at the 78.6% Fibonacci retracement level from the August 2012 highs to the April 2020 lows, near 7.28. Above there is horizontal resistance from the lows of August 2012 near 7.74, then the highs of August 2012, near 8.43.

Source: Tradingview, City Index

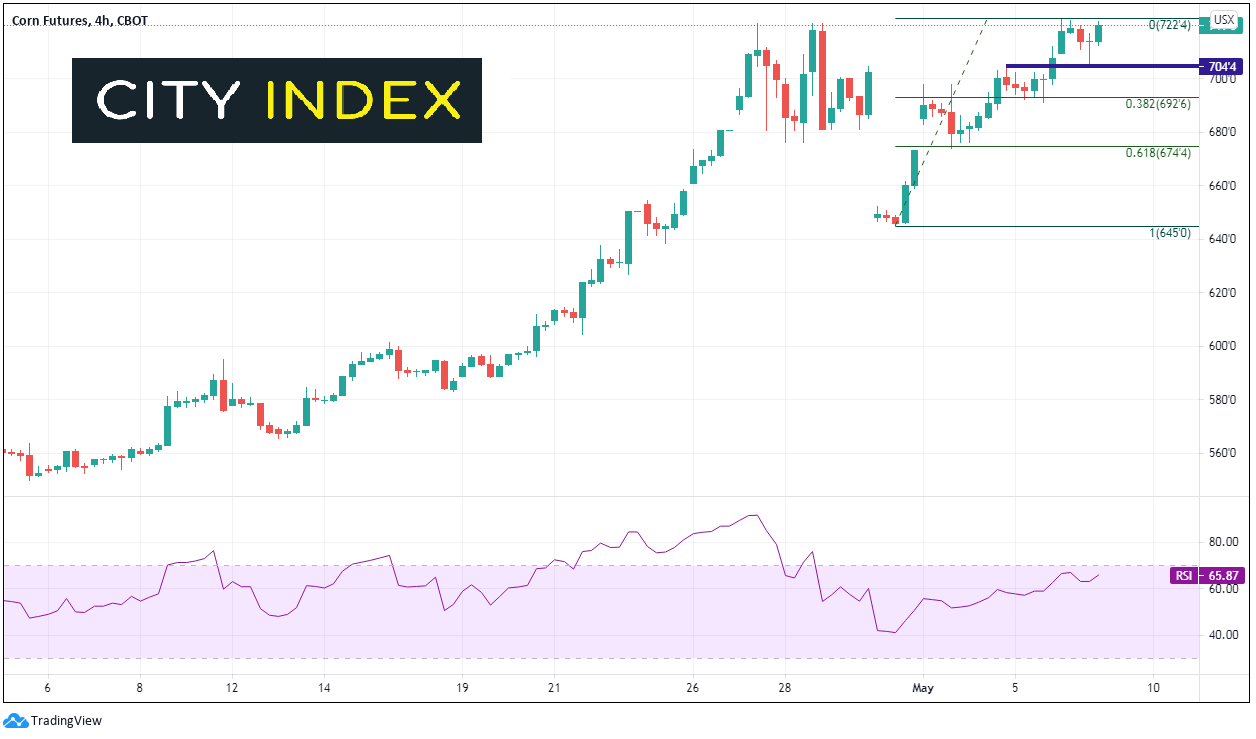

However, note that on the weekly timeframe the RSI is near 88, which is considered extremely overbought. Therefore, with the near-term Fibonacci level above and the overbought RSI, it is quite possible that corn prices may pull back. On a 4-hour timeframe, the July contract put in a low of 6.45 on April 30th and put in all-time highs today near 7.20. Horizontal support is below near 7.04, and then the 38.2% Fibonacci retracement from the April 30th lows to the May 6th highs near 6.97. Below there is the 61.8% Fibonacci retracement from the same timeframe a gap-fill near 6.74.

Source: Tradingview, City Index

Corn prices appear as if bulls may try to push them higher, given both the fundamentals and technicals. However, don’t be surprised if it pulls back first given the overbought conditions on the weekly timeframe.

Learn more about commodity trading opportunities.