So, it is all about US CPI today, and investors are clearly expecting another downside surprise as they keep buying risk assets. Investor sentiment remains largely positive thanks to optimism about China re-opening and hopes that inflation has peaked. Will the markets get another shot in the arm by a weaker CPI print today, or get a reality check today?

For now, things are looking rosy in the markets with cryptos finally breaking higher. Bitcoin has risen well above $18K for first time since mid-December. Ether has risen to $1.4K and its best level since early November, testing its 200-day average there.

The crypto recovery comes as investors have been selling the dollar and piling into Asian and European equities in particular. The ongoing optimism has lifted FTSE at highest level since Aug 2018, as European indices continue to outperform their US counterparts.

US CPI expected to fall again

Crypto traders and literally everyone else will be paying close attention to today’s publication of US CPI. Expectations are for consumer prices to have continued cooling in December. The annual rate is seen falling to 6.5% YoY, down from 7.1% in November. Core inflation is also expected to edge lower to 5.7% from 6.1%.

If inflation comes in around those expected levels, or, better still, weaker, then this should send cryptos higher, I’d imagine, as cooling inflation would bolster dovish Fed expectations. The last couple of softer CPI (and PPI) reports were the reason stocks rallied and the dollar dropped. Are we going to see another such scenario?

Conversely, a stronger CPI report would pour cold water on a dovish Fed tilt, which may cause a bullish reversal on the dollar. In this scenario, everything denominated in USD could suffer, including gold, silver and Bitcoin. That’s not to say these markets will top out, but a stronger inflation report could nonetheless create some short-term weakness for all asset prices.

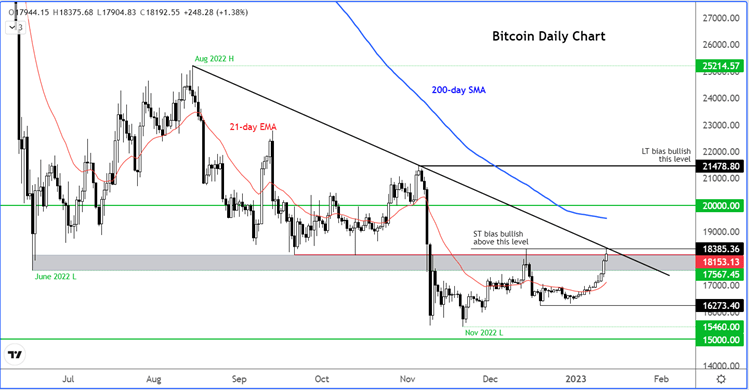

Technical analysis on Bitcoin

From a technical point of view, Bitcoin has been eroding its bearish price action thanks to its recent consolidation and a bit of upside momentum in recent days. It will now need to create and a higher high and hold above its mid-December high of $18385 to confirm the short-term bullish bias. If this happens, the bearish trend line that has been in place since August will break, further supporting the bullish technical view. The bulls will then eye the $20K handle as their next objective.

But if Bitcoin fails to do that – regardless of how weak or otherwise today’s CPI is going to be – then traders will need to be extra cautious.

Meanwhile, the next level of potential support comes in around $18K, which happens to be Wednesday’s high too. Below that, $17.5K is the next obvious support.

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade