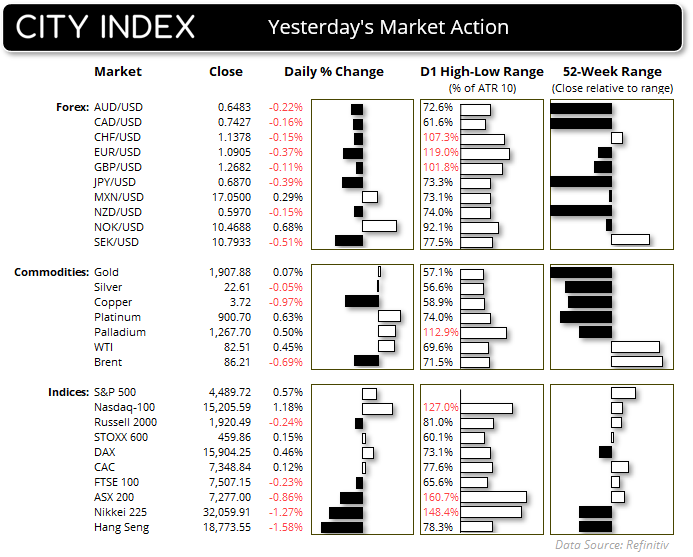

Market Summary:

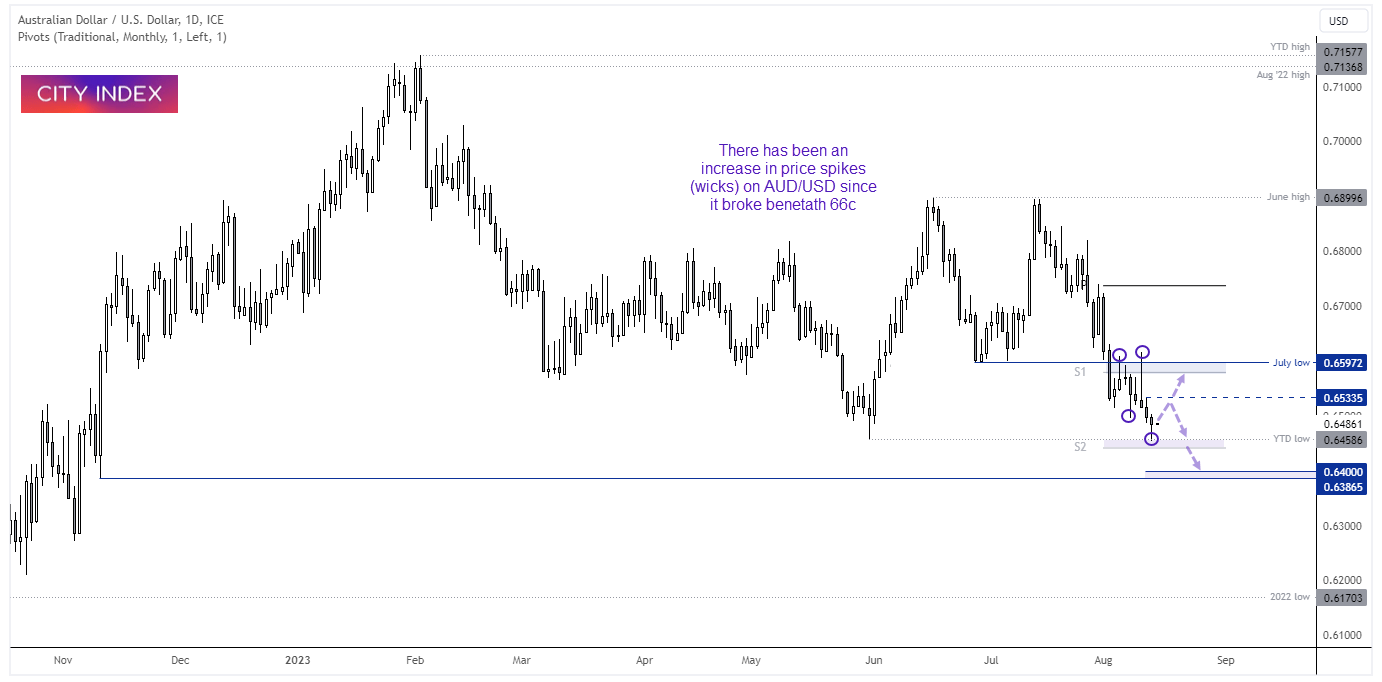

- Weak loan data from China over the weekend left its mark on global markets Monday, weighing heavily on Asian indices and sending AUD/USD briefly to a fresh YTD low

- Traders continued to test the BOJ (Bank of Japan) and MOF (Ministry of Finance) by sending USD/JPY above 145 – a level which was accompanied by verbal intervention in June and a -5.4% decline. Yet with no stern words from officials yet to arrive, USD/JPY now trades at its highest level since November.

- Bets that interest rate will remain above inflation in the future saw US bond yields continue to rise across the board. The US 2-year yield is now trading just below 5%, the 10-year reaching a 14-year high and TIPS (inflation protected yields on 10-year treasury debt) reached its highest level since 2009.

- This saw demand for US dollar remain in place, with the US dollar index (DXY) reaching a 1-month high, before pausing just beneath the July high. In all likelihood, this has allowed AUD/USD and gold to remain above key support levels.

- A stronger US dollar and higher yields saw gold fall to a 6-week low, and now less that a day’s trade away from 1900 – a key level of support for gold bugs to defend.

- Even WTI crude oil – which has increased over 25% in just 30 trading days – struggled to maintain its bullish momentum, pulling back to a 4-day low but remaining within its bullish channel on the 4-hour chart.

Events in focus (AEDT):

- 09:50 – Japan’s Q2 GDP

- 11:30 – Australian wage price index (WPI) for Q2, RBA minutes: I’m not overly convinced we’ll glean much new from the RBA minutes that we haven’t already from Lowe’s recent comments or their last statement. Wages would also have to come in much higher than expected to cause a stir, so perhaps the best bet for a decent outcome is for a softer-than-expected wage set (which could weigh on AUD/USD).

- 12:00 – China’s retail sales, industrial production, fixed-asset investments will be a key focus given the impact weak loan data had on markets yesterday. If retail sales disappoints it is yet more evidence that the government are not getting the demand-driven growth they desire, and likely results in yet more calls for stimulus.

- 14:30 – Japan’s industrial production, capacity utilisation

- 16:00 – UK earnings and employment data could be seen as a proxy for tomorrow’s inflation data (which is in turn a proxy for BOE’s level of hawkishness). Wages need to stop rising to justify a terminal BOE rate below 6%.

- 22:30 – US retail sales

Technically Speaking:

- AUD/JPY saw a break of Friday’s low before reversing high and closing with a bullish hammer day. If there’s any indication it was not a true risk-off day, it is here on AUD/JPY. Should it continue higher and Asian indices hold support levels, the case builds for a leg higher with risk sentient.

- USD/CNH briefly traded to its highest level since November yesterday, and with no immediate signs of a top and the potential for the PBOC to keep lowering the yuan fix, a move above 7.30 seems plausible this week as it head back towards the 2022 highs.

- The Hang Seng held above the July 24 low yesterday, and we also have the July low and 18k handle nearby as potential support levels (which means reward to risk for bears is limited over the near-term).

- The China A50 is a market worth keeping an eye on to gauge appetite for risk across Asia. Whilst it traded lower yesterday, volatility was lower than Friday and it is showing at least some appetite in holding above 12,600. As I tweeted yesterday, will 12,600 become the new 12,400? It could do if the plunge protection team is rumoured to be at work or more stimulus is announced.

- WTI crude oil remains within its 4-hour bullish channel, but its lower trendline is being challenged more frequently as the trend matures, and with the US dollar index near resistance and volatility increasing, I’m on guard for a near-term change in trend. This could serve as more of a warning for bulls than an outright bearish take though, given its defiance of late.

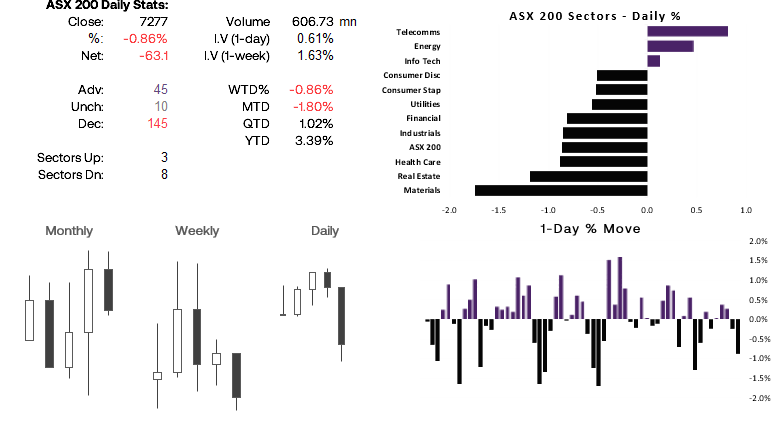

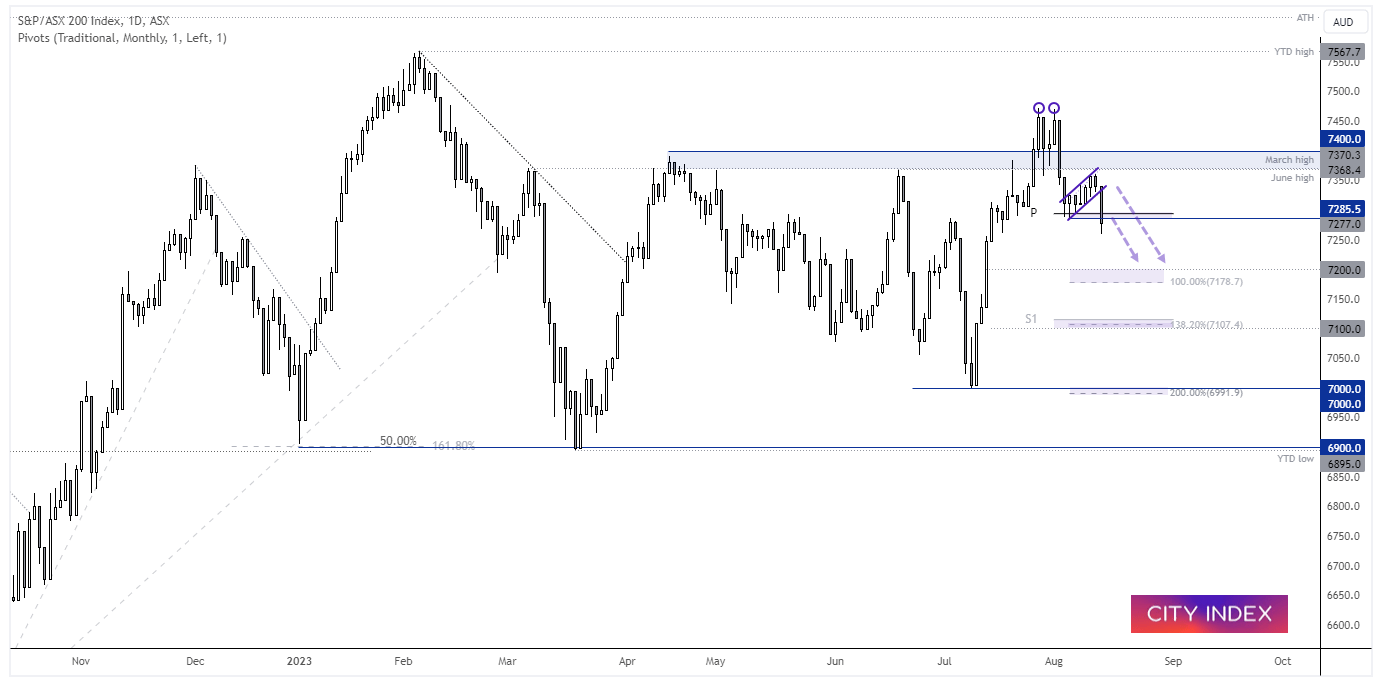

ASX 200 at a glance:

- Its most bearish day in seven on the ASX 200 which closed beneath 7300 for the first time in a month

- The ASX 200 produced a larger range on Monday than it did over the previous week

- Prices broke out of a bearish flag pattern on the daily chart which had pulled back into a precious resistance zone (March/June highs) and 7400 handle.

- With a double top reversal ack in range, bearish flag and bearish range expansion, the market appears to have tipped its hand in favour of bears.

- From here, my bias is to fade into small rallies towards or around resistance levels in anticipation of moves down to 7200 or 7100.

- SPI futures point towards a flat open and Wall Street held its ground, so we may see prices try to recycle higher today (initial resistance is around monthly pivot point / 7277 lows)

AUD/USD technical analysis (daily chart):

We saw AUD/USD test (and briefly trade beneath) the June low before pulling back to form a bullish hammer. It’s a big level to break, and with the US dollar index hovering beneath its July high, perhaps we’ll see the market hold higher for now and maybe even retrace towards Thursday’s high. But unless we see clear evidence of a rebound for risk sentiment, a move towards 0.6500 / 0.6530 could simply become a gift for bears to load up and seek that break to new lows and aim for 64c. And given the notable pickup on spikes on the daily chart since AUD/USD broke beneath 66c, we once again remind ourselves to not get too attached to positions for the long-term and to remain nimble whilst keep a close eye on sentiment across indices, gold and the US dollar.

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade