Market Summary:

- The IMF (International Monetary Fund) increased their growth outlook forecast for the US and China – the two largest economies – and noted that inflation was cooling faster than anticipated

- US consumer confidence rose for a third month according to the Consumer Board, and reached a 2-year high on expectations of lower inflation expectations. Job openings were also higher according to the JOLTS report.

- A combination of profit taking ahead of the FOMC meeting and mixed earnings saw a mixed response on Wall Street indices.

- The Dow Jones extended its rally to a fresh all-time high, although the S&P 500 closed flat with an abnormally low-range day after printing an intraday record high, and the Nasdaq 100 produced a small bearish inside day

- Currency markets were confined to ranges with a general lack of direction looking at the doji’s across the FX majors. EUR/USD held above its 200-day EMA, USD/CAD edged higher and AUD/USD remained confined within its potential bear flag

- Gold failed to hold onto to its earlier safe-haven gains on renewed hopes of a truce between Hamas and Israel

- Crude oil closed back above its 200-day EMA following Monday’s bearish engulfing candle, to suggest we’re in another choppy consolidation. The bias remains for another leg higher.

- Australian retail trade was down -2.6% in December, to once again show that the majority tend to spend ahead of Xmas at the Black Friday sales and cut back at the end of the year. It’s a volatile figure at the best of times, but particularly at this time of the year. But another month of two of such figures will surely bring forward bets of a rate cut.

Events in focus (AEDT):

- 10:50 – BOJ summary of opinions, Japan’s industrial production, retail sales

- 11:00 – New Zealand business confidence (ANZ)

- 11:30 – Australian quarterly and monthly CPI reports, housing credit

- 12:30 – China’s PMIs (NBS)

- 16:00 – Japan’s construction orders, household orders, housing starts

- 18:00 – German retail sales, import/export price indices

- 18:45 – French CPI

- 19:55 – German unemployment

- 20:00 – German state CPIs

- 00:15 – US ADP employment change

- 00:30 – US employment cost index

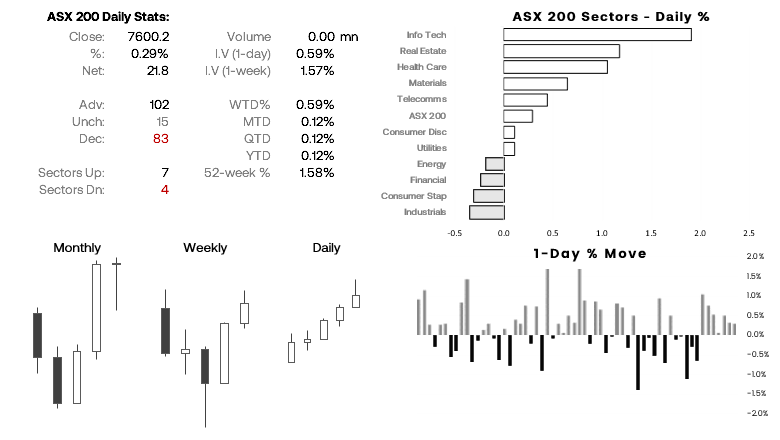

ASX 200 at a glance:

- The ASX 200 cash index rose for a seventh day came within a couple of points of its record high

- 7 of its 11 sectors advanced, led by info tech, real estate and healthcare

- If today’s Q4 inflation print comes in soft enough today, it could be the catalyst that breaks it to a new record high

- But if the Q3 report was anything to go by, traders should also be on guard for a hotter inflation report than expected – which could weigh on the ASX 200 at levels it has generally struggled to conquer

- A bearish RSI divergence is forming on the daily chart, and a shooting star candle formed on the ASX cash market

- The chart below shows a 2-bar reversal below resistance alongside a bearish divergence with RSI

- The bias is for a pullback from current levels which cold bring 7500 into focus near the 10-day EMA.

AUD/USD technical analysis (daily chart):

The Australian dollar continues to trade within a potential bear flag pattern, which projects an approximate target around 0.64. A soft inflation report could send AUD/USD lower, but its downside may be limited ahead of the FOMC meeting. The idea scenario for bears is a soft AU inflation report and relatively hawkish FOMC meeting.

Take note of the probable support zone around 0.6500 – 0.6520 which could take the string out of any bearish move, at least temporarily.

Should AU inflation come in hotter than expected, an upside break an invalidation of the bear flag seems likely. At which point I would seek evidence of a swing high around the Q3 open or 0.6700, near the volume cluster.

View the full economic calendar

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade