WTI Crude Oil Intraday: Supported by Lower Output Expectations

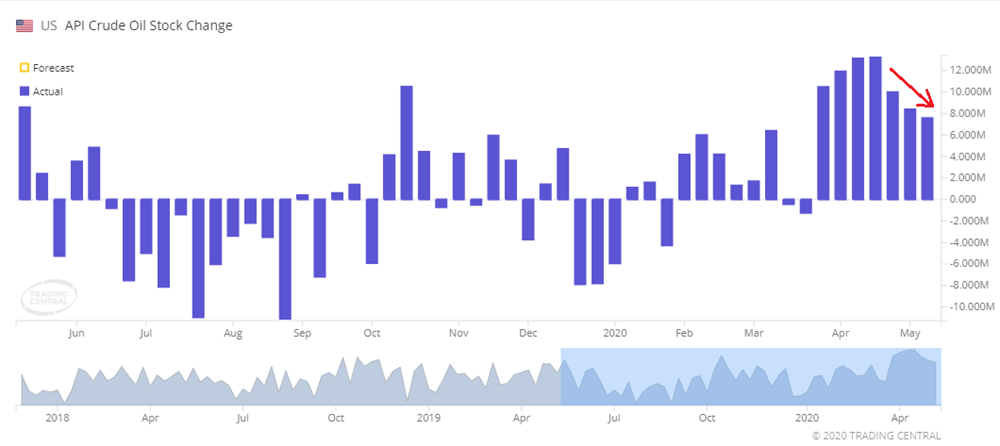

Source: Trading Economics

On the other hand, the American Petroleum Institute estimated that U.S. crude oil inventories would increase by 7.58 million barrels in the week ending May 8, more than 4.15 million barrels expected, though still showing a moderating growth as shown on the chart above. The U.S. Energy Information Administration (EIA) will report official crude inventories later today (+4.32 million barrels expected).

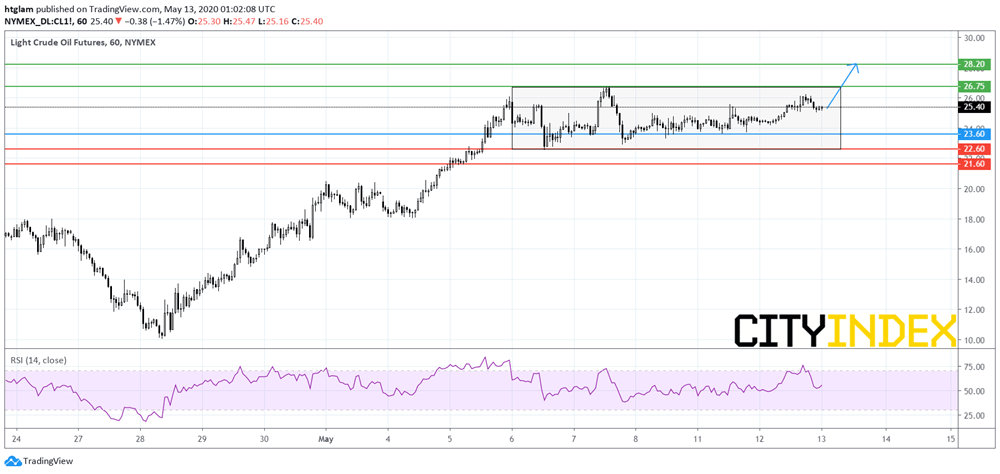

From a technical point of view, WTI crude oil futures (June contract) maintains upside momentum as shown on the 1-hour chart. It keeps trading within a consolidation range after a recent rally. Nevertheless, it has already gone past the 61.8% Fibonacci retracement resistance level of the decline started on May 7. The level at $23.60 might be considered as the nearest support level, while the 1st and 2nd resistance are likely to be located at $26.75 and $28.20 respectively. Alternatively, a break below $23.60 would suggest that the next support at $22.60 may be threatened.