March Forex Seasonality Key Points

- EUR/USD and GBP/USD tend to see relatively small moves in March.

- USD/JPY’s historical performance points to the potential for more strength in the coming month.

- USD/CAD’s strong start to 2024 could come under pressure based on the historical seasonality.

The beginning of a new month marks a good opportunity to review the seasonal patterns that have influenced the forex market over the 50+ years since the Bretton Woods system was dismantled in 1971, ushering in the modern foreign exchange market.

As always, these seasonal tendencies are just historical averages, and any individual month or year may vary from the historic average, so it’s important to complement these seasonal leans with alternative forms of analysis to create a long-term successful trading strategy.

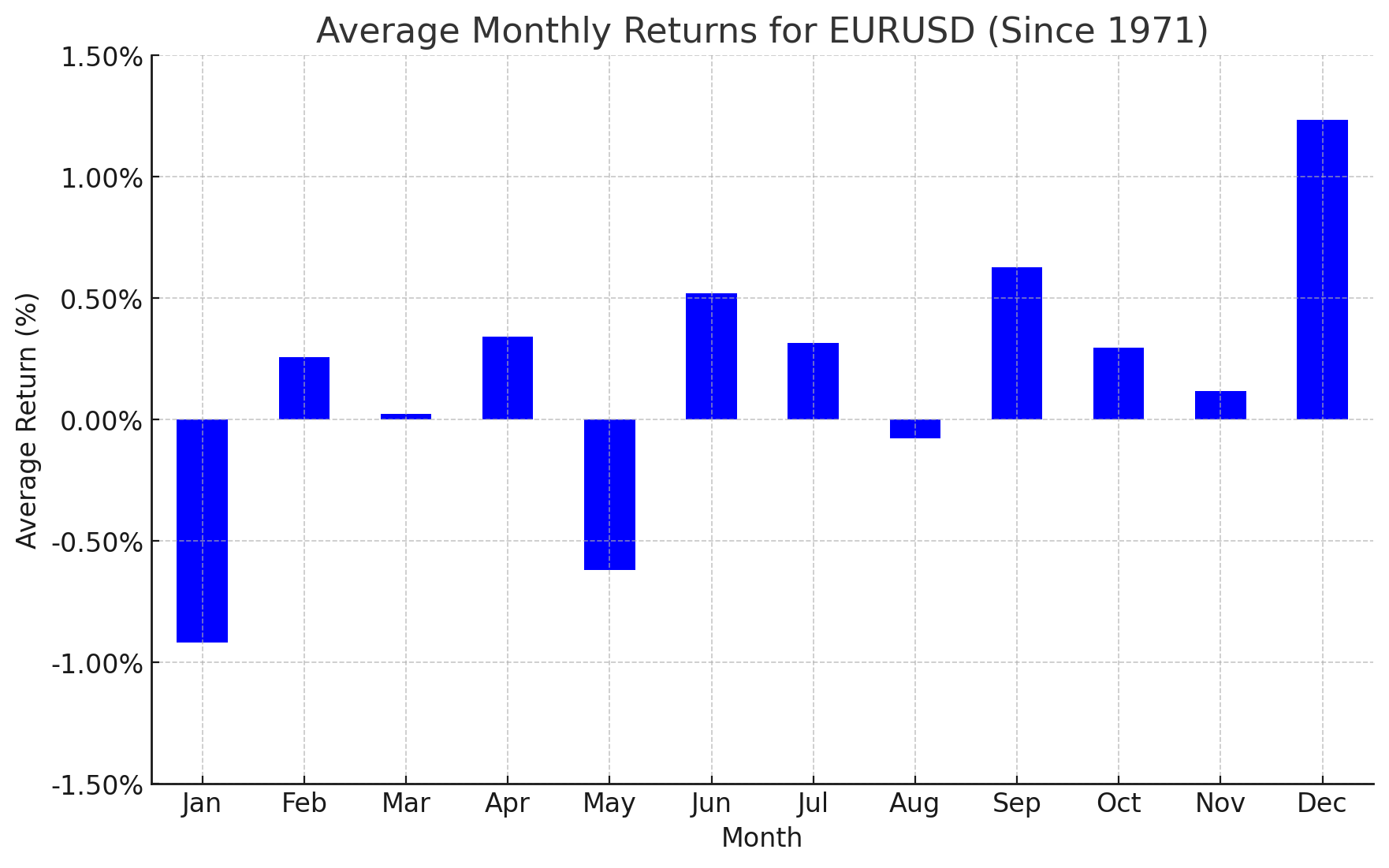

Euro Forex Seasonality – EUR/USD Chart

Source: TradingView, StoneX

March has historically been a quiet – indeed the quietest! – month of the year for EUR/USD, with the world’s most widely-traded currency pair eking out an average gain of just 0.02% since 1971. Volatility has already been subdued for the pair, so hopefully for most traders, EUR/USD can buck the historical trend over the next month.

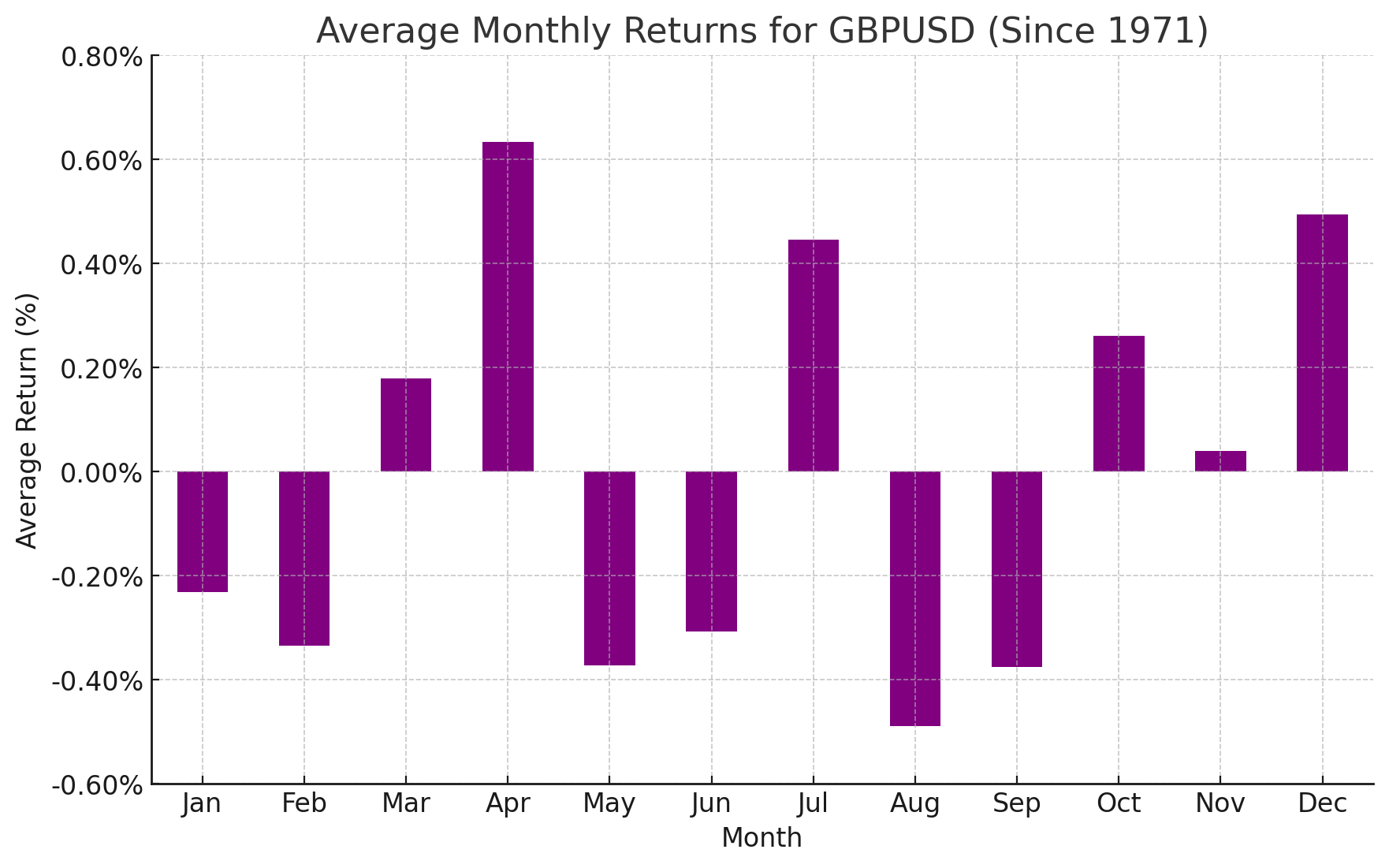

British Pound Forex Seasonality – GBP/USD Chart

Source: TradingView, StoneX

As the above chart shows, GBP/USD has historically risen slightly (+0.18%) in March. The third month is the strongest of the year so far, using average data since 1971, but only the 5th strongest of the 12 months across the entire year.

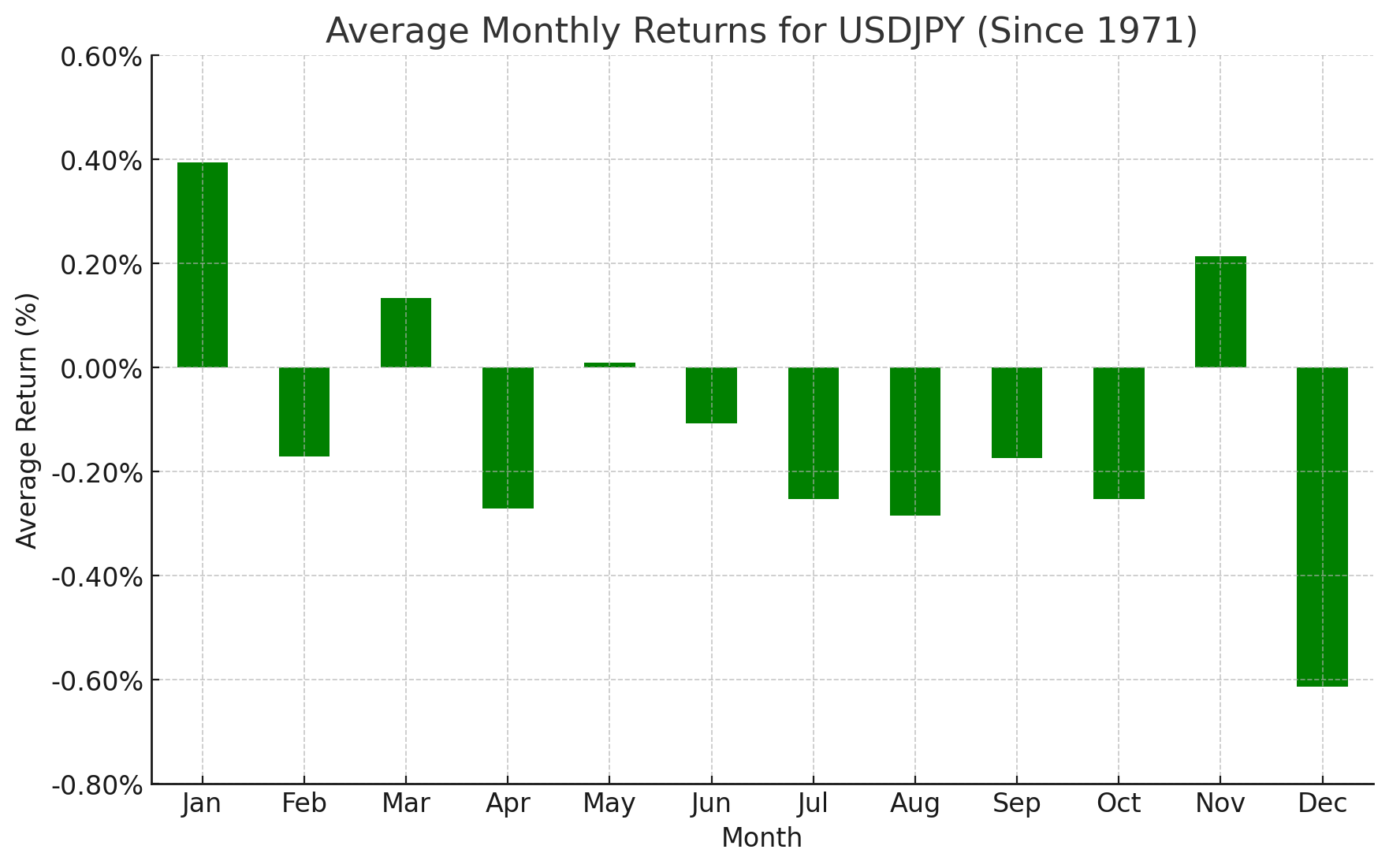

Japanese Yen Forex Seasonality – USD/JPY Chart

Source: TradingView, StoneX

USD/JPY saw a strong start to 2024, and based on history, those gains could continue into March. Since 1971, the trans-Pacific pairing has gained 0.13% on average, its 3rd strongest month across the sample.

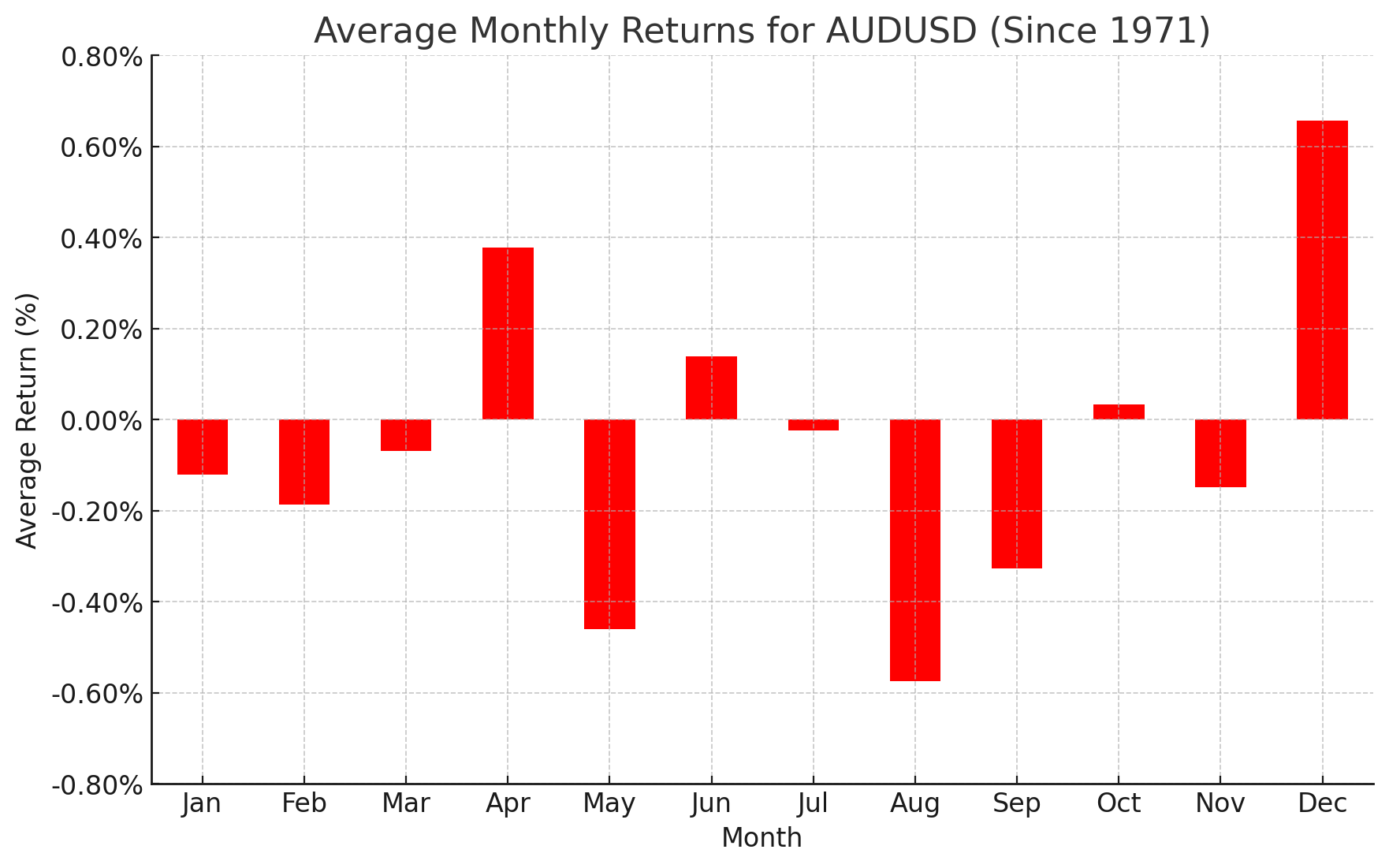

Australian Dollar Forex Seasonality – AUD/USD Chart

Source: TradingView, StoneX

AUD/USD fell in both of the first two months of the year, and the long-term seasonal tendencies hints that another drop may be in store. AUD/USD has historically fallen an average of 0.07% during March before getting its bullish mojo back in April.

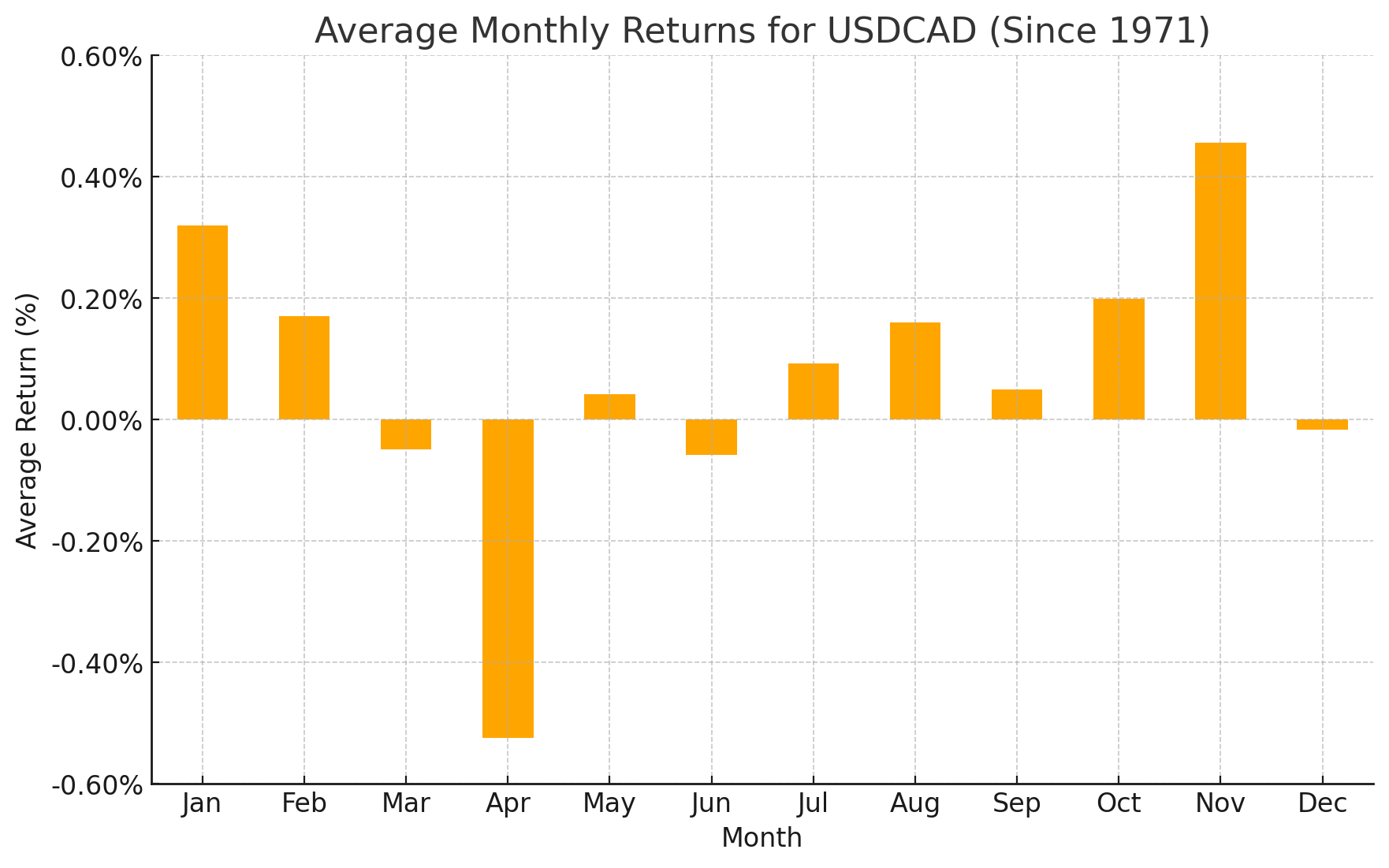

Canadian Dollar Forex Seasonality – USD/CAD Chart

Source: TradingView, StoneX

Last but not least, USD/CAD may seem some tougher sledding in March after a solid start to the year. As the chart above shows, USD/CAD has historically fell in March, losing 0.05% on average since 1971, it’s second-worst performance of any month across the year.

-- Written by Matt Weller, Global Head of Research

Follow Matt on Twitter: @MWellerFX