- Euro to US dollar analysis: EUR/USD outlook positive as dollar and yields fall

- FOMC minutes and global Flash PMIs among key macro highlights

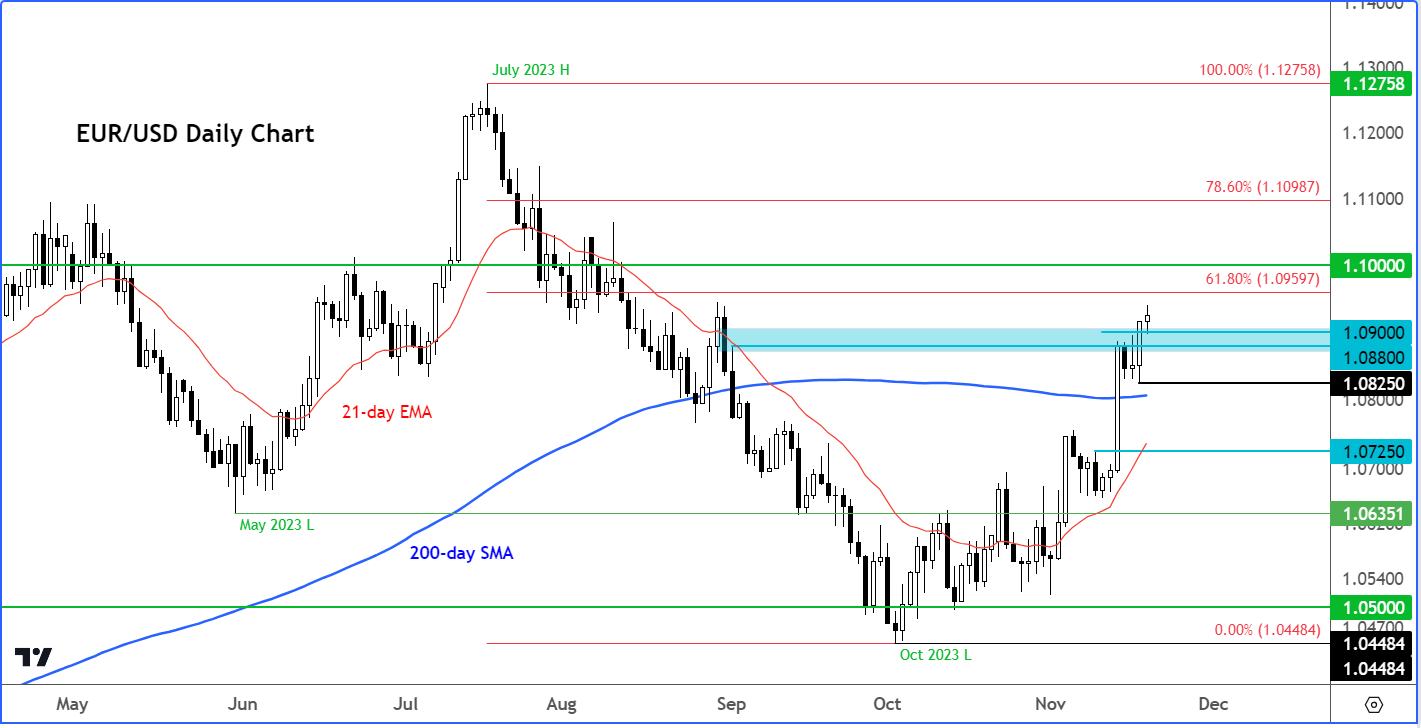

- EUR/USD technical analysis: Bullish momentum could lift pair towards 1.10

Video: FTSE, EUR/USD and silver analysis

The EUR/USD is likely to be among the more active currency pairs this week, which I am expecting to potentially rise to 1.10 handle amid improved risk sentiment and recent falls in US yields and dollar. Although the economic situation in the eurozone remains far from convincing, markets may have gotten ahead of itself with regards to ECB rate cuts being priced in as early as April. We are likely to see a pushback against those optimistic expectations from more ECB officials after Governing Council member Pierre Wunsch said the central bank may have to raise rates again if investor bets on monetary loosening undermine the institution’s policy stance. Meanwhile the next interest rate move in the US is likely to be a cut, possibly as early as the second quarter as signs emerge of inflation being on a consistent path of easing towards the Fed’s 2% average target in the long term. This week, the economic calendar is relatively quiet, but we will still have a few important macro highlights that could move the EUR/USD and other FX pairs.

Euro to US dollar analysis: US dollar outlook blighted by weak inflation data

The US dollar has started the new week lower, extending its losses from the week before when the Dollar Index had slumped nearly 1.9%. The bulk of last week’s losses came in on Tuesday when US CPI came in weaker than expected. Even before the CPI data, speculation had been rife that the Federal Reserve had reached the end of its rate-hiking cycle. But following the cooler inflation data last week, the focus has shifted to when the Fed will start cutting rates again. Previously, the market was speculating this to start after the middle of next year at the earliest. But now, the market is attaching about a 30% chance of a first Fed rate cut taking place in March. For what it is worth, I think that view is quite optimistic, but the Fed is likely to cut sooner than it had projected in its dot plots at the September meeting.

Along with the dollar, US bond yields slumped last week after US CPI fell more than expected, cementing expectations that the Fed (and other central banks) will no longer raise rates further. We also had a couple of other key US economic pointers also coming in weaker, such as industrial production and jobless claims data, while oil prices took a sharp drop too, before bouncing back on Friday.

Euro to US dollar analysis: EUR/USD shrugging off data disappointment

While the CPI-inspired dollar sell-off helped to fuel a rally in the likes of the GBP/USD and EUR/USD earlier last week, the subsequent days were dominated by consolidative price action, before the resumption of the dollar selling on Friday, which has carried on into Monday’s session so far. In Europe, economic indicators have remained weak, although some improvement in forward-looking ZEW sentiment data was observed for Germany. With much of the negativity already priced in, the euro has been able to shrug off the recent data disappointment. Will that run continue this week?

Week Ahead: FOMC minutes, Thanksgiving and global Flash PMIs

Whether the US dollar and bond yields will have more downside to go this week remains to be seen, but as we saw last week, a lot will depend on incoming data. Some investors will be expecting the slowdown in US inflation will have much more to go as higher borrowing costs increasingly weigh on economic activity while housing rents slow further down in the coming months. Unfortunately, we won’t have an awful lot of market-moving data this week, but there are still at least a few key macro highlights to look forward to.

FOMC meeting minutes

Due to the Thanksgiving holiday on Thursday, US data will be pushed forward by a day and the minutes of the FOMC’s last meeting will be published on Tuesday instead of the usual slot on Wednesday. Since their last meeting, Fed Chair Jerome Powell has spoken along with several other policymakers, suggesting that the Fed is in no hurry to further raise interest rates because of evidence that inflation pressures are continuing to ease at a gradual pace. We then had a weaker CPI report followed by a PPI miss last week, both pointing to waning price pressures. The FOMC minutes may therefore have limited impact, unless they reveal the Fed was already more dovish than expected, in which case we could see the dollar drop in reaction. Otherwise, the bulk of this week may well be characterised by consolidation in what will be a quieter week for data and given the shortened week for US and Japan.

Global Flash PMIs

The latest PMI data will be released between Thursday and Friday, with the European and US ones being most relevant to the EUR/USD pair.

Despite positive signs on inflation front, growth remains a big concern for most European countries, which may limit the upside potential for the likes of the EUR/USD and GBP/USD in the slightly longer-term outlook. We have seen mild improvement of late in some forward-looking pointers like the German ZEW survey and Sentix investor confidence index for Eurozone. But PMI have remained downbeat throughout the year, while backward-looking data have been mostly negative. However, if surveyed purchasing managers in the manufacturing and services industries indicate conditions have improved in November, then we could see the euro and pound make back further ground against the dollar.

Unlike Europe, US PMIs rose back above the expansion threshold of 50.0, if only just, last month. We have seen resilience in other US data, too, while inflation has started to fall more rapidly. So far, it looks like the US may avoid a recession despite high interest rates. But let’s see if the resilience of the world’s largest economy will continue, or high interest rates will take a toll on it. The flash PMI data will give us a snapshot of the health of the US economy on the final day of the week. But with many US investors expected to be on holiday, volatility might be on the thin side come Friday.

EUR/USD analysis: Technical levels to watch

Source: TradingView.com

Following last Tuesday’s big rally, the EURUSD consolidated those gains in a bullish manner in the next two sessions, giving back very little and keeping above the 200-day average. This strongly suggested that more gains could be on the way, which happened on Friday.

Friday’s continuation of the bullish momentum means the path of least resistance remains to the upside for now, with support now being the area where the EUR/USD had struggled in mid last week, namely around 1.0880 to 1.0900.

The line in the sand now is at 1.0825, Friday’s low. If the EUR/USD were to go below that level now, I would then expect to see a correction towards the base of last week’s breakout at 1.0725ish. But this is not my base case scenario.

Given the growing bullish momentum and price action, a run towards 1.10 handle looks the more likely scenario from here, than a drop below 1.0825.

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade