EU indices slightly up | TA focus on Standard Chartered

INDICES

Yesterday, European stocks charged higher, with the Stoxx Europe 600 Index advancing 1.7%. Germany's DAX 30 rose 1.3%, the U.K.'s FTSE 100 increased 1.9% and France's CAC 40 was up 1.4%.

EUROPE ADVANCE/DECLINE

78% of STOXX 600 constituents traded higher yesterday.

86% of the shares trade above their 20D MA vs 78% Monday (above the 20D moving average).

24% of the shares trade above their 200D MA vs 22% Monday (above the 20D moving average).

The Euro Stoxx 50 Volatility index eased 1.71pt to 33.01, a new 52w high.

SECTORS vs STOXX 600

3mths relative high: none

3mths relative low: real estate

Europe Best 3 sectors

banks, insurance, energy

Europe worst 3 sectors

health care, telecommunications, food & beverage

INTEREST RATE

The 10yr Bund yield rose 2bps to -0.45% (below its 20D MA). The 2yr-10yr yield spread fell 2bps to -22bps (above its 20D MA).

ECONOMIC DATA

EC 09:00: Mar Loans to Households YoY, exp.: 3.8%

EC 09:00: Mar M3 Money Supply YoY, exp.: 5.5%

EC 09:00: Mar Loans to Companies YoY, exp.: 3%

EC 10:00: Apr Consumer Confidence final, exp.: -11.6

EC 10:00: Apr Industrial Sentiment, exp.: -10.8

EC 10:00: Apr Services Sentiment, exp.: -2.2

EC 10:00: Apr Economic Sentiment, exp.: 94.5

EC 10:00: Apr Business Confidence, exp.: -28%

EC 10:00: Apr Consumer Inflation expectations, exp.: 23

GE 10:40: 10-Year Bund auction, exp.: -0.34%

UK 10:45: 30-Year Treasury Gilt auction, exp.: 0.68%

GE 13:00: Apr Harmonised Inflation Rate YoY Prel, exp.: 1.3%

GE 13:00: Apr Harmonised Inflation Rate MoM Prel, exp.: 0.1%

GE 13:00: Apr Inflation Rate MoM Prel, exp.: 0.1%

GE 13:00: Apr Inflation Rate YoY Prel, exp.: 1.4%

MORNING TRADING

In Asian trading hours, EUR/USD was flat at 1.0830 while GBP/USD bounced to 1.2472. USD/JPY fell further to 106.53. AUD/USD advanced further to 0.6527. Earlier today, official data showed that Australia's 1Q CPI rose 2.2% on year (+1.9% expected).

Spot gold rebounded to $1,710 an ounce.

#UK - IRELAND#

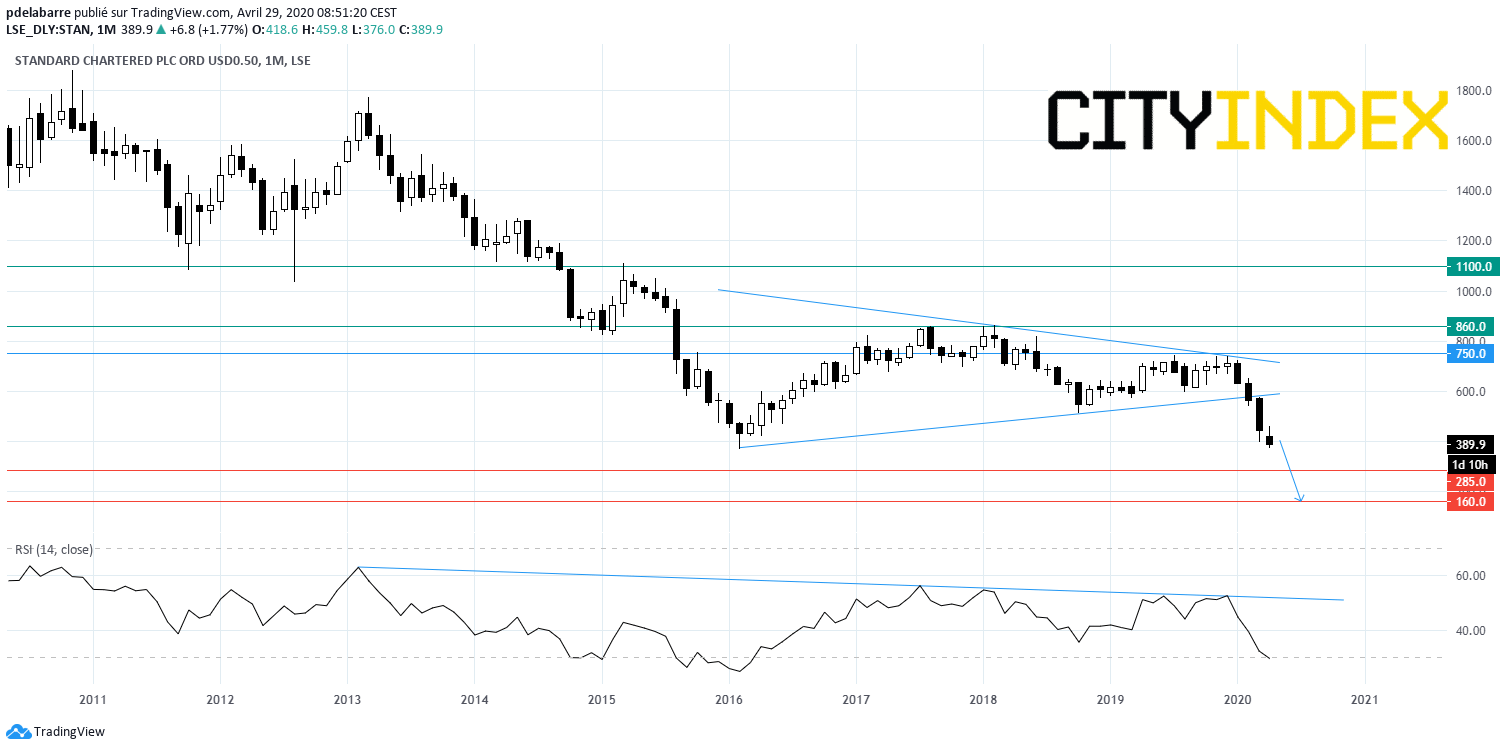

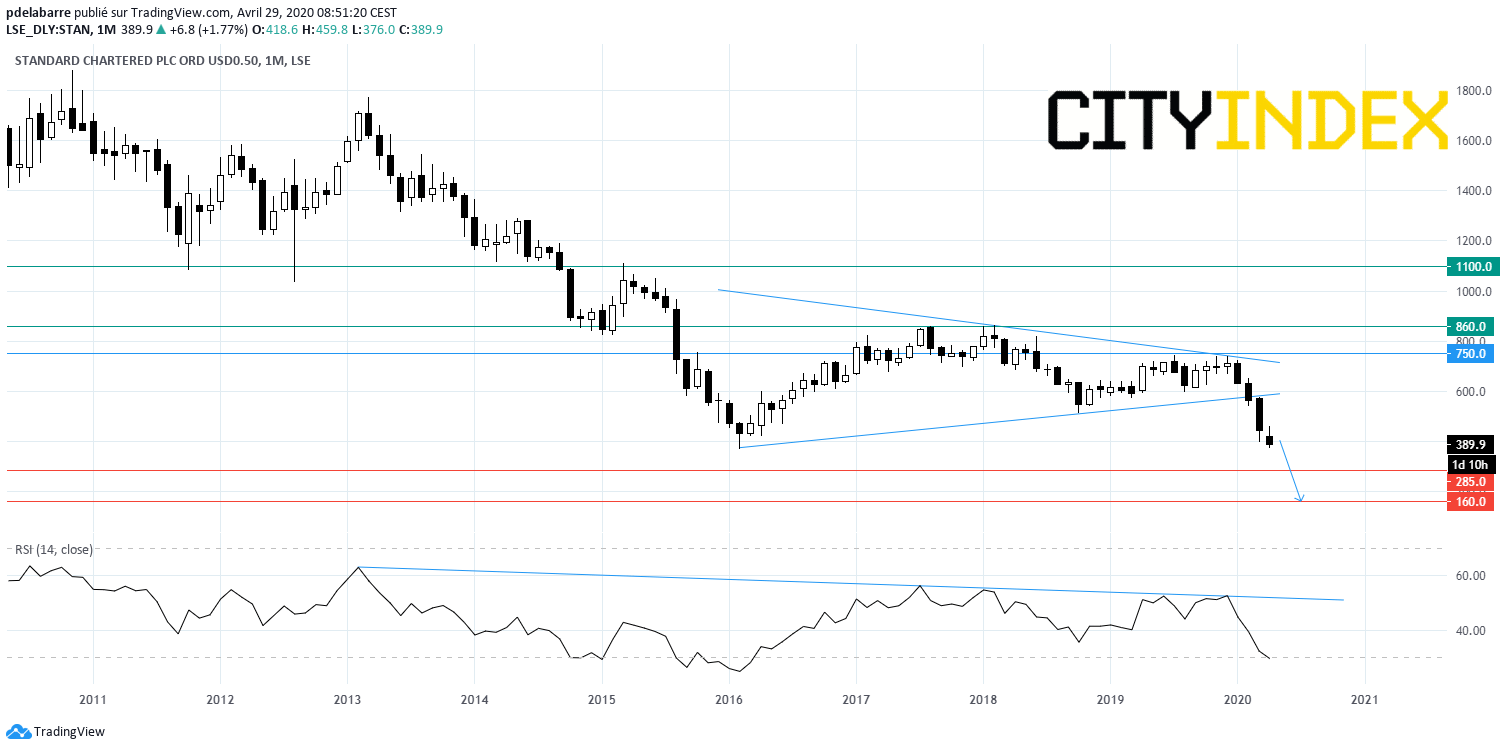

Standard Chartered, a banking group, announced that 1Q underlying net income slid 12% on year to 810 million dollars, as credit impairment surged to 956 million dollars from 78 million dollars in the prior-year period, amid COVID-19 outbreak. Meanwhile, underlying operating income rose 13% to 4.33 billion dollars on net interest income of 1.84 million dollars, down 4%. Regarding the outlook, the bank said: "We expect a gradual recovery from the COVID-19 pandemic, with major contraction in economic growth rates across most of the world in the second quarter, before the global economy moves out of recession in the latter part of 2020, most likely led and driven by markets in our footprint."

Source: GAIN Capital, TradingView

AstraZeneca, a pharmaceutical group, posted 1Q results: "Total Revenue, comprising Product Sales and Collaboration Revenue, increased by 16% in the quarter (17% at CER) to $6,354m. (...) Reported EPS of $0.59 in the quarter, represented an increase of 27% (33% at CER). (...) Financial guidance for FY 2020 is unchanged. Total Revenue is expected to increase by a high single-digit to a low double-digit percentage and Core EPS is expected to increase by a mid- to high-teens percentage. AstraZeneca recognises the heightened risks and uncertainties from the impact of COVID-19 referred to above."

Next, a retail group, reported full price sales declined 38% on year in the period from January 26 to April 25, saying: "The retail sector, along with the wider economy, has slowed faster and more steeply than we expected in March."

WPP, an advertising, public relations company, issued a 1Q trading update: "Revenue from continuing operations in the first quarter of 2020 was £2.8 billion, -4.9% compared with the same period last year on a reported basis and -4.6% on a constant currency basis. LFL revenue was -3.8% compared with last year."

Persimmon, a housebuilding company, provided a trading update: "Strong start to the year in the period before the COVID-19 lockdown - average private sales rate per site was c. 10% ahead year-on-year in the first 11 weeks of the period. (...) Current forward sales position, including legal completions taken to date in 2020, remains robust at £2.4bn (2019: £2.7bn)."

Fresnillo, a precious metals miner, published a 1Q production report: "Quarterly silver production of 13.2 moz (including Silverstream), down 4.0% vs. 4Q19. (...) Quarterly gold production of 197.0 koz down 15.7% vs. 4Q19. (...) Quarterly by-product lead and zinc production decreased 7.3% and 8.8% respectively vs. 4Q19. (...) Quarterly by-product lead production increased 14.7% vs. 1Q19. (...) Quarterly by-product zinc production increased 4.2% vs. 1Q19."

#GERMANY#

Daimler, an automobile group, reported that 1Q net income plunged 92% on year to 168 million euros and EBIT slumped 78% to 617 million euros on revenue of 37.22 billion euros, down 6%. Regarding the outlook, the company said: "Daimler expects Group revenue and Group EBIT for the financial year 2020 to be below the prior year."

Volkswagen, a vehicle manufacturer, announced that 1Q earnings before tax dropped to 0.7 billion euros from 4.1 billion euros in the prior-year period and adjusted operating profit sank to 0.9 billion euros from 3.9 billion euros on revenue of 55.1 billion euros, down 8.3%. The company said: "Sales revenue of the Volkswagen Group in 2020 is expected to be significantly below the prior s year's level as a result of the Covid-19 pandemic. Overall, the Volkswagen Group expects operating profit for 2020 to be severely below the prior year, but still to remain positive."

Deutsche Bank, a banking group, said it recorded a 1Q net loss (attributable to shareholders) of 43 million euros from a net profit of 97 million euros in the prior-year period. Profit before tax was down 29.5% on year to 206 million euros, while net revenue was broadly flat at 6.35 billion euros. Also, provision for credit losses jumped to 506 million euros from 140 million euros in the prior-year period, while CET1 ratio fell to 12.8% from 13.6% at end-2019.

#FRANCE#

Airbus, an aircraft manufacturer, said it swung to a 1Q net loss of 481 million euros from a net profit of 40 million euros in the prior-year period and adjusted EBIT dropped 49% on year to 281 million euros on revenue of 10.63 billion euros, down 15%. The company added: "The impact of COVID-19 on the business continues to be assessed and given the limited visibility, in particular with respect to the delivery situation, no new guidance is issued."

Remy Cointreau, an alcoholic beverage company, announced that full-year revenue slid 9.0% (-11.2% organic growth) to 1.02 billion euros. The company said: "The Group now anticipates Current Operating Profit to decline by around 20% on a reported basis and by around 25% on an organic basis, in the financial year 2019/20. (...) Furthermore, it confirms that wholesalers’ destocking in Greater China, along with the sharp slowdown in key European and American markets due to the ongoing public health crisis, is likely to severely impact sales in the first quarter of the 2020/21 financial year: at this stage, the Group expects organic sales to decline by around 50 to 55% over the period. However, in anticipation of a very gradual recovery in business during the second quarter of its financial year."

Carrefour, a hypermarket chain, reported that 1Q revenue grew 3.3% on year (+7.8% like-for-like) to 19.45 billion euros, "driven by a solid performance in January and February and precautionary purchases in March in the context of the COVID-19 pandemic".

Scor, a reinsurance company, reported that 1Q net income increased 23.7% on year to 162 million euros on gross written premiums of 4.16 billion euros, up 4.3%.

Klepierre, an real estate investment trust, posted 1Q revenue fell 4.2% on year to 317 million euros and net rental income slid 4.7% (+0.1% like-for-like) to 253 million euros.

#ITALY#

Italy's credit rating was downgraded to "BBB-" from "BBB+" at Fitch, outlook "Stable". The rating agency said: "The downgrade reflects the significant impact of the global COVID-19 pandemic on Italy's economy and the sovereign's fiscal position".

#SWEDEN#

Nordea, a financial services group, reported that 1Q net income grew 4% on year to 460 million euros on net interest income of 1.11 billion euros, up 5%. Also, net loan losses rose to 154 million euros from 42 million euros in the prior-year period. The bank confirmed its 2022 target of a return on equity above 10% (7.1% in 1Q).

SEB, a banking group, announced that 1Q net income declined 50% on year to 2.36 billion Swedish krona and operating income dropped 15% to 10.09 billion Swedish krona on net interest income of 6.20 billion Swedish krona, up 16%.

EX-DIVIDEND

Bayer: E2.8, Sandvik: SEK1.5

Yesterday, European stocks charged higher, with the Stoxx Europe 600 Index advancing 1.7%. Germany's DAX 30 rose 1.3%, the U.K.'s FTSE 100 increased 1.9% and France's CAC 40 was up 1.4%.

EUROPE ADVANCE/DECLINE

78% of STOXX 600 constituents traded higher yesterday.

86% of the shares trade above their 20D MA vs 78% Monday (above the 20D moving average).

24% of the shares trade above their 200D MA vs 22% Monday (above the 20D moving average).

The Euro Stoxx 50 Volatility index eased 1.71pt to 33.01, a new 52w high.

SECTORS vs STOXX 600

3mths relative high: none

3mths relative low: real estate

Europe Best 3 sectors

banks, insurance, energy

Europe worst 3 sectors

health care, telecommunications, food & beverage

INTEREST RATE

The 10yr Bund yield rose 2bps to -0.45% (below its 20D MA). The 2yr-10yr yield spread fell 2bps to -22bps (above its 20D MA).

ECONOMIC DATA

EC 09:00: Mar Loans to Households YoY, exp.: 3.8%

EC 09:00: Mar M3 Money Supply YoY, exp.: 5.5%

EC 09:00: Mar Loans to Companies YoY, exp.: 3%

EC 10:00: Apr Consumer Confidence final, exp.: -11.6

EC 10:00: Apr Industrial Sentiment, exp.: -10.8

EC 10:00: Apr Services Sentiment, exp.: -2.2

EC 10:00: Apr Economic Sentiment, exp.: 94.5

EC 10:00: Apr Business Confidence, exp.: -28%

EC 10:00: Apr Consumer Inflation expectations, exp.: 23

GE 10:40: 10-Year Bund auction, exp.: -0.34%

UK 10:45: 30-Year Treasury Gilt auction, exp.: 0.68%

GE 13:00: Apr Harmonised Inflation Rate YoY Prel, exp.: 1.3%

GE 13:00: Apr Harmonised Inflation Rate MoM Prel, exp.: 0.1%

GE 13:00: Apr Inflation Rate MoM Prel, exp.: 0.1%

GE 13:00: Apr Inflation Rate YoY Prel, exp.: 1.4%

MORNING TRADING

In Asian trading hours, EUR/USD was flat at 1.0830 while GBP/USD bounced to 1.2472. USD/JPY fell further to 106.53. AUD/USD advanced further to 0.6527. Earlier today, official data showed that Australia's 1Q CPI rose 2.2% on year (+1.9% expected).

Spot gold rebounded to $1,710 an ounce.

#UK - IRELAND#

Standard Chartered, a banking group, announced that 1Q underlying net income slid 12% on year to 810 million dollars, as credit impairment surged to 956 million dollars from 78 million dollars in the prior-year period, amid COVID-19 outbreak. Meanwhile, underlying operating income rose 13% to 4.33 billion dollars on net interest income of 1.84 million dollars, down 4%. Regarding the outlook, the bank said: "We expect a gradual recovery from the COVID-19 pandemic, with major contraction in economic growth rates across most of the world in the second quarter, before the global economy moves out of recession in the latter part of 2020, most likely led and driven by markets in our footprint."

Source: GAIN Capital, TradingView

AstraZeneca, a pharmaceutical group, posted 1Q results: "Total Revenue, comprising Product Sales and Collaboration Revenue, increased by 16% in the quarter (17% at CER) to $6,354m. (...) Reported EPS of $0.59 in the quarter, represented an increase of 27% (33% at CER). (...) Financial guidance for FY 2020 is unchanged. Total Revenue is expected to increase by a high single-digit to a low double-digit percentage and Core EPS is expected to increase by a mid- to high-teens percentage. AstraZeneca recognises the heightened risks and uncertainties from the impact of COVID-19 referred to above."

Next, a retail group, reported full price sales declined 38% on year in the period from January 26 to April 25, saying: "The retail sector, along with the wider economy, has slowed faster and more steeply than we expected in March."

WPP, an advertising, public relations company, issued a 1Q trading update: "Revenue from continuing operations in the first quarter of 2020 was £2.8 billion, -4.9% compared with the same period last year on a reported basis and -4.6% on a constant currency basis. LFL revenue was -3.8% compared with last year."

Persimmon, a housebuilding company, provided a trading update: "Strong start to the year in the period before the COVID-19 lockdown - average private sales rate per site was c. 10% ahead year-on-year in the first 11 weeks of the period. (...) Current forward sales position, including legal completions taken to date in 2020, remains robust at £2.4bn (2019: £2.7bn)."

Fresnillo, a precious metals miner, published a 1Q production report: "Quarterly silver production of 13.2 moz (including Silverstream), down 4.0% vs. 4Q19. (...) Quarterly gold production of 197.0 koz down 15.7% vs. 4Q19. (...) Quarterly by-product lead and zinc production decreased 7.3% and 8.8% respectively vs. 4Q19. (...) Quarterly by-product lead production increased 14.7% vs. 1Q19. (...) Quarterly by-product zinc production increased 4.2% vs. 1Q19."

#GERMANY#

Daimler, an automobile group, reported that 1Q net income plunged 92% on year to 168 million euros and EBIT slumped 78% to 617 million euros on revenue of 37.22 billion euros, down 6%. Regarding the outlook, the company said: "Daimler expects Group revenue and Group EBIT for the financial year 2020 to be below the prior year."

Volkswagen, a vehicle manufacturer, announced that 1Q earnings before tax dropped to 0.7 billion euros from 4.1 billion euros in the prior-year period and adjusted operating profit sank to 0.9 billion euros from 3.9 billion euros on revenue of 55.1 billion euros, down 8.3%. The company said: "Sales revenue of the Volkswagen Group in 2020 is expected to be significantly below the prior s year's level as a result of the Covid-19 pandemic. Overall, the Volkswagen Group expects operating profit for 2020 to be severely below the prior year, but still to remain positive."

Deutsche Bank, a banking group, said it recorded a 1Q net loss (attributable to shareholders) of 43 million euros from a net profit of 97 million euros in the prior-year period. Profit before tax was down 29.5% on year to 206 million euros, while net revenue was broadly flat at 6.35 billion euros. Also, provision for credit losses jumped to 506 million euros from 140 million euros in the prior-year period, while CET1 ratio fell to 12.8% from 13.6% at end-2019.

#FRANCE#

Airbus, an aircraft manufacturer, said it swung to a 1Q net loss of 481 million euros from a net profit of 40 million euros in the prior-year period and adjusted EBIT dropped 49% on year to 281 million euros on revenue of 10.63 billion euros, down 15%. The company added: "The impact of COVID-19 on the business continues to be assessed and given the limited visibility, in particular with respect to the delivery situation, no new guidance is issued."

Remy Cointreau, an alcoholic beverage company, announced that full-year revenue slid 9.0% (-11.2% organic growth) to 1.02 billion euros. The company said: "The Group now anticipates Current Operating Profit to decline by around 20% on a reported basis and by around 25% on an organic basis, in the financial year 2019/20. (...) Furthermore, it confirms that wholesalers’ destocking in Greater China, along with the sharp slowdown in key European and American markets due to the ongoing public health crisis, is likely to severely impact sales in the first quarter of the 2020/21 financial year: at this stage, the Group expects organic sales to decline by around 50 to 55% over the period. However, in anticipation of a very gradual recovery in business during the second quarter of its financial year."

Carrefour, a hypermarket chain, reported that 1Q revenue grew 3.3% on year (+7.8% like-for-like) to 19.45 billion euros, "driven by a solid performance in January and February and precautionary purchases in March in the context of the COVID-19 pandemic".

Scor, a reinsurance company, reported that 1Q net income increased 23.7% on year to 162 million euros on gross written premiums of 4.16 billion euros, up 4.3%.

Klepierre, an real estate investment trust, posted 1Q revenue fell 4.2% on year to 317 million euros and net rental income slid 4.7% (+0.1% like-for-like) to 253 million euros.

#ITALY#

Italy's credit rating was downgraded to "BBB-" from "BBB+" at Fitch, outlook "Stable". The rating agency said: "The downgrade reflects the significant impact of the global COVID-19 pandemic on Italy's economy and the sovereign's fiscal position".

#SWEDEN#

Nordea, a financial services group, reported that 1Q net income grew 4% on year to 460 million euros on net interest income of 1.11 billion euros, up 5%. Also, net loan losses rose to 154 million euros from 42 million euros in the prior-year period. The bank confirmed its 2022 target of a return on equity above 10% (7.1% in 1Q).

SEB, a banking group, announced that 1Q net income declined 50% on year to 2.36 billion Swedish krona and operating income dropped 15% to 10.09 billion Swedish krona on net interest income of 6.20 billion Swedish krona, up 16%.

EX-DIVIDEND

Bayer: E2.8, Sandvik: SEK1.5

Latest market news

Today 08:15 AM

Yesterday 10:44 PM