US futures

Dow futures -0.2% at 34670

S&P futures -0.37% at 4373

Nasdaq futures -0.7% at 14711

In Europe

FTSE +0.18% at 7107

Dax -0.55% at 15120

Euro Stoxx -0.5% at 4050

Learn more about trading indices

Inflation fears grow as costs rise

US stocks are heading for as softer start this week after booking strong gains across the previous week, as inflation concerns are back to stalk the market.

Surging commodity prices amid the ongoing energy crisis, labour shortages and supply chain bottlenecks mean costs pressures are rising. Investors are fretting over how this will feed into the inflation outlook. CPI is already elevated and with commodity prices rising it is likely to remain elevated for longer than initially expected, potentially forcing the Fed’s hand to raise rates sooner.

The rise in costs and elevated inflation are risks to growth with are making the market nervous. With earning season kicking off this week with the banks, costs will be a key focus. According to Refintiv as from Friday profits at S&P companies are expected to grow 29.6% in Q3 down from 96.3% in Q2.

Tech stocks are under the most pressure as treasury yields rise. The 10 year benchmark treasury yield has risen to 1.61% its highest level since June as bet rise that the Fed will be forced to tighten policy.

A bright spot today can be found in energy stocks which are expected to power higher on the open.

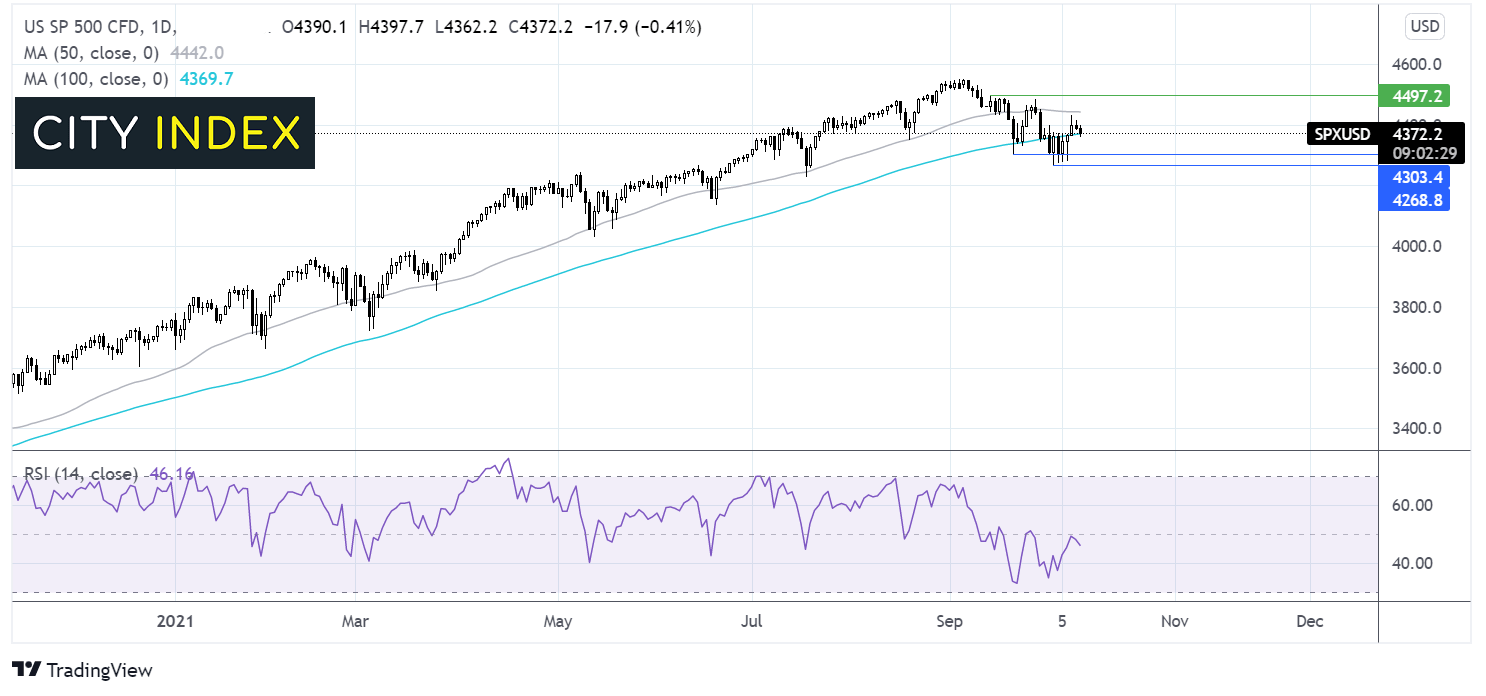

Where next for the S&P500?

The S&P is trading between the 50 & 100 sma on the daily chart. The mild move lower in the RSI favours the sellers. However, a move below the 100 sma at 4370 is needed in order to target 4300 the Sept 20 low and 4270 the October low. Any recovery would need to retake 4400 round number to head for the 50 sma at 4444. A move beyond here could see the buyers gain traction.

FX – USD strengthens, GBP rises as BoE hike bets grow

The US Dollar is rising as investors continue to bet that the Fed will announce tapering plans next month, despite the weak NFP report on Friday.

GBPUSD is on the rise after BoE Michael Saunders warned that the UK central bank may need to raise interest rates sooner than initially expected as elevated inflation could be around for longer than forecast.

USDJPY trades at an almost three year high on central bank divergence widening the yields. Japan being a net importer of oil is adding weight to the currency.

GBP/USD +0.1% at 1.3628

EUR/USD -0.05% at 1.1570

Oil set for 7th straight week of gains

Oil prices are on the rise building on solid gains from the previous week. Oil trades at multi year highs amid the ongoing energy crunch. The crisis gripping the sector shows no sign of easing with gas and coal prices surging, oil is comparatively the more attractive, cheaper option for power generation. Prices are likely to continue rising at least for now particularly as we head towards winter, a time of year which sees demand rise further.

The supply side remains tight as OPEC stick to their production increase plan agreed in July, well before the energy crisis started to grip the markets.

WTI crude trades +2.20% at $81.20

Brent trades +1.85% at $84.17

Learn more about trading oil here.

Looking ahead

N/A

How to trade with City Index

Follow these easy steps to start trading with City Index today:

- Open a City Index account, or log-in if you’re already a customer.

- Search for the market you want to trade in our award-winning platform.

- Choose your position and size, and your stop and limit levels

- Place the trade.