US futures

Dow futures -2.65% at 31140

S&P futures -2.15% at 3870

Nasdaq futures -2.34% at 11470

In Europe

FTSE -1.5% at 7160

Dax -1.85% at 12797

Euro Stoxx -1.98% at 3483

Learn more about trading indices

Stocks drop on aggressive Fed bets

US stocks are pointing to a weaker start as US inflation rose by more than expected dashing hopes that the US was passing peak inflation.

Both headline and core inflation came in stronger than expected. US CPI rose to 9.1% YoY in June, up from 8.6% in May and well ahead of the 8.8% forecast. Core CPI, which discounts more volatile items such as food and fuel, fell by less than expected to 5.9% YoY, down from 6%. While the tick lower in CPI is a move in the right direction, it is far too slow for the Fed to change its aggressively hawkish outlook.

The data shows that any talk of cooling inflation is still premature at this stage. More outsized rate hikes are expected, and the Fed is unlikely to take its foot off the hiking gas anytime soon.

The data has fueled hawkish Fed bets boosting the USD while pulling stocks and gold sharply lower.

In corporate news:

Twitter continues to scale lower after the social media platform said it was suing Elon Musk over a violation of the $44 billion takeover deal. Twitter has asked a court in Delaware to order Musk to continue the buyout as planned.

Delta trades lower despite a quarterly profit. Passenger numbers have picked up and are willing to pay more, compensating for higher costs.

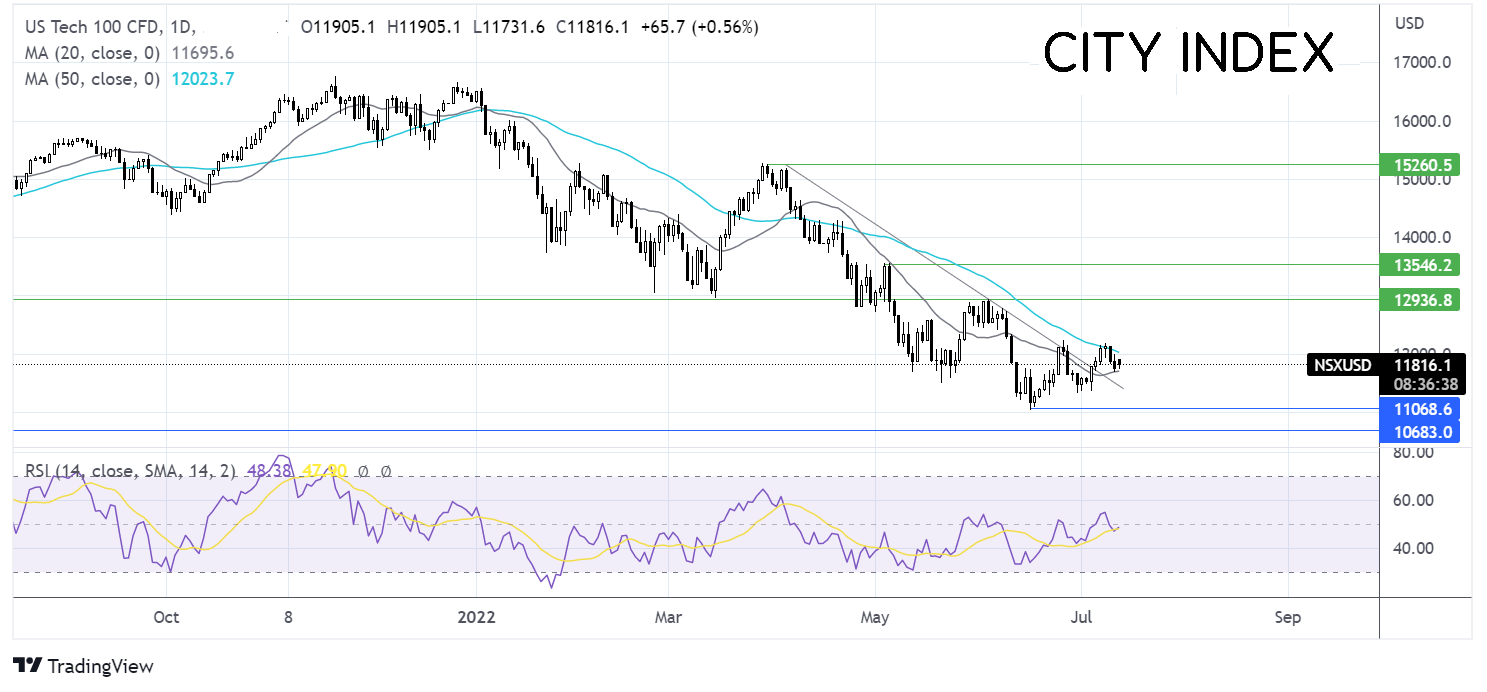

Where next for the Nasdaq?

The Nasdaq has rebounded off the 11085 the 2022 low before running into resistance at 12100 the 50 sma. The index trades caught between the 20 & 50 sma, and the RSI is giving few clues at neutral. A breakout trade will see buyers look for a move over the 50 sma at 12100, opening the door to 12930, the June high. Sellers will look for a move below the 20 sma at 11700 to bring 11085 back into play.

FX markets – USD rises, EUR back to parity.

USD is surging following the hotter-than-expected US CPI data, which has fueled aggressive Fed bets lifting the USD back over 108.00

EURUSD has fallen back to parity on USD strength, paring gains from earlier in the day. Stronger than forecast eurozone industrial production, which rose 1.6% YoY in May, up from -2.5% in April and ahead of the 0.2% forecast, had supported the euro in early trade. Central bank divergence has pulled the pair lower.

GBP/USD rose before US CPI after the UK economy unexpectedly grew in May. The GDP rose 0.5% MoM, well ahead of the 0% forecast. The UK economy contracted -0.1% in March and -0.3% in April. Even so, it is by no means out of the woods - a contraction in Q2 is still likely. Still, the pound is focusing on the positives, rising above 1.19.

GBP/USD -0.3% at 1.1930

EUR/USD -0.3% at 1.0007

Oil falls into a bear market

Oil prices are falling below $100 per barrel extending losses from the previous session and hitting a 3-month low. Oil tumbled into a bear market after falling over 20% from its recent June high.

Despite the tight market, oil prices have been falling on fears over the demand outlook as recession worries build and COVID cases in China rise. The IEA also downwardly revised its oil demand outlook for this year to 1.7M BPD, from 1.8M BPD, and inventories showed a larger than forecast build.

According to the API data, stockpiles rose by 4.8 million barrels. EIA data is due later.

Technically the oil price is testing its 200 DMA, a key level of support. A close below the 200 DMA would be significant as it would be a first this year and could open the door to further declines while it remains out of oversold territory.

WTI crude trades -1.2% at $94.73

Brent trades -0.94% at $98.60

Learn more about trading oil here.

Looking ahead

15:00 BoC rate decision

19:00 Fed Beige Book