On Friday morning, the US dollar and yields were soaring. The US Dollar Index was approaching 114.00 again and US 10-year yields were screaming at 4.335%, its highest level since June 2008! Markets seemed as though they may have been getting a little ahead of themselves in terms of interest rate expectations. Enter Nick Timiraos.

Nick’s articles sometimes move the markets, as it is suspected that the Fed “whispers” messages for him to publish. Back in June, during the Fed’s blackout period before its FOMC meeting, Nick released an article that suggested the Fed was going to hike rates by 75bps. Markets were expecting a hike of 50bps. During Powell’s press conference that followed the FOMC meeting, Powell admitted that he wanted to get the message to the markets that a 75bps hike was coming. Today, Timiraos and the WSJ released an article suggesting that the Fed will hike the Fed Funds rate once again by 75bps, AND possibly begin to discuss how to bring rate hikes down to only 50bps at its December meeting.

Everything you need to know about the Federal Reserve

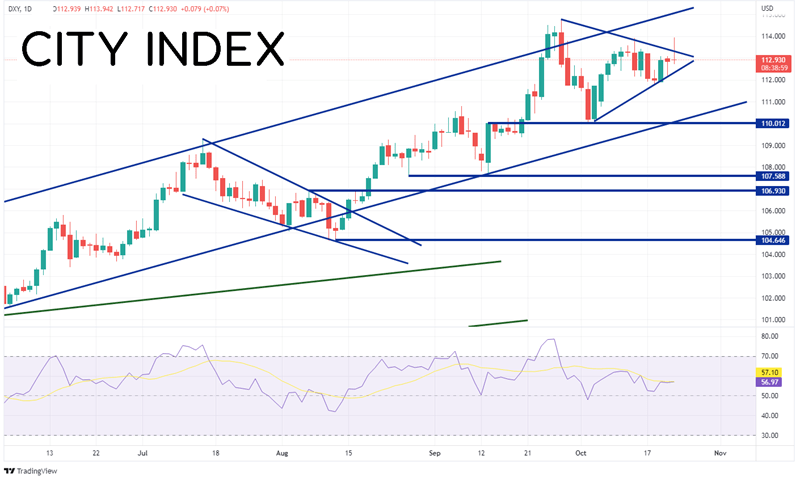

The US Dollar Index (DXY) and many of its counter currencies, along with yields, quickly reversed. The DXY went from being up 101 pips at a high print of 113.94 down to unchanged on the day near 112.94. Notice that the Index was breaking out of a consolidating triangle as the news it the wires. If today’s inverted hammer holds, it may prove to be a false breakout and price may move to test the lows form Wednesday at 111.91.

Source: Tradingivew, Stone X

Trade the DXY now: Login or Open a new account!

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

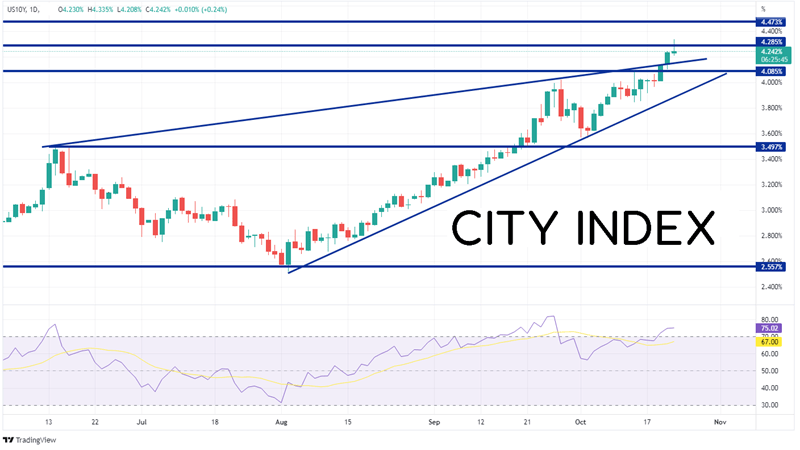

The same be said for bond yields. If the Fed threatens to begin slowing the pace of rate hikes, bond yields may begin moving lower. Notice how 10-yer yields have been moving higher in an ascending wedge. The expectation is that yields would break lower out of the pattern. However, on Thursday yields broke above the top trendline. Is this a false breakout? The action in yields after the article hit the wires is similar to that of the DXY. Yields were making new highs and quickly reversed. If the inverted hammer holds on the day, yields could be moving back inside the wedge and test the bottom trendline of the pattern near 3.85%. Also notice that the RSI is diverging yields, indicating they may be ready for a correction.

Source: Tradingivew, Stone X

Trade US Bonds now: Login or Open a new account!

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

Will today’s “leak” to the WSJ be the straw that breaks the camels back regarding the US Dollar and US rates? Markets will most likely have to wait until the official meeting on November 2nd to find out, however traders are on notice. And if Nick Timiraos’s previous articles are any indication, the Fed may be slowing the pace of rate hikes sooner rather than later!

Learn more about forex trading opportunities.