Our long-term bullish gold outlook received a boost today as fresh doubts emerged about whether the Fed will hike interest rates at all this summer, as the latest ISM services PMI raised concerns the US economy is heading for recession. The latest data comes hot on the heels of Friday’s jobs report, which showed a rise in both jobs gained and the rate of unemployment, leaving traders guessing as to which employment survey to trust. Accordingly, the mixed jobs report could not convince investors fully to price in more than a 50% probability of a June hike. Already lower, the odds of a June hike tumbled to near 20% after the ISM PMI showed worrying signs.

ISM services PMI 50.3 vs 52.2 expected and 51.9 prior. Among some of the bearish aspects of this report,

- employment index fell below the boom/bust level of 50 to 49.2 versus 50.8 prior;

- new orders index came in at 52.9 versus 56.1, and…

- prices paid index tumbled to its lowest since May 2020 at 56.2 versus 59.6 prior

So, unless we see a dramatic turnaround in the service sector activity, the US could be heading for a recession. That’s because the ISM manufacturing PMI has already been below 50.0 since November, suggesting that activity in that sector has been falling consecutively each month.

Now, with the FOMC already entering the black-out period, and just a couple of important data pointers to watch between now and the June 14 meeting, there won’t be many catalysts to fuel the dollar rally directly. Investors will probably have a much better idea once the inflation report is published on June 13th, a day ahead of the FOMC rate decision.

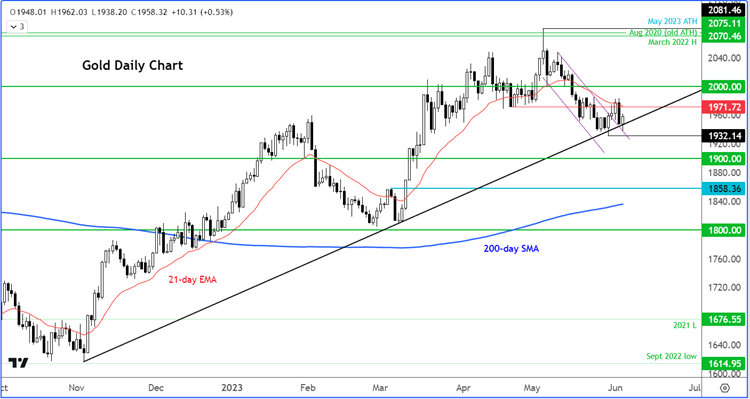

Gold outlook: technical analysis

XAU/USD has bounced right where it needed to: at the intersection of horizontal support with the bullish trend line around $1935 area. For as long as the bulls manage to cling onto the trend line, this should keep the bears at bay and keep the gold outlook positive.

Source: TradingView.com

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade