Asian Indices:

- Australia's ASX 200 index rose by 48 points (0.67%) and currently trades at 7,251.30

- Japan's Nikkei 225 index has risen by 214.5 points (0.77%) and currently trades at 28,169.35

- Hong Kong's Hang Seng index has risen by 182.69 points (0.93%) and currently trades at 19,778.89

- China's A50 Index has risen by 88.92 points (0.68%) and currently trades at 13,193.59

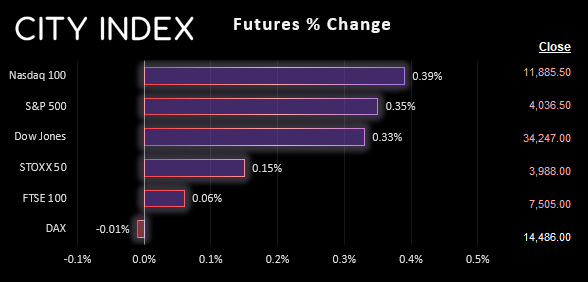

UK and Europe:

- UK's FTSE 100 futures are currently up 4.5 points (0.06%), the cash market is currently estimated to open at 7,507.39

- Euro STOXX 50 futures are currently up 6 points (0.15%), the cash market is currently estimated to open at 3,992.83

- Germany's DAX futures are currently down -1 points (-0.01%), the cash market is currently estimated to open at 14,496.89

US Futures:

- DJI futures are currently up 114 points (0.33%)

- S&P 500 futures are currently up 46 points (0.39%)

- Nasdaq 100 futures are currently up 14.25 points (0.35%)

Whilst sentiment was uplifted for Asian equities overnight, the moves were predictably not outlandish given the pending FOMC meeting today. The ASX is currently on track for its best day in 10 following softer-than-expected CPI print from the US. Yet the day’s trading volume remains on the low side which shows an air of caution ahead of the FOMC meeting.

Have the market over-reacted to CPI ahead of FOMC?

For the second month running US CPI data was softer than expected, effectively handing the Fed an early Christmas present and providing less reasons to doubt a 50b hike this week. At 7.1% it remains historically high, but good to see that it is trying to at least meet the Fed’s interest rate halfway.

I think there’s a danger that markets have over-reacted to the CPI data and that the Fed will deliver a more hawkish message than is currently being priced in. We know they need to upwardly revise their dot plot, so the median rate for 2023 will be a core focus for many. And there’s still a reasonable chance the Fed may need to raise rates above 5% - as much as I’d prefer they didn’t.

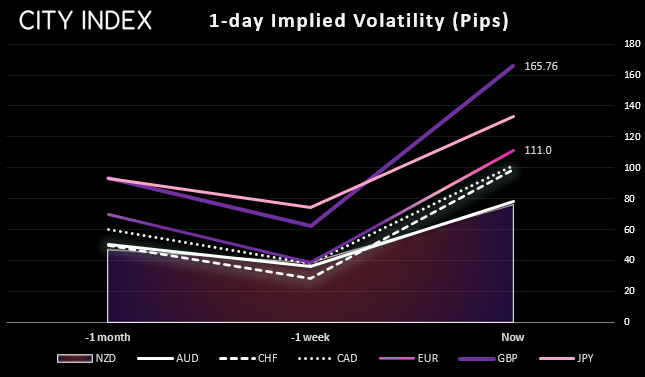

Implied volatility spikes ahead of today’s FOMC meeting

The USD and JPY were the strongest majors overnight and NZD and AUD were the weakest, as markets retraced against some of their post-CPI moves form yesterday. However, implied volatility has spiked for the majority of FX majors, and most notably on GBP as it has inflation data shortly as well as the FOMC meeting to contend with. GBP/USD’s IV reached a 3-year high of 24.9% annualised (which roughly equates to a 1-day IV of +/- 165 pips).

The consensus is for the UK inflation to rise 10.9% y/y from 11.1 previously. But if you look at the inflation chart there is no immediate signs of a top – and even if it ‘falls’ to 10.9 it is still very high indeed. So I’m bracing myself for an upside surprise which will pile on the pressure for a more aggressive response from the BOE on Thursday (whether that be signalling a higher terminal rate or going back in with another 75bp hike).

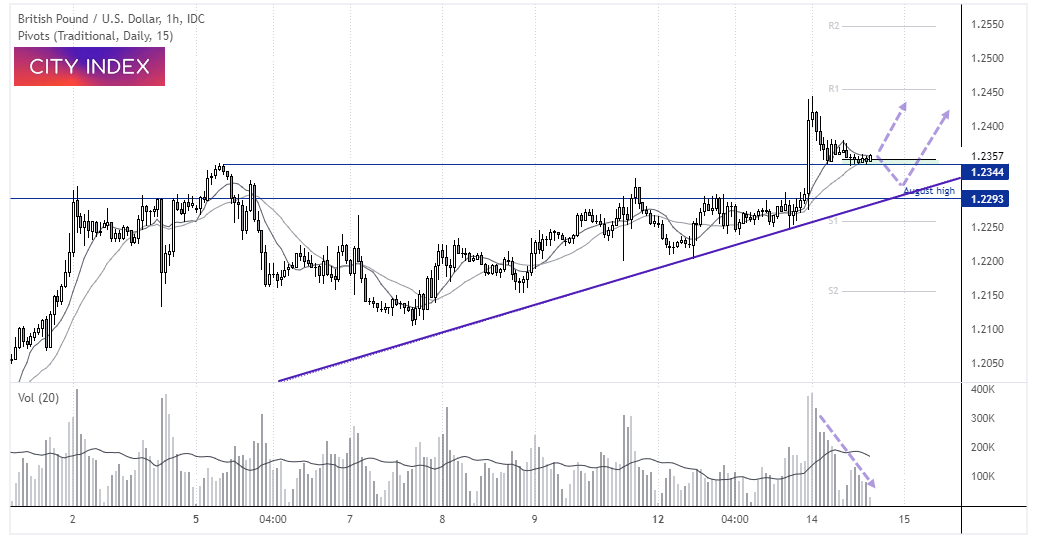

GBP/USD 1-hour chart

GBP/USD is within an established uptrend on the 1-hour chart, and it spiked convincingly above the August high with rising volumes following US inflation data. Prices have pulled back with lower volumes which suggests the move is corrective, and support has been found around the daily pivot point and 1.2344 high. The pair looks ripe for another leg higher, where a hot CPI print could help it begin – otherwise a dovish FOMC meeting may be required to help it higher. Clearly, the downside risks for GBP today are a soft inflation print and a hawkish FOMC meeting.

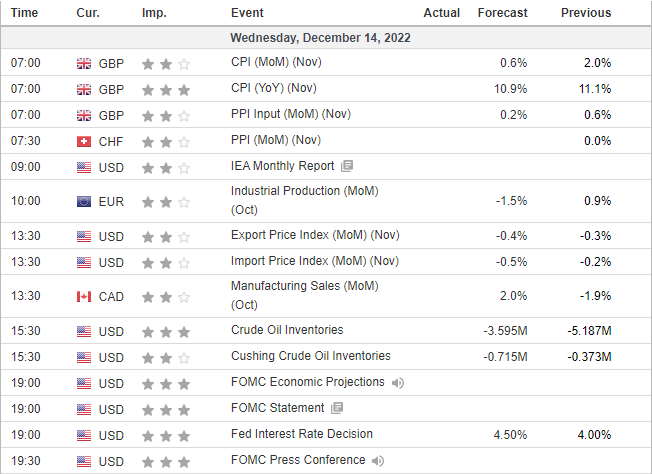

Economic events up next (Times in GMT)