Asian Indices:

- Australia's ASX 200 index fell by -57.9 points (-0.85%) and currently trades at 6,787.20

- Japan's Nikkei 225 index has fallen by -188.54 points (-0.0043%) and currently trades at 27,266.70

- Hong Kong's Hang Seng index has fallen by -305.51 points (-1.98%) and currently trades at 15,122.43

- China's A50 Index has fallen by -111.82 points (-0.96%) and currently trades at 11,509.14

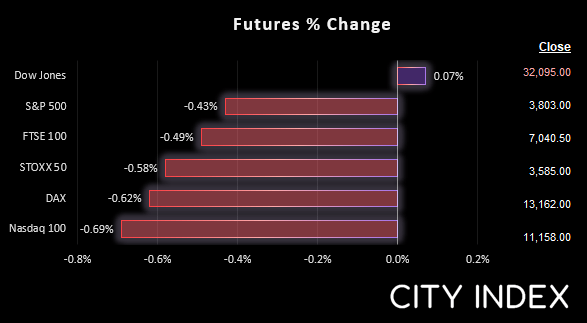

UK and Europe:

- UK's FTSE 100 futures are currently down -36 points (-0.51%), the cash market is currently estimated to open at 7,037.69

- Euro STOXX 50 futures are currently down -20 points (-0.55%), the cash market is currently estimated to open at 3,584.51

- Germany's DAX futures are currently down -79 points (-0.6%), the cash market is currently estimated to open at 13,132.23

US Futures:

- DJI futures are currently up 19 points (0.06%)

- S&P 500 futures are currently down -82.5 points (-0.73%)

- Nasdaq 100 futures are currently down -17.5 points (-0.46%)

The BOJ do… absolutely nothing

The Bank of Japan did the entirely predictable act of doing nothing, so interest rates remain at -0.1% and they will continue to target the 10-year JGB at around zero percent. Although they did announce that they’ll change the way they purchase ETF’s from December the 1st to take into account holding costs and seek to lower fees. Their quarterly outlook report stated that risks to prices are to the upside, and that growth expectations are to the downside. Also very predictable.

Japan’s government announced a spending package of ¥29.1 trillion ($199 billion) for households in response to high inflation. The yen saw little reaction during a low

Inflation keeps on doing its thing

Further signs of inflation hit the screens, as if we even needed more. Australian producer prices hit a record high of 6.9% and its quarterly read matched the record high of 1.9% last seen in 2008. Tokyo’s overall inflation also rose to its highest level since 1991. And that sets the stage nicely for today’s US inflation data.

Core PCE inflation is released for the US at 13:30 BST

US inflation data is the key event tonight, and (perhaps not surprisingly) is expected to rise further. We’ve already seen inflation for Australian and New Zealand bulldoze their way trough expectations to the upside – will the US be the next one to follow?

But when you compare the various inflation metrics to the Fed’s inflation target, it begins to look a bit silly. A 75bp Fed hike is pretty much a done deal – to the point it might even be irresponsible if the Fed didn’t. But another hot print makes it tricky for the Fed to openly discuss a slower pace of tightening, even though they sent out a ‘test balloon’ via the WSJ discussing that very subject.

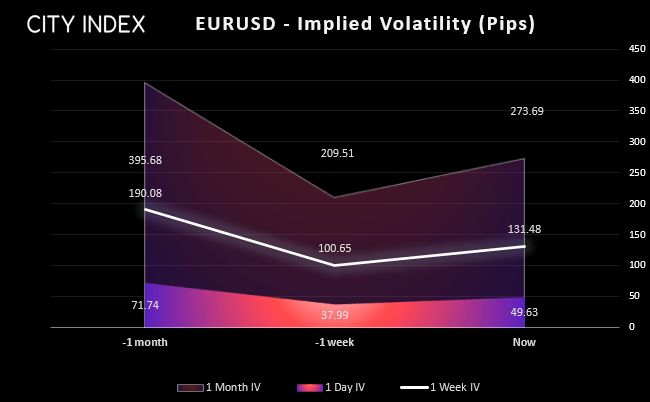

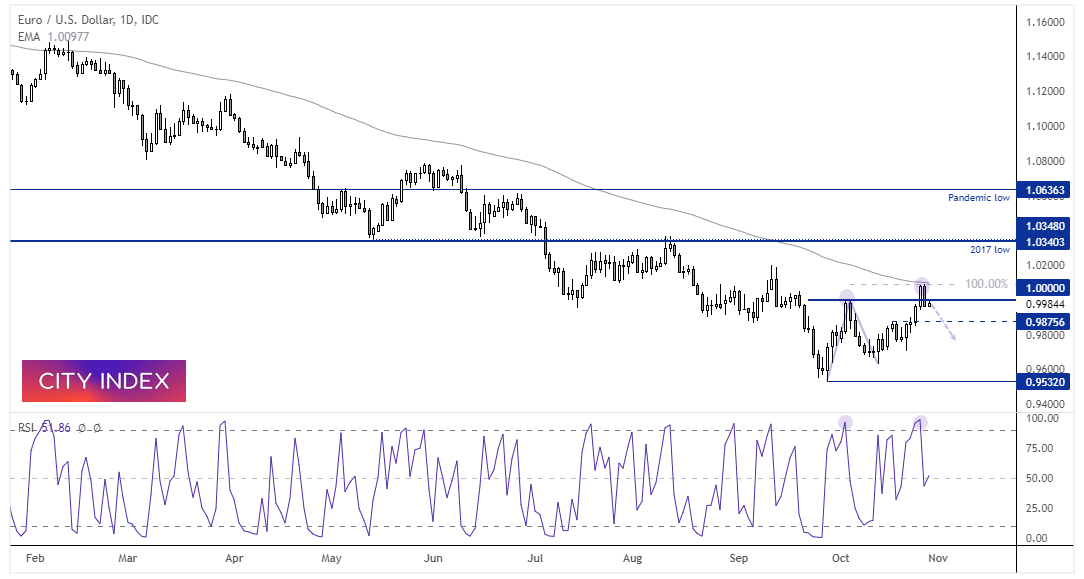

EUR/USD daily chart and implied volatility:

The euro is back below parity after spending just one day above it. It almost erased all of Wednesday’s gains and formed a 2-bar bearish reversal at the 100-day EMA. Its also coincided with a 100% projection (wave equality) so perhaps we have seen the end of a 3-wave correction. Given the US dollar index remains above trend support after pulling back, there is an argument for a stronger dollar and weaker euro. Especially if inflation rips higher than expectations, a trend which has been apparent in recent times.

FTSE 350 – Market Internals:

FTSE 350: 3910.95 (0.25%) 27 October 2022

- 143 (40.86%) stocks advanced and 194 (55.43%) declined

- 5 stocks rose to a new 52-week high, 3 fell to new lows

- 18.86% of stocks closed above their 200-day average

- 69.14% of stocks closed above their 50-day average

- 25.14% of stocks closed above their 20-day average

Outperformers:

- + 7.58% - Wizz Air Holdings PLC (WIZZ.L)

- + 7.39% - Moonpig Group PLC (MOONM.L)

- + 5.46% - Shell PLC (SHEL.L)

Underperformers:

- -15.12% - Airtel Africa PLC (AAF.L)

- -5.90% - HgCapital Trust PLC (HGT.L)

- -5.03% - Baltic Classifieds Group PLC (BCG.L)

Economic events up next (Times in BST)

How to trade with City Index

You can easily trade with City Index by using these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade