- It’s a busy calendar this week but only one event really matters for EUR/USD: the Fed interest rate decision

- Two or fewer rate cuts signaled from the Fed screens as negative for EUR/USD. Three or more would be interpreted as dovish and lend itself to EUR/USD upside

- BOJ and BoE rate decisions could generate decent intraday volatility

- ECB speakers’ calendar is full but they need to deviate away from a June cut to be significant

- EUR/USD risks are skewing to the downside

It’s going to be a massive week for EUR/USD traders with major central central bank monetary policy decisions, inflation updates from around the developed world, flash PMIs to sink your teeth into along with a busy ECB speaking calendar. But in the end, one event will likely override all others: the Federal Reserve’s March FOMC interest rate decision, specifically the updated dot plot of individual FOMC member forecasts for the Fed funds rate and Chairman Jerome Powell’s press conference.

Three Fed rate hikes would be perceived as dovish

Will the Fed acknowledge resilience in the US economy and pickup in inflationary pressures over the past three months and pare its median rate cut profile to two moves or less this year, or will it stick with three? The answer will likely determine whether EUR/USD ends the week higher or lower than where it started, with pockets of volatility in between as market activity thins ahead of the event.

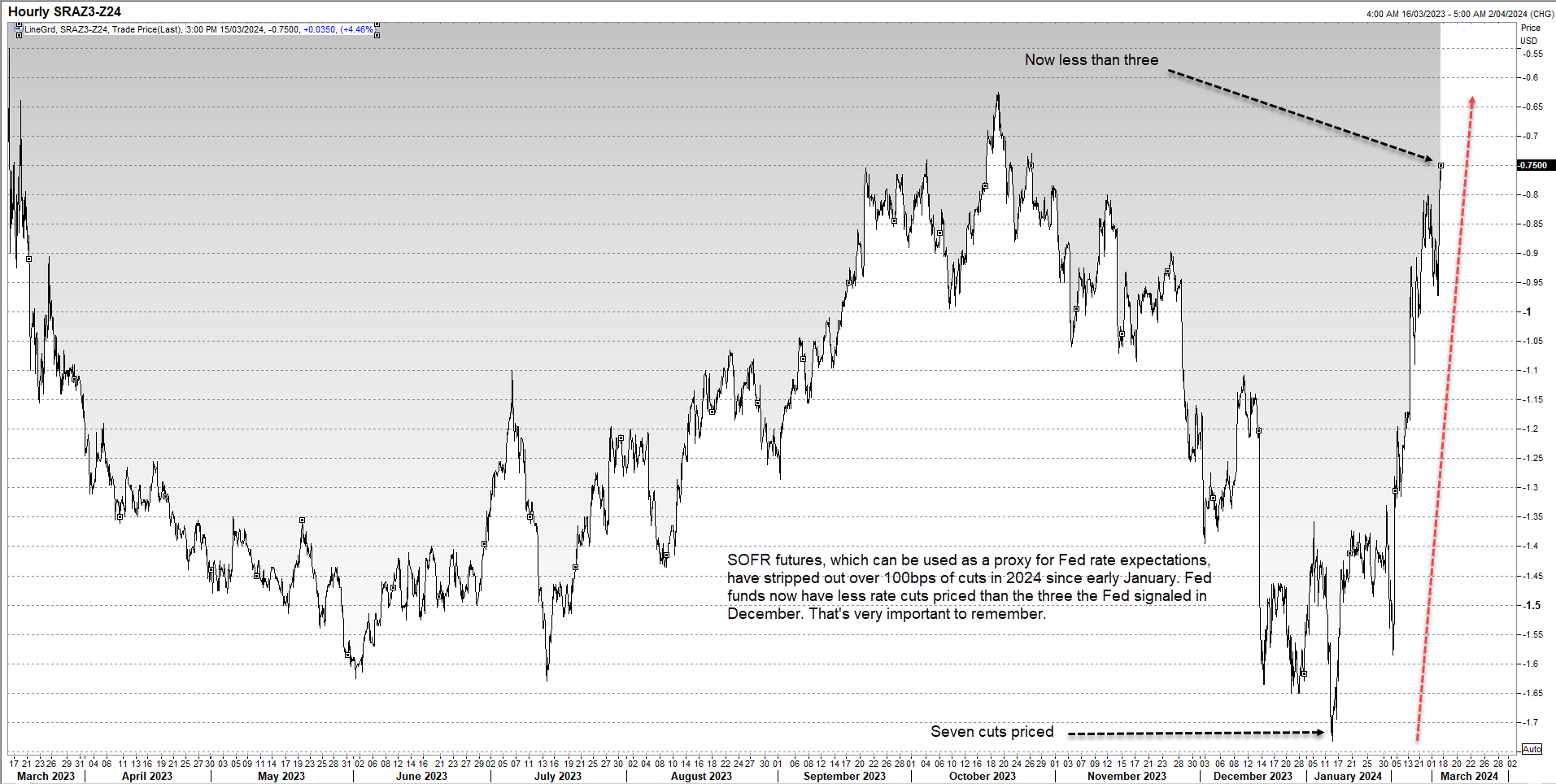

Fut

Source: Refinitiv

Starting the new week, Fed funds futures are pricing in less than three full rate cuts for 2024, the lowest amount since October and below what the Fed signaled in December. That suggests if the Fed keeps its median member forecast unchanged at three cuts this year, it will be perceived as dovish by markets, pointing to the likelihood of a stronger EUR/USD following the FOMC decision.

That’s the key point to remember for those trading EUR/USD or any other US dollar or US yield sensitive markets this week.

While the Fed will dominate from Wednesday onwards, there are other events that carry the potential to generate intraday volatility for EUR/USD. Here they are presented in chronological order, along with a quick synopsis as to what you should focus on. For clarity, the final reading of Eurozone inflation for February is not covered as it rarely deviates from the initial print.

Intraday event risk events to watch

Monday

China data dump – industrial output, retail sales, fixed asset investment and unemployment data. As the largest trade partner with the Euro area, the performance of the Chinese economy is important for sentiment. For EUR/USD, it’s retail sales that screens as most important given the implications for Euro area exporters.

Tuesday

BOJ monetary policy meeting – markets are favouring that it will hike overnight rates by 10 basis points to 0%, meaning a non-move carries the potential to deliver a knee-jerk weakening in the JPY which could flow through to other FX majors against the USD, including EUR. A hike would likely deliver the opposite outcome, albeit on a smaller scale due to market pricing. The thing to remember is a hike has been priced for months; the only question was when it was likely to occur. If the BOJ were to abandon all unconventional policy measures like QE and yield curve control, that would be a far more hawkish development, pointing to broad USD weakness. That’s very unlikely this week.

German ZEW – can and does move EUR/USD. Focus should be on the expectations measure as markets are forward-looking.

Canada CPI – any new inflation reports from the developed world provide clues on price trends and likely path for central bank policy movements. This applies to CPI and PPI reports listed below.

Wednesday

UK CPI

German PPI

Thursday

Flash manufacturing and services PMIs – as a measure on activity levels, these reports provide a near real-time assessment on how various economies have been faring. Recently, activity in the States has been softening while that in the Eurozone has been stabilising, so the market reaction will be driven by any deviation from that trend, should there be one. Keep an eye on price and employment measures given the implications for central banks.

BoE – central bank policy meetings always carry the potential to surprise, but the BoE feels further behind the ECB in terms of where it sits in the monetary cycle. EUR/USD has a strong correlation with GBP/USD, meaning any significant surprise may influence both versus the USD. BoE has typically been more hawkish relative to its counterparts until this point, meaning if there is to be a surprise it would likely be on the dovish side of the ledger.

Friday

Japan CPI

German IFO – like the flash PMIs and ZEW survey, another report that has the potential to move EUR/USD given the focus on what German business leaders are saying about operating conditions

ECB has been guiding for a summer cut for some time

Other than data and central bank decisions, there’s a busy ECB speakers calendar this week. I’m not going to preview what each speech may deliver but deliver a reminder that the ECB have been guiding markets towards the first cut arriving around June, so any commentary that deviates substantially from that assessment will have the potential to move EUR/USD.

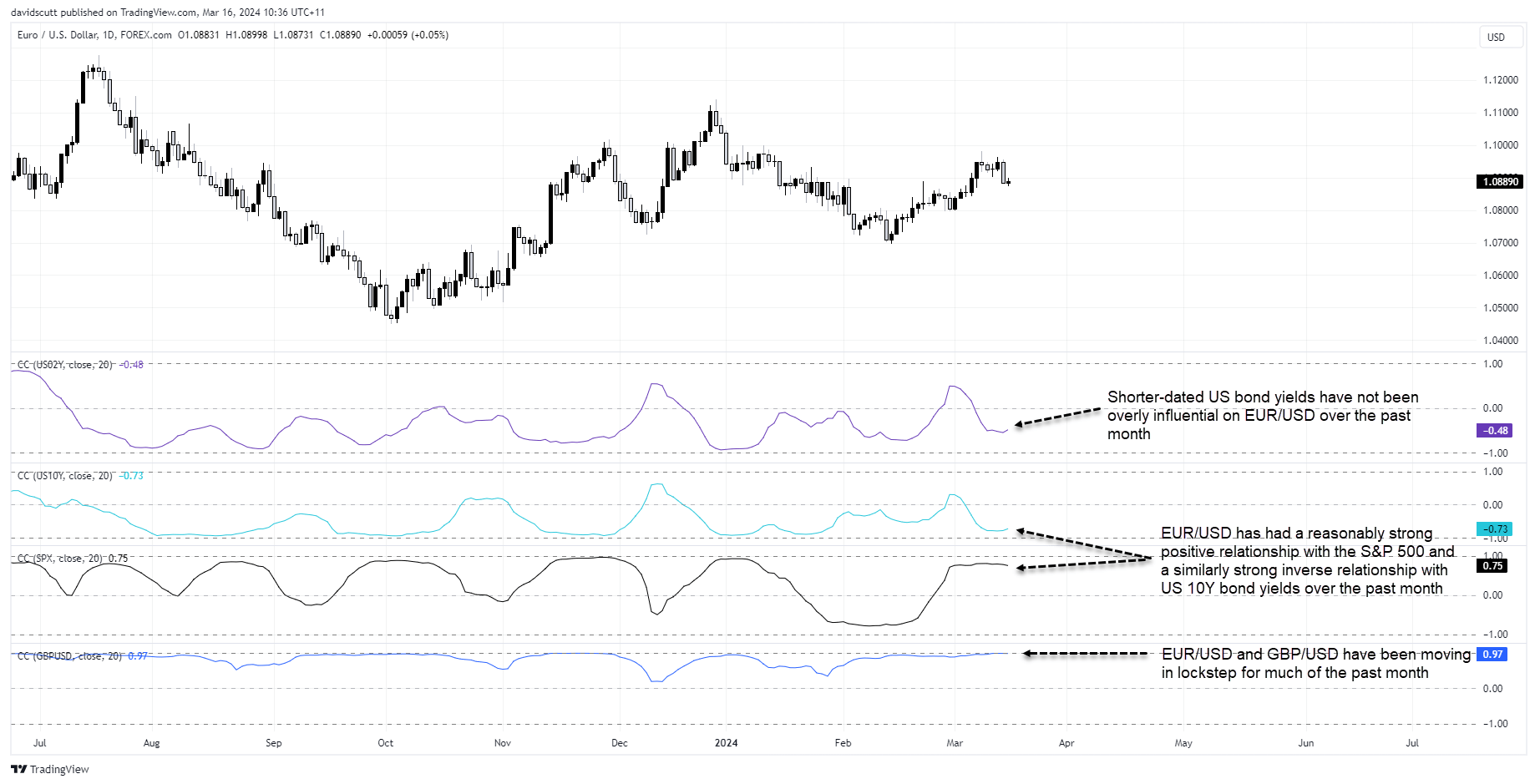

Risk appetite, BoE rate decisions may be influential

Looking at what has been influencing EUR/USD over the past month, it has had an extremely strong positive relationship with GBP/USD, reinforcing the potential importance of the BoE policy meeting. Elsewhere, there’s been a reasonable positive relationship with the S&P 500 and relative strong inverse relationship with US 10-year bond yields, suggesting risk appetite is influencing the EUR/USD performance.

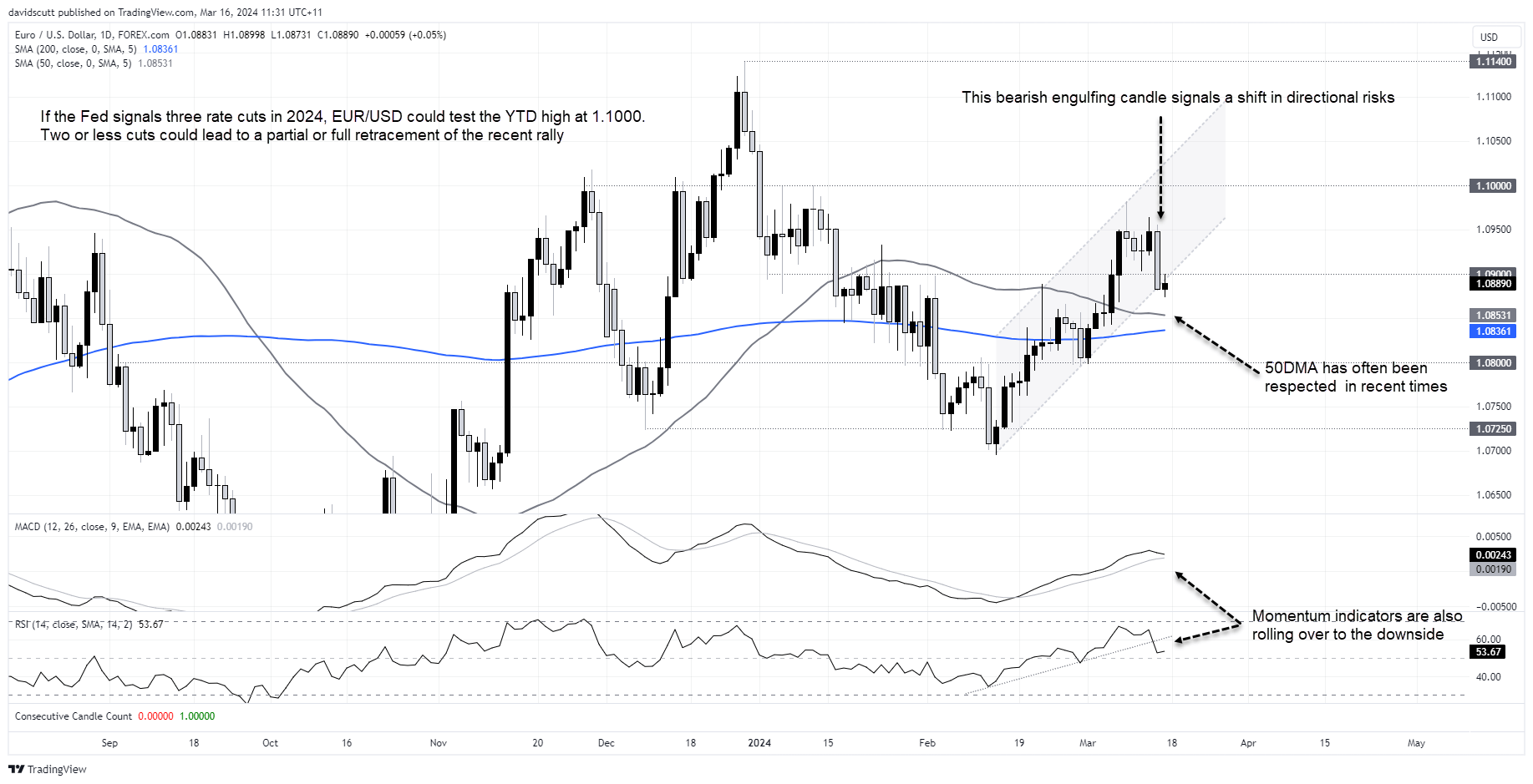

EUR/USD downside risks building

Looking on the daily, the EUR/USD uptrend over the past month came to a shuddering halt last week with the bearish engulfing candle on Thursday, combined with RSI breaking its uptrend, delivering a strong signal on a potential shift in direction. MACD also looks like it’s starting to rollover, adding to evidence of waning momentum.

On Friday, EUR/USD was unable to push back into its former ascending channel, rejected at 1.0900 which has acted a support and resistance over much of 2024. The inability to extend the move, coupled with waning upside momentum and bearish price action earlier in the week, points to downside directional risks.

However, with the Fed not until late Wednesday and 50-day moving average located 40 pips below (a level the price has often respected in the recent past), it’s debatable just how much downside we’ll see over the early parts of the week. It comes across as a stalemate scenario.

Further below, the price has a checkered history with the 200-day moving average, so it may not be as important as the 50-day above. However, its proximity just adds to the difficultly in seeing significant downside before the Fed.

But that will likely change once the Fed decision arrives. Should it continue to signal three rate cuts this year, a retest of the 2024 high around 1.1000 would be on the cards. Should it signal two or less, the risks skew to the downside with 1.0800, 1.0725 and the February low just below 1.0700 the levels to watch.

Good luck!

-- Written by David Scutt

Follow David on Twitter @scutty

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade