GBP/USD Takeaways

- GBP/USD has been rallying this week on the back of strong employment and inflation data out of the UK.

- Traders are pricing in an outside chance of a big 50bps rate hike from the BOE next month.

- GBP/USD is approaching near-term resistance around 1.2800 ahead of tomorrow’s retail sales report.

GBP/USD Fundamental Analysis

Sometimes, it pays to go back to basics.

Central bank decisions are one of the primary drivers of currency values, and central banks the world over are focused on two main economic indicators: employment and inflation. In the case of pound sterling and the Bank of England (BOE), this week we learned that UK payrolls unexpectedly rose by 97K (with wages rising at a surprisingly hot 8.2% y/y) and CPI, a measure of consumer inflation, rose by 6.8% y/y, above expectations for a 6.7% rise.

Logically, this has impacted expectations for next month’s BOE meeting, with traders now pricing in a 100% chance of a 25bps rate hike and an outside shot (25%) of another 50bps rate hike, a proverbial “bazooka” for fighting ongoing inflation. More to the point for FX traders, this allowed the pound to remain relatively strong against the US dollar through the first half of the week, and now that the greenback is pulling back, GBP/USD has risen to test its highest levels since the start of the month.

While it’s not as significant as employment or inflation data, the next economic release for GBP/USD traders to watch will be tomorrow’s UK retail sales report for July, which is expected to show a -0.6% decline on a month-over-month basis.

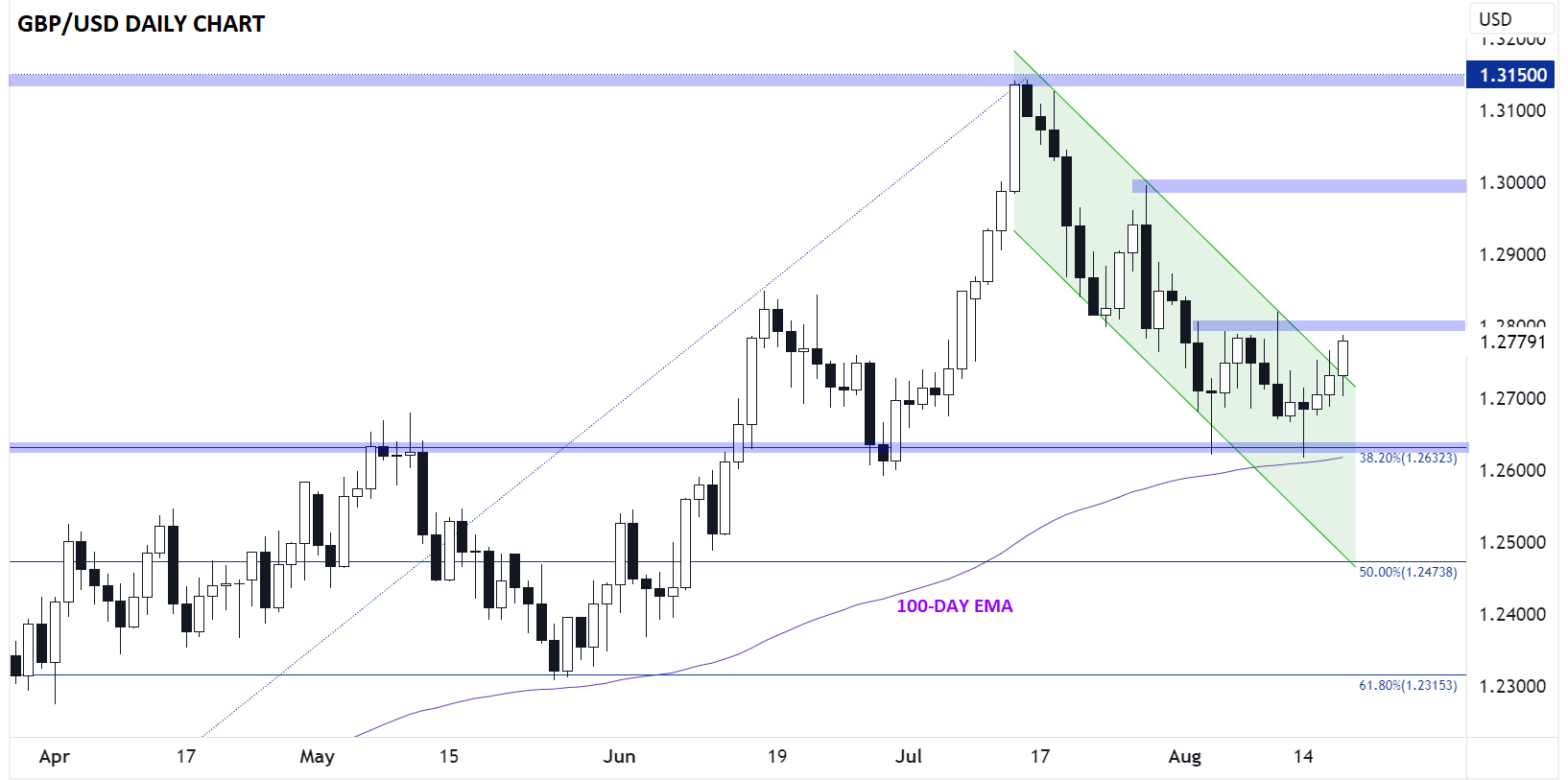

British Pound Technical Analysis – GBP/USD Daily Chart

Source: TradingView, StoneX

As the chart above shows, GBP/USD went from testing key medium-term support from the combination of a 38.2% Fibonacci retracement and the rising 100-day EMA near 1.2625 at the start of the week to threatening to break out of its short-term bearish channel in today’s trade.

That past two weeks have shown a short-term resistance level in the 1.2800 zone, but if UK retail sales can outperform downbeat expectations, the pair could clear that resistance level and resume its longer-term uptrend heading into next week. Above that area, there is little in the way of resistance until the key psychological level and late July high near 1.30.

Meanwhile, a big reversal today would flip the short-term bias back to neutral, though the longer-term uptrend remains intact as long as rates hold above the key 1.2625 support area.

-- Written by Matt Weller, Global Head of Research

Follow Matt on Twitter: @MWellerFX