In case you missed the plethora of headlines, the Bank of Japan are suspected of having intervened in the currency markets to send the yen sharply higher on Monday. The initial 170-pip spike to 160 proved too much, and was enough to prompt the central authorities into action which saw USD/JPY plunge over 400 pips in less than an hour.

This quickly placed the Japanese yen to the top spot as the strongest FX major on Monday, with other currencies also rising against the US dollar. The dollar index handed back most of Friday’s PCE report gains, but with a potentially hawkish Fed meeting looming then I continue to suspect the pullback on the dollar could be limited.

- The carnage was mostly contained within currency markets, with Wall Street indices and gold essentially flat, although US yields were slightly lower as investors sought the safety of bonds

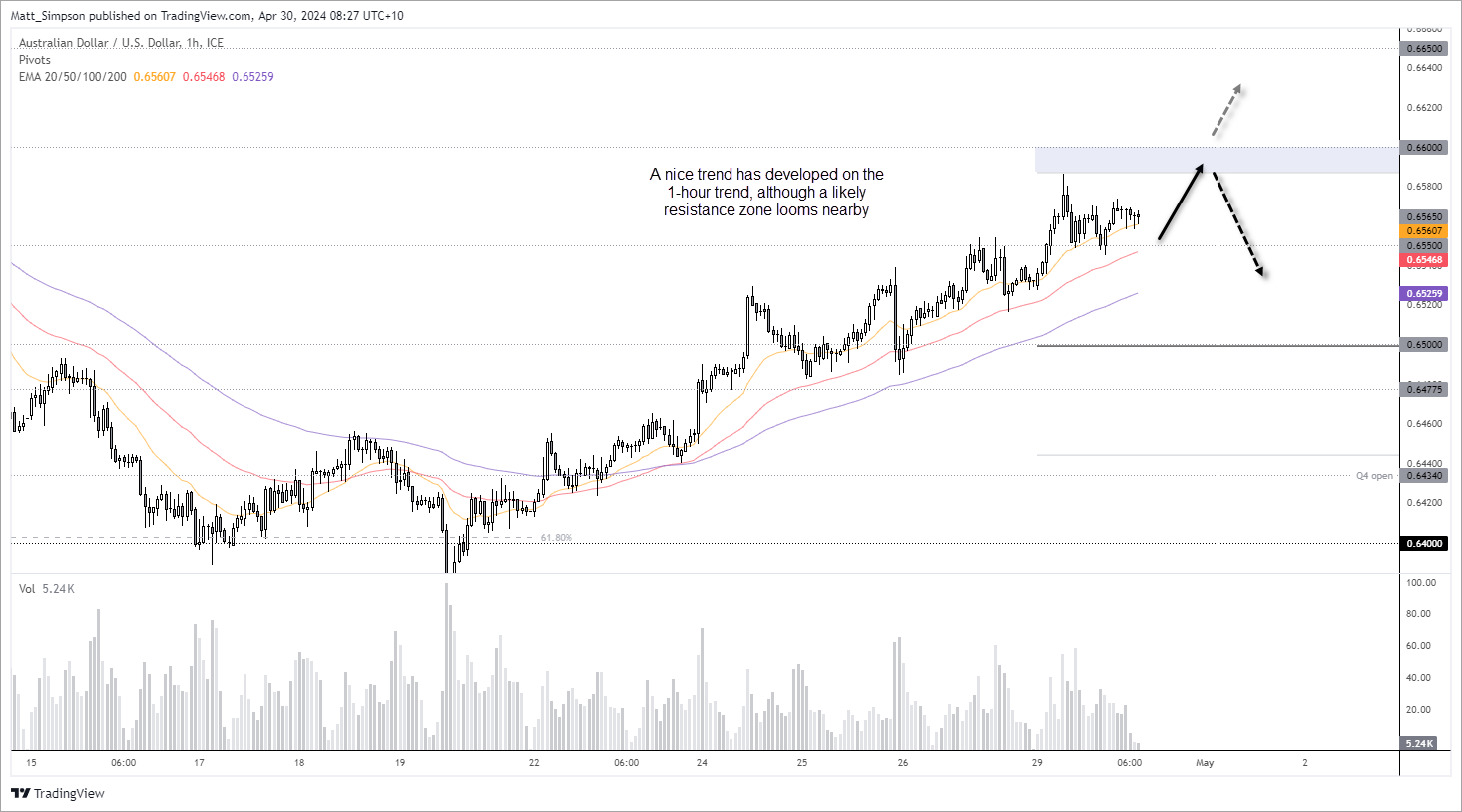

- AUD/USD rose for a sixth day, with 66c making the next likely resistance level

- WTI crude oil was -1.5% lower on early reports of a ceasefire

- Gold prices were essentially flat despite the mayhem, but found support above $2300 and formed an indecision day (spinning top candle)

- The ASX 200 is on track to break a 5-month winning streak with a bearish engulfing month, with ‘sell in May go away’ seemingly arriving a month early

Economic events (times in AEST)

- 09:30 – Japan’s job/application ratio

- 09:50 – Japan’s industrial production

- 11:00 – New Zealand business confidence

- 11:30 – Australian housing credit

- 11:30 – China PMIs (manufacturing, services, composite – NBS)

- 11:45 – China manufacturing PMI (Caixin)

- 12:00 – Singapore bank lending, unemployment

- 19:00 – Eurozone inflation

- 00:00 – US consumer confidence (Consumer Board)

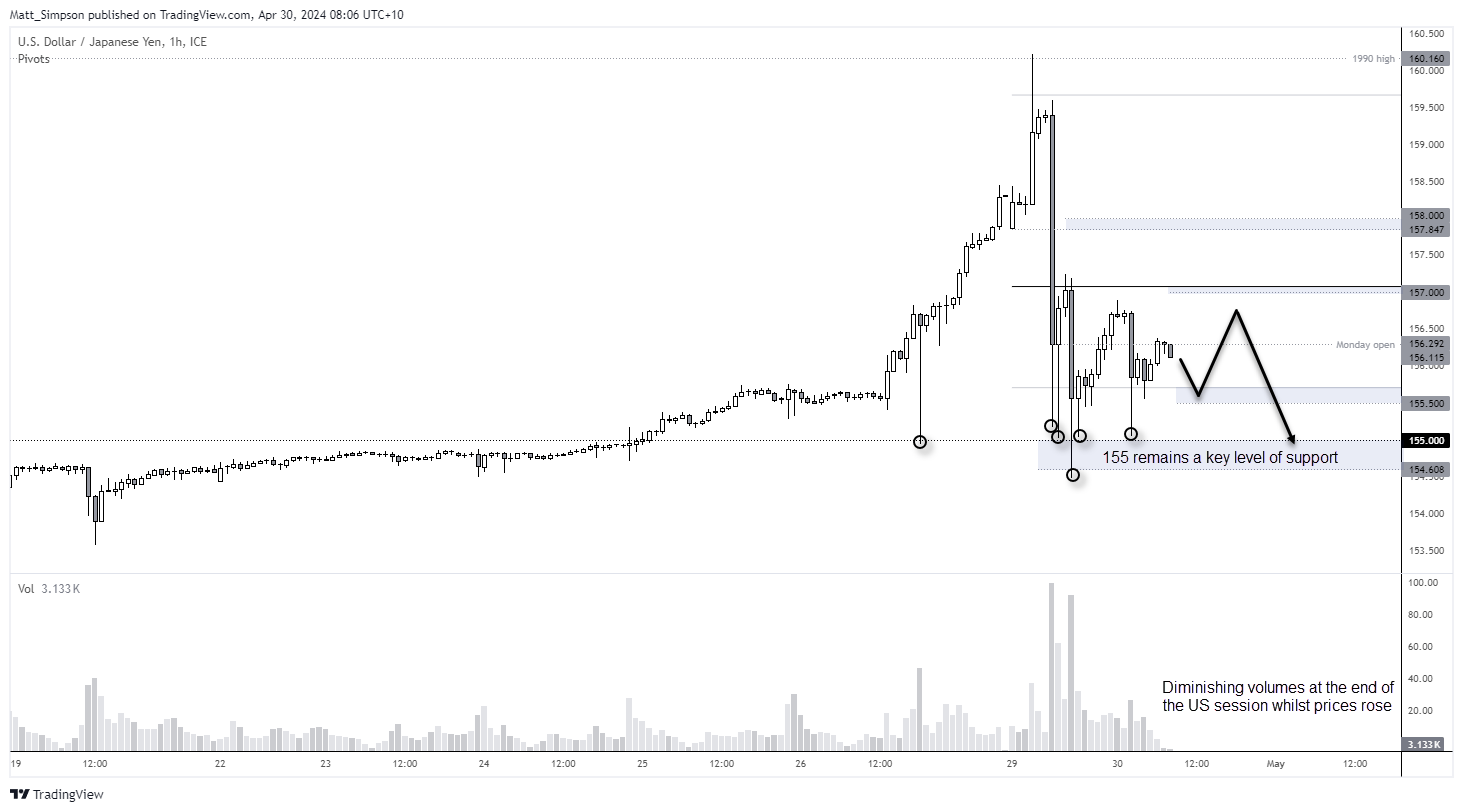

USD/JPY technical analysis:

The carnage across yen pairs saw USD/JPY formed a bearish outside day on Monday. Whilst such patterns can signify a bearish reversal, context should also be taken into account. As this candle was triggered by a likely intervention, the odds favour for volatility to remain contained and prices to remain within Monday’s range, and more likely the lower half. Add into the mix the looming Fed meeting then traders should brace for some fickle price action.

1-day implied volatility suggests a +/- 103-pip move in either direction, probably in fear of another intervention. But I suspect the BOJ will be satisfied with the response, ad that a 200pip rage today seems unlikely.

The 4-hour chart shows the importance of the 155 level, with one false break, four spikes towards it on Monday and one on Friday. Prices look like they want to di back below 156, and bulls may consider buying near-term dips towards 155.50 for some mean reversion towards 157. Whether bulls will want to remain long for ‘too long’ remains debatable, but if bullish momentum picks up I’d be suspicious of any moves too close to 158 -a level I suspect will cap as resistance heading onto the Fed’s interest rate decision.

AUD/USD technical analysis:

In the AUD/USD weekly outlook report I outlined a bias for AUD/USD to retrace. Yet having climb for a sixth day, this theme is yet to play out. And until we see evidence of a trend reversal on the 1-hour chart, then upside risks remain over the near term.

The 1-hour chart shows that the moving averages are in bullish sequence and being used as dynamic support. A retracement to the 50-bar EMA (red) could appeal to bulls for a quick swing trade long. Take note that Monday’s high respected the weekly S1 pivot, which could be used again as a profit objective – along with the 66c handle.

View the full economic calendar

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade