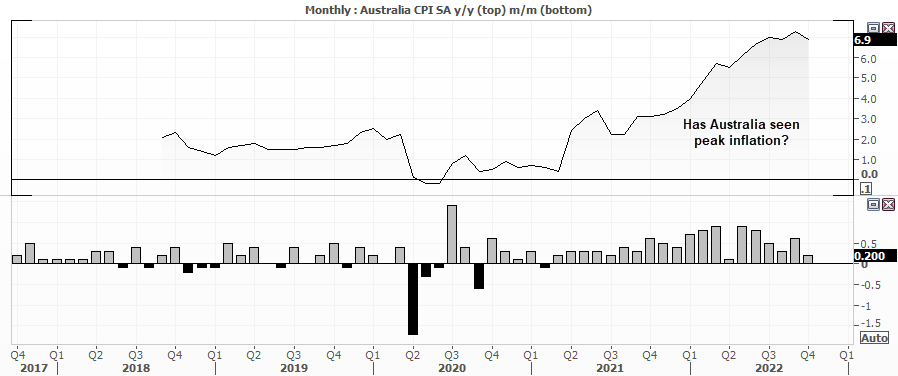

- Australian inflation ‘only’ rose 6.9% y/y, down from a peak of 7.4% and lower than the 7.5% expected

- Housing (10.5%), food and non-alcoholic beverages (8.9%) and transport (7.4%) were the most significant contributors

- CPI rose 0.2% m/m, below its long-term average of 2.5%

The RBA will be happy to hear that inflation was much lower than expected, even if it does remain historically high. But the ABS report also highlighted that they performed their annual weight adjustment to the CPI basket, and that inflation would have been 7.1% if last year’s methodology was used. But even a move down from 7.4% to 7.1% is noteworthy as it leaves the potential that inflation has in fact peaked.

If we look more broadly at inflationary drivers, it’s nice to see import prices are falling, wages remain well below inflation and that inflation expectation remain ‘well anchored’. So now we’ve seen annualised inflation drop 5 percentage points in a month, the case for RBA to pause in December is becoming stronger for a central bank that really does not want to raise rates any more than they need to.

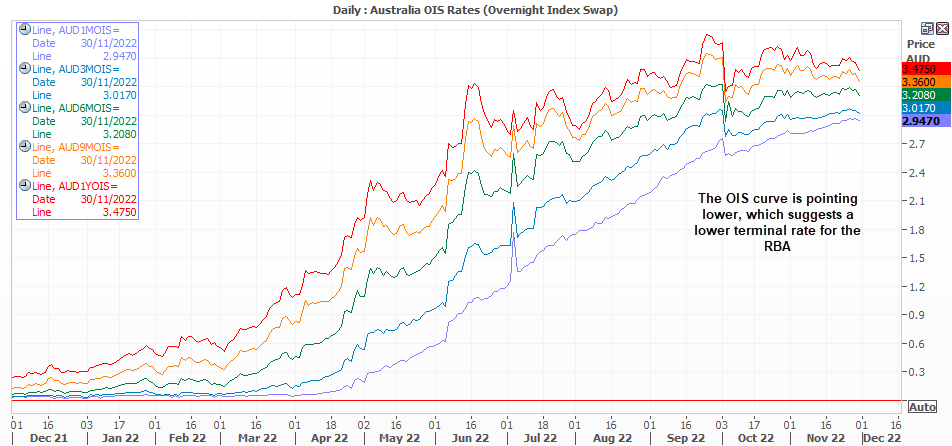

And that is being reflected within the OIS curve, which suggests money markets are now pricing in a lower terminal rate and slower pace of hikes. And that in turn could mean we’ve seen the best part of the AUD/NZD move lower, which so far is struggling to reach the 1.0700 target outlined in a previous article.

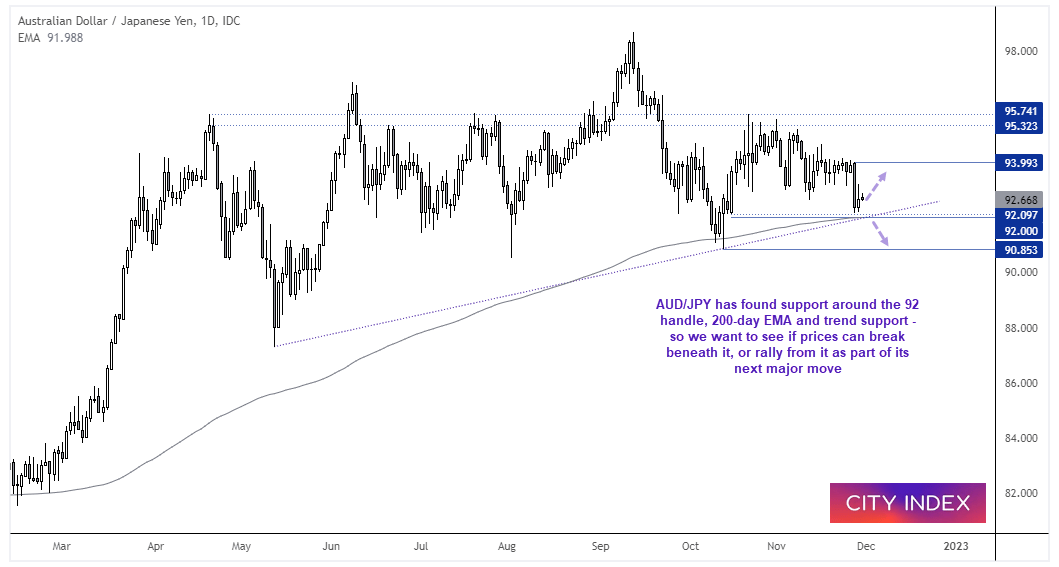

Yet there has been little to no reaction from AUD pairs following the inflation print. And it feels like markets are looking for the next major theme to come along to create big moves. Wall Street is pulling back from recent highs, the dollar index and yen are hinting at swing lows and the euro a swing high. So it is a case of watch and wait, and one pair that has caught my eye is AUD/JPY.

AUD/JPY daily chart:

On Monday AUD/JPY fell to a 30-day low and closed beneath 93.00, yet the 92.0 handle and trend support remain close by. And as markets are weighing up the dynamics of a possible China reopening amidst a more hawkish Fed, we are waiting the market to tip its hand and either break beneath 92.0 or rally from it, as part of a clear risk-on or risk-off move.

How to trade with City Index

You can easily trade with City Index by using these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade